Is MOKFX Global safe?

Business

License

Is Mokfx Global Safe or a Scam?

Introduction

Mokfx Global is an online forex and CFD brokerage that positions itself in the competitive landscape of the foreign exchange market. Established in 2021, the broker claims to offer various trading instruments and services to traders in the United States and Hong Kong. However, as the forex market continues to grow, so does the number of fraudulent brokers. This necessitates that traders exercise caution and conduct thorough evaluations of any broker they consider for their trading activities. This article aims to assess the safety and legitimacy of Mokfx Global by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk profile.

Regulation and Legitimacy

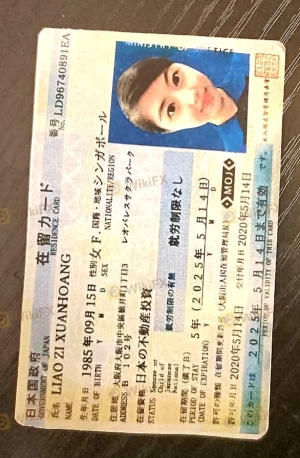

Understanding the regulatory framework within which a broker operates is crucial for assessing its legitimacy. Mokfx Global claims to be regulated by the National Futures Association (NFA), a reputable regulatory body in the United States. However, several reviews and analyses raise concerns about the authenticity of this claim, suggesting that Mokfx Global may be a suspicious clone of a legitimate broker.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0543998 | United States | Suspicious Clone |

The lack of transparency regarding Mokfx Global's regulatory status is alarming. Despite claiming to be NFA regulated, some sources indicate that they are not listed as a member, which raises red flags about their operational legitimacy. Without proper regulation, traders are left unprotected, making it essential to question whether Mokfx Global is safe for trading.

Company Background Investigation

Mokfx Global Limited was founded in 2021 and claims to operate from the United States. However, there are discrepancies regarding its actual location and registration details, leading to suspicions about its transparency and legitimacy. The ownership structure of the company remains unclear, as there is limited information available about its management team and their professional backgrounds.

The lack of transparency in disclosing company information is a significant concern. Reliable brokers typically provide clear details about their management and operational history, which helps build trust with potential clients. The absence of such information raises questions about the broker's intentions and operational integrity, further fueling doubts about whether Mokfx Global is safe for traders.

Trading Conditions Analysis

Mokfx Global's trading conditions, including fees and spreads, are critical factors for traders when choosing a broker. While the broker claims to offer competitive trading conditions, the actual costs can vary significantly.

| Fee Type | Mokfx Global | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | 1.0 - 2.0 pips |

| Commission Model | TBD | Variable |

| Overnight Interest Range | TBD | 0.5% - 1.5% |

The absence of clearly defined trading costs can be a red flag. Many traders have reported unexpected fees and charges that are not prominently disclosed. This lack of clarity can lead to an erosion of trust and raises concerns about whether Mokfx Global is safe for trading.

Client Fund Security

The security of client funds is paramount in the financial services industry. Mokfx Global claims to implement various measures to protect client funds, including fund segregation and negative balance protection. However, the effectiveness of these measures remains questionable due to the broker's overall transparency issues.

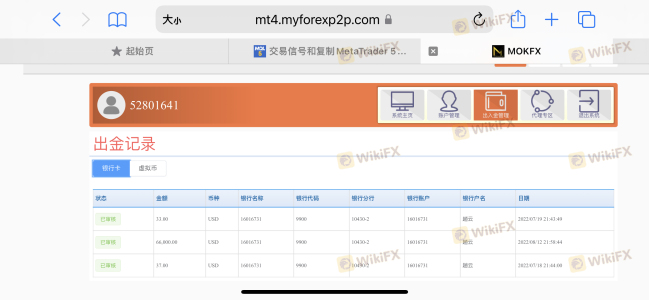

In the absence of robust regulatory oversight, the broker's ability to safeguard client funds is compromised. Historical complaints and reports of clients facing difficulties in withdrawing their funds further exacerbate concerns regarding the safety of their investments with Mokfx Global. Without a proven track record of fund security, it is challenging to assert that Mokfx Global is safe for traders.

Customer Experience and Complaints

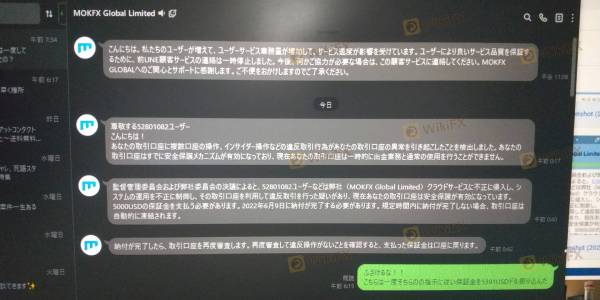

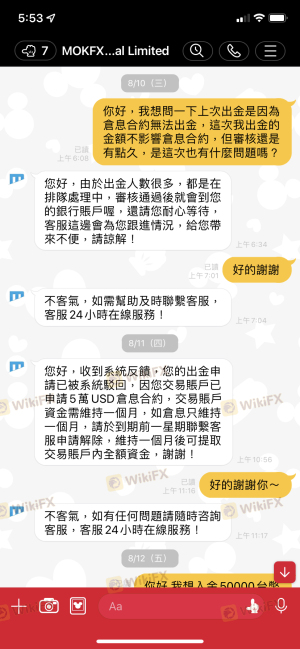

Customer feedback is a vital component in assessing the reliability of a broker. Mokfx Global has received numerous complaints, particularly regarding withdrawal issues and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Support | Medium | Poor |

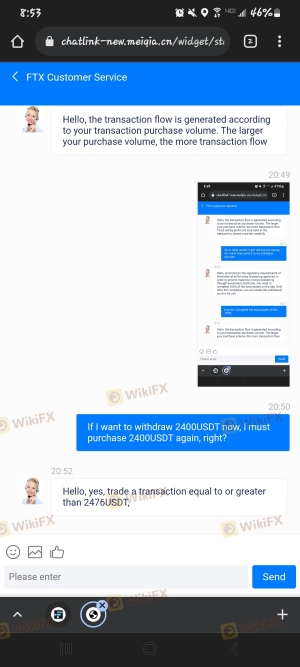

Many users have reported being unable to withdraw their funds, citing various excuses from the broker. In one case, a trader was asked to pay additional fees before being allowed to withdraw their funds, raising further suspicions about the broker's practices. These patterns of complaints contribute to the growing narrative that Mokfx Global is not safe for traders.

Platform and Trade Execution

The trading platform provided by Mokfx Global plays a crucial role in the overall trading experience. The broker claims to support the widely-used MetaTrader 4 platform, known for its user-friendly interface and advanced trading features. However, issues related to platform stability, order execution quality, and slippage have been reported by users.

Traders have expressed concerns about frequent slippage and instances where orders were not executed as expected. Such issues can significantly affect trading outcomes and raise questions about the broker's operational integrity. These factors lead to concerns about whether Mokfx Global is safe for traders.

Risk Assessment

Investing with Mokfx Global comes with inherent risks that potential traders should carefully consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of proper regulation raises concerns. |

| Fund Security Risk | High | Historical withdrawal issues and unverified claims about fund protection. |

| Operational Risk | Medium | Complaints about platform performance and service responsiveness. |

Given these risks, it is crucial for traders to conduct thorough research and consider alternative options. Seeking brokers with strong regulatory oversight and positive customer feedback can help mitigate these risks and enhance the overall trading experience.

Conclusion and Recommendations

In conclusion, the evidence suggests that Mokfx Global presents several red flags that warrant caution. The broker's questionable regulatory status, lack of transparency, and numerous customer complaints indicate that Mokfx Global is not safe for trading.

For traders seeking to invest in the forex market, it is advisable to consider alternatives that are well-regulated and have a proven track record of reliability. Brokers such as IG, OANDA, and Forex.com are examples of reputable firms that provide a safer trading environment. Ultimately, conducting thorough due diligence is essential for protecting one's investments in the volatile forex market.

Is MOKFX Global a scam, or is it legit?

The latest exposure and evaluation content of MOKFX Global brokers.

MOKFX Global Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MOKFX Global latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.