Is LIG safe?

Pros

Cons

Is Lig Safe or a Scam?

Introduction

In the rapidly evolving world of forex trading, the legitimacy of brokers is a crucial concern for traders. One such broker, Lig, has garnered attention in the forex market as a platform that claims to offer competitive trading conditions and a wide range of financial instruments. However, potential investors must exercise caution and conduct thorough evaluations before engaging with any trading platform. This article aims to investigate whether Lig is a trustworthy broker or if it exhibits characteristics of a scam. Our assessment will be based on a combination of regulatory information, company background, trading conditions, customer experiences, and risk evaluations.

Regulation and Legitimacy

Understanding the regulatory framework within which a broker operates is essential for assessing its legitimacy. Regulatory bodies ensure that brokers adhere to specific standards, providing a degree of protection to traders. In the case of Lig, the broker claims to be registered in the United Arab Emirates but lacks clear regulatory oversight from reputable financial authorities.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | UAE | Unregulated |

The absence of regulation raises significant concerns about the safety of funds and the broker's operational integrity. Regulatory agencies typically enforce rules that protect investors, such as segregating client funds and ensuring transparent operations. Lig's lack of oversight means that traders may have limited recourse in the event of disputes or financial issues. Furthermore, the broker's claims of accreditation by the Ministry of Commerce and the Securities and Exchange Commission appear dubious, as these entities do not regulate retail forex trading in the manner Lig suggests.

Company Background Investigation

Lig's company history and ownership structure warrant close examination. Established in 2023, Lig is a relatively new entrant in the forex market. The broker's website lacks detailed information about its management team and corporate structure, which is often a red flag for potential investors. Transparency is crucial in the financial services industry, as it fosters trust between brokers and their clients. The absence of identifiable ownership and management information raises questions about the broker's accountability and operational practices.

Moreover, the lack of a robust track record in the industry makes it difficult to assess Lig's reliability. A well-established broker typically has a history of compliance with regulatory standards and positive customer feedback. In contrast, Lig's short existence and vague company details suggest a lack of commitment to building a reputable brand in the forex space.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions and fee structures is vital. Lig offers various account types with varying minimum deposit requirements, leverage ratios, and commission structures. However, the overall fee structure appears to be steep compared to industry standards.

| Fee Type | Lig | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.8 pips | 1.0-1.5 pips |

| Commission Model | 10% | 0-2% |

| Overnight Interest Range | Variable | Variable |

The high commission rates, particularly the 10% charged on beginner accounts, are concerning. Such fees can significantly erode traders' profits, especially for those who engage in frequent trading. Additionally, the lack of a demo account for prospective clients to test the platform and its conditions is another indication of potential issues. A reputable broker usually provides demo accounts to help traders familiarize themselves with the platform without risking real funds.

Customer Fund Security

The safety of customer funds is a paramount concern for any trader. Lig's website provides limited information about its fund security measures. It is crucial for brokers to implement robust security protocols, such as segregating client funds from operational funds, to protect investors' capital in the event of financial difficulties.

Unfortunately, Lig does not appear to have established such measures. The absence of details regarding investor protection policies and negative balance protection further exacerbates concerns about fund safety. Traders must be wary of platforms that do not prioritize the security and integrity of their clients' funds, as this can lead to significant financial losses.

Customer Experience and Complaints

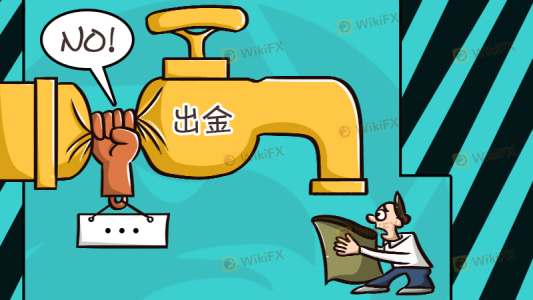

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews of Lig reveal a range of experiences, with several users reporting difficulties in withdrawing funds and poor customer service. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Poor Customer Support | Medium | Inadequate |

One notable case involved a trader who reported being unable to withdraw their funds after multiple requests. This situation highlights the potential risks associated with trading on unregulated platforms. A broker's willingness to address customer concerns and resolve issues promptly is crucial for maintaining trust and credibility. Lig's apparent lack of responsiveness to complaints raises significant red flags and suggests that traders may face challenges in seeking recourse if problems arise.

Platform and Trade Execution

The trading platform's performance is another critical factor for evaluating a broker's reliability. Lig utilizes a web-based trading platform that has received mixed reviews regarding its stability and user experience. Traders have reported issues such as slippage and order rejections, which can negatively impact trading outcomes.

Moreover, the absence of advanced trading tools and features typically found in established platforms raises concerns about the overall trading experience. A reputable broker should provide a robust platform that facilitates smooth order execution and offers essential tools for analysis and strategy development.

Risk Assessment

Using Lig as a trading platform presents several risks that potential traders should consider.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases the risk of fraud. |

| Fund Security Risk | High | Lack of clear fund protection measures. |

| Customer Service Risk | Medium | Poor response to complaints and withdrawal issues. |

To mitigate these risks, traders should conduct thorough research before engaging with Lig. It is advisable to consider using well-regulated brokers with a proven track record and positive customer feedback. Additionally, employing risk management strategies, such as limiting investment amounts and diversifying trading portfolios, can help protect capital.

Conclusion and Recommendations

In conclusion, the evidence suggests that Lig may not be a safe trading option for forex traders. The broker's unregulated status, high fees, lack of transparency, and poor customer feedback indicate potential risks that could lead to significant financial losses. Traders should exercise extreme caution when considering engagement with Lig and may want to explore alternative options that offer better regulatory oversight and customer protection.

For those seeking reliable trading platforms, consider well-established brokers such as OANDA, IG, or Forex.com, which provide robust regulatory frameworks, transparent fee structures, and positive customer experiences. Always prioritize safety and due diligence when navigating the forex market to ensure a secure trading environment.

Is LIG a scam, or is it legit?

The latest exposure and evaluation content of LIG brokers.

LIG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LIG latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.