Is Oubo Global safe?

Business

License

Is Oubo Global Safe or a Scam?

Introduction

Oubo Global is a forex broker that has emerged in the trading landscape, offering a range of services to traders interested in foreign exchange and other financial instruments. With the allure of high leverage and diverse trading options, Oubo Global positions itself as a viable choice for both novice and experienced traders. However, the forex market is notorious for its risks, and traders must exercise caution when selecting a broker. The potential for scams and fraudulent activities necessitates thorough due diligence, as the stakes can be high. This article aims to provide a comprehensive evaluation of Oubo Global's legitimacy by examining its regulatory status, company background, trading conditions, customer experiences, and risk factors. The analysis is based on a review of various sources, including regulatory databases and user feedback, to present a balanced perspective on whether Oubo Global is safe or a scam.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical aspects to evaluate when assessing its legitimacy. Regulatory oversight ensures that brokers adhere to certain standards, providing a level of protection for traders. In the case of Oubo Global, there are significant concerns regarding its regulatory compliance. The broker claims to be regulated by the National Futures Association (NFA) in the United States; however, a verification check reveals that it is not listed as a member of the NFA. This discrepancy raises serious doubts about its regulatory status.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0536478 | United States | Not Listed |

The lack of a legitimate regulatory framework is alarming, as it leaves traders vulnerable to potential misconduct. The absence of a robust regulatory body overseeing Oubo Global's operations suggests that traders may not have adequate recourse in case of disputes or issues. Furthermore, the presence of a suspicious regulatory license casts a shadow over the broker's credibility. Without stringent regulation, traders should be cautious and consider the implications of trading with Oubo Global.

Company Background Investigation

Oubo Global Pty. Ltd. is a relatively new player in the forex market, having been established approximately 1-2 years ago. The company is registered in Canada, but its operational transparency is questionable. The ownership structure and management team details are not readily available, which can be a red flag for potential investors. A lack of transparency regarding the company's history and ownership can indicate a higher risk of fraudulent activities.

The management team's background and expertise are crucial in establishing trustworthiness. Unfortunately, Oubo Global does not provide sufficient information about its leadership, which raises concerns about the broker's operational integrity. A reputable brokerage typically showcases the qualifications and experience of its management team to instill confidence among traders. In the case of Oubo Global, the opacity surrounding its leadership is a significant drawback.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is paramount. Oubo Global has set a minimum deposit requirement of $1,000, which is relatively high compared to industry standards. While the broker offers leverage of up to 1:1000, the lack of transparency regarding spreads and commissions is concerning. Traders need to be aware of the costs associated with trading, as hidden fees can significantly impact profitability.

| Fee Type | Oubo Global | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Not Specified | 1-3 pips |

| Commission Structure | Not Specified | Varies |

| Overnight Interest Range | Not Specified | Varies |

The absence of clear information about spreads and commissions may indicate an intention to obscure the true cost of trading. Traders should be wary of brokers that do not provide comprehensive details about their fee structures, as this can lead to unexpected costs and diminished returns. Moreover, the lack of a demo account restricts new traders from practicing and familiarizing themselves with the platform without risking real capital.

Client Fund Security

Client fund security is another crucial aspect to consider when evaluating whether Oubo Global is safe. The broker claims to implement measures for fund security, but specific details regarding fund segregation and investor protection mechanisms are lacking. Traders must ensure that their funds are held in separate accounts to prevent misuse and to safeguard against broker insolvency.

Additionally, the absence of negative balance protection raises concerns about the potential risks involved in trading with Oubo Global. Negative balance protection is essential in volatile markets, as it ensures that traders cannot lose more than their deposited funds. The lack of transparency surrounding these security measures is alarming and suggests that traders may be exposed to higher risks.

Customer Experience and Complaints

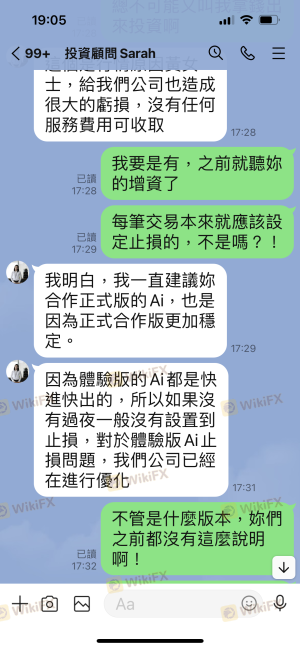

Customer feedback is invaluable in assessing the reliability of a broker. In the case of Oubo Global, reviews and user experiences reveal a mixed picture. While some users report satisfactory trading experiences, there are numerous complaints regarding the broker's customer support and transparency. Common complaints include difficulties in withdrawing funds and a lack of timely responses from the support team.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Lack of Transparency | Medium | Poor Communication |

| Customer Support Availability | High | Limited |

Typical cases highlight frustrations experienced by traders attempting to withdraw their funds, often facing delays and insufficient communication from the broker. These issues can significantly undermine trust in Oubo Global and raise concerns about its operational practices. A broker's ability to address customer complaints effectively is a strong indicator of its reliability.

Platform and Execution

The trading platform is a vital component of the trading experience, influencing order execution quality and user satisfaction. Oubo Global does not provide specific information about its trading platform, leaving traders uncertain about its functionalities. The absence of well-known platforms like MetaTrader 4 or 5 raises questions about the broker's technological capabilities.

Additionally, the quality of order execution, including slippage and rejection rates, is critical for traders. Without transparent information regarding these metrics, traders may find themselves at a disadvantage. Any signs of platform manipulation or unreliable execution can severely impact trading outcomes.

Risk Assessment

Using Oubo Global carries inherent risks that potential traders must consider. The lack of regulatory oversight, combined with unclear trading conditions and customer service issues, presents a high-risk environment. Traders must be vigilant and assess their risk tolerance before engaging with this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Lack of oversight |

| Trading Costs | Medium | Hidden fees possible |

| Customer Support Reliability | High | Slow and limited |

To mitigate risks, traders should consider diversifying their investments and not committing significant capital to Oubo Global until more clarity and transparency are provided. Exploring alternative brokers with stronger regulatory frameworks and better customer support may also be prudent.

Conclusion and Recommendations

In conclusion, the evidence suggests that Oubo Global raises significant concerns that warrant careful consideration. The lack of regulatory transparency, coupled with the absence of clear trading conditions and customer support issues, indicates that Oubo Global may not be a safe choice for traders. Is Oubo Global safe? The answer is not straightforward, as the broker exhibits several red flags that could potentially lead to negative experiences for traders.

For those considering trading with Oubo Global, it is advisable to proceed with caution and conduct further research. Beginners and risk-averse traders should explore alternative brokers that offer robust regulatory oversight, transparent fee structures, and reliable customer support. Recommended alternatives include well-established brokers with a strong reputation for safety and customer service. Ultimately, the decision to engage with Oubo Global should be made with a clear understanding of the associated risks and potential challenges.

Is Oubo Global a scam, or is it legit?

The latest exposure and evaluation content of Oubo Global brokers.

Oubo Global Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Oubo Global latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.