Is Qoin Capital safe?

Business

License

Is Qoin Capital Safe or Scam?

Introduction

Qoin Capital is an online forex broker that has recently entered the trading landscape, primarily targeting retail traders interested in forex and cryptocurrency trading. Established in 2020 and based in Estonia, it aims to provide a user-friendly platform for traders of various experience levels. However, the rapid rise of online trading platforms has also led to an increase in scams, prompting traders to exercise caution when evaluating brokers. This article aims to provide an objective analysis of Qoin Capital to determine whether it is a safe trading option or a potential scam. Our investigation utilizes various sources, including regulatory information, customer feedback, and industry standards to assess the broker's credibility.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial in determining its legitimacy. A regulated broker is typically required to adhere to strict guidelines that protect traders' interests and ensure fair trading practices. Unfortunately, Qoin Capital has not been found to be regulated by any significant financial authority, which raises concerns about its operational legitimacy. Below is a summary of its regulatory status:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Estonia | Not Verified |

The lack of regulation means that Qoin Capital does not provide the same level of protection that regulated brokers offer. Without oversight from a financial authority, traders may find it challenging to seek recourse in case of disputes or issues such as fund withdrawal difficulties. Furthermore, unregulated brokers often have a higher risk of engaging in unethical practices, including price manipulation and withholding funds. Therefore, it is essential to ask, is Qoin Capital safe? The absence of regulation is a significant red flag.

Company Background Investigation

Understanding the background of a broker can provide insights into its reliability. Qoin Capital was founded in 2020, making it a relatively new entity in the forex market. The companys ownership structure is somewhat opaque, with limited information available regarding its founders or key stakeholders. This lack of transparency can be alarming for potential clients, as knowing who is handling your funds is critical for trust.

The management teams experience is another vital factor. A strong team with a proven track record in finance and trading can enhance a broker's credibility. However, Qoin Capital's website does not provide detailed profiles of its management team, which raises questions about their qualifications and experience. Without this information, it is difficult to assess the company's operational capabilities and commitment to ethical trading practices.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential. Qoin Capital offers various account types with differing minimum deposits and trading features. However, the overall fee structure appears to be less competitive than industry standards. The following table summarizes the core trading costs associated with Qoin Capital:

| Fee Type | Qoin Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.0 pips | 1.2 pips |

| Commission Model | None | $5 per lot |

| Overnight Interest Range | 0.5% | 0.2% |

The higher spreads offered by Qoin Capital compared to the industry average may indicate that traders will incur additional costs, reducing their overall profitability. Furthermore, the absence of a commission model could lead to hidden fees, making it difficult for traders to understand the true cost of their trades. This leads to the question, is Qoin Capital safe? The unfavorable trading conditions might suggest that traders could be better off seeking alternatives.

Client Fund Safety

Client fund safety is paramount when choosing a forex broker. Qoin Capitals website does not provide detailed information on its fund safety measures. It is unclear whether client funds are held in segregated accounts, a practice that protects traders' capital in case of the broker's insolvency. Additionally, the broker does not offer any investor protection schemes, which are typically provided by regulated entities.

The absence of a clear fund safety policy raises concerns about the broker's commitment to safeguarding client assets. Past complaints about difficulties in withdrawing funds can further exacerbate these worries. Traders must consider whether their funds would be secure with Qoin Capital, and the lack of transparency does not inspire confidence in this regard.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. Reviews of Qoin Capital reveal a mixed bag of experiences, with several users reporting issues related to fund withdrawals and unresponsive customer service. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Blocking | Medium | Poor |

| Customer Service Delays | Medium | Average |

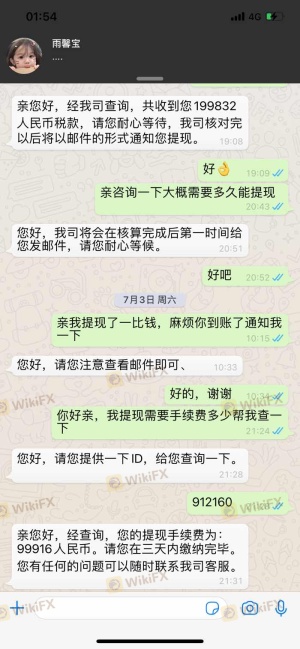

One notable case involved a trader who reported being unable to withdraw funds after multiple attempts. The broker allegedly requested additional fees before processing the withdrawal, which is a common tactic used by scam brokers. Such experiences lead to serious concerns about the broker's integrity and reliability. This further complicates the question of is Qoin Capital safe? The negative feedback from clients suggests that potential traders should proceed with caution.

Platform and Execution

The trading platform's performance is critical for a satisfactory trading experience. Qoin Capital offers a digital trading platform that claims to be user-friendly and efficient. However, reports from users indicate that the platform often experiences downtime and slow execution speeds. Such issues can significantly impact a trader's ability to execute trades effectively, leading to potential losses.

Moreover, the lack of transparency regarding order execution quality, including slippage rates and order rejection percentages, raises further concerns. Without reliable information on these metrics, traders may find it challenging to trust the platform's integrity. Therefore, when asking is Qoin Capital safe?, the evidence suggests that the platform may not meet the standards expected by serious traders.

Risk Assessment

When evaluating a broker, understanding the associated risks is crucial. Qoin Capital presents several risk factors that potential clients should consider:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Safety Risk | High | Lack of fund segregation policies |

| Customer Service Risk | Medium | Poor response to complaints |

| Platform Stability Risk | Medium | Frequent downtime and execution issues |

Given these elevated risk levels, it is essential for traders to approach Qoin Capital with caution. Potential clients should consider these risks seriously and weigh them against their trading objectives.

Conclusion and Recommendations

In conclusion, the evidence suggests that Qoin Capital may not be a safe trading option for forex traders. The absence of regulation, coupled with negative customer feedback and questionable trading conditions, raises significant concerns. Therefore, it is crucial for potential clients to ask themselves, is Qoin Capital safe?

For traders seeking reliable alternatives, it is advisable to consider brokers that are well-regulated and have a proven track record of positive client experiences. Options such as brokers regulated by authorities like the FCA, ASIC, or CySEC may offer a more secure trading environment. In sum, while Qoin Capital presents itself as an attractive option, the risks involved warrant a thorough evaluation and consideration of safer alternatives.

Is Qoin Capital a scam, or is it legit?

The latest exposure and evaluation content of Qoin Capital brokers.

Qoin Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Qoin Capital latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.