Regarding the legitimacy of HKJOJO forex brokers, it provides HKGX and WikiBit, .

Is HKJOJO safe?

Business

License

Is HKJOJO markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

UnverifiedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

匯啟智投貴金屬有限公司

Effective Date: Change Record

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

香港九龍尖沙咀廣東道28號力寶太陽廣場9樓912室Phone Number of Licensed Institution:

29876269Licensed Institution Certified Documents:

Is HKJOJO A Scam?

Introduction

HKJOJO, a Hong Kong-based forex broker established in 2017, positions itself as a platform for traders seeking to engage in foreign exchange markets. With the increasing popularity of forex trading, it is crucial for traders to carefully evaluate the brokers they choose to work with. The potential for scams and fraudulent activities in the forex industry is high, making due diligence essential for safeguarding investments. In this article, we will investigate whether HKJOJO is a safe trading environment or a potential scam. Our analysis will be based on a combination of regulatory information, company background, trading conditions, customer experiences, and the overall risk assessment associated with this broker.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical aspect that determines its legitimacy. HKJOJO claims to be regulated by the Chinese Gold & Silver Exchange Society (CGSE), which is a recognized financial authority in Hong Kong. However, it is essential to scrutinize the depth of this regulation and its implications for traders. The following table summarizes key regulatory information about HKJOJO:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Chinese Gold & Silver Exchange Society | 147 | Hong Kong | Verified |

While having a license from CGSE is a positive sign, it is important to note that the regulatory framework in Hong Kong is less stringent compared to other jurisdictions like the UK or the US. This can pose risks for traders, as the oversight provided by CGSE may not be as robust. Additionally, HKJOJO has received a low score of 2.0 from WikiFX, indicating significant concerns regarding its legitimacy. In the past three months, the platform has faced 11 complaints from users, raising red flags about its operational integrity. Therefore, while HKJOJO is technically regulated, the quality and effectiveness of this regulation warrant caution.

Company Background Investigation

HKJOJO's history and ownership structure provide further insights into its credibility. The broker was founded in 2017 and operates under the legal entity name "香港久久有限公司" (HK JOJO Co., Limited). The company is headquartered in Tsuen Wan, Hong Kong, and claims to have a management team with extensive experience in financial services.

However, the lack of detailed information about the management team and their qualifications raises concerns about transparency. A broker's credibility is often tied to the experience and reputation of its leadership. If the management team lacks a proven track record in the financial industry, it could indicate potential risks for investors.

Moreover, the company's disclosure practices appear to be limited. Transparency is vital in the financial sector, and brokers should provide clear information about their operations, fees, and risks. Without comprehensive disclosures, traders may find it challenging to make informed decisions. Therefore, while HKJOJO has a formal structure, the opacity surrounding its management and operations raises questions about its reliability.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is crucial for evaluating its attractiveness to traders. HKJOJO utilizes the MetaTrader 4 (MT4) platform, a widely used trading software known for its functionality. However, it is essential to analyze the overall fee structure and any potential hidden costs associated with trading on this platform.

HKJOJO's fee structure includes spreads, commissions, and overnight interest rates. The following table compares HKJOJO's trading costs with industry averages:

| Fee Type | HKJOJO | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.0 pips | 1.5 pips |

| Commission Model | None | Varies (0-5 USD) |

| Overnight Interest Range | 1.5% | 0.5% - 1.0% |

As indicated, the spreads at HKJOJO are higher than the industry average, which can significantly impact trading profitability. Additionally, the absence of a transparent commission structure raises concerns, as traders may inadvertently incur higher costs. The overnight interest rates are also on the higher side, potentially leading to increased expenses for positions held overnight.

Traders should be wary of these conditions, as they can erode profits and lead to unexpected costs. Therefore, while HKJOJO provides access to a popular trading platform, the trading conditions may not be as favorable compared to other brokers in the market.

Customer Funds Safety

The safety of customer funds is paramount when evaluating a forex broker. HKJOJO claims to implement various security measures to protect clients' investments. However, it is essential to assess the effectiveness of these measures.

HKJOJO reportedly utilizes segregated accounts to keep client funds separate from its operational funds. This practice is essential for ensuring that client money is not misused or lost in the event of the company's insolvency. Additionally, the broker claims to offer negative balance protection, which prevents clients from losing more than their initial investment.

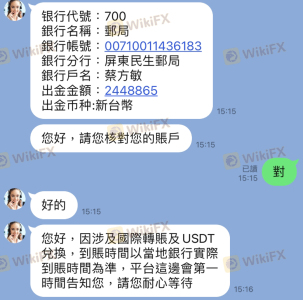

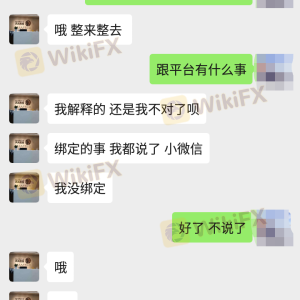

Nevertheless, the historical record of HKJOJO raises concerns. The broker has faced multiple complaints regarding withdrawal issues, with users reporting difficulties in accessing their funds. Such incidents can indicate potential problems with the broker's financial practices and raise doubts about its commitment to safeguarding customer assets.

In summary, while HKJOJO has implemented some safety measures, the lack of a strong track record and the presence of complaints regarding fund access suggest that traders should exercise caution when depositing funds with this broker.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Analyzing user experiences can provide insights into common issues and the broker's responsiveness. HKJOJO has garnered a mixed reputation, with numerous complaints surfacing in recent months.

The following table summarizes the primary types of complaints received about HKJOJO:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Slippage and Order Execution | Medium | Fair |

| Customer Service Delays | Medium | Poor |

Complaints regarding withdrawal issues have been particularly prevalent, with users expressing frustration over their inability to access funds after successful trades. Additionally, reports of slippage and execution problems further exacerbate concerns about the broker's operational integrity. The company's response to these complaints has been less than satisfactory, with many users reporting long wait times and inadequate support.

One notable case involved a trader who successfully withdrew funds twice but faced repeated rejections for subsequent withdrawals. This incident highlights potential red flags regarding HKJOJO's operational practices and raises questions about its overall trustworthiness.

Platform and Execution

The trading platform's performance and execution quality play a crucial role in a trader's experience. HKJOJO utilizes the MT4 platform, known for its user-friendly interface and extensive features. However, it is essential to evaluate the platform's stability and execution metrics.

User reviews indicate that while the MT4 platform is functional, there have been reports of execution delays and high slippage during volatile market conditions. Such issues can significantly impact trading outcomes and lead to unexpected losses. Additionally, there are concerns about the broker's transparency regarding order execution practices, as some traders suspect potential manipulation.

Overall, while the MT4 platform offers a familiar trading environment, the execution quality and potential manipulation risks warrant caution for traders considering HKJOJO.

Risk Assessment

Using HKJOJO as a trading platform involves several risks that traders should be aware of. The following table summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Limited oversight and low regulatory score. |

| Fund Safety | Medium | Complaints regarding withdrawal issues and fund access. |

| Trading Conditions | Medium | Higher spreads and potential hidden costs. |

| Customer Support | High | Poor response times and inadequate support. |

Given these risks, it is advisable for traders to exercise caution when engaging with HKJOJO. Implementing risk mitigation strategies, such as setting strict trading limits and avoiding large deposits, can help safeguard investments.

Conclusion and Recommendations

In conclusion, while HKJOJO presents itself as a legitimate forex broker, significant concerns about its regulatory status, trading conditions, and customer experiences raise red flags. The presence of numerous complaints related to withdrawals and execution issues suggests that traders should approach this broker with caution.

Traders seeking a safer trading environment may want to consider alternative brokers with stronger regulatory oversight and a proven track record of customer satisfaction. Some reputable options include brokers regulated by tier-1 authorities such as the FCA or ASIC, which offer more robust consumer protections.

In summary, is HKJOJO safe? The evidence suggests that caution is warranted, and potential traders should be aware of the associated risks before making any commitments.

Is HKJOJO a scam, or is it legit?

The latest exposure and evaluation content of HKJOJO brokers.

HKJOJO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HKJOJO latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.