Is NeoFXTrade safe?

Business

License

Is NeoFXTrade Safe or Scam?

Introduction

NeoFXTrade is a relatively new player in the forex market, positioning itself as a broker for forex and CFDs (Contracts for Difference). As with any investment platform, it is crucial for traders to evaluate the credibility and safety of a broker before committing their funds. This is particularly important in the forex market, where the lack of regulation can expose traders to significant risks. In this article, we will explore whether NeoFXTrade is a trustworthy broker or if it raises red flags that suggest it could be a scam. Our investigation is based on a thorough review of available online resources, user experiences, and regulatory information.

Regulation and Legitimacy

Understanding the regulatory status of a broker is essential for assessing its safety. Regulated brokers are required to adhere to strict guidelines that protect traders funds, while unregulated brokers can operate with little oversight, posing significant risks to investors.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

NeoFXTrade claims to be based in Cyprus and mentions affiliation with Neo Partner Online SRL. However, it does not provide any valid regulatory license information. Notably, a review of regulatory databases reveals that NeoFXTrade is not listed under any recognized financial authority, including the Cyprus Securities and Exchange Commission (CySEC). This absence of regulation is a significant concern, as it indicates that the broker operates without the necessary oversight to ensure the safety of clients' funds. Furthermore, the lack of transparency regarding the company's registration and ownership raises additional questions about its legitimacy. In summary, the lack of regulation strongly suggests that NeoFXTrade is not safe, and traders should exercise extreme caution.

Company Background Investigation

A broker's history and ownership structure provide valuable insights into its reliability. Unfortunately, information regarding NeoFXTrade's background is sparse. The broker does not disclose the names of its owners or any detailed history of its operations. This lack of transparency is a significant red flag.

The management team's professional experience is also unclear, which is concerning for potential investors. A reputable broker typically provides information about its leadership and their qualifications, helping to establish trust. The absence of such information suggests a lack of accountability, making it difficult for traders to assess the broker's credibility.

Moreover, NeoFXTrade's website is not particularly informative, offering only basic details about its services while omitting critical information about its operational history. This opacity further complicates the evaluation of its trustworthiness. In light of these factors, it is evident that NeoFXTrade lacks the transparency necessary to be considered safe.

Trading Conditions Analysis

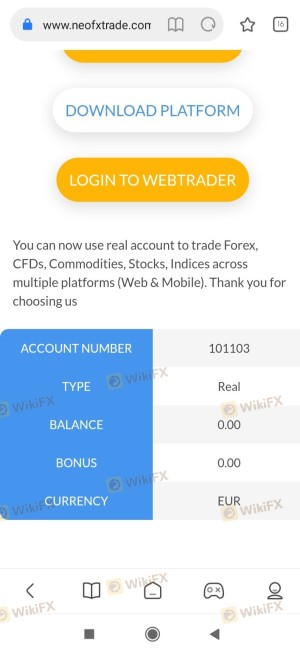

Examining the trading conditions offered by a broker is essential for understanding the overall cost of trading. NeoFXTrade provides various account types, including starter, premium, and ultimate plans, with minimum deposits ranging from €250 to €25,000. However, specific details regarding spreads, commissions, and other fees are not clearly outlined, which can lead to unexpected costs for traders.

| Fee Type | NeoFXTrade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Specified | 1-2 pips |

| Commission Model | Not Specified | Varies |

| Overnight Interest Range | Not Specified | Varies |

The lack of clear information regarding fees is concerning. Traders may encounter hidden costs that could significantly impact their profitability. Furthermore, the high leverage offered (up to 1:1000) is another potential issue, as it can lead to substantial losses, especially for inexperienced traders. In conclusion, the ambiguous and potentially unfavorable trading conditions suggest that NeoFXTrade may not be a safe choice for traders.

Client Funds Safety

The safety of client funds is paramount when evaluating a broker. NeoFXTrade does not provide sufficient information regarding its fund safety measures. There is no indication that client funds are kept in segregated accounts, which is a standard practice among regulated brokers to protect clients in the event of bankruptcy.

Additionally, the lack of investor protection schemes, such as those provided by regulatory authorities, raises concerns about the safety of funds deposited with NeoFXTrade. Historical issues related to fund withdrawals reported by users further compound these concerns, suggesting that clients may face difficulties accessing their money. Given these factors, it is clear that the safety of client funds at NeoFXTrade is questionable, making it a risky choice for traders.

Customer Experience and Complaints

Analyzing customer feedback is vital for understanding the real-world experiences of users with a broker. Many reviews of NeoFXTrade highlight significant issues, including difficulties with fund withdrawals and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Poor |

| Misleading Information | High | Poor |

Common complaints involve users reporting that their withdrawal requests were delayed for months, with some never receiving their funds. The company's response to these complaints has generally been inadequate, further eroding trust. A typical case involves a user who deposited funds but faced persistent obstacles when attempting to withdraw, ultimately leading them to believe they had been scammed. Such patterns of negative feedback indicate that NeoFXTrade does not prioritize customer satisfaction or transparency, further questioning its safety.

Platform and Trade Execution

The trading platform provided by NeoFXTrade is another critical aspect of its service. While the broker claims to offer a modern trading experience, user reviews suggest otherwise. Many traders report issues with platform stability, including frequent disconnects and slow execution times.

The quality of order execution is also a concern, with reports of slippage and rejected orders during high volatility periods. Such issues can significantly affect trading outcomes, particularly for those employing short-term strategies. The absence of robust performance metrics and user testimonials regarding the platform's reliability raises further doubts about its safety. In light of these factors, it is evident that the trading platform at NeoFXTrade may not be reliable, which is a significant risk for traders.

Risk Assessment

Using NeoFXTrade involves several risks that potential clients should consider.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status exposes traders to fraud. |

| Withdrawal Risk | High | Reports of delayed or denied withdrawals. |

| Trading Platform Risk | Medium | Stability and execution issues reported. |

To mitigate these risks, traders should conduct thorough research and consider using regulated brokers with established reputations. It is advisable to avoid high leverage unless you are an experienced trader, as it can amplify losses. Overall, the risks associated with NeoFXTrade are significant, and potential clients should proceed with caution.

Conclusion and Recommendations

In conclusion, after thoroughly evaluating the evidence, it is clear that NeoFXTrade raises several red flags that suggest it may not be safe. The absence of regulation, lack of transparency, poor customer feedback, and potential issues with fund safety all point to a broker that could pose significant risks to traders.

For those considering trading in the forex market, it is crucial to choose a regulated broker with a solid reputation and transparent practices. Alternatives to consider include well-established brokers that offer robust regulatory oversight and positive user experiences. By prioritizing safety and due diligence, traders can protect their investments and navigate the forex market more confidently.

Is NeoFXTrade a scam, or is it legit?

The latest exposure and evaluation content of NeoFXTrade brokers.

NeoFXTrade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

NeoFXTrade latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.