Is SA Org safe?

Business

License

Is SA Org Safe or Scam?

Introduction

In the vast and often tumultuous world of foreign exchange trading, the choice of a broker can significantly impact a trader's success. SA Org, a broker that has emerged on the scene in recent years, claims to offer a range of trading services and instruments. However, with the increasing number of scams in the financial industry, it is crucial for traders to thoroughly assess the credibility and safety of their chosen brokers. This article aims to provide an objective analysis of whether SA Org is safe or a scam by examining its regulatory status, company background, trading conditions, customer experience, and overall risk profile. The evaluation is based on comprehensive research, including reviews from reputable financial websites and user feedback.

Regulation and Legitimacy

One of the primary factors in determining the safety of any forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to strict financial standards and practices. Unfortunately, SA Org currently operates without any valid regulatory oversight, which raises significant concerns regarding its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that SA Org is not held accountable by any financial authority, which can lead to potential risks for traders. Regulators typically enforce compliance with industry standards, protecting investors from fraud and malpractice. Furthermore, the lack of a regulatory history for SA Org raises questions about its operational integrity. Traders should be particularly cautious when dealing with unregulated brokers, as they may engage in practices that are not in the best interest of their clients.

Company Background Investigation

Understanding a broker's history and ownership structure is essential in evaluating its trustworthiness. SA Org claims to have been established in 2018, positioning itself as a relatively new player in the forex market. However, details about its ownership and management team remain vague, which diminishes transparency and raises red flags. A broker's reputation is often built on the experience and credibility of its founders and executives, and the lack of accessible information about SA Org's leadership can be a cause for concern.

Additionally, the company's website provides limited information regarding its operational practices and financial stability. Transparency is a key factor in building trust with clients, and SA Org's failure to disclose essential information may indicate a lack of accountability. As traders seek to determine if SA Org is safe, the absence of comprehensive company details should be a significant factor in their decision-making process.

Trading Conditions Analysis

When evaluating a broker's safety, it is also important to consider the trading conditions it offers. SA Org advertises a variety of trading instruments, including currencies, stocks, and cryptocurrencies, but the specifics of its fee structure and trading costs are not clearly outlined.

| Cost Type | SA Org | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Varies | 1.0 - 2.0 pips |

| Commission Model | Varies | $0 - $10 per lot |

| Overnight Interest Range | Varies | 2% - 5% |

The lack of transparency regarding spreads, commissions, and overnight fees can be problematic for traders. If the costs are significantly higher than industry standards, it could eat into potential profits. Moreover, any unusual fees or hidden charges could indicate a lack of integrity in the broker's practices. As potential clients assess whether SA Org is safe, they should be wary of brokers that do not provide clear and comprehensive information about their trading conditions.

Client Fund Security

The safety of client funds is paramount when choosing a forex broker. SA Org has not provided adequate information regarding its fund security measures, which is a critical aspect for any trader. Key considerations include whether client funds are held in segregated accounts, the existence of investor protection schemes, and policies regarding negative balance protection.

While SA Org claims to prioritize client security, the absence of verifiable information on these matters raises concerns. Traders should be particularly cautious, as the lack of established safety protocols could expose them to significant financial risk. Any historical issues related to client fund security could further indicate that SA Org may not be a safe choice for traders.

Customer Experience and Complaints

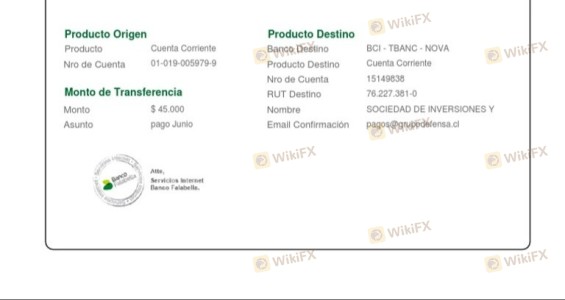

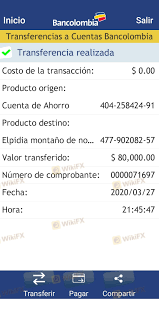

Customer feedback is invaluable in assessing a broker's reliability. Reviews of SA Org reveal a mixed bag of experiences, with some users reporting satisfactory service while others have raised serious complaints. Common issues include difficulties with withdrawals, lack of responsive customer support, and unclear communication regarding account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Poor Customer Service | Medium | Inconsistent |

| Lack of Transparency | High | Minimal Effort |

These complaints suggest that SA Org may struggle with operational efficiency and customer care. Traders should be cautious, as unresolved complaints can indicate deeper systemic issues within the brokerage. It is essential for potential clients to consider these experiences when determining if SA Org is safe for their trading endeavors.

Platform and Execution

The trading platform provided by a broker is another critical aspect of the trading experience. SA Org claims to offer a proprietary trading terminal, but user reviews indicate mixed experiences regarding platform performance and execution quality. Traders have reported issues with slippage and occasional order rejections, which can significantly impact trading outcomes.

A reliable trading platform should provide seamless execution, minimal downtime, and user-friendly features. If SA Org fails to deliver in these areas, it may hinder a trader's ability to operate effectively in the market. As traders assess whether SA Org is safe, the quality of the trading platform and execution should be a primary consideration.

Risk Assessment

In summary, the overall risk profile associated with SA Org appears to be high.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Unregulated status |

| Fund Security | High | Lack of transparency |

| Customer Service | Medium | Mixed feedback |

| Trading Conditions | Medium | Unclear fee structure |

Traders should be aware of these risks and consider implementing strategies to mitigate them. This could include starting with a demo account, limiting initial investments, and conducting thorough research before committing significant capital.

Conclusion and Recommendations

In conclusion, while SA Org presents itself as a legitimate forex broker, the evidence suggests that it may not be safe for traders. The absence of regulation, lack of transparency regarding company operations, and mixed customer feedback all point to potential risks associated with this broker.

Traders are advised to exercise caution and consider alternative brokers that are regulated by reputable financial authorities and have a proven track record of reliability and customer service. If safety is a primary concern, opting for brokers with established regulatory oversight and positive user experiences would be a prudent choice. Ultimately, the decision to engage with SA Org should be made with careful consideration of the associated risks and available alternatives.

Is SA Org a scam, or is it legit?

The latest exposure and evaluation content of SA Org brokers.

SA Org Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SA Org latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.