Is Orin Globals safe?

Business

License

Is Orin Globals Safe or a Scam?

Introduction

Orin Globals is a relatively new player in the forex market, positioning itself as an online broker that offers a variety of trading options. As with any financial institution, especially in the volatile world of forex trading, it is crucial for traders to exercise caution and conduct thorough research before engaging with a broker. The forex market is rife with scams and unscrupulous operators, making it essential for traders to understand the legitimacy and safety of the platforms they choose to use. In this article, we will investigate whether Orin Globals is safe or if it exhibits characteristics of a scam. Our analysis will be based on information gathered from various reputable sources, including regulatory assessments, customer reviews, and expert opinions.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most important factors to consider when evaluating its safety. Regulated brokers are subject to strict oversight, which helps protect traders' funds and ensure fair trading practices. Unfortunately, Orin Globals appears to be unregulated, which raises significant concerns regarding its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation from a reputable authority such as the Financial Conduct Authority (FCA) or the Commodity Futures Trading Commission (CFTC) is a major red flag. Furthermore, the broker is registered in Saint Vincent and the Grenadines, a jurisdiction known for its lax regulatory framework. The Financial Services Authority (FSA) in this region has ceased issuing licenses to forex brokers since 2019, making it increasingly difficult to find a reputable broker operating under this jurisdiction.

The lack of regulatory oversight means that traders have limited recourse in the event of disputes or issues, which significantly impacts the overall safety of using Orin Globals. In summary, the lack of a valid regulatory license and the dubious status of its registration raise serious concerns about whether Orin Globals is safe.

Company Background Investigation

Orin Globals was established relatively recently, with its domain registered in 2021. However, the information available about its ownership and management is scarce, which is another cause for concern. A transparent company should provide detailed information about its founders and management team, along with their professional backgrounds and experiences. Unfortunately, Orin Globals lacks such transparency, with hidden information about domain owners and servers intensifying suspicions.

The company claims to offer attractive trading conditions, but the absence of verifiable documentation regarding its history and ownership structure raises questions about its credibility. Moreover, the generic design of its website and the lack of investment in promotion suggest that Orin Globals may not be committed to building a trustworthy brand.

In terms of management, the absence of professional profiles or detailed information on the team further complicates the assessment of whether Orin Globals is safe. A reputable broker typically provides information about its management team, including their qualifications and experiences in the financial industry. The opacity surrounding Orin Globals management raises significant concerns about the broker's legitimacy and operational integrity.

Trading Conditions Analysis

When evaluating whether Orin Globals is safe, it is essential to examine its trading conditions, including fees, spreads, and overall cost structure. Orin Globals offers various account types, including standard and VIP accounts, with minimum deposits ranging from $500 to $20,000. While the broker advertises maximum leverage of 1:500, which can be enticing for traders, such high leverage also comes with increased risk.

| Fee Type | Orin Globals | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.0 pips | 1.5 pips |

| Commission Model | N/A | $5 per lot |

| Overnight Interest Range | Varies | 0.5% - 1% |

The spreads offered by Orin Globals appear competitive when compared to industry averages, but traders should approach these claims with caution. Many brokers advertise attractive trading conditions that do not always reflect the actual trading experience. Additionally, the lack of clear information regarding commissions and overnight interest rates raises concerns about potential hidden fees that could affect traders' profitability.

Moreover, the promise of bonuses and promotions could be a tactic to lure traders into making larger deposits, which is often a tactic used by less reputable brokers. In conclusion, while the trading conditions may seem appealing, the lack of transparency and potential hidden fees suggest that Orin Globals may not be a safe option for traders.

Customer Funds Safety

The safety of customer funds is paramount when assessing whether Orin Globals is safe. A reputable broker should implement robust measures to ensure the security of client funds, including segregated accounts, investor protection schemes, and negative balance protection. Unfortunately, there is little information available regarding Orin Globals' policies on these critical aspects.

Without clear guidelines on how customer funds are managed and protected, traders are left vulnerable to potential risks. Additionally, the absence of regulatory oversight means that there are no guarantees in place to protect traders' investments. Historical safety issues or controversies surrounding fund management could further indicate a lack of commitment to client protection.

In summary, the lack of transparency regarding customer fund safety measures raises significant concerns about whether Orin Globals is safe. Traders should be cautious when dealing with brokers that do not prioritize the protection of their clients' funds.

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a broker's reliability and safety. Reviews and testimonials from traders can provide valuable insights into their experiences with a broker. Unfortunately, the feedback surrounding Orin Globals is predominantly negative, with numerous complaints regarding delayed payments, account blocks, and misleading information.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Blocking | High | Poor |

| Misleading Promotions | Medium | Poor |

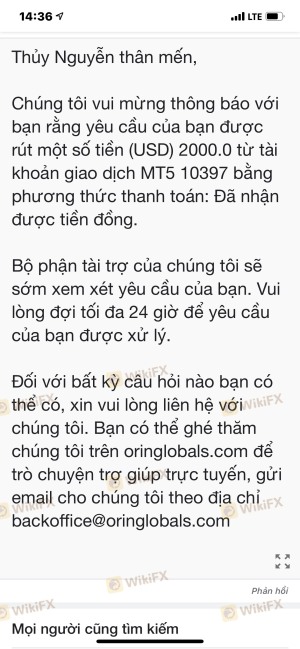

Common complaints highlight issues with withdrawals, where traders report significant delays or outright denials when attempting to access their funds. Additionally, many users have claimed that their accounts were blocked without clear explanations, which raises serious concerns about the broker's operational integrity.

One notable case involved a trader who deposited a substantial amount only to face difficulties when requesting a withdrawal. The broker's lack of responsiveness and transparency in addressing these issues only exacerbated the situation, leading to a loss of trust.

In conclusion, the overwhelming negative feedback regarding customer experiences with Orin Globals indicates that it may not be a safe option for traders. The patterns of complaints and the company's inadequate responses suggest a troubling environment for potential clients.

Platform and Trade Execution

The trading platform provided by a broker plays a crucial role in the overall trading experience. A reliable platform should offer stability, ease of use, and efficient order execution. However, there is limited information available regarding Orin Globals' trading platform performance.

Traders have reported issues related to order execution quality, including slippage and rejected orders. Such problems can significantly impact trading outcomes and raise concerns about the broker's operational capabilities. If a broker's platform frequently causes execution issues, it could indicate potential manipulation or other unethical practices.

In summary, the lack of transparency regarding the performance and reliability of Orin Globals' trading platform raises significant concerns about whether it is safe for traders. The reported issues with order execution further highlight the risks associated with using this broker.

Risk Assessment

Using Orin Globals presents several risks that traders should consider before engaging with the broker. The lack of regulation, transparency, and negative customer experiences contribute to an overall high-risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight, leading to potential fraud. |

| Financial Risk | High | Lack of transparent fund management and withdrawal issues. |

| Operational Risk | Medium | Reports of execution issues and account blocking. |

To mitigate these risks, traders should consider the following recommendations:

- Conduct Thorough Research: Always investigate a broker's regulatory status and customer reviews before depositing funds.

- Start Small: If you choose to engage with a broker, begin with a small deposit to test their services.

- Monitor Withdrawals: Ensure that you can easily withdraw funds before committing larger amounts.

Conclusion and Recommendations

In conclusion, the evidence suggests that Orin Globals exhibits several characteristics of a potentially unsafe broker. The lack of regulation, negative customer experiences, and transparency issues raise serious concerns about its legitimacy. Traders should be cautious and consider the risks associated with using this broker.

For those seeking reliable alternatives, it is advisable to choose brokers that are regulated by reputable authorities, have positive customer feedback, and demonstrate transparency in their operations. Some recommended brokers include those regulated by the FCA, ASIC, or CFTC, which are known for their stringent oversight and commitment to protecting traders.

In light of the findings, it is clear that Orin Globals is not a safe choice for forex trading, and potential clients should proceed with extreme caution.

Is Orin Globals a scam, or is it legit?

The latest exposure and evaluation content of Orin Globals brokers.

Orin Globals Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Orin Globals latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.