Is TRP safe?

Business

License

Is TRP A Scam?

Introduction

TRP, a forex broker that has emerged in the crowded online trading landscape, claims to offer a variety of trading instruments, including currencies, commodities, and cryptocurrencies. However, as the forex market continues to attract both seasoned traders and novices, the need for cautious evaluation of brokers like TRP is paramount. Traders must consider the potential risks associated with unregulated platforms, which can lead to significant financial losses. This article aims to provide a thorough investigation into the legitimacy of TRP, evaluating its regulatory status, company background, trading conditions, client fund safety, customer experiences, and overall risk profile. The assessment is based on multiple credible sources, including user reviews and regulatory databases, to determine whether TRP is safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial in determining its legitimacy and safety for traders. TRP claims to operate under various financial authorities; however, a closer examination reveals significant discrepancies. Below is a summary of TRP's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

As indicated in the table, TRP lacks a valid regulatory license, which raises serious concerns about its operational legitimacy. The absence of oversight from recognized regulatory bodies such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the United States means that traders using TRP have no safety net should issues arise. This lack of regulation is a significant red flag, as it suggests that TRP does not adhere to the necessary legal frameworks that protect traders' interests. Furthermore, historical compliance issues have been reported, with numerous users expressing concerns about their inability to withdraw funds, which further emphasizes the importance of asking, "Is TRP safe?"

Company Background Investigation

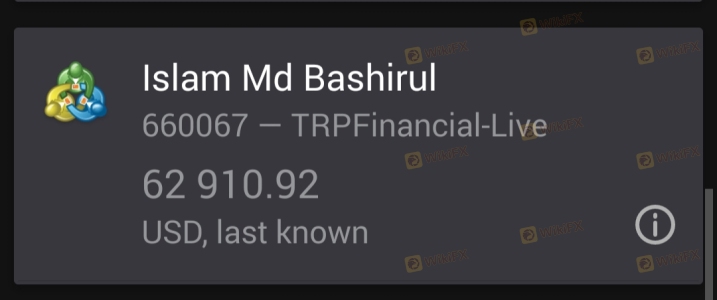

TRP's history and ownership structure are essential components in assessing its reliability. The company claims to have been providing financial investment services for nearly a decade, yet its domain was only registered in 2022. This discrepancy raises questions about the broker's actual experience and transparency. The lack of information regarding its management team and operational history further complicates the assessment of TRP's credibility.

Moreover, potential clients may find it challenging to obtain reliable information about the company's operations, which is a critical factor in determining whether TRP is safe or a potential scam. The absence of clear ownership details and the company's vague history suggest a lack of accountability. This opacity can be alarming for traders, as it undermines confidence in the broker's ability to act in the best interests of its clients.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential for traders aiming to maximize their returns. TRP presents itself as offering competitive trading conditions, but a closer examination reveals several concerning aspects. Below is a comparison of TRP's core trading costs with industry averages:

| Fee Type | TRP | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips | 1.0 - 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

The spreads offered by TRP are higher than the industry average, which can significantly erode potential profits. Additionally, the broker's unclear commission structure raises concerns about hidden fees that may be applied during trading. Such potentially unusual fee policies warrant caution, as they can lead to unexpected costs that traders may not be prepared for. This lack of transparency in trading conditions further adds to the question of whether TRP is safe.

Client Fund Safety

Client fund safety is a paramount concern when choosing a forex broker. TRP's approach to fund security raises several alarming questions. The broker does not provide clear information regarding its fund safety measures, including whether client funds are kept in segregated accounts or if there is any form of investor protection in place. The absence of segregated accounts means that there is a risk that client funds could be misused for operational expenses, which is a common practice among unregulated firms.

Moreover, there is no indication that TRP offers any form of negative balance protection, leaving traders vulnerable to losing more than their initial investment. Historical reports of clients being unable to withdraw funds further exacerbate concerns regarding the safety of their investments with TRP. These issues highlight the importance of assessing whether TRP is safe for managing trading capital.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability. Unfortunately, TRP has garnered a significant number of complaints from users, particularly regarding withdrawal issues and poor customer service. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Quality | Medium | Poor |

Common complaints include difficulties in withdrawing funds, lack of communication from customer support, and accusations of misleading advertising practices. For instance, several users have reported that after making an initial deposit, they faced obstacles when attempting to withdraw their funds, leading to frustration and financial loss. The overall negative feedback suggests that TRP may not prioritize customer satisfaction or transparency, raising further questions about whether TRP is safe for traders.

Platform and Trade Execution

The performance and reliability of a trading platform are critical to a trader's success. TRP claims to offer a user-friendly platform; however, many users have reported issues related to stability, order execution speed, and slippage. A reliable trading platform should provide fast and accurate order execution, minimizing the risk of slippage and rejected orders. Unfortunately, reports of platform manipulation and poor execution quality have emerged from users, raising concerns about the broker's operational integrity. These issues make it essential for traders to consider whether TRP is safe for conducting trades in a competitive market.

Risk Assessment

Engaging with TRP entails several risks that traders must be aware of. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Safety Risk | High | No clear fund segregation or protection. |

| Customer Service Risk | Medium | Poor feedback on support and withdrawals. |

To mitigate these risks, traders are advised to conduct thorough research before committing funds to any broker, especially those lacking regulatory oversight. It is also recommended to start with a small investment and test the platform's performance before scaling up. These precautions are essential in determining whether TRP is safe for trading.

Conclusion and Recommendations

In conclusion, the evidence suggests that TRP exhibits several characteristics commonly associated with scam brokers. The lack of regulation, combined with numerous complaints regarding fund safety and customer service, raises serious concerns about the platform's legitimacy. For traders considering using TRP, it is advisable to exercise extreme caution. Those new to trading should seek platforms that are well-regulated and have a proven track record of reliability.

For those looking for reliable alternatives, consider brokers that are regulated by reputable authorities, such as the FCA or ASIC, which offer better protection for your funds and a more trustworthy trading environment. Ultimately, the question "Is TRP safe?" leans towards a negative answer, and traders should prioritize safety and transparency when choosing a forex broker to protect their investments.

Is TRP a scam, or is it legit?

The latest exposure and evaluation content of TRP brokers.

TRP Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TRP latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.