Is IroneFX safe?

Business

License

Is IroneFX A Scam?

Introduction

IroneFX is a forex and CFD broker that claims to provide traders with access to various financial instruments, including forex pairs, commodities, and indices. Established in 2010, the broker positions itself as a competitive player in the online trading market. However, the financial industry is rife with both reputable and questionable brokers, making it essential for traders to conduct thorough due diligence before committing their funds. This article aims to assess whether IroneFX is a safe trading option or if it raises red flags that suggest it may be a scam. The evaluation will be based on regulatory compliance, company background, trading conditions, customer experiences, and overall risk assessment.

Regulation and Legitimacy

Regulatory oversight is a critical factor in determining a broker's legitimacy. IroneFX operates under multiple regulatory bodies, which is generally a positive sign. However, the quality of these regulations varies significantly. Below is a summary of the key regulatory information concerning IroneFX:

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| FCA | 585561 | United Kingdom | Verified |

| CySEC | 125/10 | Cyprus | Verified |

| BMA | N/A | Bermuda | Unregulated |

The Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC) are both considered tier-1 regulators, which means they enforce strict compliance standards. However, the Bermuda Monetary Authority (BMA) does not provide the same level of oversight, and IroneFX's operations under this entity raise concerns. Historically, IroneFX has faced regulatory scrutiny, including warnings from various financial authorities about its practices. This mixed regulatory status necessitates caution, as traders should be wary of engaging with brokers that lack consistent regulatory oversight.

Company Background Investigation

IroneFX was founded in 2010 and has since expanded its operations to various countries. The company is owned by Notesco Limited, which operates multiple entities across different jurisdictions. While the management team comprises individuals with experience in finance and trading, the opacity surrounding the ownership structure can be concerning. Transparency is a critical factor for traders, as it fosters trust. IroneFX's website provides some information about its services, but it lacks comprehensive disclosures about its corporate structure and management team, which could hinder a trader's ability to make informed decisions.

Trading Conditions Analysis

The trading conditions offered by IroneFX are pivotal in assessing its attractiveness to potential clients. The broker provides various account types, each with different fee structures. Heres a comparison of core trading costs:

| Cost Type | IroneFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 - 2.0 pips | 1.0 - 1.5 pips |

| Commission Model | $18 per lot | $10 per lot |

| Overnight Interest Range | Varies widely | Varies widely |

IroneFX's spreads can be higher than the industry average, particularly for standard accounts. Additionally, the commission structure can be complex, with some accounts incurring significant fees. This raises concerns about the overall cost-effectiveness of trading with IroneFX, especially for high-frequency traders who rely on tight spreads and low commissions.

Customer Funds Security

The safety of customer funds is paramount in the forex trading industry. IroneFX claims to implement several measures to protect client funds. It segregates client funds from its operational funds, which is a standard practice among regulated brokers. Furthermore, the broker provides negative balance protection, ensuring that clients cannot lose more than their deposited amount. However, the historical context of IroneFX raises questions about its reliability. There have been instances of customer complaints regarding withdrawal issues and fund access, which could indicate underlying problems with the broker's operational integrity.

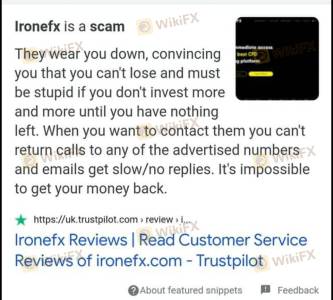

Customer Experience and Complaints

Customer feedback is often the most telling indicator of a broker's reliability. IroneFX has received a mix of reviews, with some users praising its educational resources and trading conditions, while others report significant issues with withdrawals and customer service. Below is a summary of common complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow or unresponsive |

| Account Verification | Medium | Lengthy process |

| Customer Support Issues | High | Inconsistent quality |

Typical cases include clients reporting that their withdrawal requests were delayed for weeks or even months, leading to frustration and distrust. In one case, a trader's account was suspended without clear communication, resulting in significant losses. Such experiences highlight the importance of evaluating customer service quality and responsiveness when assessing whether IroneFX is a safe trading option.

Platform and Trade Execution

The trading platform is another critical aspect of a broker's service. IroneFX primarily utilizes the MetaTrader 4 (MT4) platform, which is well-regarded for its features and reliability. However, some users have reported issues related to platform stability, execution speed, and slippage. The quality of order execution is essential for traders, particularly those employing scalping strategies. While IroneFX claims to offer competitive execution speeds, the presence of slippage and rejected orders raises concerns about the integrity of its trading environment.

Risk Assessment

Engaging with IroneFX carries certain risks that traders should consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Mixed regulatory status and warnings |

| Financial Stability | Medium | Historical compliance issues |

| Withdrawal Issues | High | Frequent customer complaints |

| Platform Reliability | Medium | Reports of execution problems |

To mitigate these risks, traders should ensure they fully understand the terms and conditions of trading with IroneFX, use risk management strategies, and consider starting with a demo account to assess the platform's reliability before committing real funds.

Conclusion and Recommendations

In conclusion, the evidence suggests that IroneFX presents several red flags that warrant caution. While it is regulated by reputable authorities like the FCA and CySEC, the existence of unregulated entities and a history of complaints raises questions about its overall trustworthiness. Traders should be particularly wary of potential withdrawal issues and the broker's fee structure, which may not be as competitive as advertised.

For those considering trading with IroneFX, it is advisable to start with a small investment and employ robust risk management strategies. Additionally, traders may want to explore alternative brokers with a stronger reputation for reliability and customer service, such as those with tier-1 regulation and positive user reviews. Ultimately, conducting thorough research and remaining vigilant can help mitigate the risks associated with trading in the forex market.

Is IroneFX a scam, or is it legit?

The latest exposure and evaluation content of IroneFX brokers.

IroneFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IroneFX latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.