Is UTGX safe?

Business

License

Is UTGX Safe or Scam?

Introduction

In the ever-evolving landscape of the Forex market, traders are constantly seeking reliable brokers to facilitate their trading activities. UTGX, a relatively new player in this arena, claims to offer a range of trading opportunities across various financial instruments. However, the question remains: Is UTGX safe or a scam? Given the prevalence of fraudulent schemes in the Forex industry, it is crucial for traders to conduct thorough evaluations of any broker before committing their funds. This article aims to analyze the safety and legitimacy of UTGX by examining its regulatory status, company background, trading conditions, customer experiences, and risk factors. Our investigation is based on a comprehensive review of available online resources, user feedback, and expert analysis.

Regulatory Status and Legitimacy

One of the primary indicators of a broker's reliability is its regulatory status. A regulated broker is typically subject to strict oversight, ensuring that it adheres to industry standards and protects clients' funds. Unfortunately, UTGX operates without any valid regulatory license, which raises significant concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that UTGX does not have to comply with the stringent requirements set forth by reputable authorities. This lack of oversight can expose traders to various risks, including potential fraud and mismanagement of funds. Furthermore, the company is registered in Saint Vincent and the Grenadines, a jurisdiction often associated with lax regulatory practices. Without a credible regulatory framework, it is challenging to assess the broker's historical compliance and operational integrity.

Company Background Investigation

UTGX presents itself as a leader in online trading, yet its company background raises several red flags. The broker's website lacks comprehensive information about its history, ownership structure, and management team. This opacity is typical of many fraudulent brokers, which often provide minimal details to evade scrutiny.

The lack of transparency regarding the management team and their qualifications further compounds concerns about the broker's credibility. A reputable broker typically showcases its leadership's expertise and experience in the financial industry. However, UTGX fails to provide such information, making it difficult for potential clients to evaluate the broker's trustworthiness.

In summary, the absence of a clear company background and management profile suggests that traders should exercise extreme caution when considering UTGX as their broker.

Trading Conditions Analysis

When assessing a broker's safety, it is essential to evaluate its trading conditions, including fees, spreads, and overall cost structure. UTGX claims to offer competitive trading conditions, but the lack of transparency regarding its fee structure raises concerns.

| Fee Type | UTGX | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | N/A | 0.5 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Standard |

The absence of specific fee information on UTGX's website makes it challenging for traders to compare its offerings with industry standards. Moreover, many users have reported hidden fees and unexpected charges, which can significantly impact trading profitability. This lack of clarity in trading costs is a common tactic used by scam brokers to lure unsuspecting traders.

Customer Fund Safety

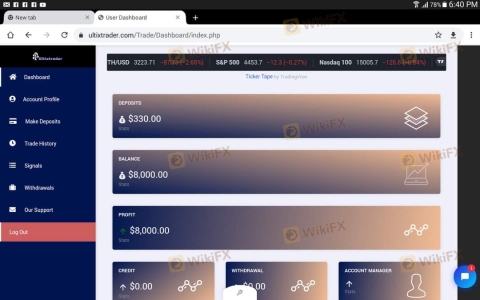

The security of client funds is paramount when choosing a Forex broker. UTGX's lack of regulation raises significant concerns about the safety of customer deposits. A reputable broker typically employs measures such as segregated accounts and investor protection schemes. However, UTGX has not provided any information regarding its fund security protocols.

In the absence of clear policies on fund segregation and protection against negative balances, traders are left vulnerable to potential losses. Additionally, there have been reports of users facing difficulties when attempting to withdraw their funds, a common complaint associated with unregulated brokers. This history of withdrawal issues further emphasizes the need for caution when dealing with UTGX.

Customer Experience and Complaints

Analyzing customer feedback is crucial in determining the reliability of a broker. Many users have expressed dissatisfaction with UTGX, citing issues such as poor customer support and difficulty in accessing their funds.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Poor Customer Support | Medium | Slow Response |

| Misleading Information | High | No Resolution |

Common complaints include unresponsive customer service and delays in fund withdrawals, which are significant red flags for any potential trader. In one notable case, a user reported being unable to withdraw funds for several weeks, leading to frustration and distrust. These issues indicate a lack of accountability and transparency, further supporting the notion that UTGX may not be a safe broker.

Platform and Execution

A broker's trading platform is a vital component of the trading experience. UTGX offers a basic trading platform, but user reviews suggest that it suffers from performance issues, including slow execution and occasional downtime.

Traders have reported instances of slippage and rejected orders, which can greatly affect trading outcomes. These execution problems are particularly concerning for those engaging in high-frequency trading or relying on timely market entries and exits. The combination of a subpar trading platform and untrustworthy execution raises significant concerns about the overall reliability of UTGX.

Risk Assessment

Using UTGX comes with inherent risks that potential traders should carefully consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Fund Safety Risk | High | Lack of fund protection measures |

| Customer Service Risk | Medium | Poor response and support issues |

| Execution Risk | High | Slippage and rejected orders reported |

Given the high-risk levels associated with UTGX, traders should be well aware of the potential pitfalls. To mitigate these risks, it is advisable to conduct thorough research and consider alternative, regulated brokers with proven track records.

Conclusion and Recommendations

In conclusion, the evidence suggests that UTGX is not a safe broker. The lack of regulation, transparency issues, and numerous customer complaints indicate potential fraudulent activity. Traders should exercise extreme caution when considering UTGX as their Forex broker.

For those seeking reliable alternatives, it is recommended to explore brokers that are regulated by top-tier authorities, ensuring a safer trading environment. Brokers such as FXTM, IG, or OANDA offer the necessary regulatory oversight and customer protections that are critical for a secure trading experience. Ultimately, being informed and cautious can help traders avoid scams and ensure their investments are safeguarded.

Is UTGX a scam, or is it legit?

The latest exposure and evaluation content of UTGX brokers.

UTGX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

UTGX latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.