Is Londonex safe?

Business

License

Is LondonEX A Scam?

Introduction

LondonEX is a forex and CFD broker that has emerged in the competitive landscape of online trading, claiming to offer a wide range of financial instruments, including forex, commodities, indices, and cryptocurrencies. As with any broker, it is crucial for traders to conduct thorough due diligence before committing their funds. The forex market is rife with both legitimate opportunities and potential scams, making it imperative for traders to assess the credibility and reliability of brokers carefully. This article aims to evaluate the safety and legitimacy of LondonEX by examining its regulatory status, company background, trading conditions, client fund security, and customer experiences. The analysis is based on a review of various online sources, including expert opinions and user feedback.

Regulation and Legitimacy

One of the most critical factors in determining whether a broker is trustworthy is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and operate transparently. LondonEX claims to be registered in Saint Vincent and the Grenadines, a jurisdiction known for its lenient regulatory environment, which raises concerns about the broker's legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Saint Vincent and the Grenadines | Not Verified |

The lack of a legitimate regulatory body overseeing LondonEX is a significant red flag. The Financial Services Authority (FSA) of Saint Vincent and the Grenadines has declared itself ineligible to regulate forex and binary options firms, making it a haven for unregulated brokers. This absence of oversight means that traders have little to no recourse in case of disputes or issues with fund withdrawals. It is essential for traders to understand that engaging with unregulated brokers poses substantial risks, as they are not bound by the same standards as regulated entities.

Company Background Investigation

LondonEX appears to be a relatively new player in the forex market, with limited historical data available about its operations. The company claims to have a professional team dedicated to helping traders succeed; however, the lack of transparency regarding its ownership structure and management team raises concerns. A credible broker typically provides information about its founders and key executives, including their professional backgrounds and experience in the financial industry.

Unfortunately, LondonEX does not disclose any such information on its website, which can be indicative of a lack of transparency. Traders should be cautious when dealing with brokers that do not provide adequate information about their management and operational history. The absence of a clear corporate structure and identifiable leadership can be a warning sign that the broker may not have the best interests of its clients in mind.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is crucial for evaluating its overall reliability. LondonEX claims to provide competitive spreads and a variety of account types. However, it is essential to scrutinize the fee structure and any potential hidden costs that may affect a trader's profitability.

| Fee Type | LondonEX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 - 1.5 pips | 1.0 - 2.0 pips |

| Commission Model | $10 (raw account) | $5 - $10 |

| Overnight Interest Range | N/A | Varies |

While LondonEX advertises tight spreads, traders should be wary of the overall cost of trading, including commissions and overnight fees. The high leverage offered (up to 1:1000) can be enticing but also poses significant risks, as it can amplify both gains and losses. The lack of clarity regarding the minimum deposit requirements and potential withdrawal fees raises additional concerns about the broker's transparency.

Client Fund Security

The safety of client funds is paramount when choosing a broker. LondonEX claims to implement various security measures, but the lack of regulatory oversight raises questions about the effectiveness of these measures.

Traders should look for brokers that offer segregated accounts, ensuring that client funds are kept separate from the broker's operational funds. Additionally, the absence of investor protection schemes means that traders using LondonEX would have no safety net in case of broker insolvency.

Historically, brokers operating in unregulated jurisdictions have been known to engage in fraudulent activities, including the misappropriation of client funds. This makes it crucial for potential clients to consider whether they can trust LondonEX with their money.

Customer Experience and Complaints

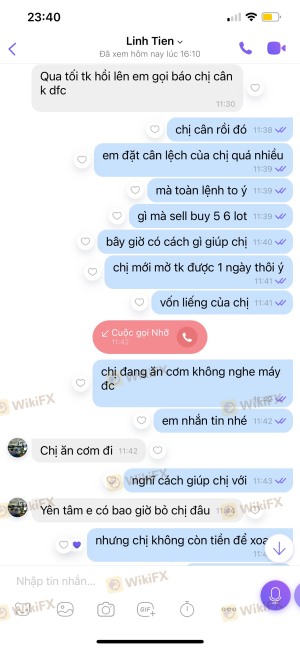

User feedback is a valuable resource for assessing a broker's reliability. A review of various online forums and complaint platforms reveals that many users have reported negative experiences with LondonEX, including issues with fund withdrawals and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Poor |

| Misleading Promotions | High | Poor |

Common complaints include difficulty withdrawing funds, lack of transparency regarding account management, and aggressive sales tactics. Several users have reported that after making deposits, they encountered obstacles when trying to access their funds. The poor response from customer service further exacerbates these issues, indicating a lack of commitment to client satisfaction.

Platform and Trade Execution

A broker's trading platform is a critical component of the trading experience. LondonEX offers access to the popular MetaTrader 5 platform; however, user reviews suggest mixed experiences regarding platform stability and execution quality.

Many traders have reported issues with slippage and order rejections, which can significantly impact trading outcomes. Additionally, the lack of transparency regarding platform manipulation raises concerns about the broker's integrity. Traders should be cautious and consider whether they can trust LondonEX to provide a fair trading environment.

Risk Assessment

Engaging with LondonEX carries several risks, primarily due to its unregulated status and lack of transparency.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No oversight from recognized authorities. |

| Fund Safety Risk | High | Potential for fund misappropriation. |

| Customer Service Risk | Medium | Poor responsiveness and support. |

| Trading Execution Risk | High | Issues with slippage and order rejections. |

To mitigate these risks, traders should consider using regulated brokers that offer robust client protection measures and transparent trading conditions. Conducting thorough research and seeking out reputable alternatives can help safeguard investments.

Conclusion and Recommendations

Based on the analysis, it is evident that LondonEX raises several red flags that suggest it may not be a safe option for traders. The lack of regulation, transparency issues, and numerous customer complaints indicate that potential clients should exercise extreme caution before investing with this broker.

While the broker offers attractive trading conditions, the associated risks far outweigh the potential benefits. For traders seeking reliable options, it is advisable to consider well-regulated brokers that provide a secure trading environment and prioritize client satisfaction.

In summary, is LondonEX safe? The evidence strongly suggests that it is not. Traders are encouraged to seek alternatives that offer better protection for their funds and a more transparent trading experience.

Is Londonex a scam, or is it legit?

The latest exposure and evaluation content of Londonex brokers.

Londonex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Londonex latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.