Is LCG Market safe?

Business

License

Is LCG Market Safe or a Scam?

Introduction

London Capital Group (LCG) is a well-established online brokerage firm that has been operating since 1996, positioning itself as a significant player in the forex and CFD trading markets. With a broad range of trading instruments and competitive trading conditions, LCG attracts both novice and experienced traders. However, the increasing number of brokers in the forex market necessitates that traders conduct thorough evaluations of their chosen platforms. Given the potential risks associated with trading, including the loss of capital, it is crucial for traders to assess the credibility and safety of brokers like LCG.

This article aims to provide an objective analysis of whether LCG is a safe trading option or if it raises any red flags that could classify it as a scam. We will utilize a comprehensive evaluation framework that includes regulatory compliance, company background, trading conditions, customer feedback, and risk assessment.

Regulation and Legitimacy

The regulatory status of a broker is a key indicator of its legitimacy and safety. LCG operates under the oversight of several regulatory bodies, which is essential for ensuring that they adhere to strict financial standards and protect client funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 182110 | United Kingdom | Verified |

| CySEC | 341/17 | Cyprus | Verified |

| SCB | SIA-F194 | Bahamas | Verified |

LCG is regulated by the Financial Conduct Authority (FCA) in the UK, a highly respected regulatory body known for its stringent regulations. The FCA ensures that brokers maintain a high level of transparency and that client funds are kept safe in segregated accounts. Additionally, LCG is also regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Securities Commission of the Bahamas (SCB), which further enhances its credibility.

Historically, LCG has maintained compliance with regulatory requirements, which is a positive sign for potential traders. However, it is important to note that regulatory standards can vary by jurisdiction, and the presence of offshore licenses like that from the SCB may raise concerns about the level of protection offered to clients. Overall, LCGs regulatory status suggests that it is safe, but traders should remain vigilant regarding the specific protections offered by each regulatory body.

Company Background Investigation

LCG has a long history in the financial services industry, having been established in 1996. Over the years, the company has evolved, expanding its offerings and enhancing its technological capabilities. LCG is publicly listed on the London Stock Exchange, which adds an additional layer of transparency and accountability, as it is subject to strict reporting requirements.

The management team at LCG comprises experienced professionals with extensive backgrounds in finance and trading. This expertise is crucial for navigating the complex financial markets and ensuring that the firm operates effectively. The company also emphasizes transparency, providing detailed information about its services, fees, and trading conditions on its website.

Despite its strengths, LCG has faced scrutiny and complaints from clients regarding its services. Transparency in operations and clear communication with clients are essential for maintaining trust. LCG has made efforts to improve its information disclosure levels, but traders should always be cautious and conduct their own research before engaging with any broker.

Trading Conditions Analysis

Analyzing the trading conditions offered by LCG is essential for understanding the overall cost of trading with this broker. LCG provides a variety of account types, including standard and ECN accounts, which cater to different trading styles. The fee structure includes spreads, commissions, and overnight financing costs, which can vary based on market conditions.

| Fee Type | LCG Market | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | From 1.0 pips | From 0.6 pips |

| Commission Model | $10 per lot | $5 per lot |

| Overnight Interest Range | 0.04% per day | Varies widely |

Overall, LCG's spread and commission structure appears competitive, especially for traders using ECN accounts, which can offer lower spreads. However, the commissions for standard accounts may be higher than the industry average. Traders should be aware of any unusual fee policies, particularly concerning overnight financing and inactivity fees, which can add to trading costs.

While LCG does offer competitive trading conditions, potential traders should carefully evaluate their trading strategies and consider how these fees will impact their overall profitability. Understanding the fee structure is crucial for assessing whether LCG is indeed safe for your trading needs.

Customer Funds Security

The security of customer funds is a paramount concern for any trader. LCG implements several measures to ensure the safety of client funds. Client deposits are held in segregated accounts at tier-1 banks, which helps protect funds in the event of financial difficulties faced by the broker.

Additionally, LCG offers negative balance protection, which means that traders cannot lose more money than they have in their accounts. This is an important feature for risk management, especially in the volatile forex market. The presence of such protective measures suggests that LCG is committed to safeguarding its clients' investments.

However, there have been historical concerns regarding the safety of funds with LCG, particularly related to withdrawal difficulties reported by some clients. It is essential for traders to be aware of these potential issues and to ensure they fully understand the withdrawal process and any associated fees.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing the reliability of a broker. LCG has received mixed reviews from its clients, with some praising its trading platforms and customer service, while others have expressed frustrations regarding withdrawal processes and platform stability.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response times |

| Platform Stability | Medium | Ongoing improvements |

| Customer Service Quality | Medium | Generally positive |

Common complaints include difficulties in withdrawing funds, particularly during high market volatility. Clients have also reported issues with platform stability, including unexpected downtime during critical trading periods. While LCG has made efforts to address these concerns, the responsiveness of customer support remains a critical factor in overall customer satisfaction.

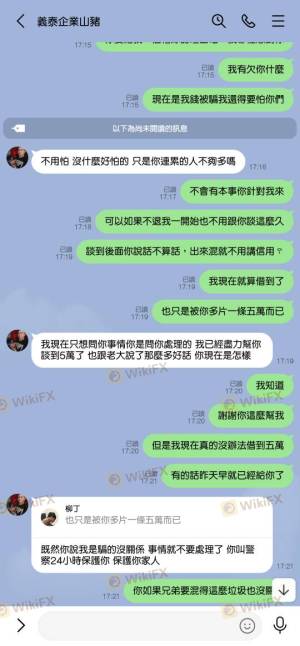

One notable case involved a trader who experienced significant delays in withdrawing funds, leading to frustration and a loss of confidence in the broker. While LCG eventually resolved the issue, the experience highlighted potential weaknesses in their customer service response times.

Platform and Trade Execution

The performance of a trading platform is crucial for an effective trading experience. LCG offers two primary platforms: their proprietary LCG Trader and the widely-used MetaTrader 4 (MT4). Both platforms provide a range of tools for analysis and trade execution.

LCG Trader is known for its user-friendly interface and advanced charting capabilities, while MT4 is favored for its customizable features and support for automated trading. However, some users have reported issues with order execution, including slippage and rejections during volatile market conditions.

Traders should carefully evaluate both platforms to determine which best suits their trading style. Monitoring execution quality and responsiveness during critical trading times is essential for ensuring a safe trading experience.

Risk Assessment

Using LCG as a trading platform involves several risks that traders should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Subject to varying regulations across jurisdictions. |

| Withdrawal Risk | High | Reports of delays and difficulties with withdrawals. |

| Platform Stability Risk | Medium | Occasional platform downtimes reported. |

To mitigate these risks, traders should conduct thorough research before engaging with LCG. It is advisable to start with a demo account to familiarize oneself with the platform and trading conditions before committing significant capital.

Conclusion and Recommendations

In conclusion, LCG presents itself as a well-regulated broker with a long history in the financial markets. The presence of multiple regulatory bodies, such as the FCA and CySEC, indicates a commitment to maintaining a safe trading environment. However, potential traders should be cautious of the reported difficulties regarding withdrawals and platform stability.

While LCG does not appear to be a scam, the mixed feedback from users warrants careful consideration. For those new to trading or looking for a reliable broker, it may be prudent to explore alternative options that have consistently positive reviews and a strong track record of customer service.

If you decide to proceed with LCG, ensure that you understand their trading conditions and fees thoroughly. Additionally, consider starting with a smaller investment to gauge the platform's reliability before committing larger sums.

Is LCG Market a scam, or is it legit?

The latest exposure and evaluation content of LCG Market brokers.

LCG Market Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LCG Market latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.