Raynar Trade 2025 Review: Everything You Need to Know

Executive Summary

This Raynar Trade review looks at a broker that has raised big red flags in the trading world. Many industry sources say Raynar Trade is unreliable and possibly fake, so investors should be very careful. The platform says it offers forex and CFD trading services with different account types, including demo accounts and swap-free options for Islamic trading.

The broker advertises maximum leverage up to 1:1000 and requires a minimum deposit of $500. This targets traders who can handle higher risks. However, the lack of proper rules and many warning signs suggest this platform may not be a real trading opportunity. TheForexReview reported that "Raynar Trade is a not very convincing attempt by a scam website to persuade us that it represents an established forex and CFD broker that we could safely trust with our money."

Given the serious concerns from industry experts and no credible regulatory backing, this review gives traders key information to make smart investment choices.

Important Notice

Regional regulatory differences play a crucial role in determining broker legitimacy. Raynar Trade appears to lack authorization from any major regulatory bodies including the FCA, CySEC, or other recognized financial authorities. This absence of regulatory oversight creates significant risks for traders across all jurisdictions.

This evaluation is based on publicly available information and user feedback from various industry sources. Our analysis aims to provide objective insights while highlighting potential risks with this platform. Traders should always verify regulatory status independently before making any investment decisions.

Rating Framework

Broker Overview

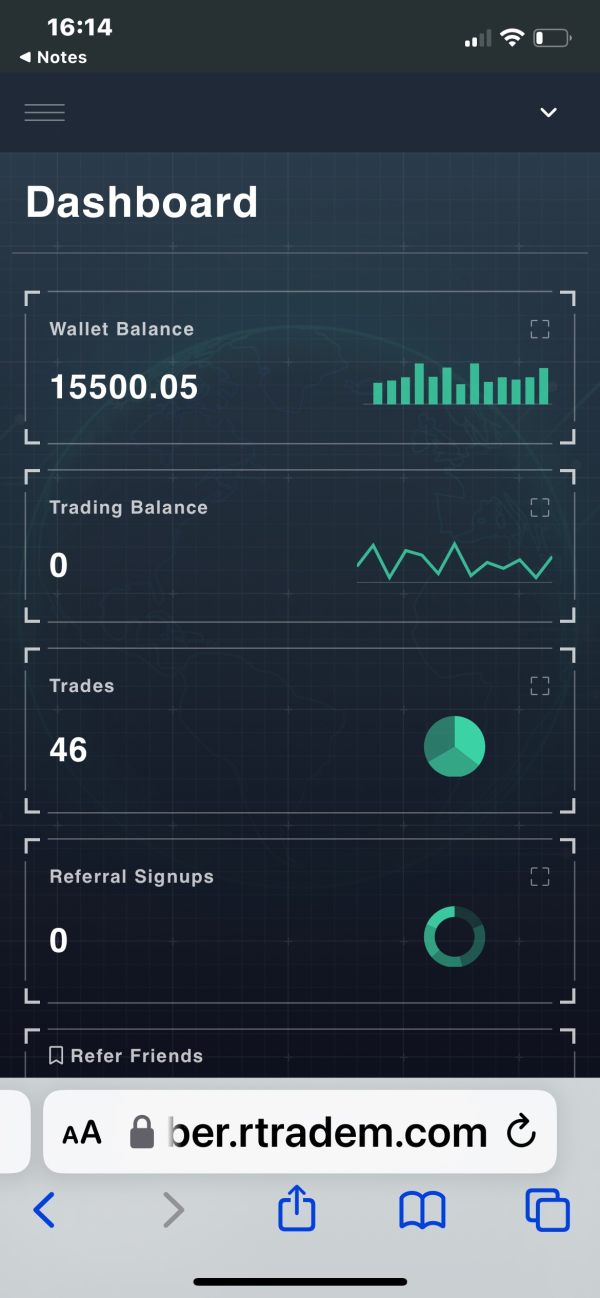

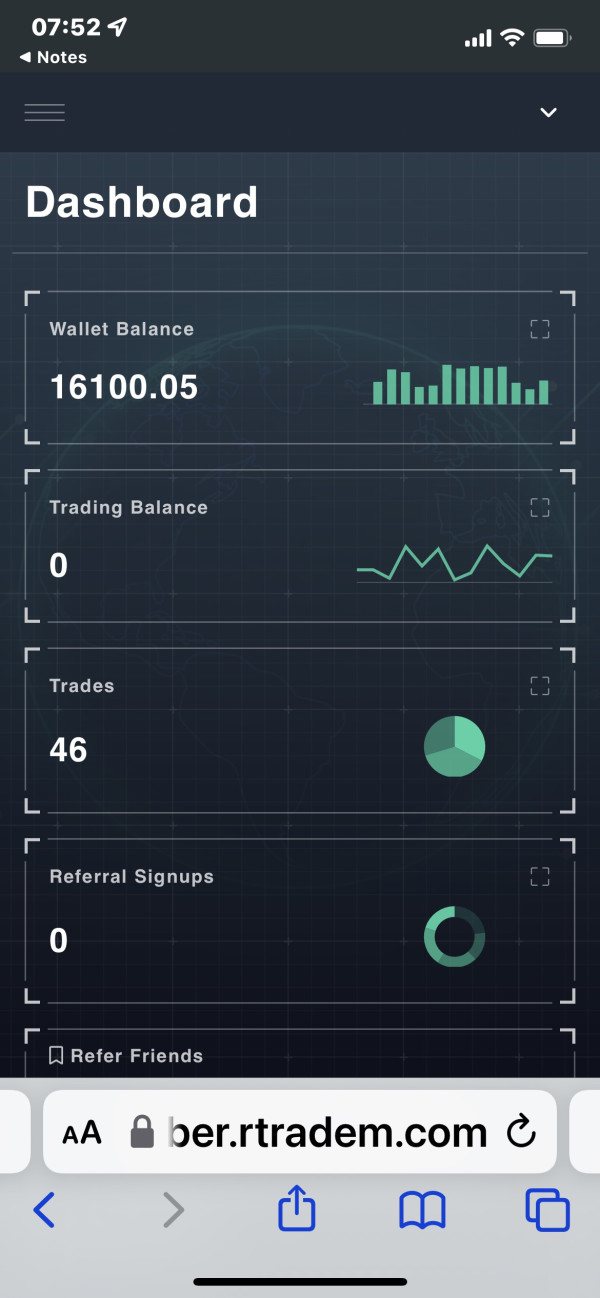

Raynar Trade presents itself as an online trading platform based in Ukraine. The company claims to provide access to various financial markets including forex and contracts for difference. However, the company's background information remains largely unclear, with no verified establishment date or concrete corporate structure details available in public records.

The platform operates under a business model that supposedly offers retail traders access to global financial markets through online trading services. According to available information, the broker focuses mainly on forex and CFD trading, targeting individual investors who want exposure to currency pairs and leveraged financial instruments.

Regarding technical infrastructure, specific details about the trading platform technology remain undisclosed in available documentation. The asset classes reportedly include standard forex pairs and CFDs, though complete asset lists are not readily available. Most concerning for this Raynar Trade review is the complete absence of oversight from any recognized financial regulatory authority, which represents a significant red flag for potential investors.

The lack of clear information about the company's operational history, regulatory compliance, and technical specifications raises serious questions about the legitimacy and reliability of this trading platform.

Regulatory Status: Raynar Trade operates without supervision from any major financial regulatory authority. This creates substantial risks for client fund protection and dispute resolution.

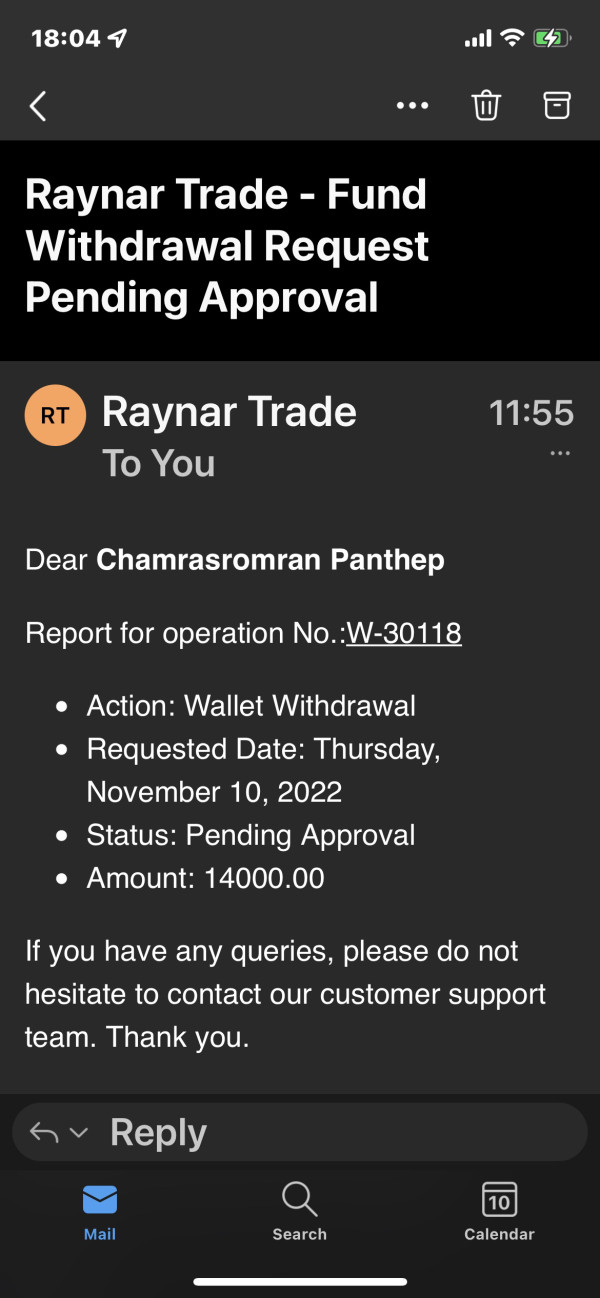

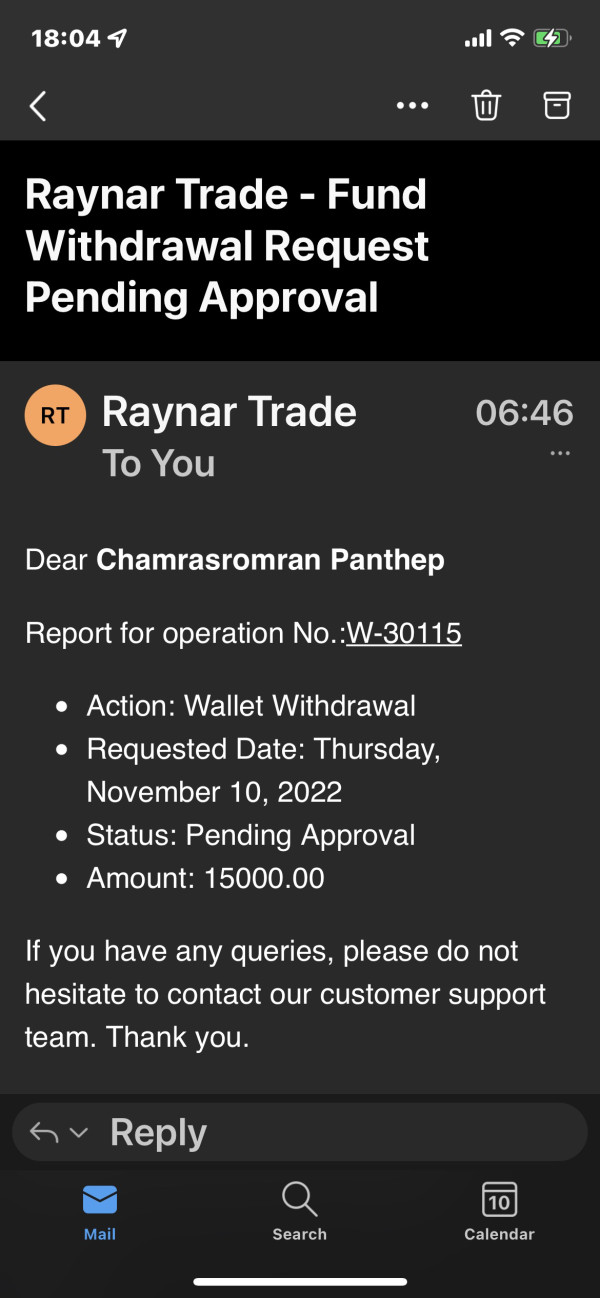

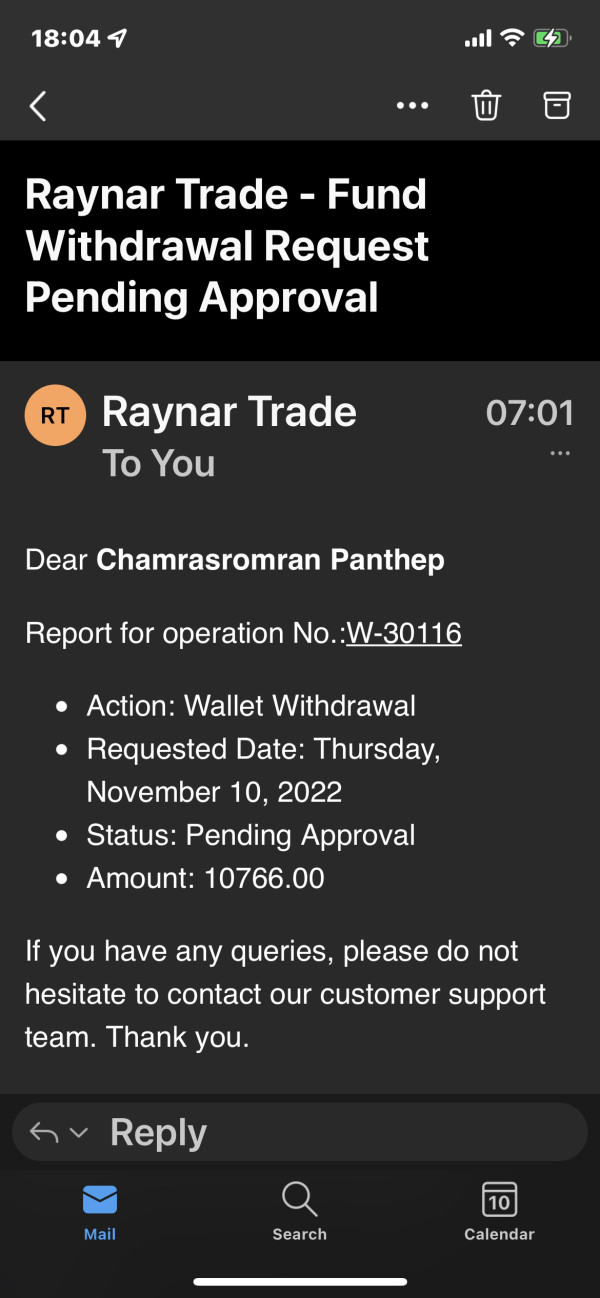

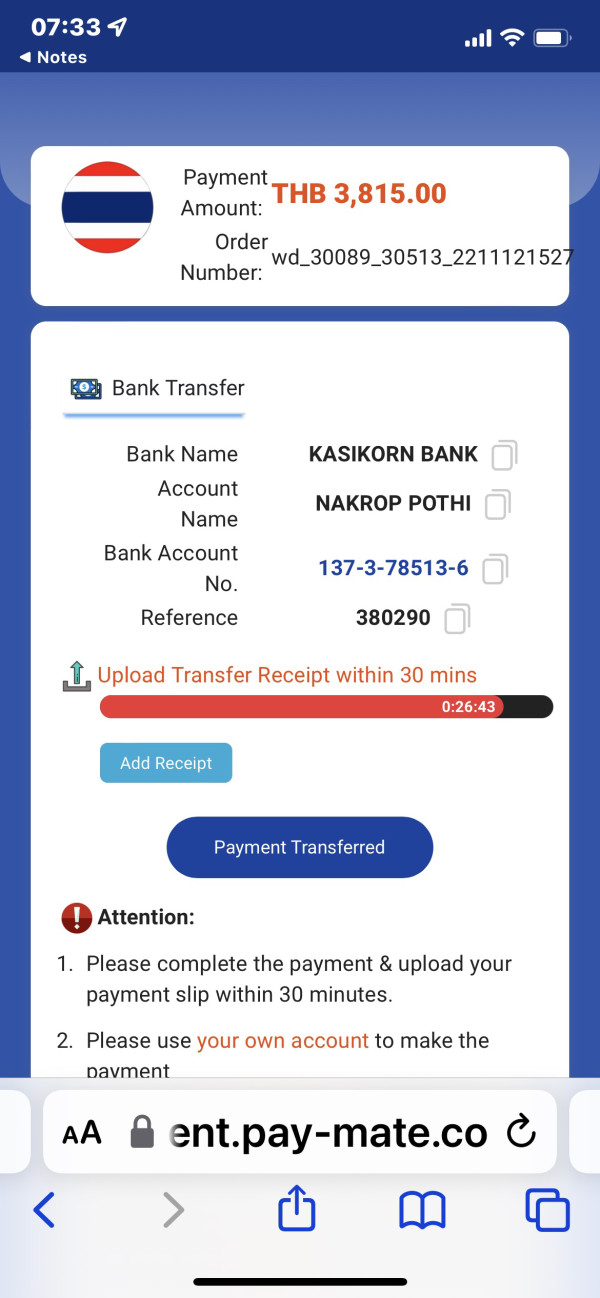

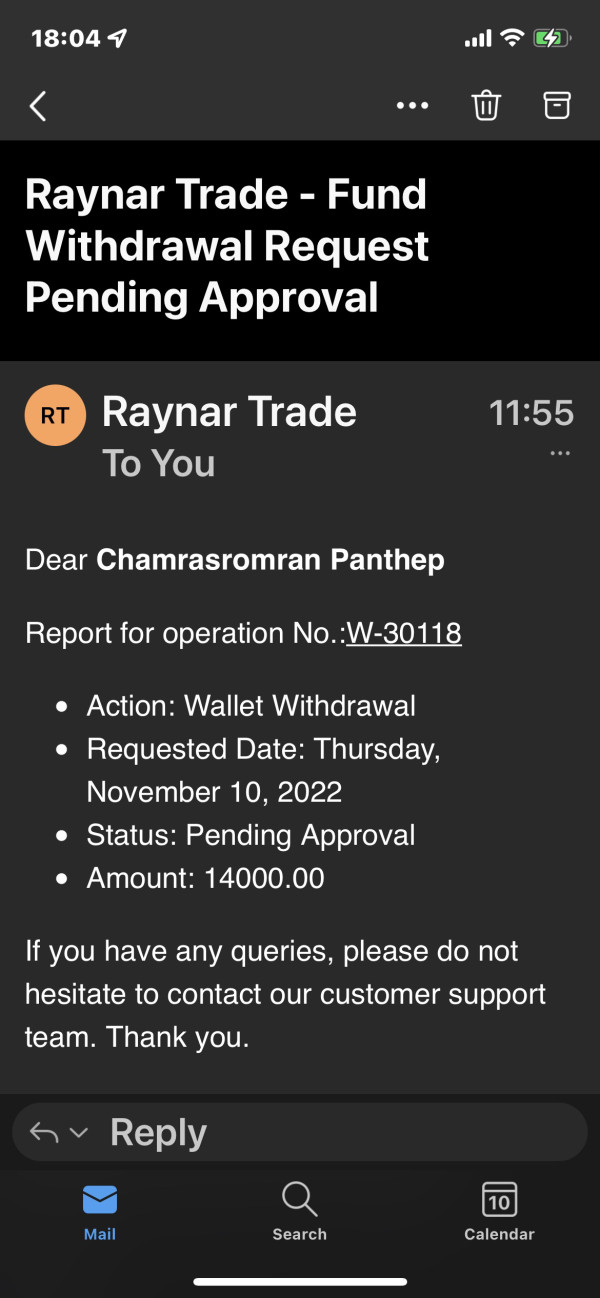

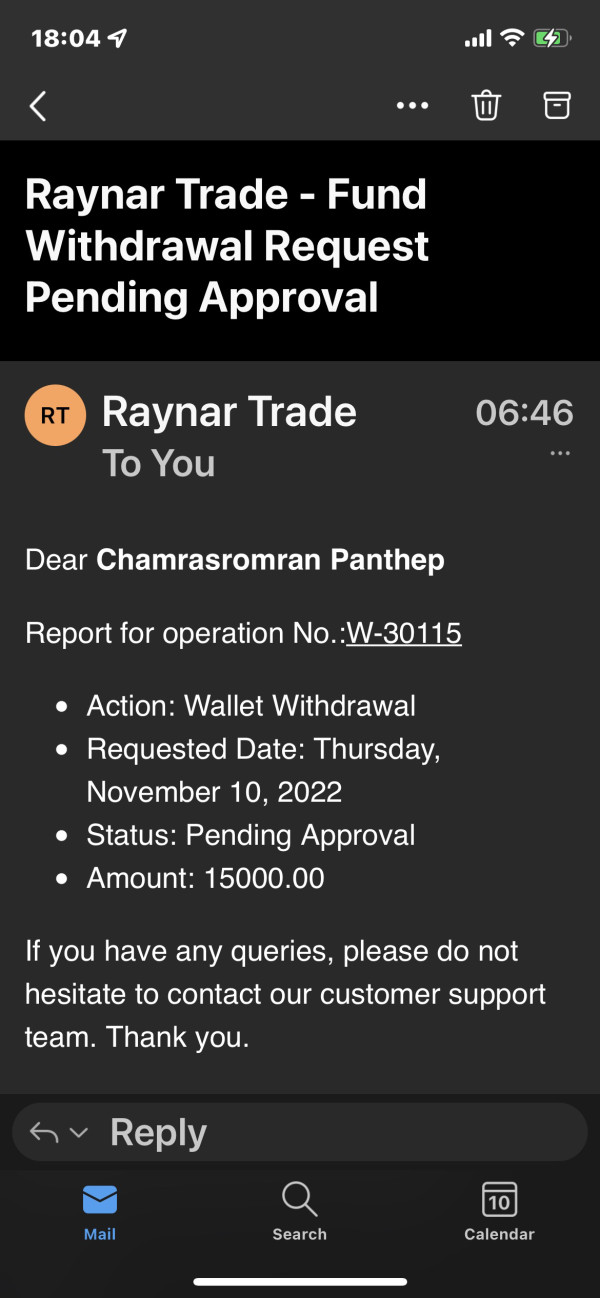

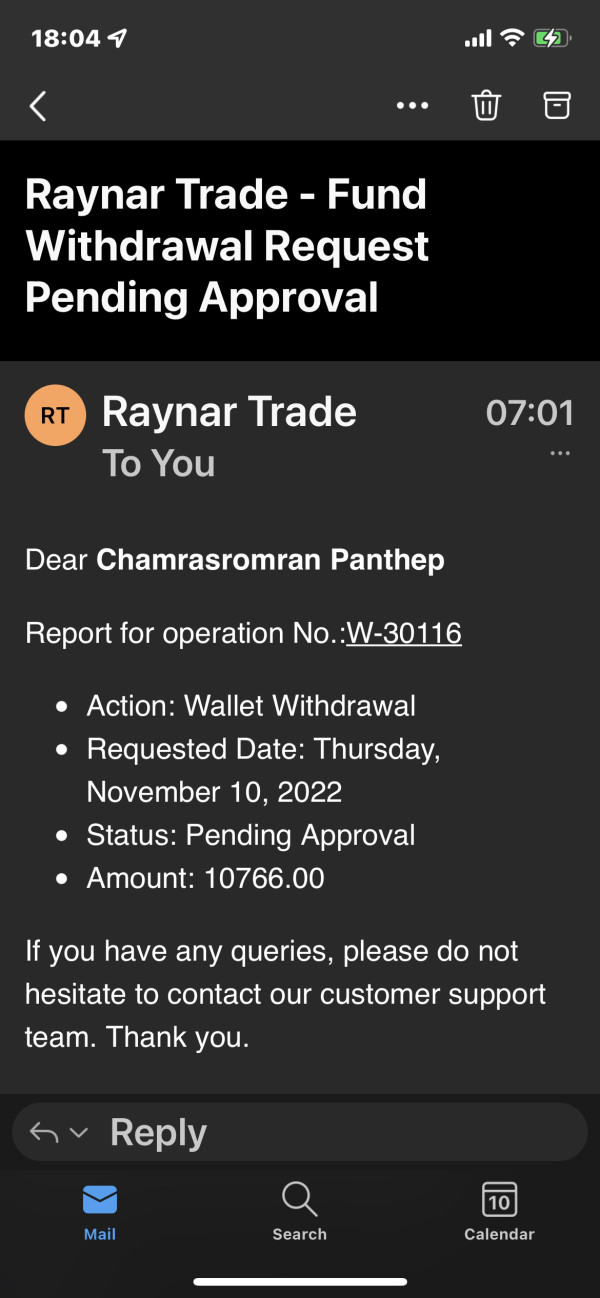

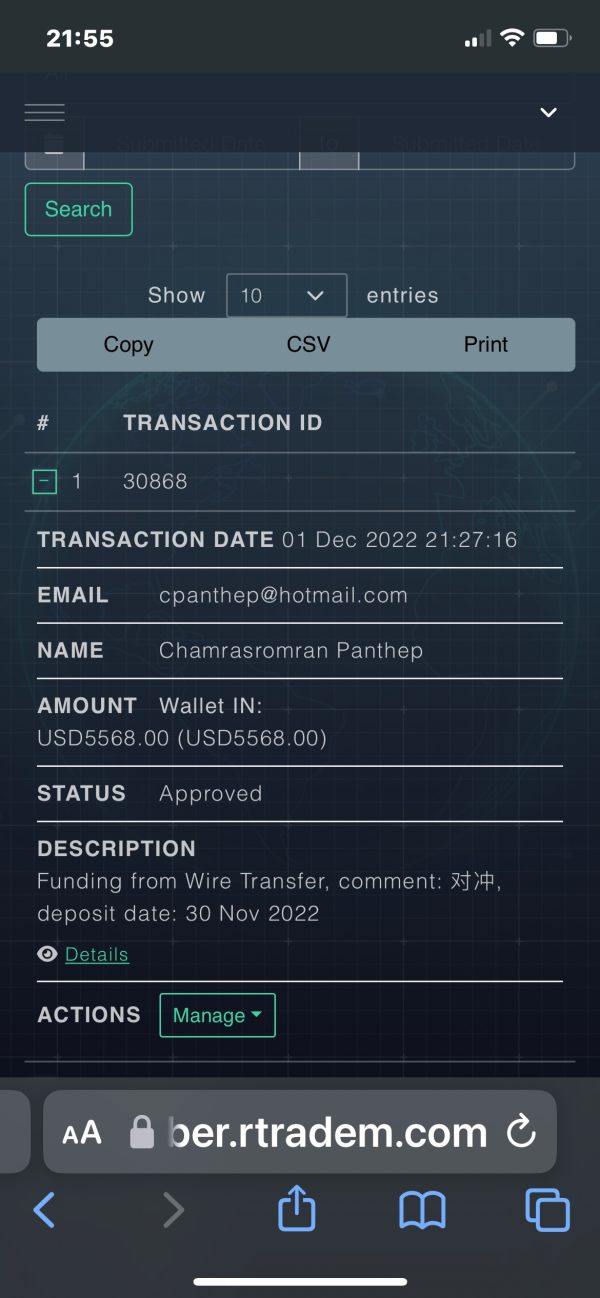

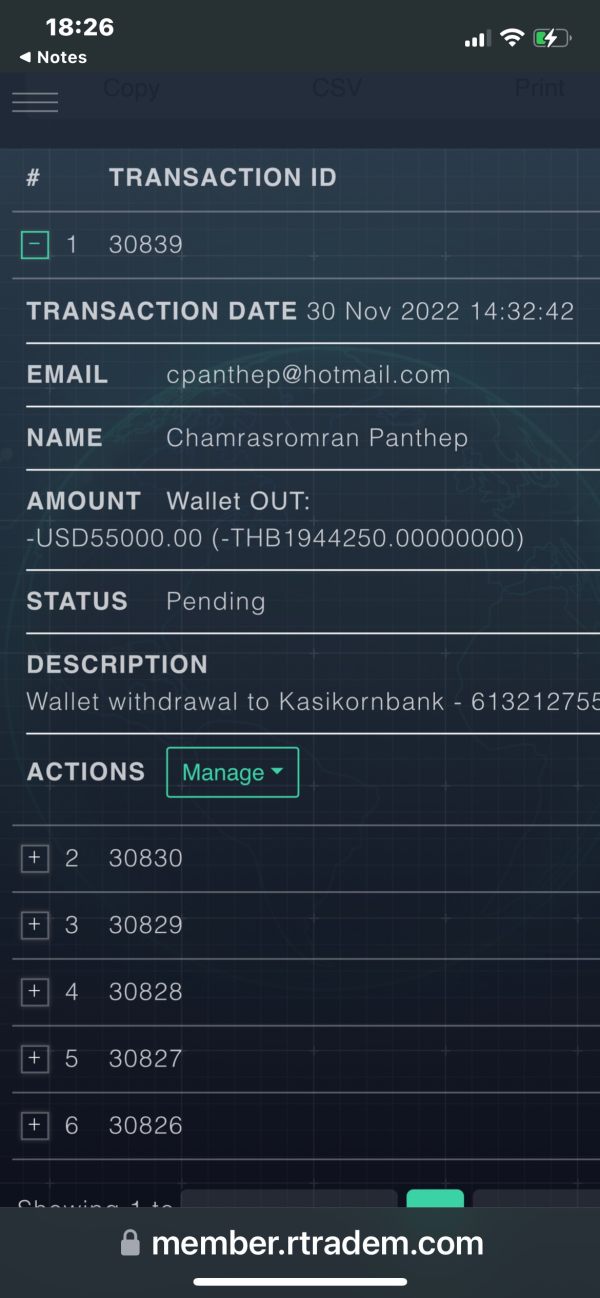

Deposit and Withdrawal Methods: Specific information regarding funding methods and withdrawal procedures has not been disclosed in available documentation.

Minimum Deposit Requirements: The platform requires a minimum initial deposit of $500. This is relatively high compared to many legitimate brokers in the market.

Bonus and Promotional Offers: No information about promotional offerings or bonus structures is available in current documentation.

Tradeable Assets: The platform reportedly provides access to forex currency pairs and contracts for difference. However, specific instrument lists are not detailed.

Cost Structure: Critical information about spreads, commissions, and other trading costs remains undisclosed. This makes it impossible to assess the platform's competitiveness.

Leverage Ratios: Maximum leverage is advertised at 1:1000. This represents extremely high risk levels that could result in rapid account depletion.

Platform Selection: Specific trading platform information has not been provided in available sources.

Geographic Restrictions: Regional availability and restrictions are not clearly outlined in accessible documentation.

Customer Support Languages: Supported languages for customer service are not specified in current materials.

This Raynar Trade review highlights the concerning lack of transparency across multiple operational aspects.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

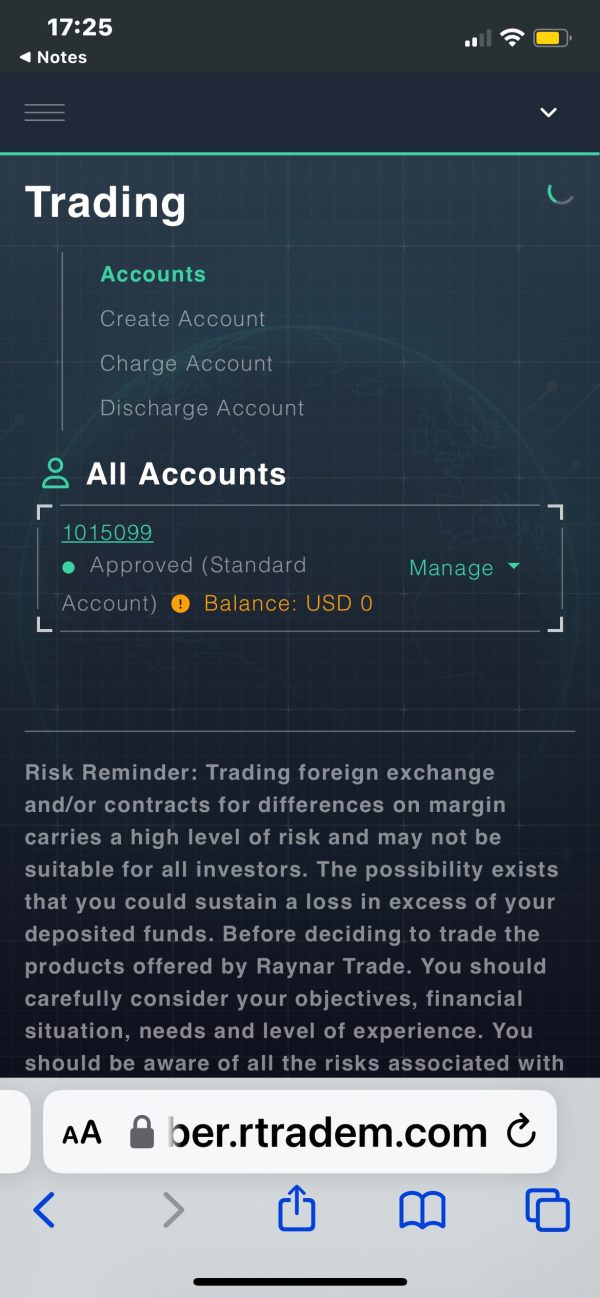

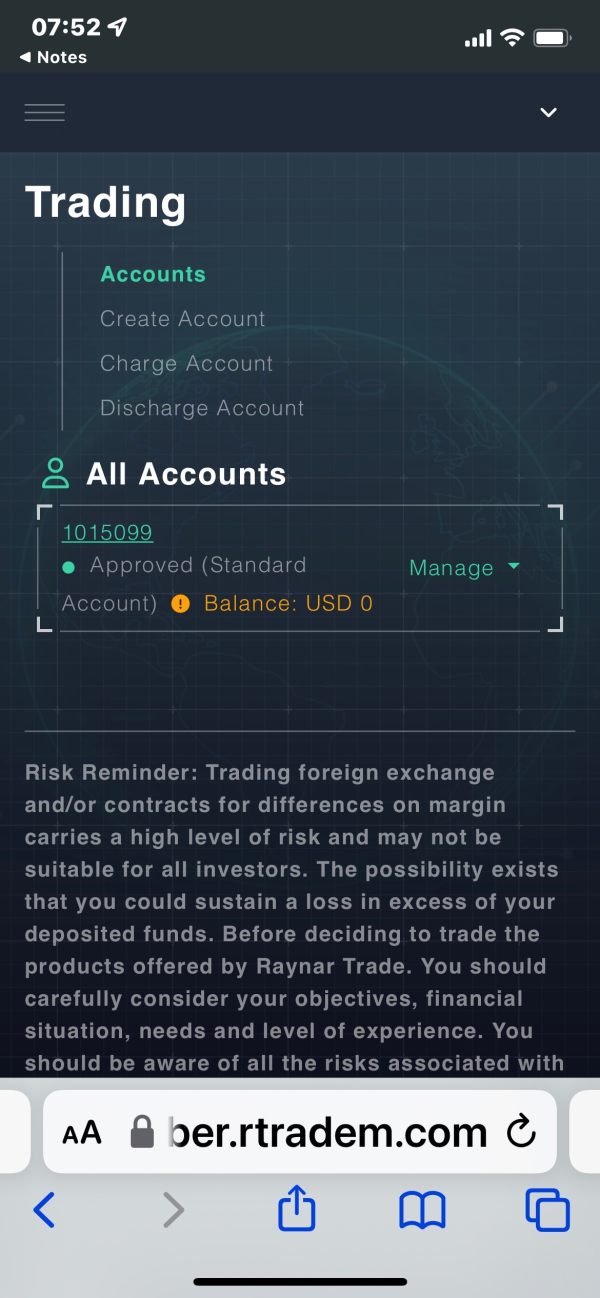

The account structure at Raynar Trade includes multiple trading account types. Demo accounts and swap-free options are reportedly available for different trader preferences. The inclusion of Islamic accounts suggests some consideration for diverse religious requirements, though specific terms and conditions remain unclear.

However, the $500 minimum deposit requirement is notably higher than many established brokers who offer account opening with $100 or less. This elevated barrier to entry may exclude smaller retail traders and raises questions about accessibility. The absence of detailed information about account features, benefits, and specific terms creates uncertainty for potential clients.

Account opening procedures and verification requirements are not clearly outlined in available documentation. This makes it difficult to assess the onboarding experience. The lack of transparency regarding account management, maintenance fees, and inactive account policies further complicates the evaluation process.

Compared to regulated brokers that provide comprehensive account documentation and clear terms of service, Raynar Trade's opaque approach to account information represents a significant disadvantage. This Raynar Trade review must note that legitimate brokers typically provide detailed account specifications and transparent pricing structures.

Available information suggests that Raynar Trade provides basic trading tools. However, specific details about research capabilities, analytical resources, and educational materials remain largely undocumented. The platform's tool offerings appear limited compared to established brokers who typically provide comprehensive market analysis, economic calendars, and trading signals.

Educational resources, which are crucial for trader development, are not mentioned in available documentation. Legitimate brokers usually offer extensive educational libraries, webinars, tutorials, and market commentary to support trader success. The absence of such resources suggests a limited commitment to client development and success.

Automated trading support and expert advisor capabilities are not specified. This leaves questions about the platform's compatibility with algorithmic trading strategies. Advanced charting tools, technical indicators, and analytical capabilities also lack detailed description.

The overall impression suggests a basic service offering without the comprehensive tool suite that serious traders typically require for informed decision-making and successful trading outcomes.

Customer Service and Support Analysis (Score: 3/10)

Customer service information for Raynar Trade is notably absent from available documentation. This raises serious concerns about support availability and quality. Legitimate brokers typically provide multiple contact channels including phone, email, live chat, and comprehensive FAQ sections.

Response times, service hours, and support quality cannot be assessed due to lack of available information. The absence of clear customer service protocols suggests potential difficulties in obtaining assistance when needed, particularly during critical trading situations or account-related issues.

Multilingual support capabilities are not documented. This could create communication barriers for international clients. Professional brokers usually provide support in multiple languages to serve diverse client bases effectively.

User feedback regarding customer service experiences is not available in current sources, though the overall negative sentiment toward the platform suggests potential service quality issues. The lack of accessible customer support information represents a significant operational red flag in this Raynar Trade review.

Trading Experience Analysis (Score: 5/10)

The trading experience evaluation for Raynar Trade is severely limited by the lack of detailed platform information. Critical factors such as execution speed, platform stability, and order processing quality cannot be properly assessed without comprehensive technical specifications.

Platform functionality, user interface design, and overall usability remain undocumented. This makes it impossible to compare the trading experience with established industry standards. Mobile trading capabilities, which are essential in today's market environment, are not addressed in available information.

Order execution quality, slippage rates, and pricing accuracy are fundamental aspects that cannot be evaluated due to insufficient data. The absence of spread information and execution statistics prevents meaningful assessment of the trading environment's competitiveness.

Without user testimonials or independent platform reviews, it's impossible to gauge real-world trading conditions or user satisfaction levels. This lack of transparency regarding the core trading experience represents a significant concern for potential clients considering this platform.

Trust and Reliability Analysis (Score: 2/10)

The trust and reliability assessment for Raynar Trade reveals multiple serious concerns that significantly impact the platform's credibility. The complete absence of regulatory oversight from recognized financial authorities represents the most critical issue, as regulation provides essential client protections and operational standards.

Fund security measures, segregated account policies, and client money protection protocols are not documented. This creates substantial risks for trader deposits. Legitimate brokers typically maintain client funds in segregated accounts with tier-one banks and provide detailed information about fund protection measures.

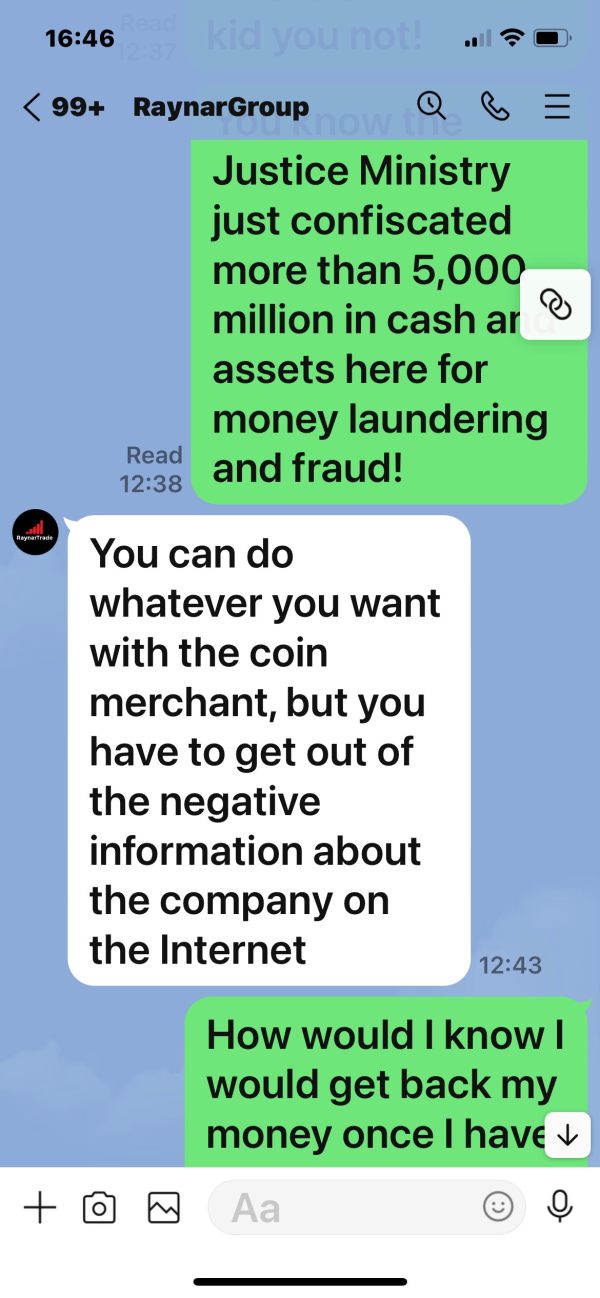

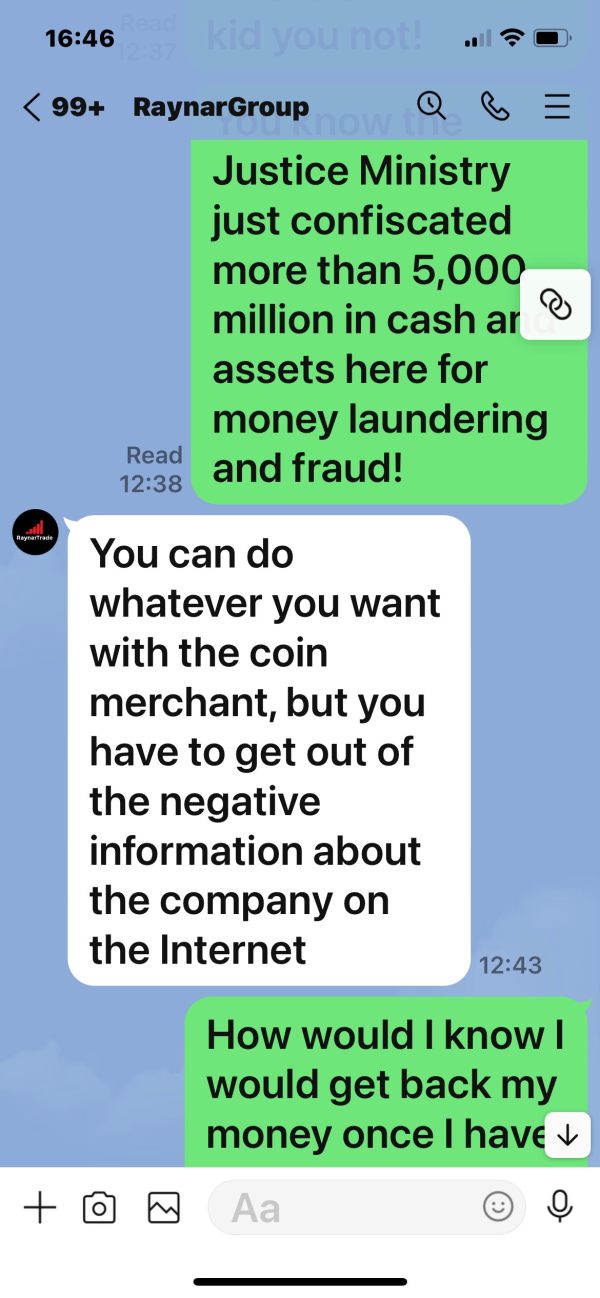

Company transparency is severely lacking, with minimal verifiable information about corporate structure, management team, or operational history. According to industry sources, the platform has been characterized as an unconvincing attempt to appear legitimate, which raises serious questions about its actual operational intent.

The industry reputation appears predominantly negative, with warnings from review sites characterizing the operation as potentially fraudulent. This Raynar Trade review must emphasize that the combination of no regulation, limited transparency, and negative industry sentiment creates an extremely high-risk environment for potential investors.

User Experience Analysis (Score: 3/10)

User experience evaluation for Raynar Trade is complicated by the scarcity of genuine user feedback and the predominance of negative industry warnings. The overall user satisfaction appears to be poor based on available industry assessments and warning notices from review platforms.

Interface design and platform usability cannot be properly assessed due to limited access to detailed platform information. Registration and account verification processes are not clearly documented, which could indicate potential operational inefficiencies or deliberate obfuscation.

The user demographic appears to be targeted toward high-risk tolerance traders. However, this positioning may be more reflective of the platform's risky nature rather than sophisticated trading offerings. Common user complaints center around the platform's lack of credibility and regulatory concerns.

The absence of positive user testimonials and the presence of industry warnings suggest that the user experience is likely to be unsatisfactory and potentially harmful to trader interests. Improvement recommendations would necessarily focus on obtaining proper regulatory authorization and establishing transparent operational practices.

Conclusion

This comprehensive Raynar Trade review reveals a platform that presents significant risks and concerns for potential investors. The broker operates without regulatory oversight, lacks transparency in critical operational areas, and has received negative assessments from industry sources. The combination of high minimum deposits, unclear terms of service, and absence of proper regulatory backing creates an environment unsuitable for most traders.

The platform is not recommended for conservative investors or those seeking reliable, regulated trading environments. Even traders with high risk tolerance should exercise extreme caution given the serious credibility concerns and potential fraud warnings associated with this operation.

The primary advantages appear limited to basic account variety, while the disadvantages include lack of regulation, poor transparency, and negative industry reputation. Traders seeking legitimate forex and CFD trading opportunities would be better served by choosing properly regulated brokers with established track records and comprehensive client protections.