Is WPG safe?

Pros

Cons

Is WPG Safe or a Scam?

Introduction

WPG, a relatively new player in the forex market, has attracted attention for its trading offerings and potential for high returns. However, the influx of forex brokers has led to a surge in scams and unreliable platforms, making it crucial for traders to thoroughly assess the legitimacy of any broker before investing their hard-earned money. In this article, we will investigate whether WPG is safe or a scam, exploring various aspects of the broker's operations, including regulatory status, company background, trading conditions, customer experiences, and risk factors. Our evaluation will be based on a comprehensive analysis of available information from reputable sources and user feedback.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy and safety. WPG currently operates without any recognized regulatory oversight, which raises significant concerns among potential investors. The absence of regulation means that there are no authorities ensuring the broker adheres to industry standards, which can expose traders to risks such as fraud, mismanagement, and a lack of recourse in case of disputes.

Here is a summary of WPG's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The lack of a regulatory framework is alarming, as it implies that WPG does not have to comply with strict guidelines designed to protect traders. Furthermore, historical compliance issues have been reported, with claims of refusal to process withdrawals and serious slippage during trades, indicating potential malpractices. Therefore, it is essential for traders to consider this lack of oversight seriously when evaluating if WPG is safe.

Company Background Investigation

WPG's company history and ownership structure play a vital role in understanding its credibility. Established as a forex trading platform, WPG has not provided sufficient information regarding its founders, management team, or operational history. This lack of transparency can be a red flag for potential investors, as reputable brokers typically offer detailed insights into their origins and the expertise of their leadership.

The management team's experience is another crucial aspect to consider. A well-versed team can enhance a broker's credibility, but WPG's website lacks detailed profiles or qualifications of its executives. This absence of information raises questions about the firm's commitment to transparency and its ability to manage client funds responsibly.

Moreover, the overall information disclosure level is concerning. Traders expect to find clear, accessible information about the broker's operations, trading conditions, and risk factors. WPG's failure to provide this information may indicate a lack of accountability and could potentially point to a scam. Thus, in evaluating whether WPG is safe, it is vital to scrutinize these factors thoroughly.

Trading Conditions Analysis

Understanding the trading conditions offered by WPG is essential for assessing its safety. A transparent fee structure is a hallmark of trustworthy brokers; however, WPG's fees and commissions remain unclear. Traders often face unexpected charges, which can significantly impact their overall profitability.

Here is a comparative overview of WPG's core trading costs:

| Fee Type | WPG | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Low |

| Commission Model | Unclear | Defined |

| Overnight Interest Range | Varies | Standardized |

The high spreads and lack of clarity regarding commissions may suggest that WPG is not aligned with industry standards. Such discrepancies can lead traders to incur higher costs than anticipated, potentially affecting their trading performance. Therefore, prospective clients should approach WPG with caution and conduct further research to understand the complete fee structure before committing any funds.

Client Fund Safety

The safety of client funds is paramount when evaluating a forex broker. WPG's measures regarding fund security, including fund segregation, investor protection, and negative balance protection, are critical to assess. Unfortunately, the absence of regulatory oversight raises concerns about how WPG manages client funds.

Without proper fund segregation, clients may risk losing their investments in the event of the broker's insolvency. Additionally, WPG has not provided clear details regarding investor protection measures, leaving clients vulnerable. Historical complaints suggest that clients have faced difficulties in withdrawing funds, further indicating potential issues with fund safety.

In summary, WPG's lack of transparency and regulatory oversight raises significant concerns about the safety of client funds. Traders should consider these factors carefully when determining if WPG is safe for their investments.

Customer Experience and Complaints

Customer feedback is a vital component in assessing a broker's reliability. Reviews of WPG highlight a mixed bag of experiences, with several users reporting significant challenges, including withdrawal issues and poor customer service.

Common complaint patterns include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| Slippage Issues | Medium | Unresolved |

| Lack of Communication | High | Poor |

Many users have expressed frustration over their inability to withdraw funds, often citing unresponsive customer service as a major concern. Such complaints can be indicative of deeper operational issues within the broker and raise serious questions about its legitimacy.

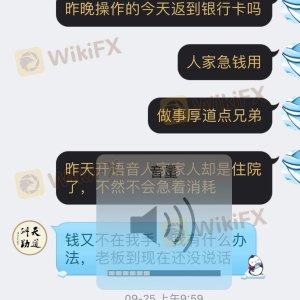

A few notable case studies illustrate these issues. For instance, one user reported that their withdrawal request was ignored for weeks, leading them to believe that WPG may be engaging in practices typical of a scam. Another trader experienced significant slippage, which negatively impacted their trades and raised suspicions about the broker's execution quality.

Platform and Execution

Evaluating the trading platform's performance is crucial in determining if WPG is safe. A reliable platform should offer stability, user-friendly features, and efficient order execution. However, reviews indicate that WPG's platform has faced issues with stability and execution quality, leading to significant slippage and rejected orders.

Traders have reported that during periods of high volatility, the platform struggled to execute trades at the desired prices, causing frustration and potential losses. These execution issues can significantly impact a trader's experience and raise concerns about the broker's reliability.

In conclusion, the platform's performance and order execution quality are critical factors in assessing WPG's safety. Traders should be wary of potential manipulation or execution issues that could adversely affect their trading outcomes.

Risk Assessment

When considering whether WPG is safe, it is essential to evaluate the overall risks associated with trading through this broker. The lack of regulation, unclear fee structures, and negative customer experiences contribute to a high-risk environment for traders.

Here is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | Medium | Unclear fee structures and practices |

| Operational Risk | High | Poor customer service and complaints |

To mitigate these risks, traders are advised to conduct thorough research, start with minimal investments, and be cautious with their trading strategies. It is essential to remain vigilant and aware of the potential pitfalls associated with trading through WPG.

Conclusion and Recommendations

In light of the evidence presented, it is clear that WPG raises several red flags that warrant caution. The lack of regulation, unclear trading conditions, and negative customer feedback suggest that WPG may not be the safest choice for traders.

If you are considering trading with WPG, it is crucial to weigh these factors carefully and consider alternative, more reputable brokers that offer robust regulatory oversight, transparent fee structures, and positive customer experiences. Some recommended alternatives include brokers with strong regulatory backgrounds and proven track records in customer service.

In conclusion, while WPG may offer certain trading opportunities, the risks associated with this broker should not be overlooked. Traders must prioritize their safety and consider all aspects before making any commitments.

Is WPG a scam, or is it legit?

The latest exposure and evaluation content of WPG brokers.

WPG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

WPG latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.