VS FX 2025 Review: Everything You Need to Know

Executive Summary

This vs fx review gives you a fair look at VS FX, a forex broker that has some serious transparency problems because there's not much public information available about them. The broker does offer some good trading conditions like maximum leverage of 1:100 and starting spreads from 0 pips, but the lack of clear regulatory information and user feedback should make potential traders think twice.

You can access the popular MT4 platform along with their own mobile app, which might appeal to traders who already know how to use MetaTrader's interface. But there's no detailed information about minimum deposits, commission structures, available assets, and customer support services, so it's hard to give you a complete picture.

VS FX might work for traders who want high leverage opportunities and competitive spread conditions. However, potential clients should be careful because there's limited transparency about regulatory oversight and how they actually operate day-to-day.

The broker's overall profile shows they're targeting active traders who care more about leverage and low-cost trading conditions than comprehensive educational resources and extensive customer support services.

Important Disclaimers

This review is based on limited publicly available information, so specific details might be different depending on where you live. Since there's no clear regulatory information in the materials we could find, you should check the broker's licensing status and regulatory compliance in your own country before you start trading.

The assessment in this review hasn't been tested through actual trading experience or direct platform testing. We strongly advise potential clients to do their own research and consider talking with financial advisors before making any investment decisions.

Rating Framework

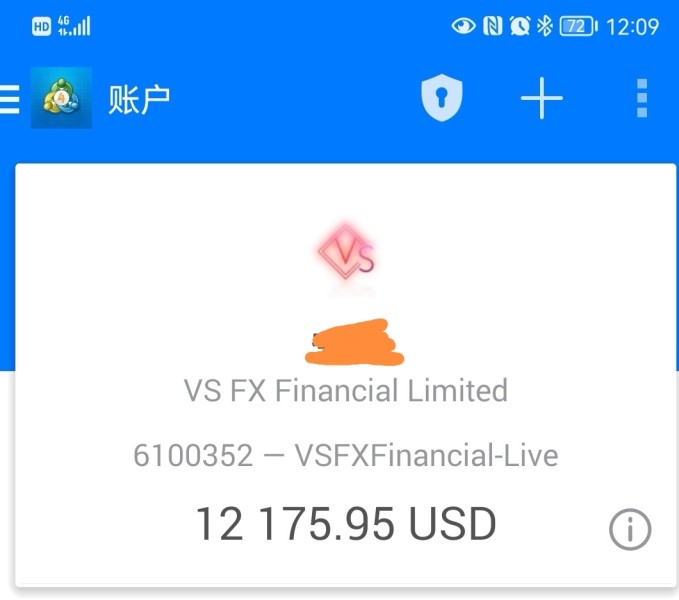

Broker Overview

VS FX operates in the competitive forex brokerage landscape, but we don't know much about when it was established, its corporate background, or how its business model works. The broker's history and corporate structure aren't well-documented in materials we can access, which creates problems for traders who want comprehensive background information.

The company seems to focus mainly on forex trading services. However, we need more information to understand the full scope of its operations and how it positions itself in the target market.

From a technical standpoint, VS FX gives you access to the widely-used MetaTrader 4 platform, plus its own mobile application for trading when you're away from your computer. This vs fx review notes that while MT4 remains popular among forex traders because of its comprehensive charting tools and automated trading capabilities, the lack of information about additional platform options or proprietary trading tools limits our overall assessment of the broker's technological offerings.

We don't have clear information about available asset classes beyond the implied forex focus. This makes it hard to determine whether VS FX offers diversified trading opportunities across multiple financial markets or keeps a specialized focus on currency pairs.

Regulatory Oversight: Available information doesn't specify which regulatory jurisdictions VS FX operates under, and this represents a significant transparency gap that potential clients should carefully consider.

Deposit and Withdrawal Methods: We don't have specific information about accepted payment methods, processing times, and fees for deposits and withdrawals.

Minimum Deposit Requirements: The broker doesn't specify minimum deposit thresholds for different account types in accessible materials. This makes it difficult for potential clients to assess entry requirements.

Promotional Offers: Information about welcome bonuses, deposit bonuses, or other promotional incentives isn't available in current sources.

Available Assets: While the broker appears to focus on forex trading, we don't have comprehensive details about available currency pairs, exotic options, and potential additional asset classes.

Cost Structure: The broker advertises starting spreads from 0 pips, but specific commission rates and fee structures for different account types remain unclear. This vs fx review emphasizes how important it is to understand the complete cost picture before trading.

Leverage Options: VS FX offers maximum leverage of 1:100, which may appeal to traders seeking moderate leverage exposure while maintaining manageable risk levels.

Platform Selection: Clients can access MetaTrader 4 and the broker's proprietary mobile application. However, detailed feature comparisons aren't available.

Geographic Restrictions: Information about restricted countries or regional limitations isn't specified in available materials.

Customer Support Languages: Available language options for customer service aren't detailed in accessible sources.

Account Conditions Analysis

Evaluating VS FX's account conditions proves challenging because there's limited information available about account structures and requirements. Without specific details about different account tiers, minimum deposit requirements, or account-specific features, it's difficult to assess how well the broker serves different trader segments or experience levels.

There's no information about Islamic accounts or other specialized trading arrangements. This limits our understanding of how the broker accommodates diverse trading preferences and religious requirements.

Additionally, we don't know about the account opening process, required documentation, and verification procedures from available sources.

This vs fx review notes that while the broker offers competitive leverage ratios and spread conditions, the lack of transparency about account management features raises concerns about the overall account condition framework. We don't know about negative balance protection, margin call procedures, and account maintenance requirements.

The incomplete picture of commission structures across different account types makes it challenging for traders to calculate their total trading costs accurately. This is essential for developing effective trading strategies and risk management approaches.

Assessing VS FX's trading tools and educational resources faces significant limitations because there isn't enough publicly available information. While the broker provides access to MetaTrader 4, which includes standard charting tools, technical indicators, and automated trading capabilities, we don't know about additional proprietary tools or enhanced features.

Educational resources, market analysis materials, and research offerings aren't detailed in available sources. This makes it difficult to evaluate the broker's commitment to trader development and providing market insights.

The absence of information about webinars, trading guides, or market commentary suggests either limited educational support or poor communication of available resources.

Economic calendar access, market news feeds, and fundamental analysis tools aren't specifically mentioned in available materials. For traders who rely on comprehensive market research and analytical resources, this information gap represents a significant consideration in broker selection.

We don't know about automated trading support beyond standard MT4 capabilities, such as VPS services or advanced algorithmic trading tools, from current information sources.

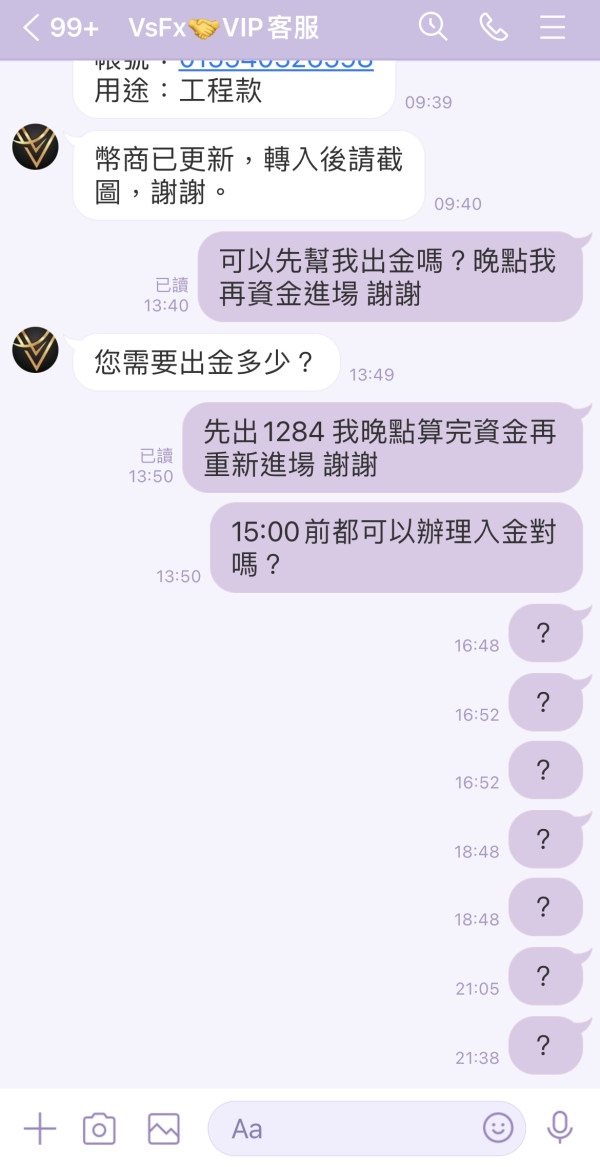

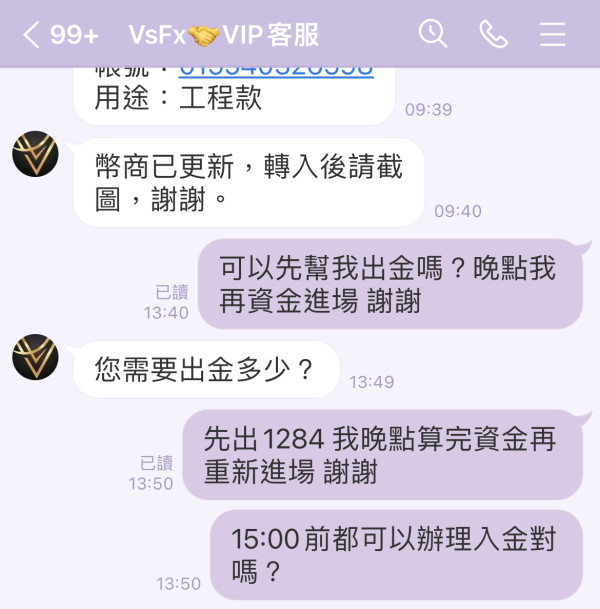

Customer Service and Support Analysis

Customer service evaluation proves particularly challenging for VS FX because there's no information about support channels, availability hours, and service quality measures. Without details about live chat, email support, phone assistance, or response time expectations, potential clients can't assess the broker's commitment to customer care.

Multi-language support capabilities, which are crucial for international brokers serving diverse client bases, aren't specified in available materials. This lack of information makes it difficult for non-English speaking traders to determine whether appropriate support will be available in their preferred language.

The absence of information about dedicated account managers, technical support specialists, or educational support staff suggests either limited customer service infrastructure or inadequate communication of available services. For traders who value responsive customer support, this information gap represents a significant concern.

Problem resolution procedures, escalation processes, and customer satisfaction measures aren't detailed in accessible sources. This makes it impossible to evaluate the effectiveness of the broker's customer service framework.

Trading Experience Analysis

The trading experience evaluation for VS FX centers primarily on the availability of MetaTrader 4, a well-established platform known for its reliability and comprehensive feature set. However, without specific user feedback or performance data, it's challenging to assess how effectively the broker implements and maintains this platform.

Order execution quality, including execution speeds, slippage rates, and requote frequency, aren't detailed in available information sources. These factors significantly impact trading outcomes, particularly for active traders and scalping strategies, making this information gap concerning for performance-focused traders.

The broker's proprietary mobile application represents an additional trading option. However, we don't know about specific features, functionality comparisons with the MT4 mobile app, and user experience feedback.

Mobile trading capabilities have become increasingly important for modern forex traders, making detailed mobile platform information essential.

Platform stability during high-volatility market conditions, server uptime statistics, and technical reliability measures aren't specified in accessible materials. The starting spread of 0 pips suggests competitive pricing, though we don't know about the consistency of spread conditions during different market sessions without user experience data.

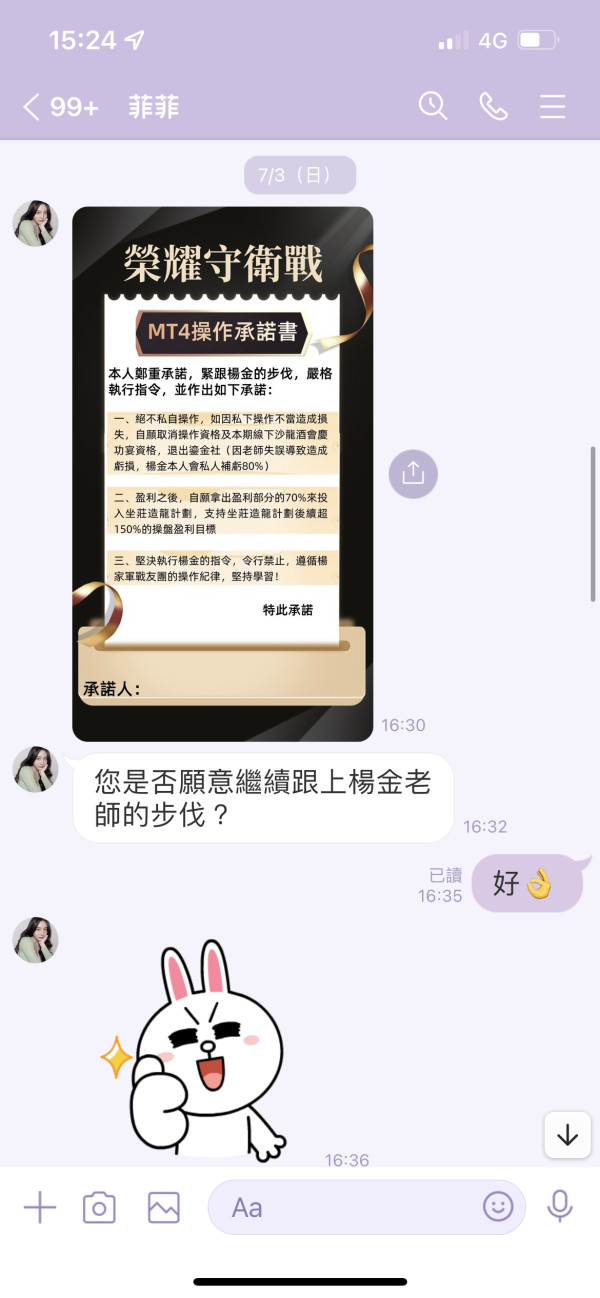

Trust and Reliability Analysis

The trust and reliability assessment for VS FX faces significant challenges because there's no clear regulatory information in available sources. Regulatory oversight represents a fundamental aspect of broker trustworthiness, as it provides legal protections, operational standards, and recourse mechanisms for traders.

Without specific details about regulatory licenses, supervisory authorities, or compliance frameworks, potential clients can't verify the broker's adherence to industry standards or assess the level of protection for their funds. This regulatory transparency gap represents a critical concern for risk-conscious traders.

Client fund segregation practices, deposit insurance coverage, and financial reporting transparency aren't detailed in available materials. These factors directly impact fund security and represent essential considerations for traders evaluating broker trustworthiness.

The broker's operational history, any regulatory actions or sanctions, and industry reputation indicators aren't available in current information sources. Third-party ratings, industry awards, or professional recognition that might support trustworthiness assessments are similarly absent from accessible materials.

User Experience Analysis

User experience evaluation for VS FX proves challenging because there's limited availability of actual user reviews and feedback in accessible sources. Without direct user testimonials, satisfaction ratings, or experience reports, it's difficult to assess how well the broker meets client expectations in practical trading scenarios.

Interface design quality, platform navigation ease, and overall usability factors aren't detailed for either the MT4 implementation or the proprietary mobile application. These elements significantly impact daily trading efficiency and user satisfaction, making their absence from available information concerning.

The registration and account verification process, including required documentation, processing times, and user-friendliness, aren't specified in current sources. A streamlined onboarding experience often correlates with overall service quality, making this information gap relevant for prospective clients.

Common user complaints, frequently reported issues, or areas of particular user satisfaction aren't documented in available materials. This vs fx review emphasizes that without user feedback, potential clients can't benefit from the experiences of existing traders when making their broker selection decisions.

Conclusion

This comprehensive evaluation of VS FX reveals a broker with some potentially attractive trading conditions, including competitive leverage ratios and starting spreads from 0 pips, but significant transparency challenges that limit our ability to provide a fully informed assessment. The absence of clear regulatory information, detailed operational procedures, and user feedback creates substantial information gaps that prospective clients must consider carefully.

VS FX may appeal to traders specifically seeking high leverage opportunities and low-cost trading conditions, particularly those comfortable with the MetaTrader 4 environment. However, the lack of comprehensive information about account conditions, customer support, and regulatory oversight suggests that this broker may be more suitable for experienced traders who can navigate these uncertainties rather than beginners seeking comprehensive support and transparent operations.

The primary advantages appear to be competitive trading conditions and familiar platform access. The main concerns center on transparency limitations and the absence of detailed operational information that typically supports informed broker selection decisions.