Is IndusGold Company safe?

Business

License

Is Indusgold.company Safe or Scam?

Introduction

Indusgold.company positions itself as a player in the Forex trading market, offering various trading products and platforms to its clients. In an industry where trust and transparency are paramount, traders must exercise caution when selecting a broker. The rise of unregulated and potentially fraudulent brokers has led to significant financial losses for many traders. Therefore, it is essential to evaluate the credibility and safety of Indusgold.company through a comprehensive analysis of its regulatory status, company background, trading conditions, and customer feedback. This article employs a structured assessment framework, drawing on multiple online sources, to determine whether Indusgold.company is safe for trading or if it raises red flags indicative of a scam.

Regulation and Legitimacy

Regulation serves as a vital cornerstone in the Forex industry, ensuring that brokers adhere to specific standards designed to protect traders. Indusgold.company has come under scrutiny regarding its regulatory status. The following table summarizes its core regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

As indicated, Indusgold.company currently does not possess any valid regulatory licenses. This lack of oversight is a significant concern, as it may indicate that the broker operates outside the bounds of established financial regulations. The absence of regulation can lead to a lack of accountability, making it difficult for traders to seek recourse in the event of disputes or financial losses. Furthermore, a low score of 1.51 on platforms like WikiFX suggests that the broker has a questionable reputation within the trading community. Such regulatory gaps should prompt traders to ask: Is Indusgold.company safe? The answer, based on current evidence, leans towards caution.

Company Background Investigation

Indusgold.company is registered under the name Indus Gold Markets Investing Limited in the United Kingdom, having been incorporated on September 8, 2021. The company's brief history raises questions about its operational longevity and stability. The ownership structure remains somewhat opaque, as there is limited publicly available information about its management team and their professional backgrounds. A transparent company typically provides details about its leadership, including their qualifications and experience in the financial sector. However, the lack of such information may indicate a deficiency in transparency, which is another red flag for potential traders.

Moreover, the company's website has been reported as inaccessible at times, further complicating efforts to verify its legitimacy. In an industry where trust is paramount, these factors contribute to an unsettling picture regarding the safety of trading with Indusgold.company. The absence of credible information about the company's operations and management raises the question: Is Indusgold.company safe? The evidence suggests that potential traders should proceed with caution.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is crucial for evaluating its overall appeal and safety. Indusgold.company claims to provide competitive trading fees and a variety of trading instruments. However, the specifics of its fee structure remain somewhat vague. The following table outlines the core trading costs associated with Indusgold.company compared to industry averages:

| Fee Type | Indusgold.company | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 2.0% |

The lack of detailed information about spreads, commissions, and overnight interest rates raises concerns. A broker that is transparent about its fees typically publishes this information clearly on its website. The absence of such clarity could indicate hidden fees or unfavorable trading conditions, which may not align with industry standards. Traders should be wary of brokers that do not provide complete transparency regarding their costs, as this can lead to unexpected expenses that compromise trading profitability.

Customer Funds Security

The security of customer funds is a paramount concern for any trader. Indusgold.company's policies regarding fund security are not well-documented, which raises questions about the measures it has in place to protect client funds. Key aspects to consider include:

- Segregated Accounts: Are client funds held in segregated accounts to ensure they are not mixed with the broker's operational funds?

- Investor Protection: Does the broker offer any form of investor protection, such as insurance on deposits?

- Negative Balance Protection: Is there a policy in place to prevent clients from losing more than their initial deposit?

Without clear information on these aspects, it is challenging to assess the level of safety that Indusgold.company provides. The absence of established security measures could expose traders to significant risks, particularly in the volatile Forex market. Therefore, the question remains: Is Indusgold.company safe? Based on the lack of transparency regarding fund security, potential clients may want to consider alternative brokers that prioritize the safety of client funds.

Customer Experience and Complaints

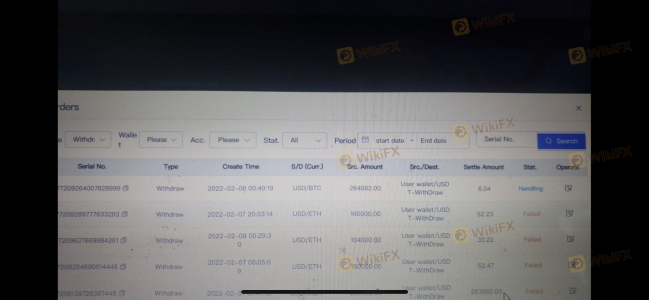

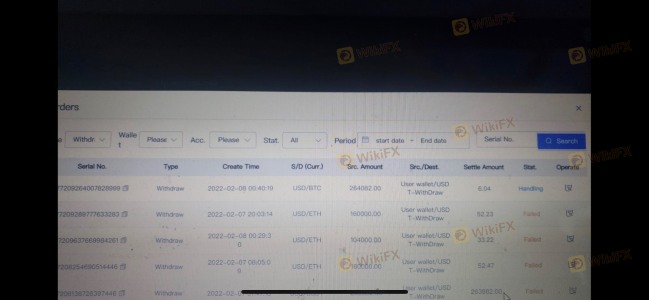

Customer feedback plays a crucial role in evaluating a broker's reliability. Various online reviews indicate a pattern of negative experiences with Indusgold.company. Common complaints include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Account Blocking | High | Poor |

| Withdrawal Issues | High | Poor |

| Customer Service Quality | Medium | Poor |

Many users have reported difficulties in withdrawing funds, with some alleging that their accounts were blocked without clear explanations. Such complaints are serious and suggest a troubling trend that could indicate deeper issues within the company's operations. A broker that fails to address customer complaints effectively may be prioritizing profit over client satisfaction, which is a significant concern for potential traders.

Platform and Trade Execution

The trading platform is a critical component of the trading experience. Indusgold.company claims to offer the popular MT5 trading platform, known for its advanced features and user-friendly interface. However, the lack of accessibility to the broker's website raises concerns about the platform's reliability and performance. Traders rely on stable and efficient platforms to execute trades effectively, and any issues related to execution quality, slippage, or order rejections can significantly impact trading outcomes.

Without firsthand experience or detailed user reviews regarding the platform's performance, it is difficult to ascertain whether Indusgold.company provides a reliable trading environment. Therefore, the question of Is Indusgold.company safe? remains unanswered, as the available information does not provide a clear picture of the platform's operational integrity.

Risk Assessment

Engaging with any broker involves inherent risks, and Indusgold.company is no exception. The following risk assessment summarizes key risk areas associated with trading through this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of regulation increases vulnerability. |

| Financial Risk | High | Unclear fee structure may lead to losses. |

| Customer Service Risk | Medium | Poor responsiveness to complaints. |

| Platform Stability Risk | High | Inaccessible website raises execution concerns. |

Given these risk factors, potential traders should approach Indusgold.company with caution. It is advisable to conduct thorough research and consider alternative brokers with a stronger regulatory framework and proven track record of customer satisfaction.

Conclusion and Recommendations

In conclusion, the investigation into Indusgold.company raises numerous concerns regarding its safety and reliability as a Forex broker. The absence of regulation, lack of transparency around trading conditions, and negative customer feedback suggest that caution is warranted. Therefore, it is essential for traders to ask themselves: Is Indusgold.company safe? The evidence indicates that it may not be the best choice for those seeking a secure trading environment.

For traders looking for safer alternatives, consider brokers with reputable regulatory oversight, transparent fee structures, and positive customer reviews. Always prioritize brokers that demonstrate a commitment to client security and satisfaction. In the ever-evolving Forex landscape, making informed decisions is crucial to safeguarding your investments.

Is IndusGold Company a scam, or is it legit?

The latest exposure and evaluation content of IndusGold Company brokers.

IndusGold Company Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IndusGold Company latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.