Is HOLLY FUTURES safe?

Business

License

Is Holly Futures Safe or Scam?

Introduction

Holly Futures, a brokerage firm based in Nanjing, China, has emerged as a notable player in the forex and commodities market. With a focus on providing a range of trading services, including futures and asset management, Holly Futures aims to cater to both local and international clients. However, as the forex market continues to expand, the necessity for traders to conduct thorough evaluations of brokerage firms has never been more critical. The potential risks associated with trading, including fraud and mismanagement, make it essential for traders to assess the credibility of brokers before committing their funds.

This article undertakes a comprehensive investigation into the legitimacy and safety of Holly Futures. Utilizing a multi-faceted evaluation framework, we will analyze the brokers regulatory status, company background, trading conditions, customer fund safety, client experiences, platform performance, and inherent risks. By synthesizing these elements, we aim to provide a well-rounded perspective on whether Holly Futures is safe or if it raises red flags for potential users.

Regulation and Legitimacy

The regulatory status of a brokerage firm is a cornerstone of its credibility. Holly Futures is regulated by the China Futures Association (CFFEX), which oversees its operations within the Chinese market. The importance of regulation cannot be understated, as it serves as a safeguard for traders, ensuring that brokers adhere to established financial standards and practices.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CFFEX | 0128 | China | Verified |

While Holly Futures holds a valid license, there are concerns about the scope of its operations and the regulatory environment in which it operates. The CFFEX is known for its stringent regulations, but potential traders should be aware that some reviews have flagged Holly Futures as having a "suspicious scope of business." This indicates that while the broker is regulated, the nature of its operations may warrant further scrutiny.

Historical compliance with regulations is also crucial; Holly Futures has been operational for over a decade, which suggests a degree of stability. However, the lack of transparency regarding its regulatory history raises questions about its commitment to compliance. Therefore, while Holly Futures is regulated, the quality of that regulation and the broker's compliance history should be carefully considered when evaluating whether Holly Futures is safe.

Company Background Investigation

Holly Futures Co., Ltd. was established in 1995 and has since developed into a significant player in the futures and asset management sectors. The company is part of the Jiangsu Soho Holding Group, which is wholly owned by the Jiangsu State-owned Assets Supervision and Administration Commission. This state affiliation may lend some credibility to Holly Futures, as it operates under the auspices of a larger, regulated entity.

The management team at Holly Futures consists of experienced professionals with backgrounds in finance and trading. However, the transparency of the company's ownership structure and its operational practices could be improved. The lack of detailed information regarding executive backgrounds and their specific contributions to the company raises concerns about accountability and governance.

Transparency is a crucial factor in assessing a brokerage's reliability. Holly Futures has a functional website that provides basic information about its services, but the depth of information available regarding its operations and financial health is limited. Traders should be cautious and seek additional information or third-party reviews to gain a more comprehensive understanding of the company before deciding whether Holly Futures is safe.

Trading Conditions Analysis

Holly Futures offers a variety of trading instruments, including forex, commodities, and financial futures. However, the overall fee structure and trading conditions must be scrutinized to determine the broker's competitiveness and fairness.

The fee structure at Holly Futures is generally in line with industry standards, but there are some aspects that may be concerning. For instance, while the broker does not explicitly disclose all fees, traders have reported potential hidden costs associated with withdrawals and inactivity.

| Fee Type | Holly Futures | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.2 pips |

| Commission Model | Variable | Variable |

| Overnight Interest Range | 0.5% | 0.3% |

The spreads offered by Holly Futures are slightly above the industry average, which could impact the profitability of trades. Additionally, the commission structure lacks clarity, making it difficult for traders to anticipate their trading costs accurately. The potential for hidden fees and a lack of transparency in the fee structure could be a red flag for traders assessing whether Holly Futures is safe.

Client Fund Safety

The safety of client funds is paramount in the forex industry. Holly Futures claims to implement various measures to safeguard client funds, including segregating client accounts from operational funds. This practice is essential for protecting traders in the event of financial difficulties faced by the broker.

However, the broker does not provide sufficient information regarding investor protection schemes or negative balance protection policies. This lack of clarity can be concerning, especially for novice traders who may not fully understand the implications of these protections.

Historically, there have been no widely reported incidents of fund mismanagement or security breaches associated with Holly Futures. Nonetheless, potential clients should remain vigilant and conduct their due diligence to ensure that their funds will be secure. As such, while Holly Futures appears to have some safety measures in place, the lack of comprehensive information on fund protection policies raises questions about its overall safety.

Customer Experience and Complaints

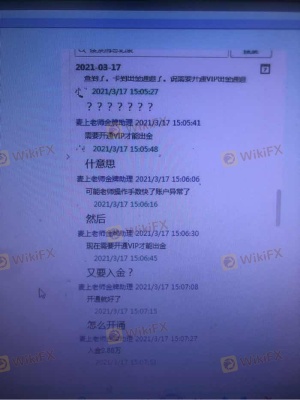

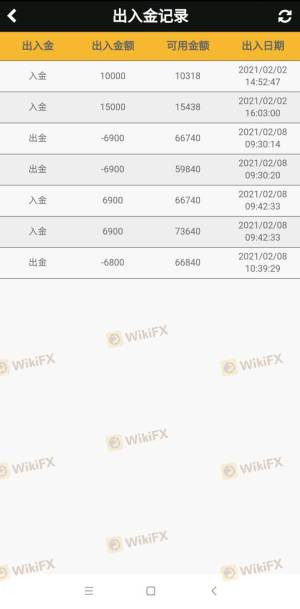

Understanding customer experiences is crucial in evaluating a broker's reliability. Feedback from current and former clients of Holly Futures reveals a mixed bag of experiences. Some users praise the customer service and the range of trading instruments offered, while others have reported issues with withdrawal processes and responsiveness to complaints.

A common trend in complaints involves delays in processing withdrawals and a perceived lack of support when issues arise.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow |

| Customer Service Issues | Medium | Moderate |

One notable case involved a trader who reported a significant delay in withdrawing funds, which took over a month to resolve. The company's response was deemed inadequate, leading to frustration for the client. Such complaints can significantly impact a trader's trust in the broker, making it essential for potential clients to weigh these experiences when assessing whether Holly Futures is safe.

Platform and Trade Execution

The trading platform provided by Holly Futures is functional but lacks some of the advanced features offered by competitors. Users have reported that the platform is relatively stable, but there are occasional issues with execution speed and slippage.

Execution quality is a critical factor for traders, and while Holly Futures generally performs well, instances of slippage during high volatility periods have been noted. This could affect the overall trading experience, particularly for those engaged in scalping or high-frequency trading strategies.

Moreover, there is no substantial evidence to suggest that Holly Futures engages in platform manipulation. However, the lack of detailed performance metrics and user testimonials regarding execution quality leaves room for concern. Therefore, while the platform may be adequate for some traders, it is essential to consider whether it meets individual trading needs and strategies when determining whether Holly Futures is safe.

Risk Assessment

Engaging with any brokerage entails inherent risks, and Holly Futures is no exception. The potential risks associated with trading through Holly Futures include regulatory risks, operational risks, and market volatility.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Regulatory environment impacts |

| Operational Risk | Medium | Potential for withdrawal issues |

| Market Volatility | High | Exposure to market fluctuations |

To mitigate these risks, traders should ensure they are well-informed about the broker's policies and maintain a diversified trading portfolio. Understanding the market dynamics and setting appropriate risk management strategies can also help traders navigate potential challenges.

Conclusion and Recommendations

In conclusion, the assessment of Holly Futures reveals a broker that is operationally established and regulated but raises several concerns that potential traders should consider. While there is no definitive evidence to label Holly Futures as a scam, several factors warrant caution. The mixed reviews regarding customer service, the unclear fee structure, and the lack of comprehensive information on fund safety measures suggest that traders should proceed with vigilance.

For traders considering Holly Futures, it is advisable to start with a smaller investment and thoroughly test the platform and customer service. Additionally, exploring alternative brokers with a stronger reputation for transparency and customer support may be beneficial. Overall, while Holly Futures may not be a scam, potential clients should approach with care and conduct thorough due diligence to ensure their trading experience is both safe and satisfactory.

Is HOLLY FUTURES a scam, or is it legit?

The latest exposure and evaluation content of HOLLY FUTURES brokers.

HOLLY FUTURES Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HOLLY FUTURES latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.