Is Parkway FX safe?

Business

License

Is Parkway FX Safe or Scam?

Introduction

Parkway FX is a forex broker that has recently garnered attention in the trading community. Established in 2012 and operating primarily in the unregulated space, Parkway FX offers a range of trading services, including forex, commodities, and cryptocurrencies. Given the complexities and risks associated with forex trading, it is crucial for traders to conduct thorough evaluations of brokers before investing their funds. A cautious approach can help protect against potential scams and ensure a safer trading environment.

This article aims to provide a comprehensive analysis of Parkway FX, assessing its regulatory status, company background, trading conditions, customer experiences, and overall safety. The evaluation will rely on information gathered from various reputable sources, including user reviews and regulatory databases, to determine whether Parkway FX is a safe trading option or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is paramount in assessing its legitimacy and safety. Parkway FX operates without significant regulatory oversight, which raises concerns about the protection of traders' funds and the broker's operational integrity. The absence of regulation means that Parkway FX is not subject to any stringent compliance measures that regulated brokers must adhere to.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of a valid regulatory license is a significant red flag. Regulatory bodies play a vital role in ensuring that brokers operate fairly and transparently, providing traders with a layer of protection against fraud. Parkway FX's unregulated status suggests that there is no oversight to safeguard traders' interests, making it imperative for potential clients to exercise caution. Furthermore, historical compliance issues, such as complaints about withdrawal difficulties and aggressive marketing tactics, further highlight the risks associated with trading with Parkway FX.

Company Background Investigation

Parkway FX was founded in 2012, claiming to be based in the United Kingdom. However, its operational transparency is questionable, with limited information available about its ownership structure and management team. A thorough background check reveals that Parkway FX is registered under the name Parkway FX Limited, but it has faced scrutiny regarding its legitimacy.

The management team behind Parkway FX lacks public profiles or verifiable professional histories, which raises concerns about their expertise and accountability. Transparency in ownership and management is crucial for building trust with clients, and the absence of such information can be indicative of potential issues within the company.

Additionally, the company's website has faced accessibility issues, further complicating efforts to gather reliable data about its operations. Overall, the lack of transparent information about Parkway FX's history and management is a cause for concern, prompting traders to question whether they are dealing with a reputable broker.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. Parkway FX provides access to various trading instruments, including forex, commodities, and cryptocurrencies. However, the overall fee structure appears to be less favorable compared to industry standards.

| Fee Type | Parkway FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1-2 pips |

| Commission Structure | Varies | $5-$10 per lot |

| Overnight Interest Range | Variable | 0.5%-2% |

The lack of clarity regarding spreads and commissions raises questions about Parkway FX's pricing model. Traders have reported unexpected fees and difficulties in withdrawing funds, which can lead to a negative trading experience. The variability in spreads, especially for major currency pairs, can significantly impact trading costs, and traders should be cautious of any hidden fees that may arise.

Furthermore, the absence of a clear commission structure may lead to confusion, making it challenging for traders to accurately assess their trading costs. The overall trading conditions at Parkway FX warrant careful consideration, as they may not align with the expectations of traders seeking transparent and competitive pricing.

Customer Funds Security

The security of customer funds is a critical aspect of any forex broker's operations. Parkway FX's lack of regulation raises significant concerns regarding the safety of clients' funds. Unregulated brokers often do not implement robust security measures, leaving traders vulnerable to potential losses.

Parkway FX has not provided sufficient information regarding its policies on fund segregation, investor protection, or negative balance protection. These measures are crucial for safeguarding traders' investments and ensuring that they are not liable for losses exceeding their account balance.

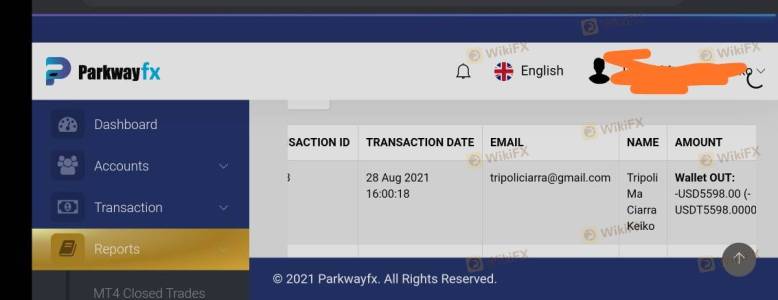

Additionally, there have been reports of withdrawal issues, where clients experienced delays and difficulties in accessing their funds. Such incidents can indicate a lack of transparency and operational integrity, further emphasizing the risks associated with trading with Parkway FX. The absence of a solid framework for fund security is a concerning factor for potential clients considering this broker.

Customer Experience and Complaints

Customer feedback plays a vital role in assessing a broker's reliability. Reviews of Parkway FX indicate a mix of experiences, with many users reporting difficulties in withdrawing funds and receiving consistent customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Aggressive Marketing | Medium | Inconsistent |

| Customer Support | High | Limited Availability |

Common complaints include aggressive marketing tactics, where clients receive persistent calls and emails urging them to deposit more funds. This behavior can create an uncomfortable trading environment and raises questions about the broker's ethical practices. Furthermore, the lack of timely responses from customer support can exacerbate issues related to withdrawals and account management.

Two notable case studies highlight these concerns. One user reported being unable to withdraw funds after multiple requests, leading to frustration and financial loss. Another client described receiving constant pressure to increase their deposits, which ultimately resulted in a negative trading experience. These patterns of complaints suggest a concerning trend that potential traders should be aware of before engaging with Parkway FX.

Platform and Trade Execution

The performance of a trading platform is crucial for a trader's success. Parkway FX offers its proprietary trading platform, which has received mixed reviews regarding its stability and user experience.

Issues such as order execution delays, slippage, and occasional system outages have been reported, which can significantly impact trading outcomes. Traders expect reliable and efficient execution, and any signs of manipulation or technical difficulties can raise red flags.

Additionally, the absence of industry-standard platforms like MetaTrader 4 or 5 may limit traders' options for analysis and strategy implementation. A lack of transparency in trade execution practices can further exacerbate concerns about Parkway FX's reliability.

Risk Assessment

Engaging with Parkway FX presents a range of risks that traders should carefully consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases vulnerability. |

| Withdrawal Risk | High | Complaints about withdrawal difficulties persist. |

| Customer Support Risk | Medium | Limited responsiveness can lead to unresolved issues. |

Given the high regulatory risk and the prevalence of withdrawal complaints, potential clients should approach Parkway FX with caution. It is advisable to conduct further research and consider alternative brokers with stronger regulatory oversight and a proven track record of customer satisfaction.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Parkway FX operates in a high-risk environment characterized by a lack of regulation, transparency issues, and a concerning history of customer complaints. The absence of robust fund security measures and the prevalence of withdrawal problems raise significant red flags for potential traders.

For those considering trading with Parkway FX, it is crucial to weigh the risks carefully. If you are a trader seeking a reliable and secure trading environment, it may be prudent to explore alternative brokers that offer regulatory oversight, transparent trading conditions, and positive customer feedback. Recommended alternatives include brokers with strong regulatory frameworks and a history of positive customer experiences, such as Pepperstone or Admiral Markets.

Ultimately, the question "Is Parkway FX safe?" leans towards a cautious "no," and potential clients should proceed with extreme care if they choose to engage with this broker.

Is Parkway FX a scam, or is it legit?

The latest exposure and evaluation content of Parkway FX brokers.

Parkway FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Parkway FX latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.