Parkway FX 2025 Review: Everything You Need to Know

Executive Summary

This detailed parkway fx review looks at a trading platform that started in 2012. The platform targets traders who want high leverage opportunities and good trading conditions. Parkway FX calls itself a forex and multi-asset broker, but it works without formal oversight from major financial authorities.

The broker's main attractions include leverage ratios up to 2000:1 and tight spreads from 1-2 pips on major currency pairs. These features appeal to active traders and those who want aggressive trading strategies. However, the lack of regulatory supervision raises important questions about trader protection and fund security.

Parkway FX mainly targets experienced traders who value high leverage access and low transaction costs over regulatory assurance. The platform uses cTrader technology and offers access to multiple asset classes including forex, commodities, energy markets, indices, and cryptocurrencies. Commission structures range from $5-$10 per standard lot, making the broker competitive within the high-leverage market segment.

User feedback shows a mixed picture with both positive and neutral reviews. Potential clients should carefully weigh the benefits of enhanced leverage against the risks of trading with an unregulated entity.

Important Notice

Traders across different regions should be very careful because Parkway FX lacks regulation. They should fully understand their local legal frameworks before using this platform. Regulatory requirements and trader protections vary significantly between regions, and the absence of oversight means standard compensation schemes may not apply.

This review uses available market information, user feedback, and publicly accessible data. The analysis has not been independently verified through direct platform testing, so readers should conduct their own research before making trading decisions.

Rating Framework

Broker Overview

Parkway FX started operations in 2012. The company positions itself as a UK-based trading platform focused on providing high-leverage access to global financial markets. The company operates without formal regulatory oversight from major financial authorities, which distinguishes it from traditional regulated brokers but also places greater responsibility on traders to assess risk independently.

The broker's business model centers on providing direct market access through advanced trading technology. It specifically uses the cTrader platform known for its institutional-grade execution capabilities. This technological foundation supports the company's focus on active traders who require sophisticated order management and execution tools.

Parkway FX offers comprehensive access to multiple asset classes including major and minor currency pairs, commodity markets, energy futures, global equity indices, and emerging cryptocurrency markets. This diverse offering allows traders to implement cross-market strategies and diversify their trading portfolios within a single platform environment. The broker's operational structure emphasizes competitive pricing through tight spreads while generating revenue through commission-based fees rather than spread markups.

Regulatory Status: Available information shows Parkway FX operates without formal regulatory oversight from established financial authorities. Potential clients should carefully consider this when evaluating platform safety and fund protection measures.

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and minimum withdrawal amounts is not detailed in available sources. This requires direct inquiry with the broker.

Minimum Deposit Requirements: Exact minimum deposit thresholds for different account types are not specified in accessible documentation.

Promotional Offers: Current bonus structures and promotional campaigns are not detailed in available materials.

Tradeable Assets: The platform provides access to forex markets, commodity trading, energy sector instruments, major global indices, and cryptocurrency markets. This offers comprehensive coverage for diversified trading strategies.

Cost Structure: Spreads typically range from 1-2 pips on major currency pairs. Commission charges are $5-$10 per standard lot depending on the specific instrument and account configuration.

Leverage Options: Maximum leverage reaches 2000:1. This positions among the highest available in the retail trading market.

Platform Technology: Trading operations utilize the cTrader platform. The platform is known for advanced charting capabilities and institutional-level execution technology.

Geographic Restrictions: Specific regional limitations are not detailed in available information sources.

Customer Support Languages: Supported language options for customer service are not specified in accessible materials.

This parkway fx review continues with detailed analysis of each evaluation criterion.

Account Conditions Analysis

Parkway FX's account structure centers on providing competitive trading conditions through tight spreads and exceptional leverage access. The broker's spread range of 1-2 pips on major currency pairs positions it favorably within the high-leverage broker segment, though the commission structure of $5-$10 per standard lot adds to overall trading costs that active traders must factor into their strategies.

The standout feature remains the 2000:1 maximum leverage. This significantly exceeds regulatory limits in major jurisdictions but appeals to traders seeking maximum capital efficiency. However, this extreme leverage also amplifies risk exposure, requiring sophisticated risk management approaches from users.

Account opening procedures and specific account type variations are not detailed in available sources. This creates uncertainty about whether the broker offers tiered account structures or specialized features such as Islamic accounts for Sharia-compliant trading. The absence of disclosed minimum deposit requirements makes it difficult for potential clients to assess accessibility, particularly for smaller traders.

User feedback regarding account conditions remains limited in available sources. This prevents comprehensive assessment of practical account management experiences. The lack of detailed information about account features beyond basic trading conditions suggests potential clients should directly verify specific requirements and available account options before committing funds.

Parkway fx review analysis indicates that while core trading conditions appear competitive, the limited transparency regarding account specifics may concern traders who prioritize comprehensive information before platform selection.

The broker's technological foundation built on the cTrader platform provides access to institutional-grade trading tools and advanced charting capabilities. cTrader technology offers sophisticated order management features, multiple execution types, and comprehensive market analysis tools that support both manual and automated trading strategies.

Asset diversity across forex, commodities, energy markets, indices, and cryptocurrencies enables traders to implement cross-market strategies. This also allows them to respond to global economic developments through a single platform interface. This comprehensive market access eliminates the need for multiple broker relationships for traders seeking diversified exposure.

However, available information does not detail specific research resources, educational materials, or market analysis services. Many traders consider these essential for informed decision-making. The absence of information regarding webinars, trading tutorials, or market commentary suggests either limited educational support or insufficient documentation of available resources.

Automated trading support capabilities through the cTrader platform likely include expert advisor functionality and algorithmic trading options. However, specific details about supported programming languages or strategy development tools are not specified in accessible sources.

The platform's mobile trading capabilities and synchronization features are not detailed in available materials. This leaves questions about cross-device functionality that modern traders increasingly expect. Overall tool quality appears solid based on cTrader's established reputation, but comprehensive resource assessment requires additional information verification.

Customer Service and Support Analysis

Parkway FX provides customer support through traditional channels including telephone and email contact methods. This establishes basic accessibility for trader inquiries and technical assistance. However, the quality and responsiveness of these support services lack detailed user feedback validation in available sources.

The absence of information regarding support availability hours creates uncertainty about whether the broker provides round-the-clock assistance. This is particularly important for active traders operating across multiple time zones. Similarly, multilingual support capabilities are not specified, potentially limiting accessibility for international clients.

Response time expectations and typical resolution procedures for common issues are not documented in accessible materials. These issues include platform technical problems, account management requests, or withdrawal processing questions. This information gap makes it difficult for potential clients to set appropriate expectations regarding support quality.

User experiences with customer service quality, problem resolution effectiveness, and staff knowledge levels are not detailed in available feedback sources. The lack of documented case studies or user testimonials regarding support interactions prevents comprehensive assessment of service standards.

Live chat functionality is not mentioned in available information. Many traders consider this essential for immediate assistance during trading sessions. This suggests either unavailability or insufficient documentation of contact methods. The overall customer service evaluation remains limited due to insufficient user experience data and service specification details.

Trading Experience Analysis

The trading environment at Parkway FX centers on the cTrader platform's execution capabilities combined with competitive spread pricing and high leverage access. The 1-2 pip spread range on major currency pairs provides cost-effective trading conditions, while the 2000:1 maximum leverage enables significant position sizing flexibility for experienced traders.

Platform stability and execution speed metrics are not detailed in available user feedback. This creates uncertainty about performance during high-volatility periods or market stress events. Order execution quality, including slippage frequency and requote occurrences, lacks documented user experiences that would inform potential clients about practical trading conditions.

The cTrader platform's advanced functionality likely includes features such as market depth display, one-click trading, and sophisticated order types. However, specific available features and customization options are not detailed in accessible sources. Mobile trading capabilities and synchronization between desktop and mobile platforms remain unspecified.

Trading environment factors such as available liquidity providers, execution model transparency, and potential conflicts of interest are not addressed in available materials. The absence of information about trading restrictions, such as scalping policies or hedging limitations, creates additional uncertainty for traders with specific strategy requirements.

User feedback regarding overall trading satisfaction, platform reliability, and execution quality is limited in available sources. This prevents comprehensive assessment of practical trading experiences. This parkway fx review finds that while core conditions appear attractive, detailed performance validation requires additional user experience documentation.

Trust and Safety Analysis

The most significant concern regarding Parkway FX centers on its unregulated status. This places it outside the oversight of established financial authorities and their associated trader protection frameworks. This regulatory absence means clients cannot rely on standard compensation schemes, segregated account requirements, or dispute resolution mechanisms typically available through regulated brokers.

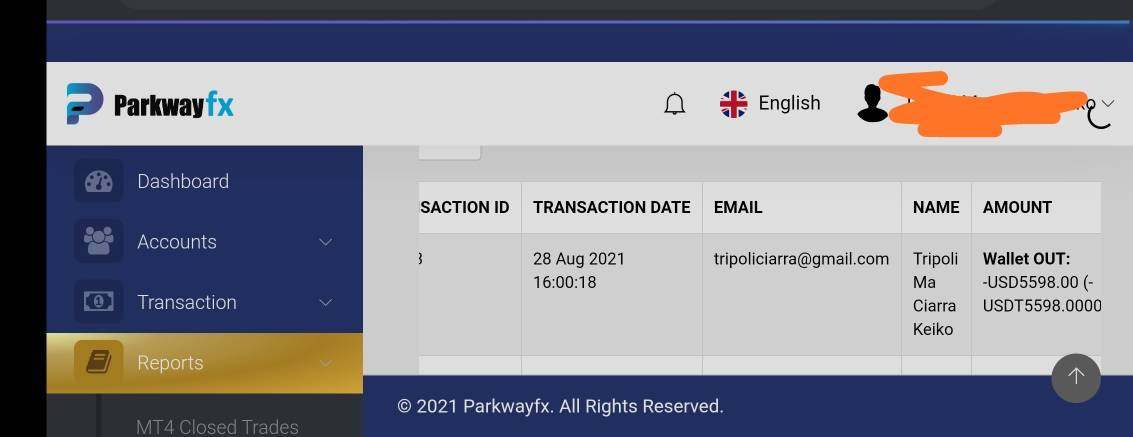

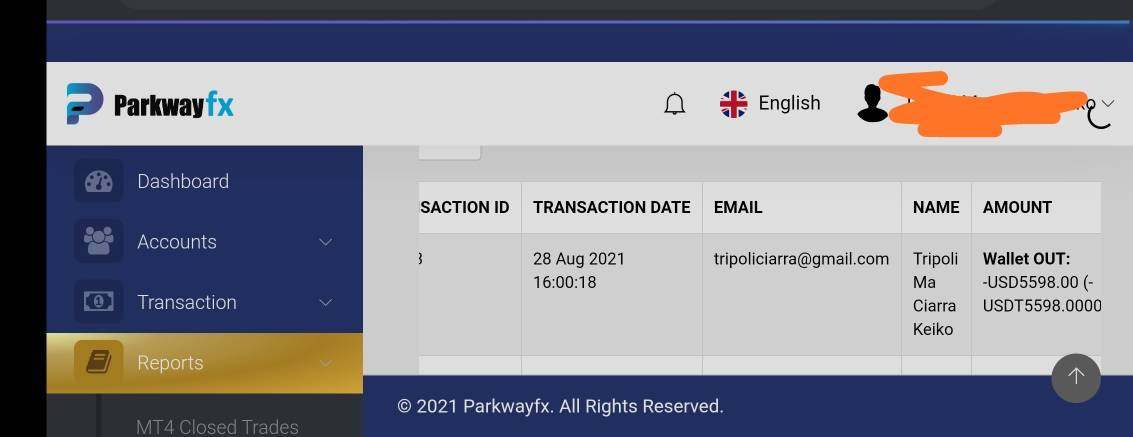

Fund safety measures are not detailed in available information sources. These include client money segregation practices, bank custody arrangements, and operational transparency standards. The absence of regulatory oversight also means independent auditing requirements and financial reporting standards may not apply, limiting transparency regarding the company's financial stability.

Company transparency regarding management structure, ownership details, and operational procedures is not evident in accessible materials. This creates uncertainty about corporate governance standards and accountability mechanisms. The lack of published financial statements or third-party verification of business practices further compounds transparency concerns.

Industry reputation indicators are not documented in available sources. These include awards, recognition from trading publications, or positive coverage from financial media. Similarly, information about how the company handles negative events, client complaints, or operational challenges is not publicly available.

The absence of regulatory protection means traders bear full responsibility for due diligence and risk assessment. They have limited recourse options in case of disputes or operational problems. This regulatory gap represents the most significant risk factor potential clients must evaluate when considering this platform.

User Experience Analysis

Available user feedback presents a mixed picture with both positive and neutral reviews. However, detailed satisfaction metrics and comprehensive user surveys are not accessible through available sources. The limited feedback suggests adequate platform functionality, but lacks the depth needed for thorough user experience assessment.

Interface design quality, navigation ease, and overall platform usability are not detailed in available user reviews. This makes it difficult to assess how well the platform serves traders with varying experience levels. Registration and account verification processes, including required documentation and approval timeframes, are not specified in accessible materials.

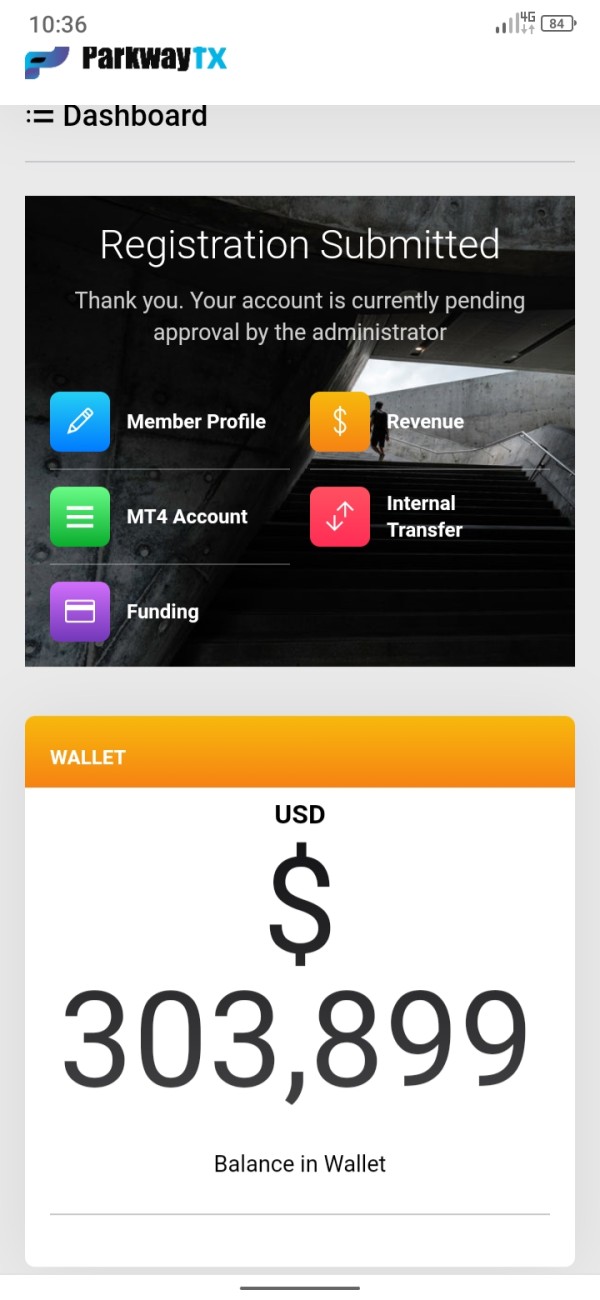

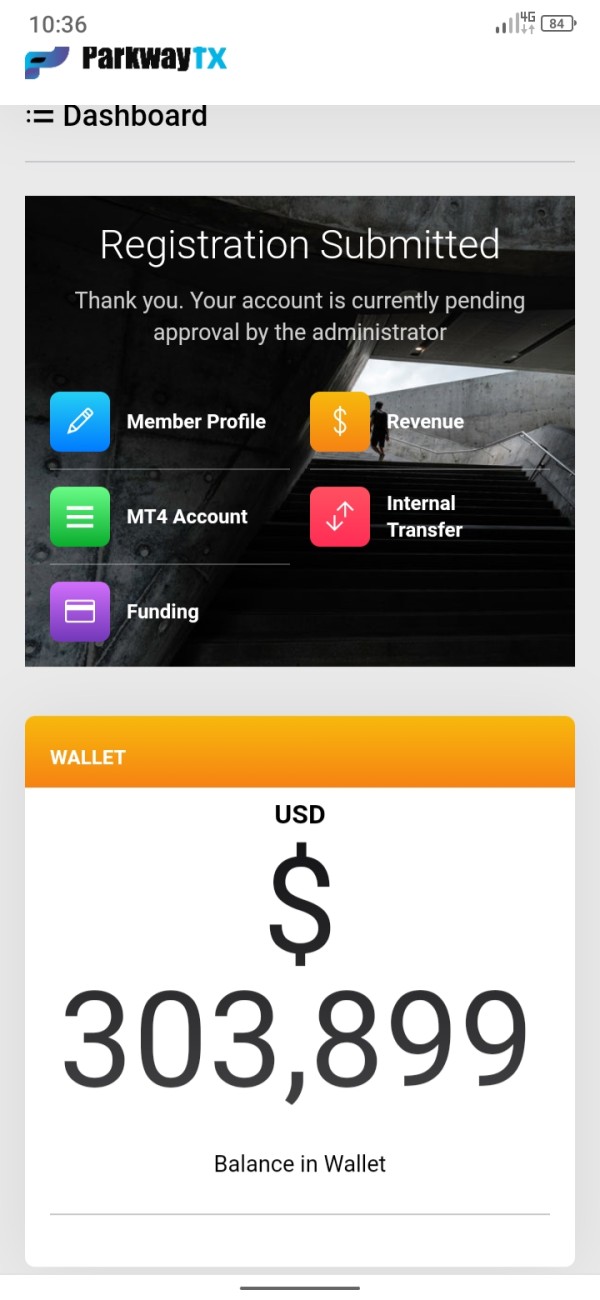

Fund management experiences lack detailed user documentation that would inform potential clients about practical operational aspects. These include deposit processing speed, withdrawal efficiency, and payment method reliability. The absence of user feedback regarding common operational challenges or satisfaction with financial transactions creates additional uncertainty.

User demographic analysis suggests the platform primarily attracts traders seeking high leverage and competitive costs. However, comprehensive user profiling data is not available. Common user complaints, feature requests, or suggestions for platform improvements are not documented in accessible sources.

The overall user satisfaction level remains difficult to assess due to limited feedback availability and absence of comprehensive user experience surveys. Potential improvements and areas where the platform could better serve client needs are not identified through available user input. This limits the ability to provide specific recommendations for platform enhancement.

Conclusion

This comprehensive analysis reveals that Parkway FX offers compelling trading conditions for experienced traders seeking high leverage access and competitive spreads. However, it operates with significant transparency and regulatory limitations that potential clients must carefully consider. The broker's core strengths include 2000:1 maximum leverage, tight 1-2 pip spreads, and cTrader platform integration, making it potentially attractive for active traders prioritizing these specific features.

However, the unregulated status represents the most significant limitation. This places clients outside standard protective frameworks and requires independent risk assessment. The limited availability of detailed information regarding account features, customer service quality, and user experiences further complicates comprehensive evaluation.

Parkway FX appears most suitable for experienced traders who understand the implications of unregulated trading environments and prioritize high leverage access over regulatory protection. New or conservative traders would likely benefit from considering regulated alternatives that provide additional safety measures and transparency standards.