Regarding the legitimacy of PPFX forex brokers, it provides FSCA and WikiBit, .

Is PPFX safe?

Risk Control

License

Is PPFX markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

ProperFX (Pty) Ltd

Effective Date:

2018-02-06Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

OFFICE 1215THE LEONARDO75 MAUDE STREET2196Phone Number of Licensed Institution:

61 9342674Licensed Institution Certified Documents:

Is ProperFX Safe or a Scam?

Introduction

ProperFX is a relatively new player in the forex market, positioning itself as a global provider of online brokerage services. With claims of offering a user-friendly platform and access to various financial instruments, it aims to attract both novice and experienced traders. However, the rise of online trading has also seen a surge in fraudulent activities, making it crucial for traders to carefully assess the legitimacy and safety of brokers before committing their funds. This article investigates whether ProperFX is a safe choice for traders or if it exhibits characteristics typical of a scam. Our evaluation is based on a comprehensive review of regulatory compliance, company background, trading conditions, customer feedback, and risk assessment.

Regulatory and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy. ProperFX claims to be registered in South Africa and indicates that it is regulated by the Financial Sector Conduct Authority (FSCA). However, the quality of this regulation is questionable. The FSCA has been criticized for its lax oversight, especially following the country being placed on the Financial Action Task Force (FATF) grey list due to inadequate anti-money laundering measures.

Here is a summary of ProperFX's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSCA | 49045 | South Africa | Verified |

While ProperFX claims compliance with FSCA regulations, it's essential to note that obtaining a license in South Africa can be relatively straightforward, often requiring only a fee. This raises significant concerns about the broker's operational integrity and commitment to protecting clients' interests. Additionally, the absence of a regulatory framework that offers robust protections for traders further complicates the matter, leading many to question: Is ProperFX safe?

Company Background Investigation

ProperFX has a brief history, having been established in 2024, and is registered as Proper FX (Pty) Ltd. However, the lack of substantial information regarding its ownership structure and management team raises red flags about its transparency. A broker's credibility often hinges on the experience and qualifications of its leadership, and in this case, ProperFX does not provide adequate insights into who is running the company.

The absence of a physical office location on its website is another concern. Reliable brokers typically disclose their operational addresses, allowing clients to verify their legitimacy. The lack of such transparency at ProperFX suggests a potential attempt to obscure its true operational practices. This lack of clarity leads to further skepticism regarding the question: Is ProperFX safe?

Trading Conditions Analysis

In evaluating the trading conditions at ProperFX, we find a mixed bag of offerings. The broker advertises a variety of trading accounts, including mini, standard, and managed accounts, with leverage up to 1:500. However, the overall fee structure appears to be less competitive compared to industry standards. For example, the spreads offered by ProperFX start at 1.2 pips, which may not be attractive for traders looking for low-cost trading options.

Here is a comparison of key trading costs:

| Fee Type | ProperFX | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 1.2 pips | 0.6 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

The relatively high spreads and lack of transparency regarding commissions may deter traders who are sensitive to trading costs. Furthermore, the absence of detailed information about additional fees or hidden charges raises questions about the brokers overall integrity. This leads us to wonder again: Is ProperFX safe?

Customer Funds Security

The security of customer funds is paramount in the forex trading landscape. ProperFX claims to implement measures for fund protection, yet it lacks clarity on whether client funds are held in segregated accounts. Segregated accounts are critical as they ensure that client funds are kept separate from the broker's operational funds, providing an additional layer of security in case of insolvency.

Moreover, the absence of investor protection schemes or negative balance protection policies raises concerns about potential financial risks for traders. Historical issues related to fund security or any controversies involving ProperFX have not been publicly documented, but the lack of comprehensive measures to safeguard customer funds is alarming. Thus, the question remains: Is ProperFX safe?

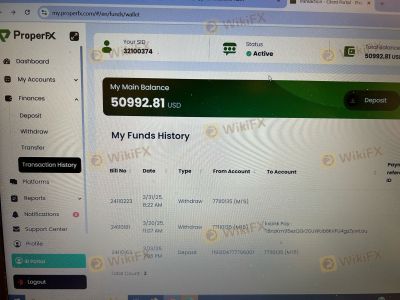

Customer Experience and Complaints

Customer feedback is often a reliable indicator of a broker's reliability. In the case of ProperFX, reviews from traders tend to highlight negative experiences, particularly concerning withdrawal issues and customer support responsiveness. Common complaints include delayed withdrawals, high-pressure tactics to deposit funds, and inadequate customer service responses.

Here is an overview of the main complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| High-Pressure Sales Tactics | Medium | Inconsistent |

| Customer Support Responsiveness | High | Lacking |

For instance, several traders have reported difficulties in withdrawing their funds, with some claiming that their requests were ignored or delayed indefinitely. Such practices are typical of fraudulent brokers, leading to widespread dissatisfaction among users. This reinforces the notion that potential clients should exercise caution when considering whether is ProperFX safe for their trading activities.

Platform and Execution

The trading platform offered by ProperFX is based on MetaTrader 5 (MT5), a popular choice among traders for its advanced features and user-friendly interface. However, users have reported issues regarding platform stability and order execution quality. Instances of slippage and rejected orders have been cited, which can significantly impact trading performance, especially for those employing high-frequency trading strategies.

The lack of transparency regarding the broker's execution model raises concerns about potential market manipulation. Traders need to ensure that their broker provides a reliable and fair trading environment. Therefore, the question persists: Is ProperFX safe?

Risk Assessment

Engaging with ProperFX involves several inherent risks that potential traders should be aware of. Below is a concise risk assessment summarizing key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Weak oversight and potential for fraud |

| Fund Security | High | Lack of segregated accounts and protections |

| Customer Service | Medium | Poor responsiveness to complaints |

| Trading Conditions | Medium | High spreads and unclear fee structures |

To mitigate these risks, traders should conduct thorough research and consider starting with a small deposit to test the broker's services before committing significant capital. This cautious approach can help ensure that traders do not expose themselves to unnecessary risks.

Conclusion and Recommendations

In conclusion, based on the evidence gathered, ProperFX does not meet the standards of a trustworthy forex broker. The lack of robust regulatory oversight, poor customer feedback, and questionable trading conditions raise significant concerns about its legitimacy. Therefore, traders should approach ProperFX with caution and skepticism.

For those seeking reliable alternatives, consider brokers that are well-regulated by top-tier authorities, offer competitive trading conditions, and have a proven track record of positive customer experiences. Brokers like Forex.com, IG, and XM are examples of reputable firms that prioritize client safety and transparency.

Ultimately, the question remains: Is ProperFX safe? Given the numerous red flags, it is advisable for traders to explore other options to safeguard their investments.

Is PPFX a scam, or is it legit?

The latest exposure and evaluation content of PPFX brokers.

PPFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PPFX latest industry rating score is 5.39, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.39 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.