Is Star TradeFx safe?

Business

License

Is Star TradeFX A Scam?

Introduction

Star TradeFX is an online forex broker that has positioned itself as a player in the competitive landscape of foreign exchange trading. Established in recent years, it offers a range of trading services, including forex, commodities, and cryptocurrencies. In an industry rife with potential pitfalls, traders must exercise caution when evaluating brokers to ensure their investments are secure and legitimate. The importance of thorough due diligence cannot be overstated; a broker's regulatory status, customer feedback, and operational transparency are crucial factors that can significantly impact a trader's experience. This article employs a comprehensive assessment framework, drawing from various sources, including regulatory databases, user reviews, and industry reports, to determine whether Star TradeFX is a safe trading option or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical indicators of its legitimacy. Star TradeFX operates without any significant regulatory oversight, which raises concerns about investor protection and operational integrity. In the financial services industry, brokers regulated by reputable authorities are generally considered safer due to stringent compliance requirements. Below is a summary of the regulatory information related to Star TradeFX:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

Star TradeFX's lack of regulation is particularly alarming. The absence of oversight from established entities such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC) means that traders have limited recourse in the event of disputes or financial losses. Furthermore, the potential for fraud and market manipulation increases when a broker operates outside the purview of regulatory bodies. Historical compliance issues or any past warnings from regulatory authorities further compound these concerns, making it imperative for traders to be vigilant.

Company Background Investigation

Star TradeFX's company history is relatively short, having been established only a few years ago. The broker's ownership structure and management team remain largely opaque, which adds to the skepticism surrounding its operations. A transparent broker typically provides information about its founders and key executives, including their backgrounds and professional experience in the financial industry. Unfortunately, Star TradeFX fails to meet this standard, leaving potential clients in the dark about who is managing their investments. This lack of transparency can be a red flag for traders, as it may indicate a lack of accountability.

Moreover, the broker's operational history is limited, and there are no substantial records of its performance during market fluctuations. Without a proven track record, it becomes challenging for investors to gauge the broker's reliability and commitment to ethical trading practices. The overall transparency and information disclosure levels are inadequate, which could be indicative of deeper issues within the organization.

Trading Conditions Analysis

When evaluating the trading conditions offered by Star TradeFX, it is essential to consider its fee structure and any unusual policies that may impact traders' profitability. The broker claims to offer competitive spreads and various account types, but the lack of clarity regarding fees can be concerning. Below is a comparison of core trading costs:

| Fee Type | Star TradeFX | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.0 pips | 0.5 - 1.0 pips |

| Commission Structure | None | Varies |

| Overnight Interest Range | N/A | Varies |

While Star TradeFX advertises spreads starting from 1.0 pips, the industry average for similar brokers tends to be lower. Additionally, the absence of a clear commission structure raises questions about how the broker generates revenue. Traders should be wary of hidden fees that could erode their profits, especially in a competitive trading environment where costs are a crucial factor in overall performance.

Client Funds Safety

The safety of client funds is a paramount concern for any trader. Star TradeFX's policies regarding fund security are critical in assessing whether it is a safe broker. The absence of regulatory oversight means that there are few guarantees regarding the safeguarding of clients' investments. For instance, many reputable brokers offer segregated accounts, ensuring that client funds are kept separate from the broker's operational accounts. However, Star TradeFX does not provide clear information on whether it employs such measures.

Additionally, the lack of negative balance protection is a significant concern. This policy is crucial for preventing clients from losing more than their initial deposit, particularly when trading with high leverage. The absence of investor protection schemes further exacerbates the risk, as traders may find themselves with limited recourse in the event of a broker insolvency or operational failure.

Customer Experience and Complaints

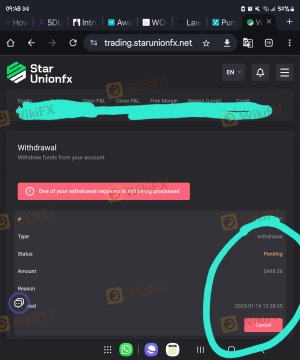

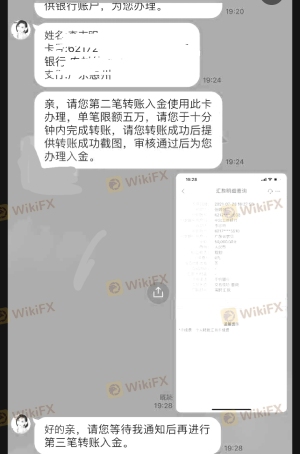

Customer feedback plays a vital role in assessing the reliability of a broker. An analysis of user reviews for Star TradeFX reveals a mixed bag of experiences. While some traders report positive interactions, many others express dissatisfaction regarding the broker's customer service and operational transparency. Common complaints include delayed withdrawals, lack of responsiveness from customer support, and issues with trade execution. Below is a summary of the primary complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Support | Medium | Inconsistent |

| Trade Execution Issues | High | Unresolved |

One notable case involved a trader who experienced significant delays in withdrawing funds, leading to frustration and a loss of trust in the broker's operations. Such complaints highlight the importance of reliable customer support and efficient operational processes, which are essential for maintaining a positive trading environment.

Platform and Trade Execution

Star TradeFX utilizes the popular MetaTrader 4 (MT4) platform for trading, which is well-regarded for its user-friendly interface and advanced features. However, the performance and stability of the trading platform are critical factors that can significantly affect a trader's experience. Reports of slippage and rejected orders have surfaced, raising concerns about the broker's execution quality. Traders expect swift and accurate order execution, and any signs of manipulation or inefficiency can lead to significant losses.

Risk Assessment

Engaging with Star TradeFX presents various risks that traders should carefully consider. The lack of regulation, potential issues with fund security, and the mixed feedback from clients all contribute to an elevated risk profile. Below is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No significant regulatory oversight |

| Fund Security Risk | High | Lack of clear safety measures |

| Customer Service Risk | Medium | Reports of slow response and delays |

To mitigate these risks, traders should approach Star TradeFX with caution, ensuring they fully understand the potential implications of trading with an unregulated broker.

Conclusion and Recommendations

In conclusion, the evidence suggests that Star TradeFX poses significant risks for traders. The absence of regulatory oversight, combined with a lack of transparency and mixed customer feedback, raises red flags about its legitimacy. While some traders may find success with the broker, the potential for issues related to fund security and customer service cannot be ignored.

For those considering trading with Star TradeFX, it is essential to weigh the risks carefully. Traders should explore alternative, regulated options that offer greater security and transparency. Reputable brokers with established regulatory oversight, such as those regulated by the FCA or ASIC, are generally safer choices for traders seeking a reliable trading environment. Ultimately, the decision to engage with Star TradeFX should be made with a clear understanding of the potential risks involved.

Is Star TradeFx a scam, or is it legit?

The latest exposure and evaluation content of Star TradeFx brokers.

Star TradeFx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Star TradeFx latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.