Is Keymax Asset safe?

Business

License

Is Keymax Asset Safe or Scam?

Introduction

Keymax Asset is a forex broker that positions itself in the competitive landscape of online trading, offering a variety of trading instruments and platforms to its clients. As the forex market continues to grow, the number of brokers also increases, making it crucial for traders to carefully evaluate the legitimacy and safety of these platforms. With numerous reports of scams and fraudulent activities in the trading industry, traders must be vigilant when selecting a broker. This article aims to provide an objective analysis of Keymax Asset by examining its regulatory status, company background, trading conditions, customer safety measures, client experiences, platform performance, and associated risks. The findings are based on a comprehensive review of online resources and user feedback.

Regulation and Legitimacy

The regulatory environment is one of the most significant factors in determining whether a broker is safe or potentially a scam. Keymax Asset currently lacks regulation by any recognized financial authority, which raises serious concerns about its legitimacy. In the absence of regulatory oversight, clients may have limited protections and recourse in case of disputes or financial losses.

Here is a summary of the regulatory information for Keymax Asset:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of a regulatory framework means that Keymax Asset is not subject to the stringent standards imposed by top-tier regulators such as the FCA (Financial Conduct Authority) or ASIC (Australian Securities and Investments Commission). This lack of oversight can lead to questionable practices, including unfair trading conditions and inadequate client fund protection. Furthermore, the absence of any historical compliance records raises red flags for potential investors.

Company Background Investigation

Keymax Asset's history and ownership structure are critical components in assessing its credibility. Unfortunately, there is scant information available regarding the companys background, development history, or ownership. This lack of transparency can be a significant warning sign for potential clients.

The management teams qualifications and experience also play a vital role in establishing trustworthiness. A well-qualified team with a solid track record can enhance a broker's credibility. However, with Keymax Asset, details about the management team remain elusive, which complicates the assessment of the company's reliability.

Transparency in operations and information disclosure is essential for building trust with clients. Keymax Asset's apparent opacity raises concerns about its commitment to ethical business practices. The lack of readily available information about the company's history and management can further deter potential clients who seek assurance before entrusting their funds.

Trading Conditions Analysis

The trading conditions offered by a broker are crucial for determining its suitability for traders. Keymax Asset has been noted for having a complex fee structure that may not be immediately apparent to potential clients. While the broker claims to offer competitive spreads and commissions, the actual costs can be higher than the industry average, which can significantly affect trading profitability.

Here‘s a comparison of Keymax Asset’s trading costs versus industry averages:

| Fee Type | Keymax Asset | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | Variable | 1.0 pips |

| Commission Model | Yes | No |

| Overnight Interest Range | High | Moderate |

The variability in spreads can lead to unexpected costs for traders, especially during volatile market conditions. Additionally, the presence of commissions may deter some traders who are accustomed to commission-free trading environments. Overall, the trading conditions at Keymax Asset warrant careful consideration, as they may not align with the expectations of all traders.

Customer Funds Safety

The safety of customer funds is paramount when evaluating a broker. Keymax Asset does not appear to have robust measures in place to protect client funds. The lack of regulatory oversight means there are no mandated requirements for fund segregation or investor compensation schemes, which can leave clients vulnerable to financial loss.

Keymax Asset's approach to fund security appears inadequate, especially when compared to regulated brokers who are required to implement strict safety protocols. The absence of negative balance protection is another concern, as it means clients could potentially lose more than their initial investment in adverse market conditions.

In summary, the lack of transparency and security measures raises serious questions about whether Keymax Asset is a safe option for traders. Historical issues related to fund safety or disputes have not been documented, but the absence of a solid foundation for fund protection remains a significant concern.

Customer Experience and Complaints

Client feedback is often a reliable indicator of a broker's legitimacy and performance. Reviews for Keymax Asset have shown a mix of experiences, with several users expressing dissatisfaction regarding customer service and withdrawal processes.

Common complaints associated with Keymax Asset include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow |

| Poor Customer Support | Medium | Unresponsive |

| Lack of Transparency | High | No Response |

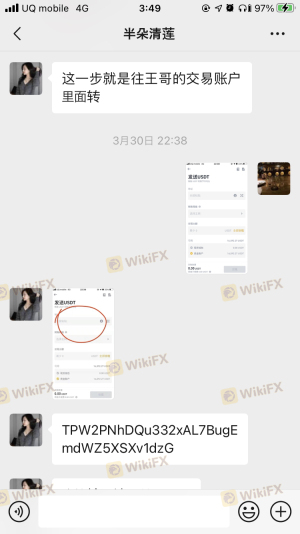

Many users have reported issues with funds being stuck during the withdrawal process, which can be a significant red flag indicating potential scams. The company's response to these complaints has been criticized for being slow and unhelpful, further eroding trust among clients.

One notable case involved a trader who faced significant delays in withdrawing their funds, leading to frustration and a loss of confidence in the broker. Such experiences are concerning and suggest that Keymax Asset may not prioritize customer satisfaction or ethical practices.

Platform and Execution

The trading platform is a critical component of the trading experience. Keymax Asset provides access to popular trading platforms; however, user experiences have been mixed. Reports indicate that traders have encountered issues with platform stability, including occasional outages and slow execution times.

Effective order execution is essential for successful trading, and any signs of slippage or rejections can significantly impact performance. While there are no widespread allegations of platform manipulation, the lack of consistency in execution quality raises concerns about whether Keymax Asset is a reliable choice for traders.

Risk Assessment

Engaging with Keymax Asset carries inherent risks. The following risk assessment summarizes the primary concerns associated with this broker:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Fund Safety Risk | High | Lack of protection measures. |

| Customer Support Risk | Medium | Slow response to complaints. |

| Execution Risk | Medium | Inconsistent platform performance. |

To mitigate these risks, traders are advised to conduct thorough research before engaging with Keymax Asset. Seeking alternative brokers with strong regulatory oversight and positive user reviews may provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence suggests that Keymax Asset may not be a safe option for traders. The lack of regulatory oversight, transparency, and adequate security measures raises significant concerns about the broker's legitimacy. While some traders may find the platform appealing, the potential risks associated with trading through Keymax Asset cannot be overlooked.

For those considering trading in the forex market, it is advisable to seek brokers that are regulated by reputable authorities, offer transparent trading conditions, and prioritize customer support. Some recommended alternatives include brokers like IG, OANDA, and Forex.com, which provide better regulatory protection and overall trading experiences.

Ultimately, traders should prioritize safety and transparency when selecting a broker to ensure their investments are protected.

Is Keymax Asset a scam, or is it legit?

The latest exposure and evaluation content of Keymax Asset brokers.

Keymax Asset Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Keymax Asset latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.