Is Nación Bursátil safe?

Pros

Cons

Is Nacion Bursatil Safe or Scam?

Introduction

Nacion Bursatil is a financial services provider based in Argentina, offering a range of trading products including equities, ETFs, and derivatives. Established in 1996, the company aims to cater to both local and international traders. However, the foreign exchange (forex) market is notorious for its volatility and the prevalence of unregulated brokers. As such, it is crucial for traders to conduct thorough evaluations of their chosen brokers to ensure their safety and legitimacy. This article investigates the safety of Nacion Bursatil by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

To achieve this, we employed a multi-faceted research approach, reviewing various online sources, user experiences, and expert analyses. Our evaluation framework includes examining regulatory compliance, financial security measures, trading conditions, customer feedback, and the overall reputation of the broker in the financial community.

Regulation and Legitimacy

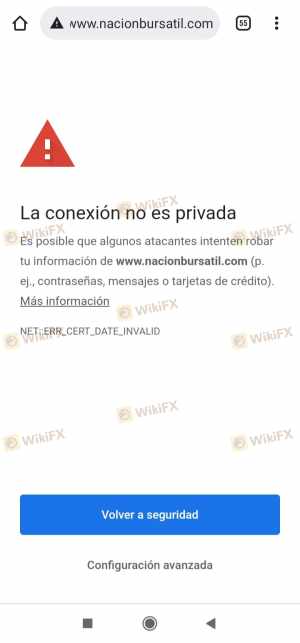

The regulatory landscape is vital in determining the safety of a forex broker. A regulated broker is subject to oversight by financial authorities, which helps ensure compliance with industry standards and protects client funds. Unfortunately, Nacion Bursatil operates without valid regulation from any recognized financial authority, raising significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | Argentina | Unregulated |

The lack of regulation means that there are no formal protections in place for investors, which increases the risk of potential fraud or mismanagement of funds. This absence of oversight is particularly alarming given that users have reported difficulties in withdrawing funds, a common red flag in unregulated environments. The regulatory quality of a broker plays a crucial role in safeguarding traders' interests, and Nacion Bursatil's unregulated status is a significant concern that potential clients should carefully consider.

Company Background Investigation

Nacion Bursatil was founded in 1996 and has since positioned itself as a financial intermediary in the Argentine market. However, details regarding its ownership structure and management team are scarce, which can hinder transparency and investor trust. A reputable broker typically provides comprehensive information about its executives and their qualifications, which helps establish credibility.

The management teams background is essential in assessing the broker's reliability. Unfortunately, there is limited publicly available information regarding the qualifications and professional experiences of the individuals leading Nacion Bursatil. This lack of transparency may indicate potential issues in governance or operational integrity. Furthermore, the company's website does not provide sufficient details about its financial standing or operational practices, which further complicates the assessment of its safety.

Trading Conditions Analysis

Nacion Bursatil offers a variety of financial instruments, including forex, equities, and derivatives. However, the overall trading conditions, including fees and spreads, warrant careful scrutiny. A broker's fee structure can significantly impact trading profitability, and it is essential to understand how these costs compare to industry averages.

| Fee Type | Nacion Bursatil | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | Variable | 0 - 5 USD per trade |

| Overnight Interest Range | High | 0 - 3% |

Reports indicate that Nacion Bursatil applies commissions and trading-related fees, but specifics are often vague. Traders should be wary of any unusual fees that may not be disclosed upfront, as this could signal hidden costs that diminish overall returns. The variability in spreads, particularly for major currency pairs, can also affect trading strategies and outcomes.

Customer Fund Safety

The safety of customer funds is paramount when selecting a forex broker. Nacion Bursatil claims to adhere to industry best practices, but without regulation, there is no guarantee of fund protection. Traders should be aware of the following safety measures:

- Fund Segregation: It is unclear whether Nacion Bursatil maintains segregated accounts for client funds, a practice that protects investor capital in the event of company insolvency.

- Investor Protection: There is no indication that Nacion Bursatil offers any form of investor protection or compensation schemes, which are typically provided by regulated brokers.

- Negative Balance Protection: The absence of negative balance protection means that traders could potentially lose more than their initial investment.

Historically, there have been reports of difficulties in fund withdrawal, which raises concerns about the company's financial practices and overall integrity.

Customer Experience and Complaints

Customer feedback is a crucial aspect of evaluating a broker's reliability. Many users have expressed dissatisfaction with Nacion Bursatil, particularly regarding withdrawal issues and customer service responses.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Customer Service Quality | Medium | Inconsistent |

| Transparency Concerns | High | Limited Information |

Common complaints include the inability to withdraw funds and poor customer support, which can severely impact the trading experience. For instance, some users have reported delays in their withdrawal requests, leading to frustration and mistrust. These complaints are indicative of deeper systemic issues within the company, raising further questions about its overall safety and reliability.

Platform and Trade Execution

The performance of a trading platform is critical for a seamless trading experience. Nacion Bursatil offers a web-based trading platform, but reviews suggest that its performance may not meet industry standards.

Key areas of concern include:

- Order Execution Quality: Traders have reported issues with slippage and order rejections, which can adversely affect trading outcomes.

- Platform Stability: Users have mentioned occasional downtimes, which can hinder trading activities during critical market movements.

Such performance issues can significantly impact traders, especially during volatile market conditions.

Risk Assessment

Using Nacion Bursatil presents several inherent risks that traders should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases fraud risk. |

| Financial Risk | Medium | Lack of fund protection and withdrawal issues. |

| Operational Risk | Medium | Platform performance issues can affect trading. |

To mitigate these risks, traders should conduct thorough due diligence, consider using smaller amounts for initial trades, and maintain a diversified trading portfolio.

Conclusion and Recommendations

In summary, the investigation into Nacion Bursatil reveals several concerning factors that suggest it may not be a safe trading environment. The lack of regulation, transparency issues, and negative customer experiences raise significant red flags. While the broker offers a range of financial products, the associated risks and complaints indicate that potential traders should exercise caution.

For those considering trading with Nacion Bursatil, it is advisable to explore alternative brokers that are regulated and have a proven track record of customer satisfaction. Reliable alternatives include brokers like Capex, XTB, and eToro, which provide robust regulatory oversight and positive user experiences. Ultimately, it is crucial for traders to prioritize safety and transparency when selecting a forex broker.

Is Nación Bursátil a scam, or is it legit?

The latest exposure and evaluation content of Nación Bursátil brokers.

Nación Bursátil Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Nación Bursátil latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.