Is RUILONG INVESTMENT safe?

Business

License

Is Ruilong Investment Safe or Scam?

Introduction

Ruilong Investment, a forex broker operating primarily in the Asian markets, has garnered attention among traders looking for opportunities in foreign exchange trading. With the rapid expansion of the online trading landscape, the need for traders to carefully evaluate the legitimacy and safety of brokers has never been more crucial. This is especially true for platforms like Ruilong Investment, where concerns about regulatory compliance and customer experiences have surfaced. In this article, we will investigate the safety of Ruilong Investment through a structured analysis, focusing on its regulatory status, company background, trading conditions, customer safety measures, and overall user experiences.

Regulation and Legitimacy

The regulatory status of a forex broker is a key indicator of its credibility and trustworthiness. Ruilong Investment operates without significant regulatory oversight, which raises alarms for potential investors. Regulation is essential as it ensures that brokers adhere to strict guidelines designed to protect traders from fraud and malpractice. Below is a summary of the broker's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Not Available | N/A | China | Unverified |

The absence of a regulatory body overseeing Ruilong Investment is concerning. A lack of regulation often indicates that a broker may not be held accountable for its actions, making it easier for unscrupulous practices to occur. Furthermore, the broker has been associated with multiple complaints regarding fund withdrawals and customer service, which undermines trust. Historically, brokers without proper regulation have been linked to fraudulent activities, making it imperative for traders to proceed with caution when considering Ruilong Investment.

Company Background Investigation

Ruilong Investment Co., Ltd. was established with the intention of providing trading services in the forex market. However, detailed information regarding its ownership structure and operational history is limited. The management team‘s qualifications and experience are also not publicly available, which raises questions about the transparency of the broker. A lack of information can lead to uncertainty among potential traders about the broker’s credibility.

Transparency in operations is vital for any financial institution, especially in the forex sector. The absence of clear communication regarding the companys management and operational history may indicate underlying issues. Without a solid foundation of trust and transparency, it is challenging for traders to feel secure when investing their funds with Ruilong Investment.

Trading Conditions Analysis

When evaluating a broker's safety, understanding the trading conditions they offer is essential. Ruilong Investment presents a variety of trading options, but the specifics of their fee structure and costs are often unclear. A summary of the core trading costs is provided below:

| Fee Type | Ruilong Investment | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 3.0 pips |

| Commission Model | N/A | $5 - $10 per lot |

| Overnight Interest Range | High | Low to Moderate |

The trading conditions at Ruilong Investment appear to be less favorable compared to industry standards, particularly concerning spreads and overnight interest rates. High costs can significantly affect a trader's profitability, and the lack of clarity around commission structures may indicate potential hidden fees. Traders should always be wary of brokers that do not provide transparent information about their trading conditions, as this can be a red flag for possible scams.

Customer Fund Safety

The safety of customer funds is paramount when assessing the reliability of a forex broker. Ruilong Investment claims to implement various safety measures; however, the effectiveness of these measures remains questionable. The broker does not provide clear information regarding the segregation of client funds, investor protection schemes, or negative balance protection policies.

Historically, there have been allegations against Ruilong Investment concerning the mishandling of client funds, which further complicates the trustworthiness of the broker. Without robust safety measures and clear policies in place, traders may find themselves at risk of losing their investments. It is crucial for potential clients to thoroughly investigate a brokers fund safety protocols before committing any capital.

Customer Experience and Complaints

Customer feedback is a vital component in assessing the safety of a broker. Reviews and complaints about Ruilong Investment reveal a concerning trend. Many users report difficulties in withdrawing funds and poor customer service responses. Below is a summary of the most common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or No Response |

| Poor Customer Service | Medium | Inconsistent |

| Misleading Information | High | Limited Transparency |

The severity of complaints regarding withdrawal issues indicates a significant risk for traders. A broker that fails to process withdrawals in a timely manner may be engaging in deceptive practices, leading to potential financial loss for clients. Furthermore, the inconsistent responses from customer service suggest a lack of commitment to resolving issues, which is a crucial aspect of a trustworthy trading environment.

Platform and Trade Execution

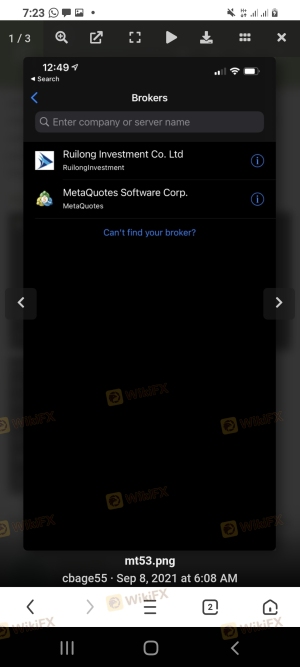

The trading platform is an essential aspect of a trader's experience. Ruilong Investment offers access to popular trading platforms like MetaTrader 4 and 5, but the performance and stability of these platforms are critical for successful trading. Users have reported issues with order execution quality, including high slippage and rejections of orders, which can severely impact trading outcomes.

Moreover, any signs of platform manipulation or irregularities in order execution should raise immediate concerns for traders. A reliable broker must ensure that their trading environment is free from such issues to maintain trader confidence and safety.

Risk Assessment

Using Ruilong Investment comes with several risks that potential traders should consider. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No significant regulation |

| Financial Risk | High | Complaints about fund withdrawals |

| Operational Risk | Medium | Platform stability issues |

Given the high-risk levels associated with Ruilong Investment, traders should approach this broker with caution. It is advisable to seek alternative options that provide a more secure trading environment and better regulatory oversight.

Conclusion and Recommendations

In conclusion, the evidence suggests that Ruilong Investment poses significant risks to potential traders. The lack of regulation, transparency, and customer complaints about fund withdrawals and service quality raises serious concerns about its legitimacy. As such, it is prudent for traders to exercise caution and consider other brokers with a stronger regulatory framework and better customer feedback.

For traders seeking reliable alternatives, it is recommended to explore well-regulated brokers with proven track records in customer service and fund safety. Always conduct thorough research and due diligence before committing your funds to any trading platform. Ultimately, the question "Is Ruilong Investment safe?" leans towards a cautious "no," and traders should prioritize their financial security above all else.

Is RUILONG INVESTMENT a scam, or is it legit?

The latest exposure and evaluation content of RUILONG INVESTMENT brokers.

RUILONG INVESTMENT Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RUILONG INVESTMENT latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.