LondonEX 2025 Review: Everything You Need to Know

Executive Summary

This londonex review shows a forex broker that works without proper rules and has many bad reviews from traders. LondonEX says it is a global financial services company that offers MetaTrader 5 trading platform with access to forex, stocks, commodities, indices, and cryptocurrencies. Our deep study shows major red flags that investors must think about carefully.

The broker wants global investors who seek different trading chances across many financial markets. LondonEX looks like it offers a complete trading environment, but it has big problems with following rules, customer service quality, and trust. ForexBrokerz and other industry watchdogs give the platform a worrying 1 out of 5 rating, with many sources calling it a possible scam. The lack of approval from any major financial authority creates serious questions about fund safety and whether the business is real.

Important Notice

Cross-Regional Entity Differences: LondonEX works as an unregistered broker without oversight from major rule-making bodies across different areas. This lack of rules creates big risks for investors no matter where they live, as there are no standard protections or ways to get help. Traders should be very careful as the lack of rules means no investor payment schemes or dispute solving processes exist.

Review Methodology: This assessment uses available market information, user feedback from many sources, and analysis of the broker's public information. Since LondonEX itself shows limited transparency, much of this evaluation relies on third-party observations and user experiences reported across various financial review platforms.

Rating Framework

Broker Overview

LondonEX entered the financial services market on May 4, 2023. The company tries to establish itself as a global provider of financial trading services, targeting investors worldwide who seek access to diverse asset classes through a single platform. Despite being new, the broker has quickly gained attention - unfortunately, much of this attention has been negative due to concerning practices and lack of proper approval.

The business model revolves around giving retail traders access to foreign exchange markets alongside other financial instruments through the popular MetaTrader 5 platform. LondonEX promotes itself as offering competitive trading conditions and comprehensive market access, though specific details about spreads, commissions, and other crucial trading parameters remain notably absent from public documentation. According to available information, LondonEX supports trading across multiple asset categories including major and minor currency pairs, global stock indices, precious metals and energy commodities, individual company stocks, and various cryptocurrencies.

The platform uses the MetaTrader 5 infrastructure, which is widely recognized in the industry for its advanced charting capabilities and automated trading support. However, the absence of regulatory oversight from established financial authorities such as the FCA, CySEC, or ASIC represents a fundamental concern that overshadows any potential technical advantages. This londonex review emphasizes the critical importance of regulatory compliance in broker selection.

Regulatory Status: LondonEX operates as an unregistered broker without authorization from any major regulatory authority. This absence of oversight means traders have no regulatory protections or recourse mechanisms.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods has not been disclosed in available documentation. This creates additional uncertainty for potential clients.

Minimum Deposit Requirements: The broker has not publicly specified minimum deposit amounts. This makes it difficult for traders to assess accessibility and account requirements.

Bonus and Promotions: No information about promotional offers, welcome bonuses, or ongoing incentives has been identified in available materials.

Tradeable Assets: The platform supports foreign exchange pairs, stock indices, commodities including metals and energy, individual company stocks, and cryptocurrency instruments across multiple markets.

Cost Structure: Detailed information about spreads, commissions, overnight financing charges, and other trading costs remains undisclosed. User feedback suggests unfavorable conditions compared to regulated alternatives.

Leverage Ratios: Specific leverage offerings have not been detailed in available documentation. This creates uncertainty about risk management parameters.

Platform Options: LondonEX provides access through the MetaTrader 5 platform. The platform offers standard charting tools and analytical capabilities.

Geographic Restrictions: Information about regional restrictions or prohibited jurisdictions has not been clearly specified.

Customer Support Languages: Available customer service languages have not been detailed in accessible documentation. This comprehensive londonex review highlights the concerning lack of transparency across multiple operational areas.

Detailed Rating Analysis

Account Conditions Analysis (1/10)

The account conditions offered by LondonEX present significant concerns for potential traders. The broker has failed to provide transparent information about account types, minimum deposit requirements, or specific trading conditions. This is highly unusual for legitimate financial service providers.

According to ForexBrokerz, the platform receives consistently poor ratings from users who cite unclear terms and conditions as major issues. The absence of detailed account specifications makes it impossible for traders to make informed decisions about whether the platform meets their trading needs. Traditional brokers typically offer multiple account tiers with clearly defined benefits, minimum deposits, and trading parameters.

LondonEX's lack of transparency in this area raises immediate red flags about their operational legitimacy. User feedback consistently indicates dissatisfaction with account-related services, with many reporting unexpected fees, unclear terms, and difficulties accessing account information. The platform's failure to provide basic account details such as spread ranges, commission structures, or minimum balance requirements suggests either poor operational management or deliberate hiding of unfavorable terms.

When compared to regulated brokers who must maintain transparent fee structures and clear account terms, LondonEX falls significantly short of industry standards. The lack of regulatory oversight means there are no external requirements forcing the broker to maintain transparent account conditions. This leaves traders vulnerable to unexpected changes or hidden fees. This londonex review strongly advises potential clients to seek regulated alternatives with clearly defined account terms.

LondonEX provides access to the MetaTrader 5 platform. This represents the primary positive aspect of their service offering.

MT5 is a well-established trading platform that provides comprehensive charting tools, technical indicators, and support for automated trading strategies. The platform supports multiple asset classes, allowing traders to access forex, stocks, commodities, indices, and cryptocurrencies through a single interface. However, beyond the basic MT5 platform access, information about additional tools and resources remains limited.

Most reputable brokers supplement their platform offerings with proprietary research, market analysis, economic calendars, and educational resources. LondonEX appears to lack these supplementary services, which are increasingly expected by modern traders. The absence of detailed information about research capabilities, analytical tools, or educational resources suggests a minimal commitment to trader development and market insight.

User feedback indicates that while the MT5 platform itself functions adequately, the overall tool ecosystem lacks depth compared to established brokers. Without access to comprehensive market research, economic analysis, or educational materials, traders must rely on external sources for market insights. This potentially increases trading costs and complexity. The limited tool offering, while centered around a solid platform, fails to provide the comprehensive trading environment that serious traders typically require for optimal performance.

Customer Service and Support Analysis (1/10)

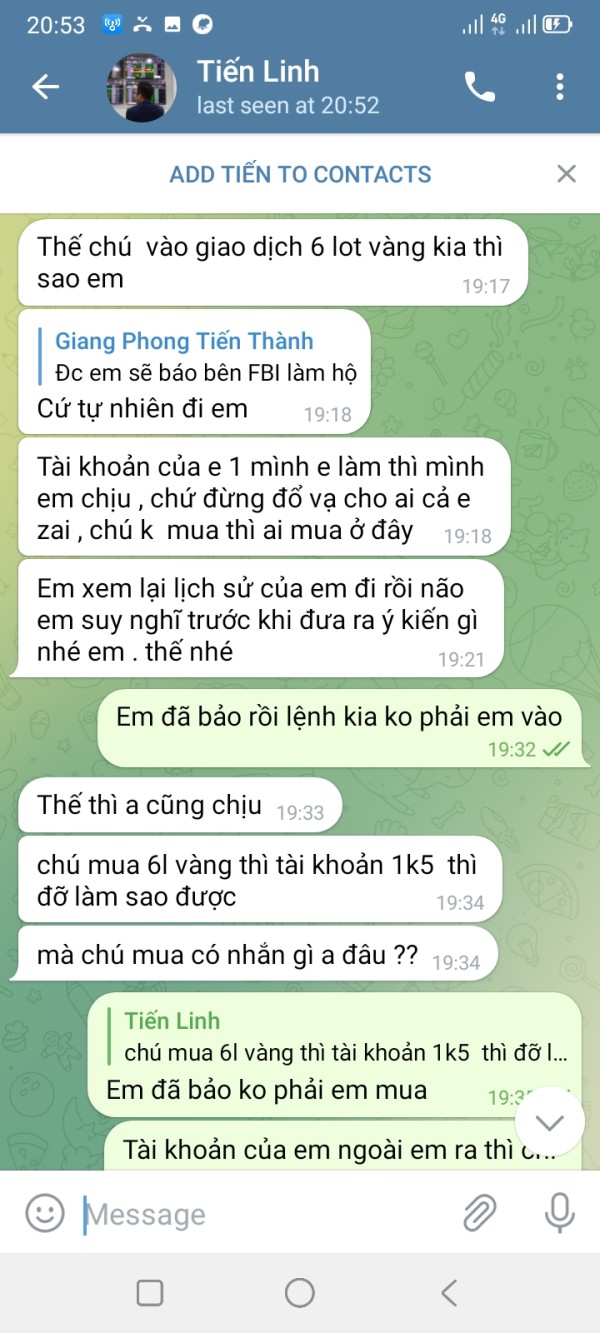

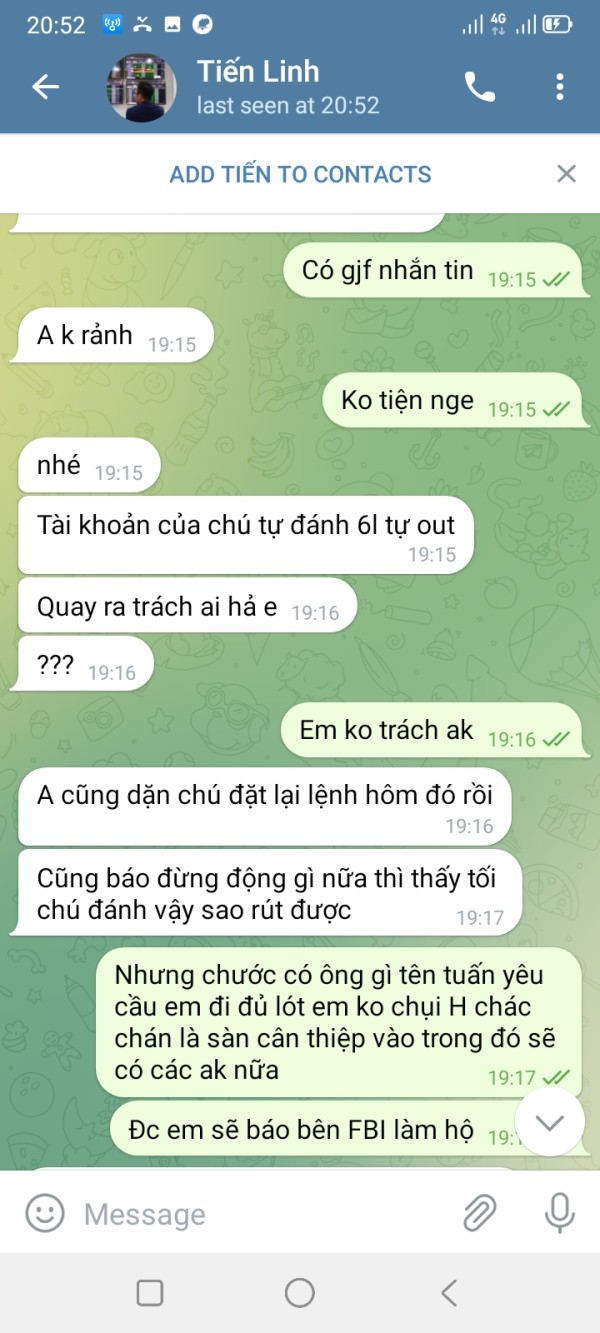

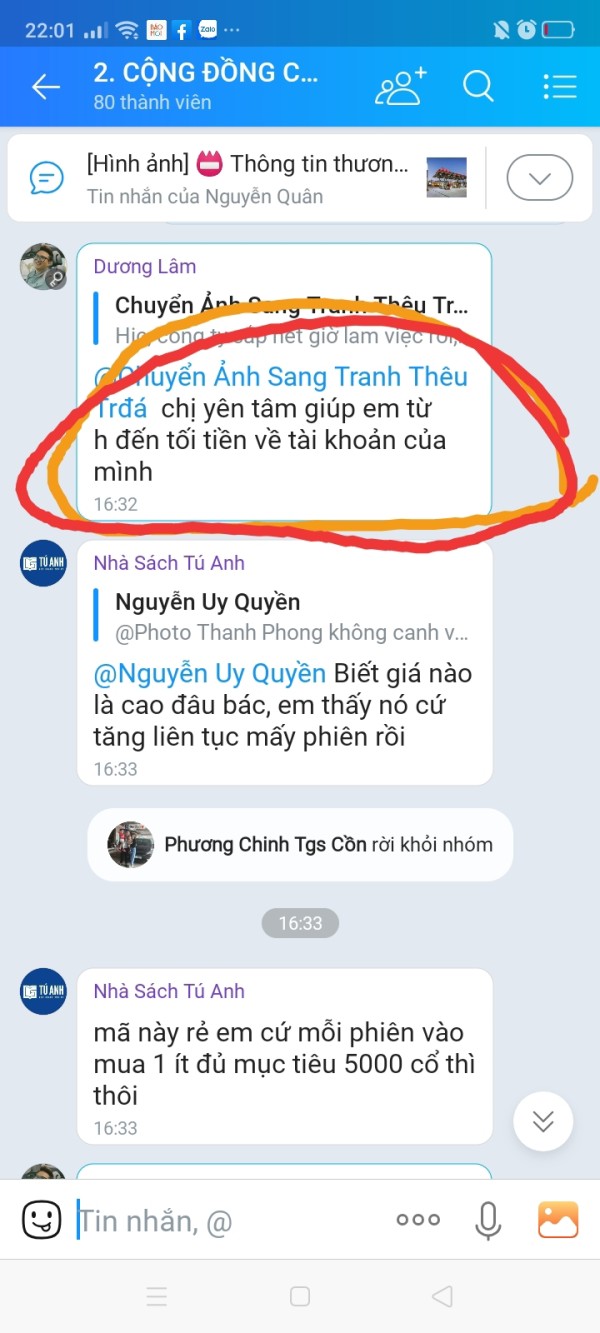

Customer service represents one of LondonEX's most significant weaknesses. User feedback consistently highlights poor support quality and responsiveness.

According to multiple review sources, traders report extended response times, unhelpful support staff, and difficulty resolving basic account issues. The lack of detailed information about support channels, operating hours, or available languages further compounds these concerns. Professional forex brokers typically provide multiple contact methods including live chat, telephone support, and email assistance with clearly defined response time commitments.

LondonEX appears to lack this comprehensive support infrastructure. This leaves traders without adequate assistance when issues arise. The absence of 24/7 support is particularly problematic for forex trading, which operates around the clock across global markets.

User experiences reported across various review platforms indicate that when support is available, the quality of assistance is generally poor. Common complaints include representatives lacking basic knowledge about trading operations, inability to resolve account issues, and inconsistent information provided by different support staff members. The customer service deficiencies become particularly concerning when combined with the broker's lack of regulatory oversight.

Without external regulatory requirements for customer service standards and no ombudsman services available for dispute resolution, traders have limited recourse when support issues arise. This creates an environment where customer concerns may go unresolved, potentially leading to financial losses or account access problems.

Trading Experience Analysis (2/10)

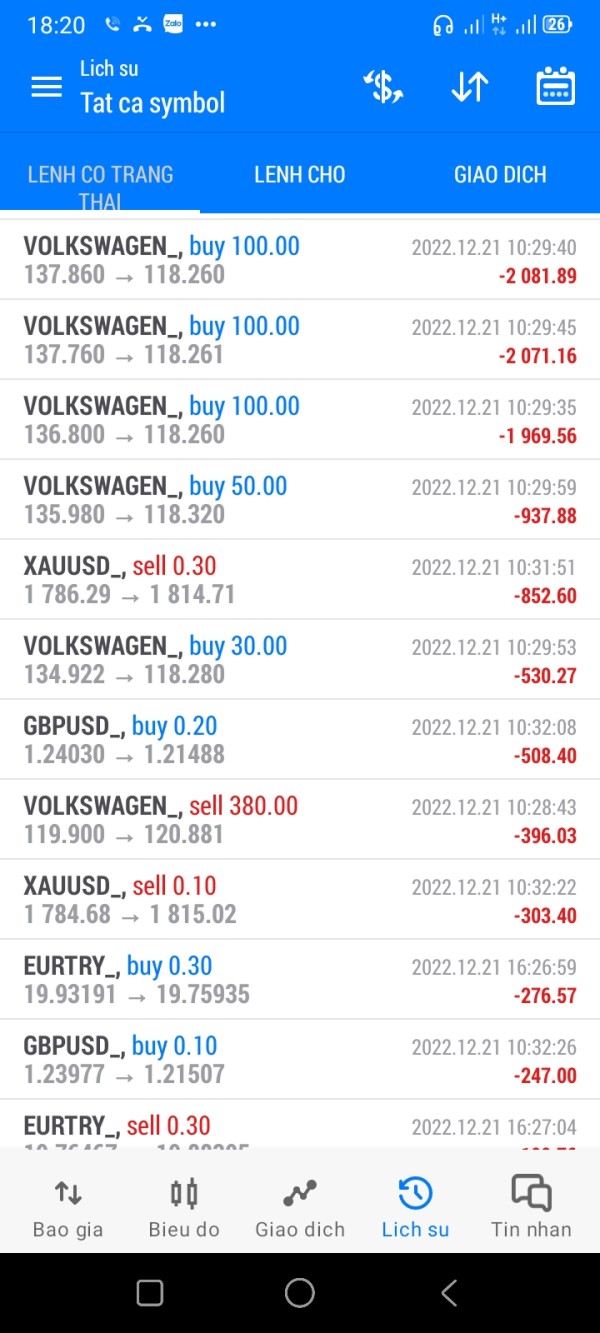

The trading experience with LondonEX falls well below industry standards despite the utilization of the MetaTrader 5 platform. While MT5 itself is a robust trading platform, users report significant issues with execution quality, including frequent slippage and requotes that negatively impact trading performance.

These execution problems suggest either inadequate liquidity provision or unfavorable order routing practices. Platform stability has been another concern raised by users, with reports of connectivity issues and system downtime during important market events. For active traders, platform reliability is crucial, and any instability can result in missed opportunities or unwanted losses.

The lack of transparent information about server infrastructure and backup systems adds to these concerns. Order execution speed and accuracy represent critical components of trading experience, particularly for scalpers and day traders who rely on precise timing. User feedback suggests that LondonEX struggles in this area, with delays and slippage occurring more frequently than would be expected from a professional trading environment.

The absence of detailed execution statistics or third-party verification of trading conditions makes it difficult to assess the true quality of the trading environment. Mobile trading capabilities, while supported through the standard MT5 mobile application, lack any proprietary enhancements or optimizations that many modern brokers provide. The overall trading experience appears to be hampered by operational issues that extend beyond the platform itself, suggesting systemic problems with the broker's infrastructure and service delivery. This londonex review indicates that traders seeking reliable execution and professional trading conditions should consider regulated alternatives.

Trust Factor Analysis (1/10)

The trust factor represents LondonEX's most critical weakness. Multiple sources identify it as an unregulated broker operating without proper authorization from established financial authorities.

According to Scam Detector and other financial watchdog organizations, the platform has been flagged with serious warnings about its legitimacy and operational practices. The absence of regulatory oversight from bodies such as the Financial Conduct Authority, Cyprus Securities and Exchange Commission, or the Australian Securities and Investments Commission means that LondonEX operates without the standard protections and oversight mechanisms that legitimate brokers must maintain. This regulatory vacuum creates significant risks for client funds and trading operations.

Industry reputation analysis reveals consistently negative feedback, with the platform receiving a 1 out of 5 rating from ForexBrokerz and similar poor ratings from other review sources. Multiple financial protection organizations have issued warnings about the broker, suggesting potential scam operations or fraudulent practices. The lack of transparent company information, including unclear ownership structure and minimal corporate disclosure, further undermines confidence.

Third-party verification of the company's claims appears to be absent, with no independent audits of client funds, trading conditions, or operational practices. The combination of regulatory absence, negative industry feedback, and lack of transparency creates a trust environment that poses significant risks to potential clients. Legitimate brokers typically maintain regulatory licenses, segregated client accounts, and transparent operational practices that LondonEX appears to lack entirely.

User Experience Analysis (1/10)

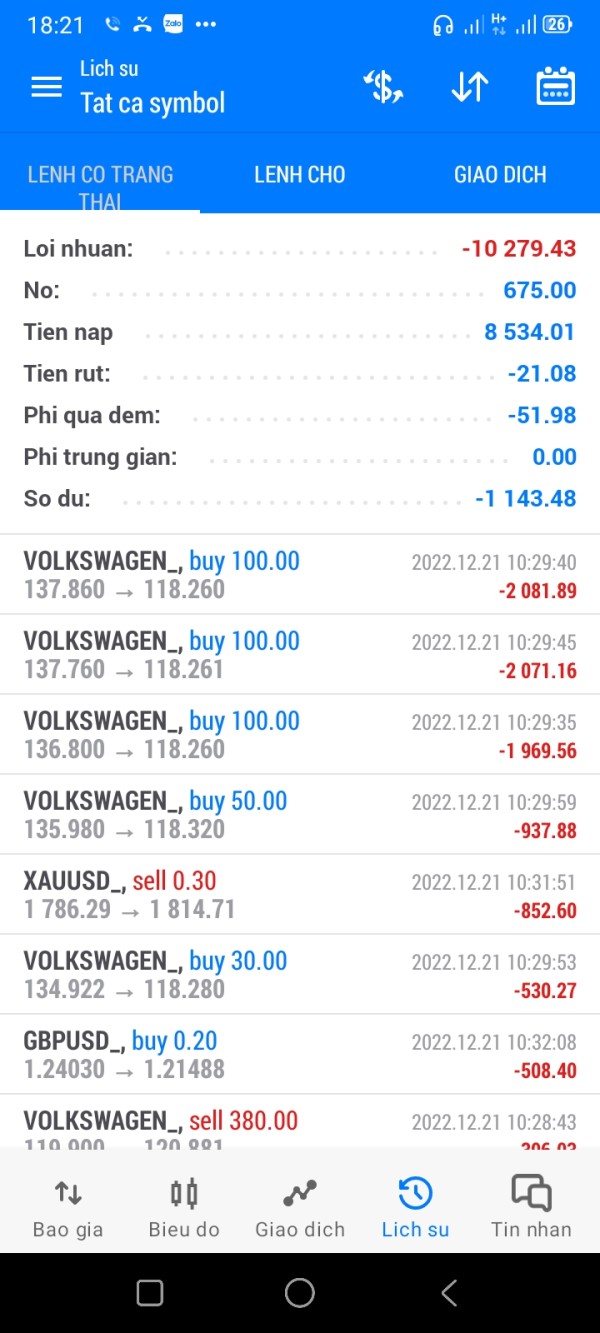

Overall user satisfaction with LondonEX is extremely poor. The platform receives a 1 out of 5 rating across multiple review platforms.

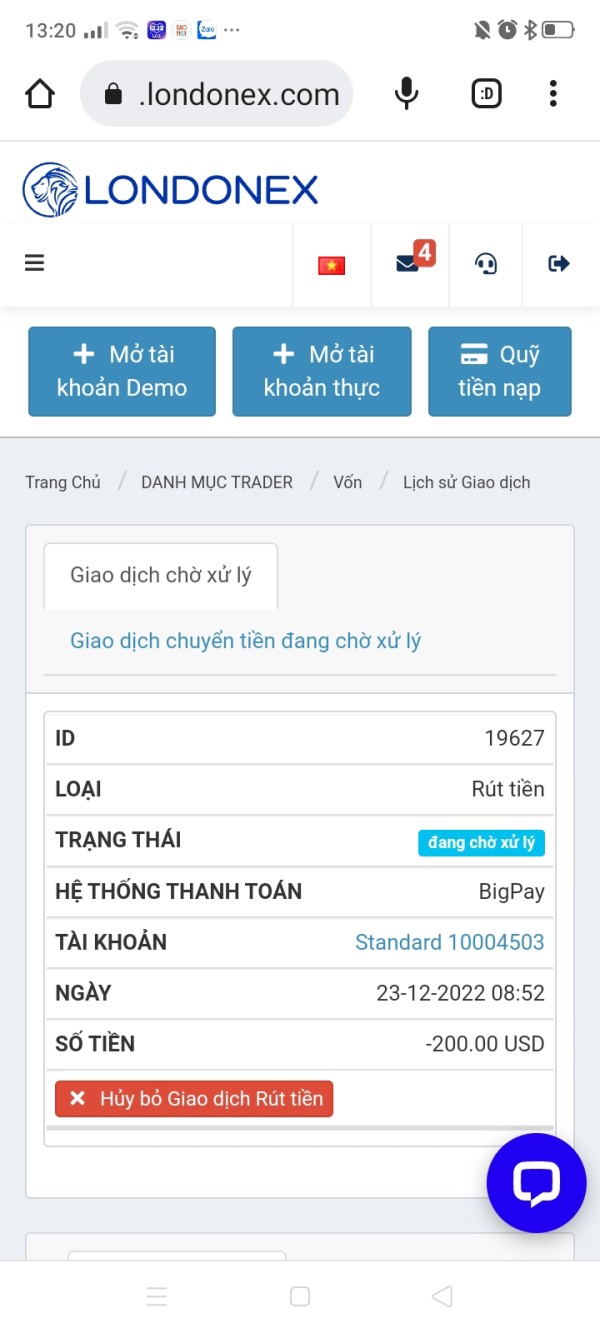

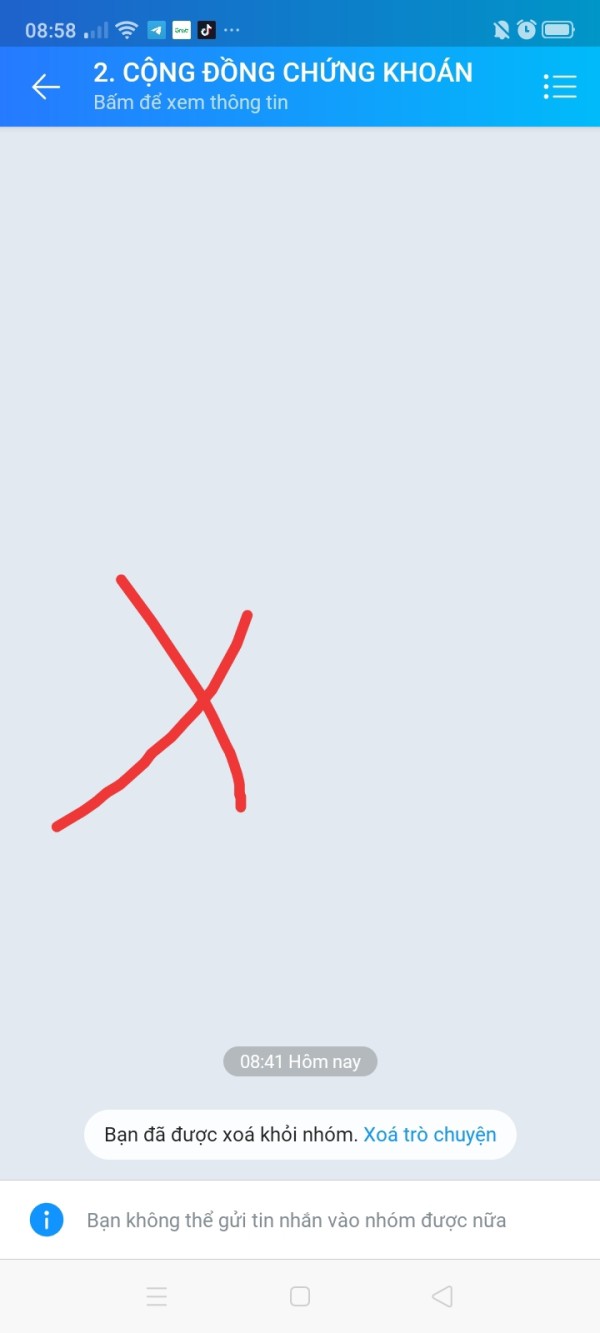

User feedback consistently highlights frustration with various aspects of the service, from account opening procedures to ongoing trading operations and customer support interactions. The registration and account verification process appears to lack the professional standards expected from legitimate financial service providers. Users report unclear documentation requirements, extended verification periods, and poor communication during the onboarding process.

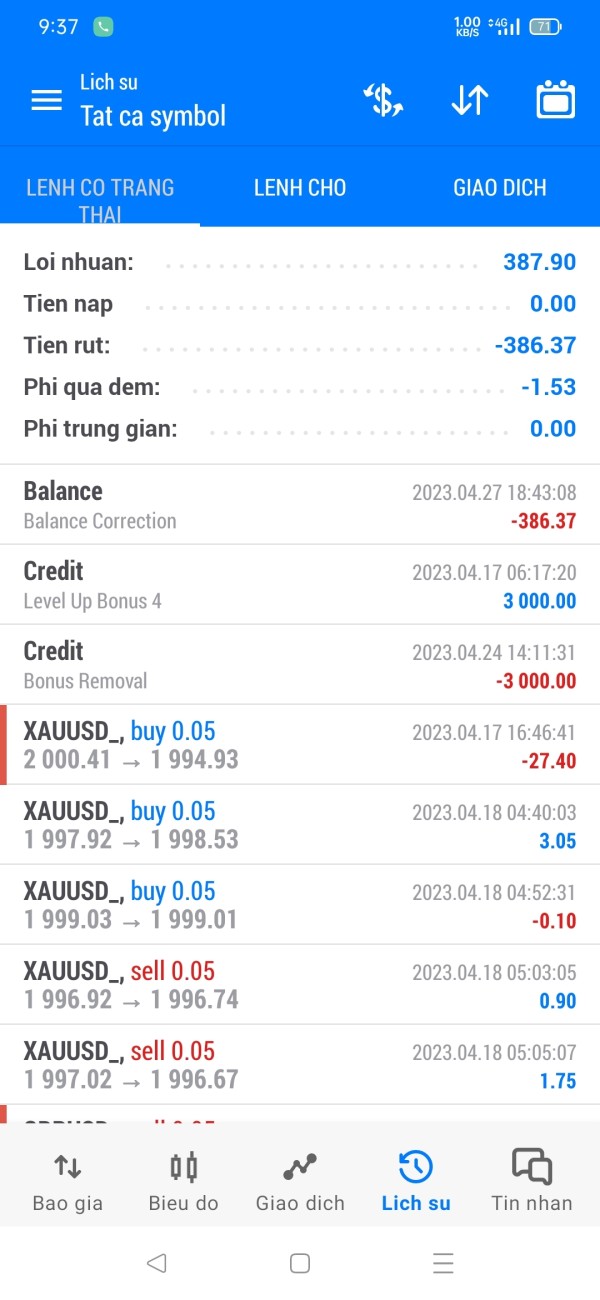

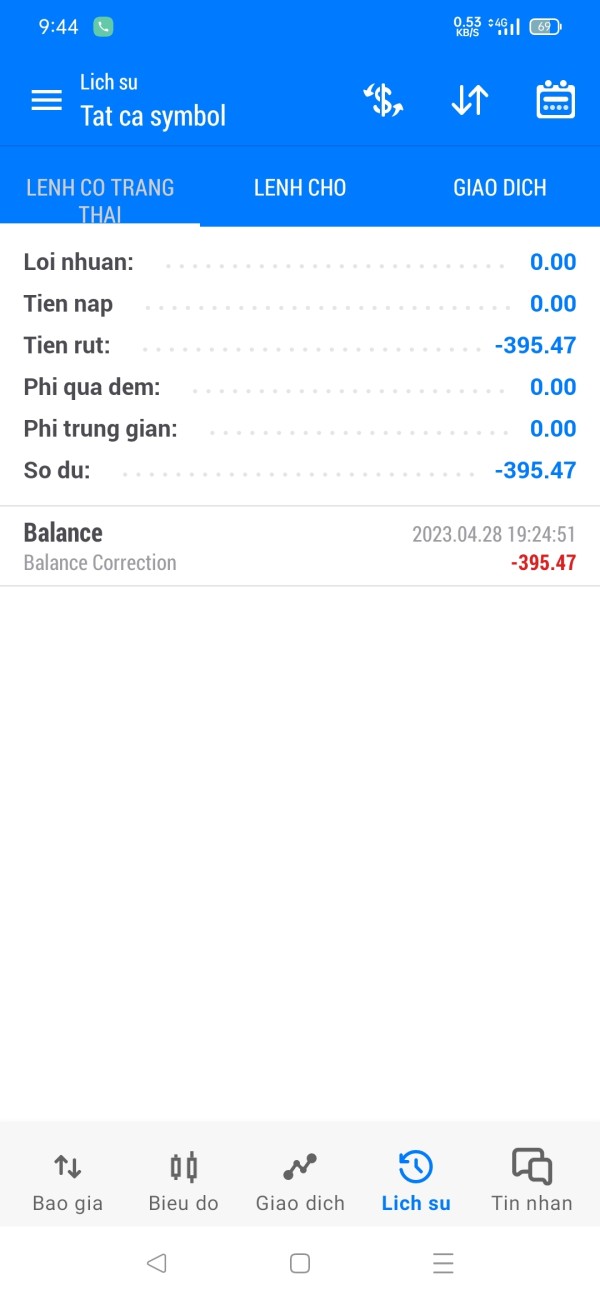

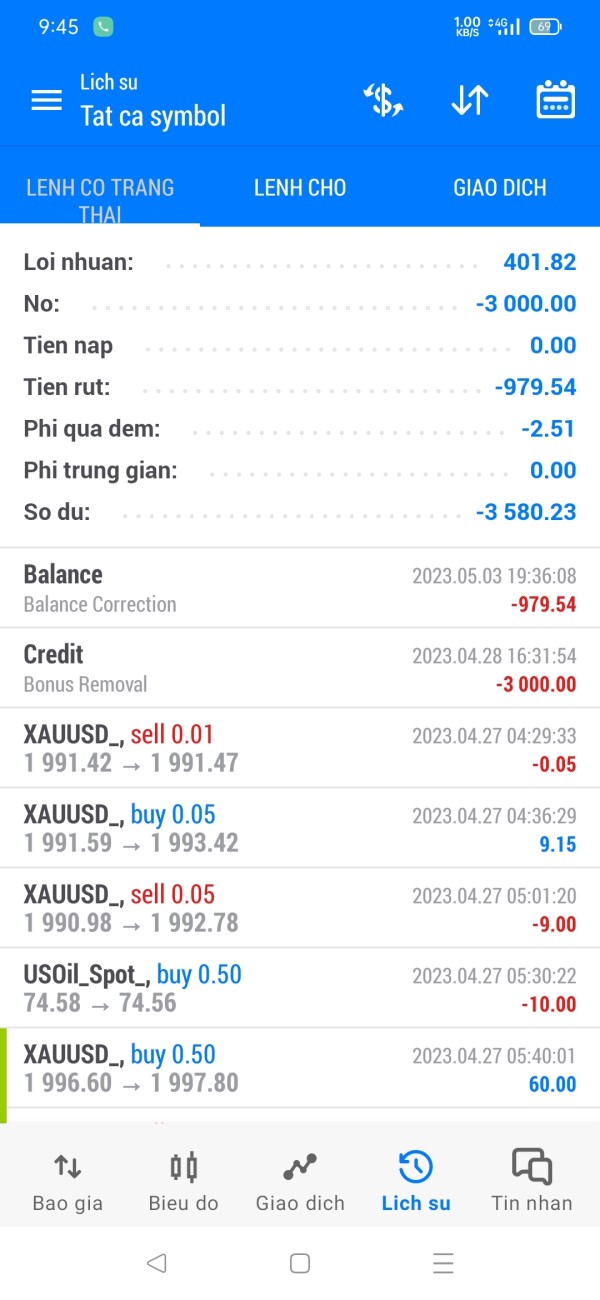

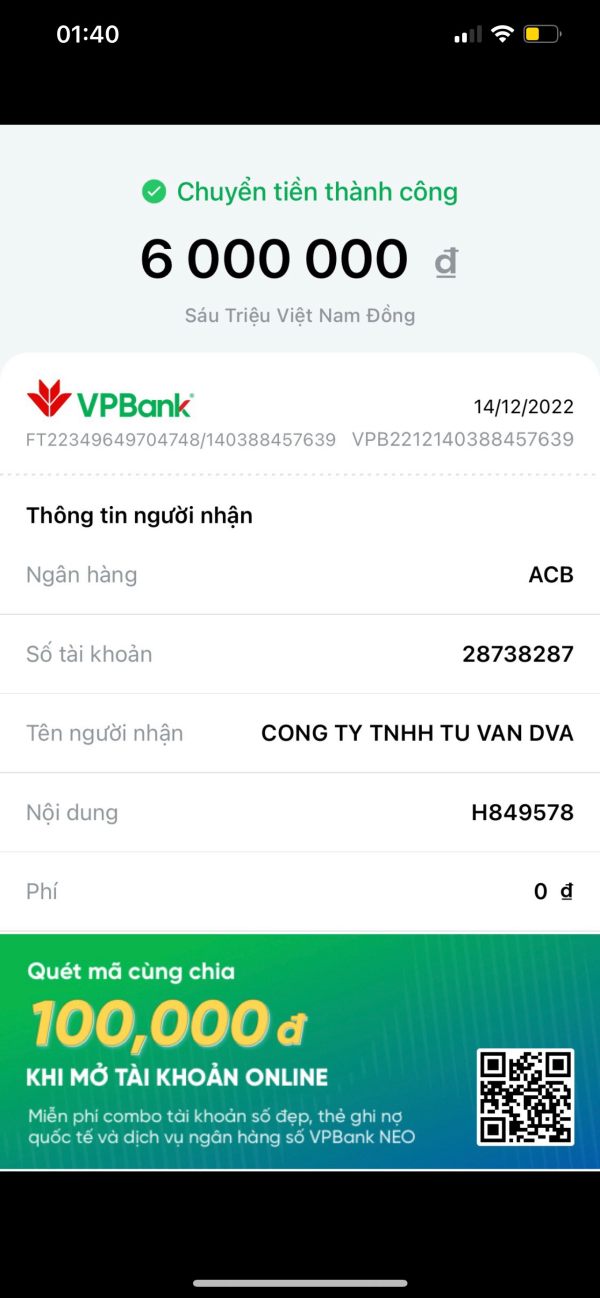

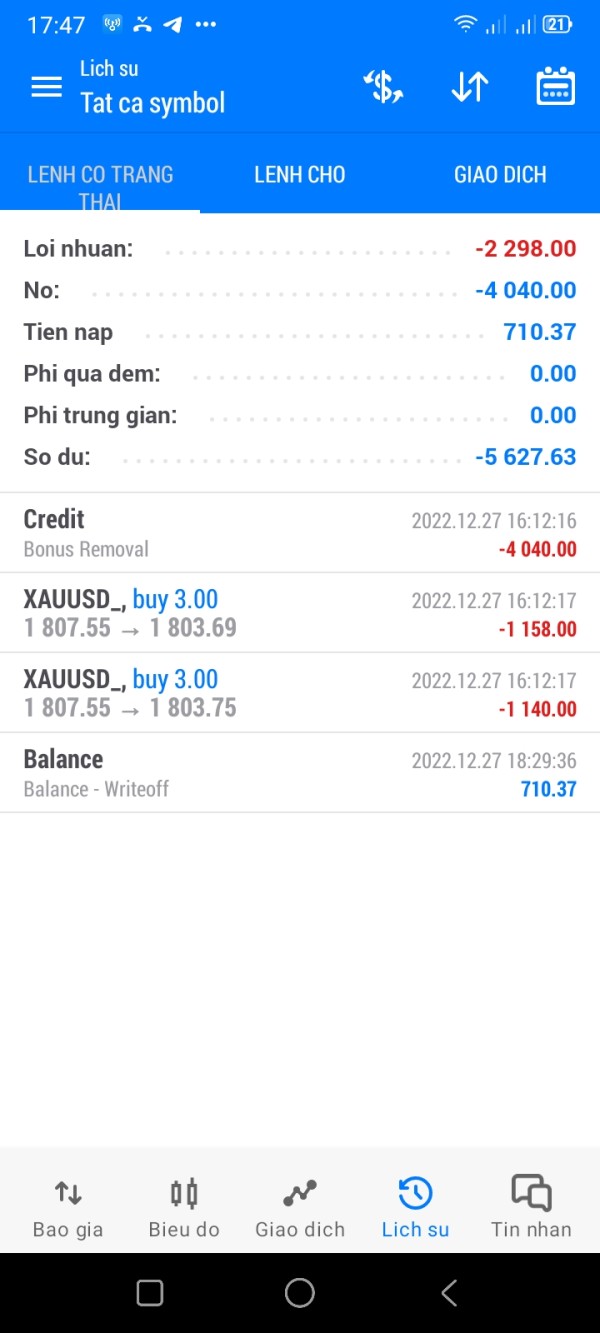

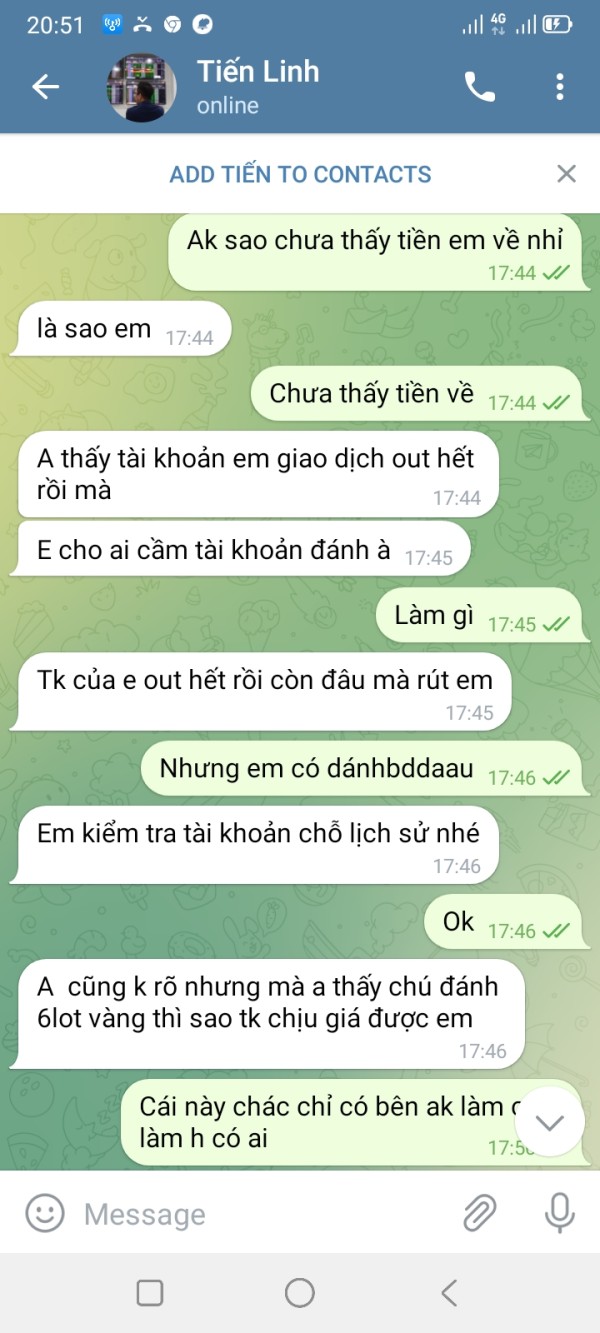

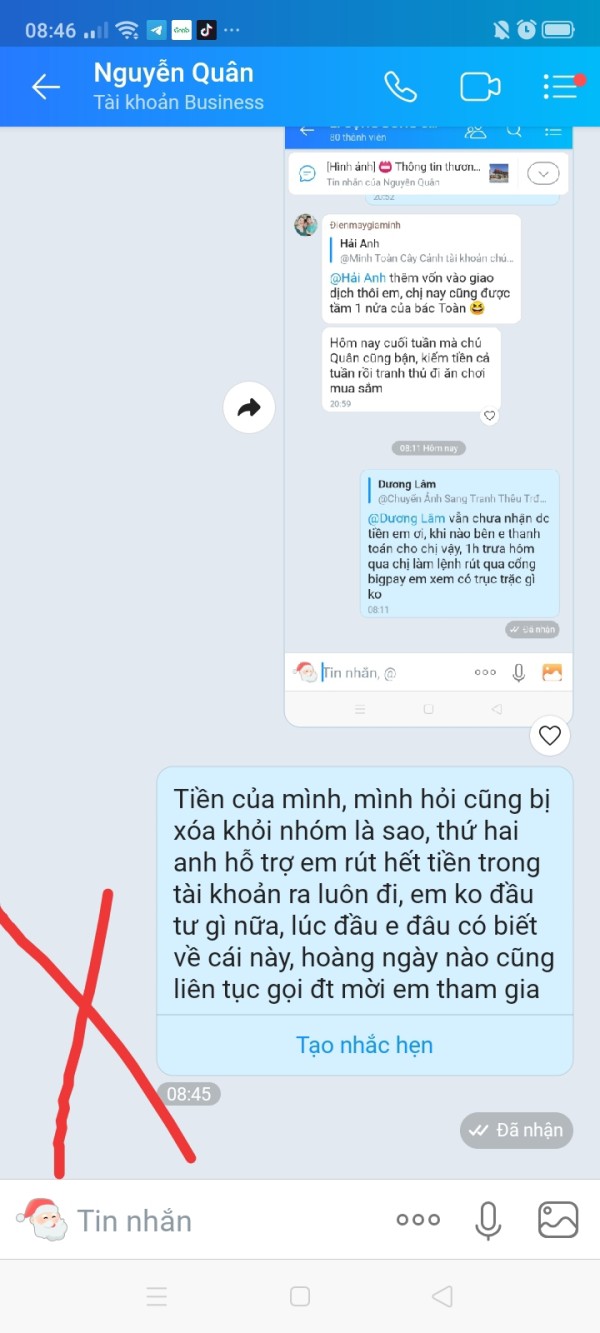

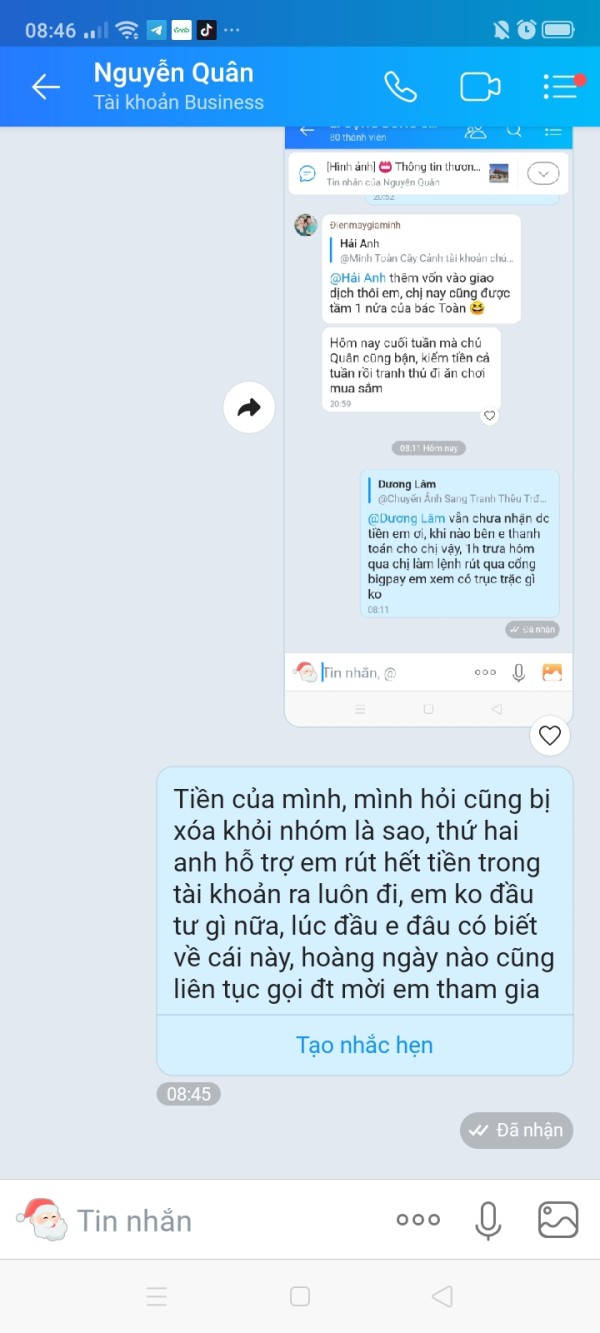

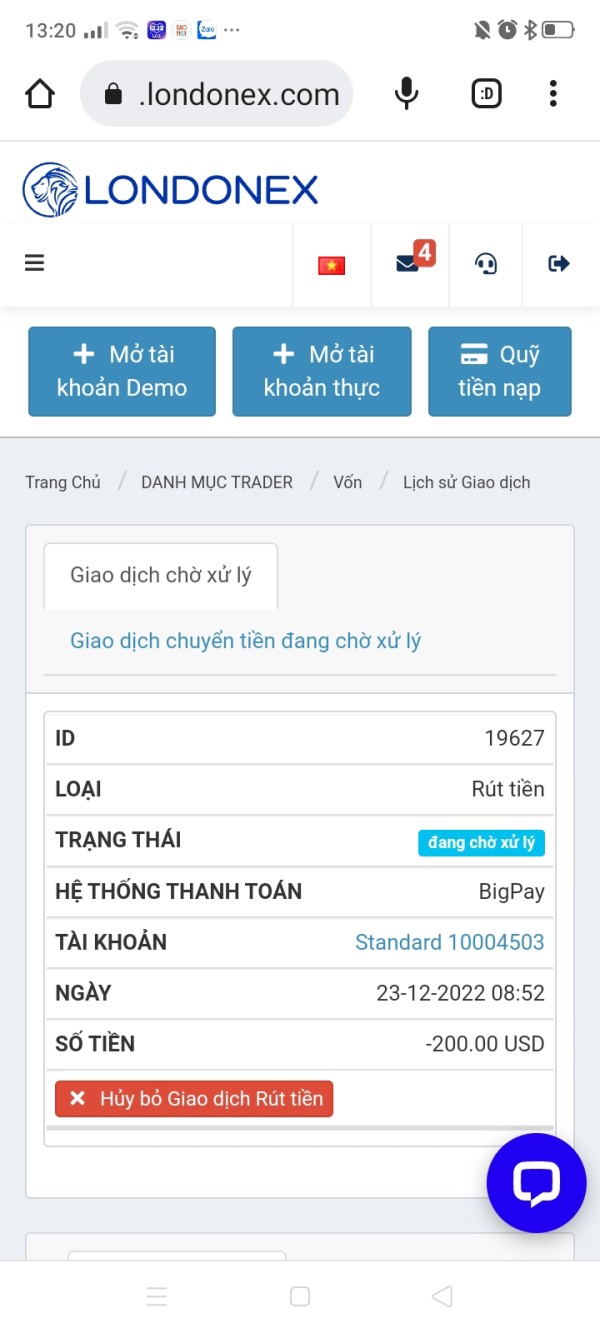

These initial negative experiences often set the tone for ongoing dissatisfaction with the platform. Fund management operations, including deposits and withdrawals, represent another area of significant user concern. While specific details about payment methods remain undisclosed, user feedback suggests difficulties with fund access and unclear processing procedures.

The absence of transparent information about withdrawal timeframes, fees, and procedures creates additional uncertainty for users. Common user complaints center around the platform's lack of transparency, poor customer service, execution issues, and concerns about fund safety. The negative feedback appears to be consistent across different user types and trading styles, suggesting systemic issues rather than isolated problems.

The user experience is further compromised by the absence of educational resources, market analysis, and other value-added services that traders typically expect from their broker relationships.

Conclusion

This comprehensive londonex review reveals a broker that poses significant risks to potential traders and investors. LondonEX operates without regulatory oversight, lacks transparency in crucial operational areas, and has garnered overwhelmingly negative feedback from users and industry watchdogs.

The platform's 1 out of 5 rating reflects serious deficiencies across multiple dimensions of broker evaluation. The broker is not recommended for any type of trader, whether novice or experienced, due to the combination of regulatory absence, poor customer service, execution issues, and trust concerns. While the platform offers MetaTrader 5 access and claims to support multiple asset classes, these potential benefits are overshadowed by fundamental operational and regulatory deficiencies that create unacceptable risks for client funds and trading operations.

Traders seeking reliable forex and multi-asset trading opportunities should prioritize regulated brokers with transparent operations, positive user feedback, and established industry reputations. The financial markets offer numerous legitimate alternatives that provide the security, transparency, and professional service standards that LondonEX appears to lack.