Is PERTH MINT safe?

Pros

Cons

Is Perth Mint Safe or Scam?

Introduction

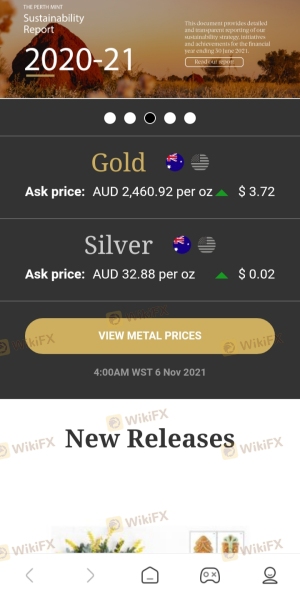

The Perth Mint, established in 1899, is one of Australias oldest and most recognized institutions in the precious metals market. It primarily focuses on gold and silver bullion, catering to both individual investors and institutional clients. Given its long-standing history and government backing, many traders might assume that the Perth Mint is a safe option for their investments. However, in the ever-evolving landscape of forex and commodities trading, it is crucial for traders to exercise caution and thoroughly evaluate the credibility of any broker or trading platform they consider. This article aims to assess whether the Perth Mint is a scam or a safe investment option by examining its regulatory status, company background, trading conditions, client safety measures, customer experiences, platform performance, and overall risk profile.

Regulation and Legitimacy

One of the primary factors determining the safety of any trading platform is its regulatory status. A broker that operates under strict regulations is generally seen as more reliable and trustworthy. In the case of the Perth Mint, it is important to note that it operates under the auspices of the Western Australian government, which provides a unique guarantee for its precious metal holdings. However, the absence of a specific financial regulatory license raises concerns about its operational legitimacy in the forex market.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Australia | Not Regulated |

The lack of regulation means that the Perth Mint is not subject to the same oversight as licensed brokers. This can pose a risk for traders, as they may not have access to the same protections and recourse options if disputes arise. Additionally, historical compliance issues have been noted, particularly concerning the mint's operations and adherence to anti-money laundering regulations. Therefore, while the mint's government backing may provide a sense of security, the absence of specific regulatory oversight in forex trading raises valid concerns about its overall safety.

Company Background Investigation

The Perth Mint has a rich history, having been established during the gold rush era in Australia. Over the years, it has evolved into a significant player in the global precious metals market. The mint is wholly owned by the government of Western Australia and operates under the Gold Corporation Act 1987. This government affiliation lends a degree of credibility to its operations; however, the lack of transparency regarding its management structure and operational practices can be concerning.

The management team at the Perth Mint includes experienced professionals from various sectors, including finance, mining, and investment. However, detailed information about their backgrounds and qualifications is not readily available, which can hinder potential investors' ability to assess the company's leadership effectively. Transparency in corporate governance is vital for building trust, and the Perth Mint's limited disclosure may raise questions among potential clients regarding its operational integrity.

Trading Conditions Analysis

When considering whether the Perth Mint is safe for trading, it is essential to evaluate its trading conditions, including fees and costs associated with trading. The mint primarily deals in precious metals rather than traditional forex trading, which can lead to different fee structures. However, potential clients should be aware of any unusual or hidden fees that may affect their overall investment returns.

| Fee Type | Perth Mint | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | Varies |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

While the Perth Mint does not operate in the same manner as a traditional forex broker, its fee structures for buying and selling precious metals can still impact investors. For instance, storage fees may apply for physical holdings, and these can vary based on the type of account chosen. Therefore, it is crucial for traders to understand these costs fully to avoid unexpected charges that could erode their profits.

Client Funds Safety

The safety of clients' funds is paramount in determining whether the Perth Mint is a scam or a safe investment option. The mint claims to implement robust security measures to protect clients' investments. All precious metals held in the Perth Mint's depository are backed by a government guarantee, which adds a layer of security for investors. Additionally, funds are held in segregated accounts, ensuring that client funds are not commingled with the company's operational funds.

However, the lack of detailed information regarding the mint's investor protection policies raises concerns. For instance, the absence of negative balance protection could leave clients vulnerable in volatile market conditions. Furthermore, any historical issues related to fund security or customer complaints should be examined to gauge the overall safety of investing with the Perth Mint.

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability and service quality. In the case of the Perth Mint, reviews are mixed, with some clients praising the quality of the products and the government guarantee, while others express dissatisfaction with customer service and communication issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Delayed Withdrawals | High | Mixed |

| Poor Customer Support | Medium | Inconsistent |

| Product Quality Issues | Low | Generally Positive |

Common complaints often revolve around delays in processing withdrawals and difficulties in reaching customer support. For instance, some users have reported waiting extended periods to receive their funds, which can be frustrating for investors. A few case studies highlight clients who experienced issues with order fulfillment, leading to negative perceptions of the mint's reliability.

Platform and Trade Execution

The performance of the trading platform is another critical aspect to consider when assessing whether the Perth Mint is safe. The mint provides an online platform for trading precious metals, which is generally user-friendly and secure. However, there have been reports of occasional technical glitches and slow response times during peak trading hours.

Order execution quality is vital for traders, particularly in the context of precious metals, where prices can fluctuate rapidly. While the Perth Mint claims to offer competitive pricing, any signs of slippage or rejected orders should be closely monitored. Instances of platform manipulation or unfair trading practices would significantly undermine the credibility of the mint.

Risk Assessment

Using the Perth Mint for trading involves certain risks that potential investors should consider. The absence of regulatory oversight, alongside mixed customer feedback and potential issues with fund security, contributes to an elevated risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of financial regulation |

| Customer Service Risk | Medium | Inconsistent support and response times |

| Fund Security Risk | Medium | Potential issues with fund protection |

To mitigate these risks, investors should conduct thorough research, ensure they understand the fee structures, and consider diversifying their investments across regulated platforms.

Conclusion and Recommendations

In conclusion, while the Perth Mint has a long-standing history and is backed by the Western Australian government, there are significant concerns regarding its regulatory status, transparency, and customer service. The absence of specific forex trading regulations raises questions about its overall safety. Therefore, it is essential for traders to approach the Perth Mint with caution.

For those considering investing in precious metals, it may be prudent to explore alternative options that offer stronger regulatory oversight and transparent fee structures. Recommended alternatives include brokers that are fully regulated and provide comprehensive investor protections. Ultimately, while the Perth Mint is not definitively a scam, the combination of potential risks and mixed customer experiences suggests that traders should exercise caution and conduct thorough due diligence before proceeding.

Is PERTH MINT a scam, or is it legit?

The latest exposure and evaluation content of PERTH MINT brokers.

PERTH MINT Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PERTH MINT latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.