Is SpaceFX safe?

Business

License

Is SpaceFX A Scam?

Introduction

SpaceFX is a brokerage firm that has emerged in the forex market, positioning itself as a potential partner for traders seeking diverse investment opportunities. With claims of offering access to a wide range of financial instruments, including forex, commodities, and indices, SpaceFX aims to attract both novice and experienced traders. However, as the forex market is rife with both legitimate and fraudulent brokers, it is crucial for traders to exercise caution and thoroughly evaluate any brokerage before committing their funds. This article aims to investigate the legitimacy of SpaceFX by analyzing its regulatory status, company background, trading conditions, customer fund security, client experiences, platform performance, and associated risks. Our investigation is based on a review of various online sources, including user reviews and regulatory warnings, to provide a comprehensive assessment of whether SpaceFX is safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a brokerage is a fundamental aspect that determines its legitimacy and the safety of traders' funds. SpaceFX operates without a valid license and is based in the Marshall Islands, a jurisdiction known for its lax regulatory environment. The absence of regulatory oversight raises significant concerns about the broker's accountability and transparency. Below is a summary of the regulatory information regarding SpaceFX:

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of regulation means that there is no external authority to monitor SpaceFXs activities or ensure that it adheres to fair trading practices. Consequently, traders engaging with SpaceFX may find themselves vulnerable to manipulative practices and potential scams, as unregulated brokers often lack the necessary checks and balances to protect their clients. Furthermore, the absence of a regulatory framework means that traders have limited recourse in the event of disputes or issues related to fund withdrawals. In light of this, it is essential to approach SpaceFX with caution, as the lack of regulatory oversight is a significant red flag indicating that SpaceFX is not safe for trading.

Company Background Investigation

Understanding the background of SpaceFX provides insight into its operational integrity and trustworthiness. The company claims to offer a wide array of trading instruments and has a presence in various markets. However, detailed information about its history, ownership structure, and management team is scarce. The company's website lacks transparency regarding its operational history and the credentials of its management team, raising questions about its professionalism and reliability.

SpaceFX appears to operate under the name PSC Technology Development Consulting S.R.L., yet there is minimal information available on the ownership and management team. A lack of transparency in this area can be concerning, as reputable brokers typically provide comprehensive details about their team and their qualifications. Moreover, the company's registered address is frequently linked to the Marshall Islands, which is often associated with unregulated and potentially fraudulent entities. This opacity in company information further reinforces the notion that SpaceFX may not be a safe trading option for investors.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is crucial. SpaceFX presents a range of account types with varying leverage options, but the specifics regarding fees and spreads are not clearly outlined, which can create confusion for traders. The overall fee structure appears to be opaque, with no transparent pricing for spreads or commissions, making it difficult for traders to assess their overall trading costs. Below is a comparison of key trading costs associated with SpaceFX:

| Fee Type | SpaceFX | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | Not disclosed | Varies (1-3 pips) |

| Commission Model | Not disclosed | Varies (0-10 USD) |

| Overnight Interest Range | Not disclosed | Varies (0.5-2%) |

The lack of clarity regarding trading fees can lead to unexpected costs for traders, which is a critical factor to consider when determining whether SpaceFX is safe. Additionally, the absence of information about overnight interest rates may indicate that the broker employs hidden fees that could diminish traders' profits. Overall, the lack of transparent trading conditions is a significant concern for potential clients.

Client Fund Security

The security of client funds is paramount when assessing the safety of a brokerage. SpaceFX claims to implement measures to protect client assets, but the specifics of these measures are not well-documented. It is essential to evaluate whether client funds are held in segregated accounts, which can provide an additional layer of security by ensuring that client funds are kept separate from the broker's operational funds.

Moreover, the absence of investor protection schemes, such as those provided by regulated brokers, raises concerns about the safety of client deposits. In the event of insolvency or fraudulent activities, traders may find it challenging to recover their funds. Historically, unregulated brokers have been associated with various fund security issues, including allegations of misappropriation of client funds. Therefore, potential traders must consider these factors seriously, as the lack of robust fund security measures indicates that SpaceFX may not be a safe choice for trading.

Customer Experience and Complaints

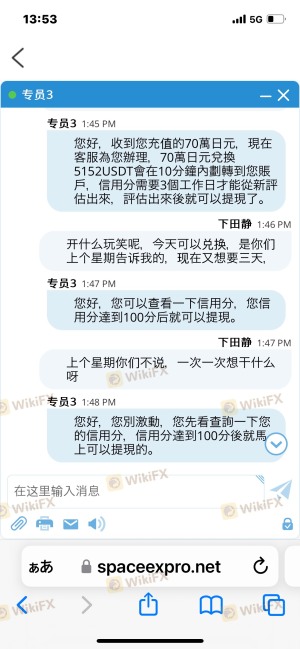

Analyzing customer feedback is crucial in understanding the overall experience with a brokerage. Reviews of SpaceFX reveal a pattern of complaints, particularly regarding the difficulty of withdrawing funds. Many users have reported issues such as unexplained delays in processing withdrawal requests and a lack of responsive customer support. Below is a summary of common complaints associated with SpaceFX:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Limited |

| Customer Support Response | High | Unresponsive |

For instance, several users have expressed frustration over their inability to withdraw funds after making deposits, which is a common red flag in the forex trading industry. Such complaints indicate that traders may face significant challenges when trying to access their funds, further suggesting that SpaceFX is not safe for trading. The overall sentiment among users highlights a concerning lack of accountability and support from the brokerage.

Platform and Execution

The trading platform offered by SpaceFX is another critical factor in evaluating its legitimacy. A reliable trading platform should provide stable performance, efficient order execution, and a user-friendly interface. However, there are limited details available regarding the platform's performance, stability, and execution quality. Reports of slippage and order rejections have surfaced, which can significantly impact trading outcomes.

The proprietary nature of the trading platform raises concerns about potential broker manipulation, as proprietary platforms are not subject to the same level of scrutiny as third-party platforms. This lack of independent oversight means that traders may be at risk of unfair practices, further emphasizing the need for caution. Overall, the absence of transparent information regarding the platform's performance and execution quality suggests that SpaceFX may not be a safe option for traders seeking a reliable trading environment.

Risk Assessment

Engaging with any brokerage carries inherent risks, and SpaceFX is no exception. The combination of its unregulated status, opaque fee structure, and history of customer complaints contributes to a high-risk profile. Below is a risk assessment summary for SpaceFX:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Fund Security Risk | High | Lack of investor protection |

| Withdrawal Risk | High | Difficulty in accessing funds |

| Transparency Risk | Medium | Opaque trading conditions |

Given these risk factors, potential traders should approach SpaceFX with extreme caution. It is advisable to conduct thorough research and consider safer alternatives to mitigate potential losses.

Conclusion and Recommendations

In conclusion, the investigation into SpaceFX raises significant concerns regarding its legitimacy and safety as a trading platform. The absence of regulation, lack of transparency in trading conditions, and numerous customer complaints suggest that SpaceFX is not safe for trading. Traders should be particularly wary of the potential difficulties in withdrawing funds and the opaque fee structure that could lead to unexpected costs.

For those considering online trading, it is recommended to explore reputable and regulated brokers that provide clear information about their services and robust investor protections. Alternatives that have established regulatory oversight and positive customer feedback may be more suitable for traders seeking a secure trading environment. Ultimately, due diligence is essential in ensuring a safe trading experience in the forex market.

Is SpaceFX a scam, or is it legit?

The latest exposure and evaluation content of SpaceFX brokers.

SpaceFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SpaceFX latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.