Is Vestvai safe?

Business

License

Is Vestvai Safe or Scam?

Introduction

Vestvai is an online forex broker that has gained attention in the trading community for its claims of offering unique trading conditions and advanced technology. However, as with any financial service provider, it is crucial for traders to conduct thorough due diligence before investing their hard-earned money. The forex market is rife with scams and unregulated brokers, making it essential for traders to assess the legitimacy of any broker they consider. In this article, we will investigate whether Vestvai is a safe option for traders or if it raises red flags indicative of a scam. Our analysis is based on a review of regulatory status, company background, trading conditions, customer experiences, and overall risk assessment.

Regulation and Legitimacy

Regulatory oversight is a vital factor in determining the safety of a trading platform. A regulated broker is generally held to higher standards of accountability and transparency, which helps protect traders' funds. Unfortunately, Vestvai claims to be regulated by various authorities, including the Cyprus Securities and Exchange Commission (CySEC), but investigations reveal that these claims are false.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | N/A | Cyprus | Not Verified |

| IFSC | N/A | Belize | Not Verified |

| FSC | N/A | Mauritius | Not Verified |

The absence of valid regulatory licenses raises significant concerns about Vestvai's legitimacy. A broker operating without proper oversight poses a higher risk to traders, as there is no governing body to address complaints or enforce compliance. Moreover, the lack of transparency regarding its regulatory claims indicates a potential attempt to mislead investors. Therefore, it is essential to question, is Vestvai safe? Given its unregulated status, the answer leans towards no.

Company Background Investigation

Understanding the history and ownership of a broker provides insight into its reliability. Vestvai presents itself as a reputable trading platform, yet there is little verifiable information about its ownership or management team. The company's website lacks transparency, failing to disclose crucial details such as the names of the individuals behind the operation or their professional experience.

Furthermore, the information available suggests that Vestvai may be operating from an offshore location, which is often associated with unregulated and potentially fraudulent brokers. The lack of a clear corporate structure and the absence of a physical address further diminish confidence in the company's legitimacy. In light of this, traders should be wary and consider whether they are comfortable investing with a broker that lacks transparency and a solid background.

Trading Conditions Analysis

When evaluating a broker, it is essential to scrutinize the trading conditions they offer. Vestvai claims to provide competitive spreads and various trading instruments, but the absence of detailed information regarding fees and commissions raises concerns.

| Fee Type | Vestvai | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 2.0 - 5.0% |

The lack of clarity on trading costs may indicate hidden fees or unfavorable trading conditions that could affect profitability. Traders must be cautious and ensure they fully understand the fee structure before committing funds. This lack of transparency leads to the question, is Vestvai safe? The potential for unexpected costs could result in a negative trading experience.

Client Fund Security

Client fund security is a critical aspect of any trading platform. A reputable broker should have measures in place to safeguard clients' funds, such as segregated accounts and investor protection schemes. Vestvai, however, does not provide sufficient information regarding its security measures.

Traders should be particularly concerned about the absence of segregated accounts, which separate client funds from the broker's operational funds, thereby protecting them in the event of insolvency. Moreover, the lack of investor protection schemes raises further alarms about the safety of funds deposited with Vestvai. Historical data on any security breaches or fund mismanagement is also lacking, making it difficult to ascertain the broker's track record. Given these concerns, it is imperative for traders to ask themselves, is Vestvai safe? The absence of robust security measures suggests that it is not.

Customer Experience and Complaints

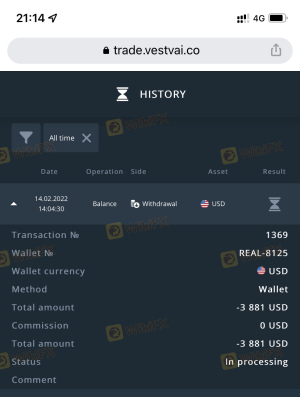

Analyzing customer feedback and experiences can provide valuable insights into a broker's reliability. Many users have reported negative experiences with Vestvai, including difficulties in withdrawing funds and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Misleading Information | High | Inadequate |

Common complaints include claims of excessive fees during withdrawal processes and a lack of support when issues arise. These patterns of dissatisfaction indicate a troubling trend that could signify deeper issues within the company's operations. Therefore, it is critical to consider whether the experiences of past clients align with your expectations. If many clients have faced challenges, one must question, is Vestvai safe? The prevailing sentiment suggests that it may not be.

Platform and Trade Execution

A broker's trading platform is the primary interface for clients, and its performance can significantly impact the trading experience. Vestvai offers a proprietary trading platform, but user reviews indicate that it may lack the stability and features found in more established platforms like MetaTrader 4 or 5.

Issues such as slippage, delayed order execution, and potential manipulation have been reported, raising concerns about the integrity of the trading environment. A reliable trading platform should provide seamless execution and transparency, which appears to be lacking with Vestvai. This leads to further skepticism about the broker's practices and raises the question of whether is Vestvai safe? The potential for poor execution could lead to financial losses for traders.

Risk Assessment

In summary, the overall risk associated with trading with Vestvai appears to be high.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises significant concerns. |

| Financial Risk | High | Lack of transparency on fees and fund security. |

| Operational Risk | Medium | Reports of poor platform performance and execution issues. |

Given these risks, traders should approach Vestvai with caution. It is advisable to consider alternative brokers that offer better regulatory oversight and proven track records.

Conclusion and Recommendations

In conclusion, the evidence suggests that Vestvai is not a safe option for traders. The lack of regulatory oversight, transparency, and negative customer feedback raise significant red flags. If you are considering trading with Vestvai, it is important to weigh these risks carefully.

For traders seeking reliable alternatives, consider established brokers that are regulated by reputable authorities and have a proven history of customer satisfaction. Ultimately, the question of is Vestvai safe? can be answered with a resounding no, and traders should exercise caution when dealing with this broker.

Is Vestvai a scam, or is it legit?

The latest exposure and evaluation content of Vestvai brokers.

Vestvai Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Vestvai latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.