Regarding the legitimacy of hkvqfutures forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is hkvqfutures safe?

Business

License

Is hkvqfutures markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Central Universe Futures Limited

Effective Date:

2013-10-28Email Address of Licensed Institution:

april@vqfutures.com.hkSharing Status:

No SharingWebsite of Licensed Institution:

www.vqfutures.com.hkExpiration Time:

--Address of Licensed Institution:

香港九龍尖沙咀星光行8樓9室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is HKVQFutures Safe or a Scam?

Introduction

HKVQFutures is an online forex broker that positions itself in the competitive landscape of the foreign exchange market. As with any trading platform, it is crucial for traders to conduct thorough research before committing their funds. The forex market, known for its volatility and complexity, is often a target for scams, making it essential for potential clients to evaluate the legitimacy and safety of brokers like HKVQFutures. This article employs a comprehensive investigation framework, utilizing various sources and reviews to assess the safety of HKVQFutures, focusing on regulatory compliance, company background, trading conditions, customer experiences, and overall risk factors.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical indicator of its trustworthiness. HKVQFutures claims to operate under the jurisdiction of Hong Kong, yet it has been flagged as unregulated by several financial watchdogs. The absence of regulation raises significant concerns about the protection of client funds and the overall legitimacy of the broker.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | Hong Kong | Unregulated |

The lack of a valid license from a recognized regulatory authority, such as the Securities and Futures Commission (SFC) in Hong Kong, is alarming. Regulatory bodies are essential as they enforce strict compliance measures to protect traders. The absence of oversight means that traders have limited recourse in case of disputes or fraudulent activities. Historical compliance issues associated with unregulated brokers often include delayed withdrawals, poor customer service, and a lack of transparency, which are common red flags in the industry.

Company Background Investigation

HKVQFutures has a relatively obscure company background, which is often a concern for potential investors. The broker's website lacks detailed information regarding its history, ownership structure, and the qualifications of its management team. A transparent company should provide clear insights into its operational history and the professional backgrounds of its executives.

The absence of such information raises doubts about the broker's credibility. A robust management team with relevant experience in finance and trading is vital for any broker's integrity. Without this transparency, traders may find themselves vulnerable to potential scams. Furthermore, the lack of clear communication and disclosures can lead to misunderstandings regarding fees, trading conditions, and the safety of client funds.

Trading Conditions Analysis

An essential aspect of evaluating any broker is understanding its trading conditions, including fees and commissions. HKVQFutures offers a range of trading products; however, the specifics of its fee structure remain unclear.

| Fee Type | HKVQFutures | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 2.0% |

Unusual or hidden fees can significantly impact a trader's profitability. The lack of transparency regarding spreads and commissions is concerning, as it may indicate potential hidden costs that could erode trading profits. Traders should be wary of brokers that do not provide clear and upfront information about their fees.

Moreover, the presence of high overnight interest rates can also be a deterrent for traders who hold positions for extended periods. A broker that imposes exorbitant fees or lacks clarity in its fee structure may not be acting in the best interest of its clients.

Client Fund Security

The safety of client funds is paramount when assessing the integrity of a broker. HKVQFutures has been criticized for its lack of clear information regarding fund security measures. A reputable broker should implement robust security protocols, including segregated accounts, investor protection schemes, and negative balance protection.

Unfortunately, HKVQFutures has not provided sufficient details on these critical aspects. Without clear policies on fund segregation and client protection, traders may be at significant risk of losing their investments.

Historical incidents involving unregulated brokers often include cases where clients were unable to withdraw their funds or experienced significant delays in accessing their money. Such scenarios highlight the importance of ensuring that a broker has established security measures to protect client investments.

Customer Experience and Complaints

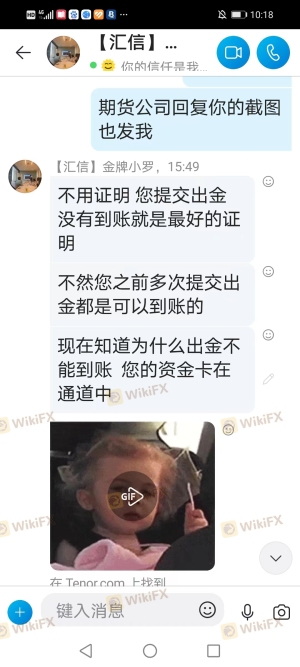

Customer feedback is an invaluable resource for assessing a broker's reliability and service quality. Reviews of HKVQFutures indicate a mixed bag of experiences, with many complaints focusing on withdrawal issues, poor customer support, and lack of transparency.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Customer Service | Medium | Poor |

| Misleading Information | High | Poor |

Common complaints from users include difficulties in withdrawing funds and unresponsive customer support, which are serious concerns for any trader. The inability to access funds can lead to significant financial distress, making it crucial for potential clients to consider these experiences before investing.

Moreover, the lack of a proactive approach to addressing customer grievances raises questions about the broker's commitment to client satisfaction. Traders should always be cautious when dealing with brokers that have a history of unresolved complaints.

Platform and Execution

The performance and reliability of the trading platform are crucial for a positive trading experience. HKVQFutures offers a platform for trading, but user reviews indicate concerns regarding its stability and execution quality.

Traders have reported instances of slippage and rejected orders, which can severely impact trading outcomes. A reliable platform should provide fast execution speeds and minimal slippage to facilitate effective trading.

Furthermore, any signs of platform manipulation or technical issues could indicate deeper problems with the broker's operations. Traders should prioritize brokers that offer robust, tested platforms with positive user feedback regarding execution quality.

Risk Assessment

Using HKVQFutures carries several inherent risks, primarily due to its unregulated status and unclear trading conditions.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Lack of transparency in fees |

| Operational Risk | Medium | Platform stability concerns |

The absence of regulatory oversight increases the risk of fraud, while unclear fees can lead to unexpected financial losses. Traders should be particularly cautious and consider these risks before engaging with the broker.

To mitigate these risks, potential clients should conduct thorough research, read reviews from other traders, and consider starting with a small investment to gauge the broker's reliability.

Conclusion and Recommendations

In conclusion, the investigation into HKVQFutures raises significant concerns regarding its safety and legitimacy. The broker's unregulated status, lack of transparency, and negative customer feedback suggest that it may not be a safe option for traders.

Potential clients should be particularly wary of the absence of regulatory oversight and the unclear fee structure. For those seeking reliable alternatives, brokers that are regulated by reputable authorities, such as the FCA or ASIC, should be prioritized. These brokers typically offer better protection for client funds and more transparent trading conditions.

In summary, is HKVQFutures safe? The evidence suggests that traders should exercise extreme caution and consider other reputable options in the market.

Is hkvqfutures a scam, or is it legit?

The latest exposure and evaluation content of hkvqfutures brokers.

hkvqfutures Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

hkvqfutures latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.