Is Raynar Trade safe?

Business

License

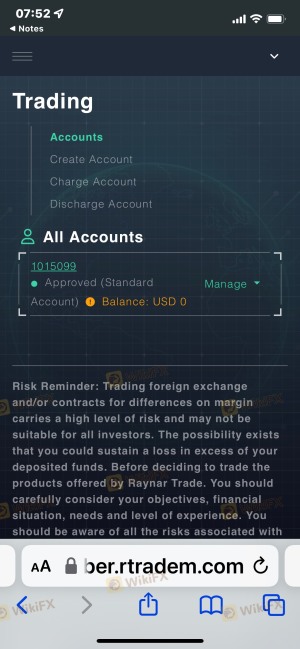

Is Raynar Trade a Scam?

Introduction

Raynar Trade is a forex and CFD broker that has garnered attention in the online trading community for its aggressive marketing strategies and promises of high returns. Operating in a highly competitive environment, it claims to provide a user-friendly platform for both novice and experienced traders. However, the importance of conducting thorough due diligence before selecting a broker cannot be overstated, as the online trading landscape is fraught with scams and unregulated entities. This article aims to provide a comprehensive analysis of Raynar Trade, focusing on its regulatory status, company background, trading conditions, client fund safety, customer experience, platform performance, and overall risk assessment. The investigation relies on multiple online sources, including user reviews and expert analyses, to present a balanced view of whether Raynar Trade is safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy and safety for traders. Raynar Trade operates without any significant regulatory oversight, which raises serious concerns about its practices and the protection of client funds. The absence of regulation means that traders may have limited recourse in case of disputes or financial losses.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The lack of a regulatory framework is a red flag, as legitimate brokers are typically overseen by recognized financial authorities such as the Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), or the Australian Securities and Investments Commission (ASIC). These regulatory bodies enforce strict guidelines to protect investors and ensure fair trading practices. Raynar Trade's failure to disclose any regulatory affiliations or licenses further amplifies concerns about its credibility. The quality of regulation is paramount, as it provides a safety net for traders, ensuring that their funds are handled responsibly and transparently. Without such oversight, Raynar Trade poses significant risks to potential investors.

Company Background Investigation

Raynar Trade's history and ownership structure are essential components in assessing its reliability. Unfortunately, information on the company is scarce. The broker does not provide clear details about its founding, ownership, or operational history on its website, which is a common tactic among unregulated brokers to maintain anonymity.

The management team behind Raynar Trade remains undisclosed, which raises questions about their qualifications and experience in the financial industry. Transparency is a hallmark of reputable brokers, and the lack of information regarding the company's leadership suggests a potential attempt to obscure its true nature. Without a clear understanding of who operates the broker, investors are left to navigate a risky environment with little assurance of accountability.

Moreover, the absence of publicly available financial reports or performance metrics further complicates the evaluation of Raynar Trade. This lack of transparency is concerning, as it prevents potential clients from making informed decisions based on the broker's financial health and operational practices.

Trading Conditions Analysis

When evaluating a broker, it is crucial to examine its trading conditions, including fees, spreads, and overall cost structure. Raynar Trade offers what appears to be competitive trading conditions at first glance, but a deeper analysis reveals several concerning aspects.

| Fee Type | Raynar Trade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

The spreads offered by Raynar Trade are significantly lower than the industry average, which may be enticing for traders. However, such low spreads can often be a bait-and-switch tactic employed by unregulated brokers. Furthermore, the absence of a transparent commission model raises questions about hidden fees that could be levied on traders.

Additionally, the broker's overnight interest rates are reportedly high, which can erode profits for traders holding positions overnight. This practice is not uncommon among unregulated brokers, who may impose exorbitant fees to maximize their profits at the expense of their clients.

Overall, while Raynar Trade may present attractive trading conditions, the potential for hidden fees and high overnight interest rates casts doubt on the true cost of trading with this broker.

Client Fund Safety

The safety of client funds is paramount when choosing a broker. Raynar Trade's approach to fund safety is troubling, as it lacks several critical safety measures that reputable brokers typically implement.

One of the most significant concerns is the absence of segregated accounts for client funds. Segregated accounts ensure that client deposits are kept separate from the broker's operational funds, providing a layer of protection in case of insolvency. Additionally, Raynar Trade does not offer any investor protection schemes, which are often mandated by regulatory authorities to safeguard client assets.

Moreover, the broker's lack of transparency regarding its fund security measures is alarming. There have been no documented instances of fund security breaches or disputes, but the absence of such history does not guarantee future safety. The potential for financial loss in an unregulated environment is heightened, making it crucial for traders to exercise caution.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Unfortunately, Raynar Trade has received numerous negative reviews from users, highlighting various issues that raise concerns about its operational practices.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Misleading Promotions | Medium | Unresponsive |

| Poor Customer Support | High | Unresponsive |

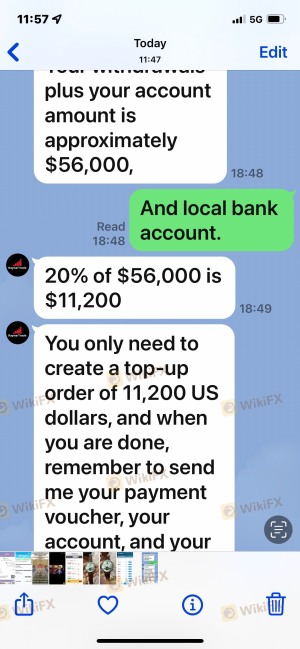

Common complaints include difficulties with fund withdrawals, misleading promotional offers, and inadequate customer support. Many users have reported challenges when attempting to withdraw their funds, often citing unreasonable withdrawal conditions or fees. Additionally, the company's response to complaints has been criticized for being slow or unhelpful, further exacerbating user frustration.

A typical case involves a trader who deposited funds with Raynar Trade, only to encounter significant delays and obstacles when attempting to withdraw their earnings. Such experiences are indicative of a broader pattern of customer dissatisfaction, raising serious questions about whether Raynar Trade is safe for traders.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for a positive trading experience. Raynar Trade claims to offer a user-friendly platform, but user reviews suggest that the platform may not be as stable or reliable as advertised.

Concerns have been raised regarding order execution quality, with reports of slippage and rejected orders. Such issues can significantly impact trading outcomes, particularly for those employing high-frequency trading strategies. Additionally, there are indications of possible platform manipulation, where trades may not be executed as intended, leading to potential losses for traders.

The overall user experience on the platform has been described as inconsistent, with some users reporting frequent downtime and technical glitches. These factors contribute to a negative trading environment, making it essential for traders to consider the platform's reliability before committing their funds.

Risk Assessment

Engaging with Raynar Trade presents several risks that potential traders must consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight increases the risk of fraud. |

| Fund Safety Risk | High | Lack of segregation and investor protection schemes. |

| Trading Conditions Risk | Medium | Potential for hidden fees and high overnight interest. |

| Customer Support Risk | High | Poor response to complaints and withdrawal issues. |

Given these risks, it is crucial for traders to approach Raynar Trade with caution. To mitigate these risks, potential clients should seek brokers with robust regulatory oversight, transparent fee structures, and a proven track record of customer support.

Conclusion and Recommendations

In conclusion, the evidence suggests that Raynar Trade exhibits several characteristics commonly associated with scam brokers. The lack of regulatory oversight, poor customer feedback, and questionable trading conditions raise significant red flags regarding the safety and legitimacy of this broker.

For traders considering their options, it is advisable to seek alternative brokers that are regulated and have a proven track record of reliability and transparency. Some reputable alternatives include brokers regulated by the FCA, ASIC, or CySEC, which provide a safer trading environment and better protection for client funds.

In summary, is Raynar Trade safe? The overwhelming consensus from available data indicates that it is not a safe choice for traders, and caution is warranted when dealing with this broker.

Is Raynar Trade a scam, or is it legit?

The latest exposure and evaluation content of Raynar Trade brokers.

Raynar Trade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Raynar Trade latest industry rating score is 1.43, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.43 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.