Is GoTrading safe?

Pros

Cons

Is Gotrading Safe or a Scam?

Introduction

Gotrading is an online forex broker that has recently gained attention in the trading community. As with any broker, it is crucial for traders to conduct thorough research before committing their funds. The forex market is rife with both legitimate and fraudulent entities, making it essential for traders to assess the credibility of their chosen broker. This article aims to provide an objective analysis of Gotrading's legitimacy, regulatory status, and overall safety for potential investors. To achieve this, we will examine various aspects of the broker, including its regulatory framework, company background, trading conditions, customer fund security, customer experiences, platform performance, and associated risks.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its safety. Gotrading's regulatory situation is somewhat concerning, as it lacks oversight from major regulatory bodies. This absence of regulation raises significant red flags for potential investors. Below is a summary of Gotrading's regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The lack of a regulatory license means that Gotrading does not have to adhere to the stringent requirements set by recognized financial authorities. This situation can lead to a lack of accountability, making it easier for unscrupulous practices to occur. Without regulatory oversight, clients have limited recourse in the event of disputes or financial misconduct. Regulatory quality is paramount, as it ensures that brokers operate transparently and ethically. In the case of Gotrading, the absence of regulation raises serious concerns about its legitimacy and the safety of traders' funds.

Company Background Investigation

Gotrading's company background is another area of concern. The broker's history is relatively short, and there is limited information available regarding its ownership structure and management team. A lack of transparency about the company's origins and leadership can be indicative of potential risks. A well-established broker typically has a clear history, a robust management team, and a transparent operational framework. Unfortunately, Gotrading does not provide sufficient information to instill confidence in potential investors.

Moreover, the company's transparency in disclosing its operations and policies is crucial for building trust. Traders should be wary of brokers that do not provide clear information about their business practices, as this can be a sign of potential malfeasance. The absence of a well-defined corporate structure and the lack of information regarding the management team's qualifications further highlight the need for caution when considering Gotrading as a trading partner.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. Gotrading's fee structure and trading conditions appear to be standard, but there are several aspects that warrant closer examination. Below is a comparison of Gotrading's core trading costs:

| Fee Type | Gotrading | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 1.5 pips | 1.0 pips |

| Commission Model | None | $3 per lot |

| Overnight Interest Range | 0.5% | 0.4% |

While Gotrading's spreads may seem competitive at first glance, they are higher than the industry average for major currency pairs. This could eat into traders' profits, especially for those who engage in high-frequency trading. Additionally, the absence of a clear commission structure raises questions about how the broker generates revenue. A lack of transparency in fees can lead to unexpected costs for traders, further complicating the decision to trade with Gotrading.

Customer Fund Security

The safety of customer funds is paramount when evaluating the credibility of a broker. Gotrading's approach to fund security is unclear, particularly regarding the segregation of client funds and investor protection measures. A reputable broker typically segregates client funds from its operational funds to ensure that traders' money is protected in the event of financial difficulties. Furthermore, negative balance protection is a critical feature that prevents traders from losing more than their deposited amount.

Unfortunately, there is no information available regarding Gotrading's policies on fund segregation or negative balance protection. This lack of clarity raises significant concerns about the safety of traders' investments. Traders should be cautious when dealing with brokers that do not prioritize the security of client funds, as this can lead to substantial financial losses.

Customer Experience and Complaints

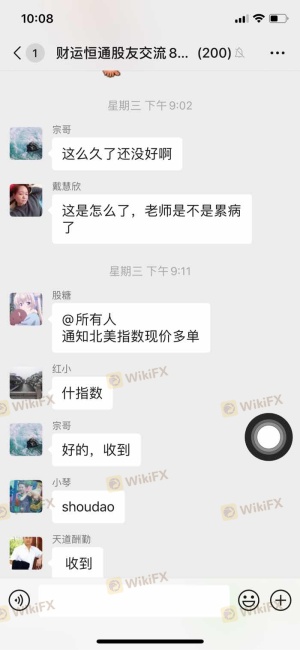

Customer feedback is an essential aspect of assessing a broker's reliability. A review of Gotrading's customer experiences reveals a mixed bag of opinions. Many users report difficulties with withdrawals and poor customer service, which are significant red flags for any broker. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or No Response |

| Customer Service | Medium | Unhelpful |

| Transparency Issues | High | Lack of Information |

One typical case involves a trader who attempted to withdraw funds after a successful trading period but faced delays and unresponsive customer support. This scenario is alarming, as it indicates potential issues with the broker's operational integrity. Such complaints highlight the importance of choosing a broker with a strong reputation for customer service and responsiveness.

Platform and Trade Execution

The trading platform's performance and reliability are crucial for a positive trading experience. Gotrading offers a standard trading platform, but there are concerns about its stability and execution quality. Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes. A reliable broker should ensure that trades are executed swiftly and accurately, without manipulation or undue delays.

The lack of transparency regarding the platform's performance raises questions about Gotrading's operational practices. Traders should be cautious of brokers that do not provide clear information about their execution methods, as this can lead to unfavorable trading conditions.

Risk Assessment

Using Gotrading comes with inherent risks that traders must consider before opening an account. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of regulation increases the risk of fraud. |

| Fund Security Risk | High | Unclear fund protection measures raise concerns. |

| Customer Service Risk | Medium | Reports of poor customer service can hinder support. |

To mitigate these risks, traders should conduct thorough research and consider alternative brokers with better regulatory oversight and customer service. Choosing a broker with a strong reputation and transparent practices is essential for minimizing potential risks.

Conclusion and Recommendations

In conclusion, the evidence suggests that Gotrading presents several red flags that warrant caution. The absence of regulatory oversight, unclear fund security measures, and negative customer experiences raise significant concerns about the broker's legitimacy. While some traders may find success, the overall risk associated with trading with Gotrading is considerable.

Traders are advised to exercise caution and consider alternative brokers that offer better regulatory protection, clearer fee structures, and more reliable customer service. Some reputable alternatives include brokers that are regulated by recognized authorities, have transparent pricing, and provide robust customer support. Ultimately, the decision to engage with Gotrading should be made with careful consideration of the risks involved.

Is GoTrading a scam, or is it legit?

The latest exposure and evaluation content of GoTrading brokers.

GoTrading Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GoTrading latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.