Is Leadmax safe?

Business

License

Is Leadmax Safe or a Scam?

Introduction

Leadmax is a forex broker that has emerged in the competitive landscape of online trading since its establishment in 2019. Based primarily in China, Leadmax claims to offer a wide range of trading instruments, including forex, stocks, indices, and commodities. However, the rise of online trading has also been accompanied by an increase in fraudulent schemes, making it crucial for traders to carefully evaluate the credibility of brokers like Leadmax. In this article, we will explore whether Leadmax is safe or a potential scam, focusing on its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and overall risk assessment. Our investigation is based on a comprehensive review of available online resources and user feedback.

Regulation and Legitimacy

One of the most critical aspects of assessing a forex broker's safety is its regulatory status. Leadmax is not regulated by any recognized financial authority, which raises significant concerns regarding its legitimacy. Operating without oversight means that there are no guarantees regarding the safety of client funds or the transparency of trading practices. The table below summarizes the core regulatory information for Leadmax:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation is alarming, as it exposes traders to heightened risks, including potential fraud and unfair trading practices. Without regulatory oversight, clients have limited recourse in the event of disputes or issues with fund withdrawals. Furthermore, the lack of a robust regulatory framework means that Leadmax may not adhere to industry standards for financial practices, leading to inadequate protection of client funds. Therefore, IS Leadmax safe? The answer leans towards caution, as the absence of regulation is a significant red flag.

Company Background Investigation

Leadmax was founded in 2019 and is registered under Lead Max Global Limited. The company claims to operate from Canada, although its actual headquarters appear to be in China. The ownership structure and management team details are not transparently disclosed, which raises questions about accountability and the broker's operational integrity.

The management team‘s background is crucial to understanding the broker’s credibility, but there is little publicly available information regarding their qualifications or previous experience in the financial sector. A lack of transparency in ownership and management can often be indicative of a broker that may not prioritize customer interests. Moreover, the companys operational history of only a few years does not provide a sufficient track record for potential clients to evaluate its reliability in the long term. Therefore, IS Leadmax safe? The uncertainty surrounding its company background suggests that potential clients should proceed with caution.

Trading Conditions Analysis

Leadmax offers a variety of account types, including micro, mini, standard, and ECN accounts, with a minimum deposit requirement starting as low as $10. While this may seem enticing for new traders, the trading conditions also raise some concerns.

The overall fee structure appears competitive, but there are hidden costs that could affect profitability. For example, Leadmax imposes a $50 inactivity fee for accounts dormant for over 90 days and a $30 withdrawal fee. The following table summarizes the core trading costs associated with Leadmax:

| Fee Type | Leadmax | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1-2 pips |

| Commission Model | $0.005/share | $0.01/share |

| Overnight Interest Range | Varies | Varies |

The variable spreads may be attractive, but the high leverage of up to 1:1000 can lead to substantial risks for traders, particularly those who are inexperienced. Such leverage can amplify both potential gains and losses, necessitating a careful approach to risk management. Therefore, while Leadmax offers enticing trading conditions, the associated risks and hidden fees raise questions about its safety.

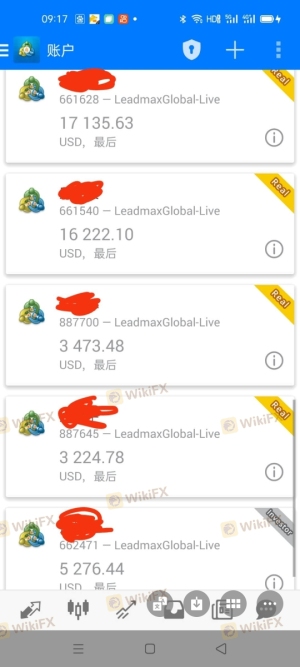

Customer Fund Security

The security of customer funds is paramount in evaluating any broker. Leadmax's lack of regulation means that there are no mandated protections for client funds, such as segregated accounts or investor compensation schemes. This absence of protective measures is a significant concern for potential traders.

Without proper fund segregation, client deposits may be at risk in the event of the broker's insolvency. Furthermore, Leadmax does not appear to offer negative balance protection, which could leave clients liable for losses exceeding their account balance. Historical complaints regarding fund withdrawals and the broker's operational transparency further exacerbate concerns about fund safety. In conclusion, IS Leadmax safe? The lack of protective measures for client funds raises serious alarms.

Customer Experience and Complaints

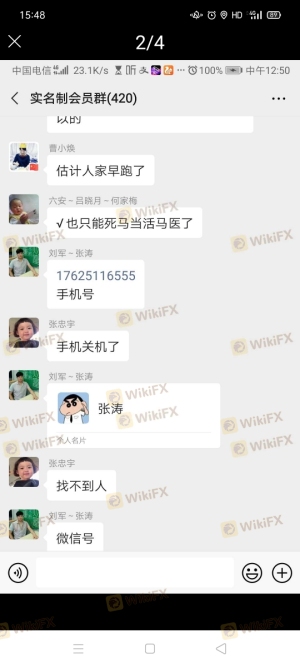

User feedback regarding Leadmax has been mixed, with several complaints surfacing about withdrawal issues and customer service responsiveness. Many users have reported difficulties in accessing their funds, which is a significant red flag in the trading industry.

The following table summarizes the main types of complaints and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Fair |

| Account Management Problems | High | Poor |

For instance, one user reported that after depositing funds, they faced multiple obstacles when attempting to withdraw, including unresponsive customer service and vague explanations regarding withdrawal policies. Such experiences highlight potential operational issues within Leadmax, leading to the conclusion that IS Leadmax safe? Based on user feedback, the broker's reliability is questionable.

Platform and Execution

Leadmax offers trading on popular platforms such as MetaTrader 4 and MetaTrader 5, which are widely regarded for their user-friendly interfaces and robust functionalities. However, the platform's execution quality, including order fulfillment and slippage, is crucial for traders.

Users have reported instances of slippage and rejected orders, which can severely impact trading performance. While the platforms themselves are reputable, any signs of manipulation or poor execution could indicate deeper issues within the broker's operations. Therefore, while the trading platforms are generally reliable, the reported execution problems raise concerns about the overall trading experience with Leadmax.

Risk Assessment

Using Leadmax presents several risks that traders should consider before committing their funds. The absence of regulation, potential withdrawal issues, and a lack of transparency all contribute to an elevated risk profile. The following risk assessment summarizes key concerns:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Fund Security Risk | High | No protection for client funds. |

| Withdrawal Risk | High | Numerous complaints about withdrawal issues. |

To mitigate these risks, potential clients should conduct thorough research, consider starting with a smaller investment, and remain vigilant about their trading activities. In addition, diversifying investments across multiple brokers may help reduce exposure to any single entity.

Conclusion and Recommendations

In summary, the analysis suggests that Leadmax raises several red flags regarding its safety and legitimacy. The lack of regulation, transparency issues, and numerous customer complaints point towards potential operational risks that traders should be wary of. While the trading conditions may seem appealing, the associated risks and lack of protective measures for client funds suggest that Leadmax may not be a safe choice for traders.

For those seeking reliable alternatives, consider brokers that are regulated by reputable authorities, offer transparent operations, and have a proven track record of customer satisfaction. Always prioritize safety and due diligence when selecting a trading platform to ensure a secure trading experience.

Is Leadmax a scam, or is it legit?

The latest exposure and evaluation content of Leadmax brokers.

Leadmax Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Leadmax latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.