Is TIME WEALTH INTERNATIONAL safe?

Business

License

Is Time Wealth International Safe or Scam?

Introduction

Time Wealth International is a forex broker that positions itself in the competitive landscape of online trading, offering various trading services including forex, CFDs, and commodities. As with any broker, it is essential for traders to exercise caution and conduct thorough research before committing their funds. The forex market is rife with opportunities, but it also harbors risks, including potential scams. Therefore, understanding the legitimacy of a broker like Time Wealth International is crucial for any trader looking to safeguard their investments. This article employs a structured evaluation framework, analyzing regulatory compliance, company background, trading conditions, customer experiences, and risk factors associated with Time Wealth International.

Regulation and Legitimacy

Regulation is a critical component in determining the safety of a forex broker. Time Wealth International claims to be regulated by the Financial Services Authority (FSA) of Hong Kong. However, the effectiveness and credibility of this regulation are under scrutiny. Below is a summary of the regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSA | N/A | Hong Kong | Suspicious |

The significance of this regulatory status cannot be overstated. A reputable regulatory body enforces strict compliance standards, ensuring that brokers operate fairly and transparently. Unfortunately, Time Wealth Internationals regulatory status raises red flags, particularly due to the absence of a concrete license number and the dubious nature of its claims. Historical compliance issues and a lack of transparency further exacerbate concerns regarding its legitimacy. The broker has been noted for having a suspicious regulatory license, which is a significant factor when assessing whether Time Wealth International is safe or a scam.

Company Background Investigation

Time Wealth International was established with the intention of providing a comprehensive trading platform for forex and other financial instruments. However, information regarding its ownership structure and management team is limited. The lack of transparency in these areas is concerning, as it raises questions about the brokers operational integrity and accountability.

The management team‘s expertise and experience play a crucial role in a broker’s reliability. Unfortunately, there is scant information available about the individuals behind Time Wealth International, making it difficult to assess their qualifications. The company‘s history also lacks a robust narrative, which is often indicative of a broker’s stability and trustworthiness. This lack of information contributes to the skepticism surrounding Time Wealth International, making it imperative for potential clients to tread carefully.

Trading Conditions Analysis

When evaluating whether Time Wealth International is safe or a scam, it is vital to analyze the trading conditions it offers. Traders need to understand the fee structure, spreads, and commissions involved. Below is a comparative table of the core trading costs:

| Fee Type | Time Wealth International | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 pips |

| Commission Model | N/A | $5 per lot |

| Overnight Interest Range | N/A | Varies |

The absence of specific data regarding spreads and commissions is alarming. Typically, reputable brokers provide clear and transparent information about their fee structures. The lack of clarity can indicate hidden fees or unfavorable trading conditions, which could be detrimental to traders. Moreover, any unusual or problematic fees should be scrutinized, as they can be a sign of a broker that is not operating in the best interest of its clients.

Customer Funds Safety

The security of customer funds is a paramount concern for any trader. Time Wealth International claims to implement measures to safeguard client funds, including segregated accounts and investor protection policies. However, the effectiveness of these measures remains questionable.

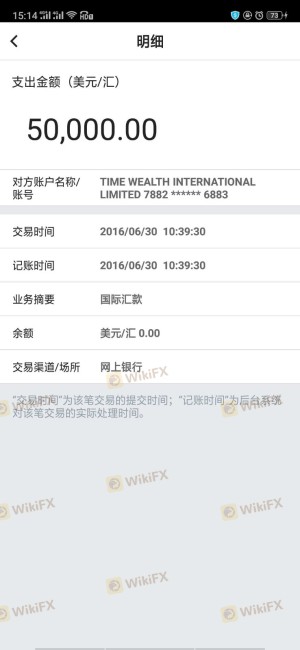

The broker's history of complaints regarding fund withdrawals and financial disputes raises significant concerns about its commitment to customer fund safety. Traders must be aware of the risks associated with investing in a broker that has a history of financial instability or unresolved disputes.

Customer Experience and Complaints

Customer feedback is an invaluable resource when assessing a broker's reliability. Reviews of Time Wealth International reveal a mix of experiences, with several users expressing dissatisfaction with the broker's customer service and withdrawal processes. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Average |

| Lack of Transparency | High | Poor |

A notable case involved a trader who reported being unable to withdraw funds after several attempts, leading to frustration and a sense of betrayal. This pattern of complaints is concerning and suggests that Time Wealth International may not be prioritizing customer satisfaction or transparency.

Platform and Execution

The trading platform offered by Time Wealth International is another critical aspect to consider. A reliable platform should provide a smooth trading experience, with efficient order execution and minimal slippage. However, users have reported issues with platform stability and execution quality, raising concerns about whether Time Wealth International is indeed safe for trading.

Moreover, any signs of platform manipulation or unfair practices should be closely monitored. Traders must ensure that the broker they choose offers a secure and efficient trading environment to protect their investments.

Risk Assessment

Using Time Wealth International presents several risks that potential traders should be aware of. Below is a concise risk scorecard summarizing the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Uncertain regulatory compliance |

| Financial Stability | High | History of withdrawal complaints |

| Customer Service | Medium | Mixed reviews on support quality |

To mitigate these risks, traders should consider starting with a small investment, conducting thorough due diligence, and remaining vigilant regarding their trading activities.

Conclusion and Recommendations

In conclusion, the evidence surrounding Time Wealth International raises significant concerns about its safety and legitimacy. The lack of clear regulatory oversight, coupled with a history of customer complaints and transparency issues, suggests that traders should approach this broker with caution.

For those seeking reliable alternatives, it is advisable to consider brokers regulated by reputable authorities such as the FCA or ASIC, which offer robust investor protections and transparent trading conditions. Ultimately, the decision to engage with Time Wealth International should be made with careful consideration of the associated risks and potential red flags.

Is TIME WEALTH INTERNATIONAL a scam, or is it legit?

The latest exposure and evaluation content of TIME WEALTH INTERNATIONAL brokers.

TIME WEALTH INTERNATIONAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TIME WEALTH INTERNATIONAL latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.