Is ProfitMarket safe?

Business

License

Is ProfitMarket Safe or Scam?

Introduction

ProfitMarket is a broker that has positioned itself in the Forex and cryptocurrency trading markets, offering a platform for investors to trade various financial instruments. However, as with any trading platform, it is crucial for traders to carefully assess the credibility and safety of the broker before committing their funds. The Forex market is rife with both legitimate brokers and scams, making it essential for investors to conduct thorough due diligence. This article aims to analyze whether ProfitMarket is a safe trading option or a potential scam. Our investigation is based on a review of available online resources, user feedback, and regulatory information, providing a comprehensive evaluation framework to help traders make informed decisions.

Regulation and Legitimacy

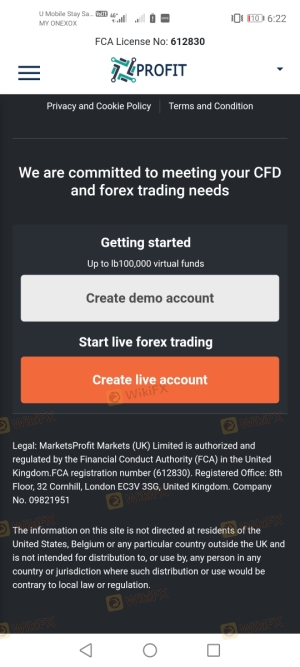

When assessing the safety of a broker, one of the most critical factors to consider is its regulatory status. Regulation serves as a safeguard for traders, ensuring that the broker adheres to industry standards and practices. ProfitMarket claims to operate under the jurisdiction of various regulatory bodies, including references to being based in Hong Kong and the UK. However, upon closer examination, there is a lack of verifiable information regarding its regulatory compliance.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Unknown | N/A | N/A | Unverified |

The absence of a valid regulatory license raises significant concerns about the legitimacy of ProfitMarket. Many reviews indicate that the broker has not provided any credible evidence of compliance with regulatory standards. Instead, it appears to be operating without oversight, which is a red flag for potential investors. In the Forex industry, brokers that are not regulated are often associated with higher risks, including the possibility of fraud or mismanagement of funds. Therefore, it is crucial to consider these factors when questioning is ProfitMarket safe.

Company Background Investigation

A deeper look into ProfitMarket reveals a lack of transparency regarding its ownership and operational history. The broker does not provide clear information about its founders or management team, which is often a sign of a potentially unreliable operation. The absence of transparency can lead to doubts about the broker's intentions and operational practices.

The management teams background is another essential aspect to evaluate. A reputable broker typically employs professionals with extensive experience in the financial industry. However, ProfitMarket has not disclosed any information regarding the qualifications or experience of its management team. This lack of disclosure is concerning and raises questions about the broker's credibility.

Furthermore, the information available about the companys establishment and growth is sparse. Without a well-documented history or established track record, it becomes increasingly difficult for traders to assess the broker's reliability. This lack of information may lead to skepticism about whether ProfitMarket is safe for investment.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact the overall trading experience and profitability for traders. ProfitMarket claims to provide competitive trading fees, but there are indications that the fee structure may not be as favorable as advertised.

| Fee Type | ProfitMarket | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-3 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

Reviews suggest that traders have encountered hidden fees and unfavorable trading conditions that were not clearly disclosed upfront. The lack of transparency regarding spreads, commissions, and overnight fees raises concerns about the broker's intentions. Traders should be wary of brokers that do not provide comprehensive information about their fee structures, as this can lead to unexpected costs and reduced profitability.

Moreover, the trading platform itself has been reported to experience issues, including slippage and delayed order execution. Such factors can severely affect a trader's ability to operate effectively in the market and can lead to significant financial losses. Therefore, it is essential to consider these aspects when evaluating whether ProfitMarket is safe.

Client Fund Safety

The safety of client funds is paramount when choosing a broker. ProfitMarket has been criticized for its lack of adequate security measures to protect client funds. It is essential for brokers to implement fund segregation, investor protection schemes, and negative balance protection policies to ensure the safety of traders' investments.

Unfortunately, ProfitMarket does not provide clear information regarding its fund safety measures. There are no indications that client funds are held in segregated accounts, which is a standard practice among regulated brokers. Additionally, there have been reports of withdrawal issues, with clients struggling to access their funds after making deposits. This raises serious concerns about the broker's ability to safeguard client investments.

In summary, the lack of transparency regarding fund safety measures, coupled with historical withdrawal problems, suggests that traders should exercise extreme caution when considering whether is ProfitMarket safe for their investment.

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability. ProfitMarket has received numerous complaints from users regarding withdrawal difficulties and poor customer service. Many traders have reported being unable to withdraw their funds, with some claiming that their accounts were blocked after requesting withdrawals.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Quality | Medium | Poor |

| Transparency Concerns | High | Poor |

The common pattern of complaints indicates a concerning trend regarding ProfitMarket's operations. Many users have expressed frustration over the lack of communication from the broker when addressing their concerns. The quality of customer support is vital in establishing trust, and the negative experiences reported by clients suggest that ProfitMarket may not prioritize customer satisfaction.

Several testimonials highlight individual cases where traders have faced significant challenges in retrieving their funds, further reinforcing the notion that ProfitMarket is not safe for trading.

Platform and Trade Execution

The trading platform offered by ProfitMarket is another critical factor to evaluate. A reliable trading platform should provide a seamless user experience, with stable performance and efficient order execution. However, reports indicate that ProfitMarket's platform may not meet these standards.

Traders have reported instances of slippage, where orders are executed at prices significantly different from expectations, as well as rejected orders during high volatility. Such issues can severely impact trading outcomes and lead to losses.

In conclusion, the overall performance and reliability of ProfitMarket's trading platform raise questions about its suitability for traders. The combination of performance issues and the lack of transparency regarding platform operations suggests that potential users should be cautious when considering whether ProfitMarket is safe.

Risk Assessment

Using ProfitMarket involves various risks, and it is crucial for traders to understand these before engaging with the broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Safety Risk | High | Lack of transparency regarding fund protection. |

| Customer Service Risk | Medium | Poor response to complaints and withdrawal issues. |

The high-risk levels associated with ProfitMarket stem from its unregulated status and historical issues with fund safety and customer service. It is advisable for traders to consider these risks seriously and to seek alternative, more reputable brokers to mitigate potential losses.

Conclusion and Recommendations

In light of the evidence presented, it is clear that ProfitMarket exhibits several red flags that suggest it may not be a safe trading option. The lack of regulation, transparency issues, and numerous customer complaints raise significant concerns about the broker's credibility and reliability.

For traders seeking a trustworthy Forex broker, it is recommended to consider alternatives that are well-regulated and have a proven track record of customer satisfaction. Brokers that are licensed by reputable regulatory bodies, offer transparent fee structures, and prioritize client fund safety are generally safer options.

In summary, potential investors should exercise extreme caution and thoroughly evaluate whether ProfitMarket is safe before making any financial commitments.

Is ProfitMarket a scam, or is it legit?

The latest exposure and evaluation content of ProfitMarket brokers.

ProfitMarket Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ProfitMarket latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.