Is HHIFX safe?

Business

License

Is HHIFX Safe or a Scam?

Introduction

In the ever-evolving landscape of the foreign exchange (forex) market, HHIFX has emerged as a notable player. Positioned as a trading platform offering various financial instruments, it claims to provide traders with competitive trading conditions and advanced technology. However, the rapid growth of online trading has also led to an increase in fraudulent schemes, making it imperative for traders to exercise caution when selecting a broker. This article aims to investigate the legitimacy of HHIFX by examining its regulatory status, company background, trading conditions, customer safety measures, and user experiences. By employing a thorough research methodology, including analysis of regulatory databases and user reviews, we aim to provide a comprehensive assessment of whether HHIFX is safe or a scam.

Regulation and Legitimacy

Regulation is a critical aspect for any trading platform, as it serves as a safeguard for traders' investments. A regulated broker is typically subject to strict oversight, which helps ensure fair trading practices and the protection of client funds. In the case of HHIFX, the broker's regulatory status raises several red flags. According to various sources, HHIFX operates under the name Fidelis Wealth and claims to be based in the United Kingdom. However, it appears that HHIFX is not regulated by any reputable financial authority.

Regulatory Information Table

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | United Kingdom | Suspicious Clone |

The lack of a valid license from a top-tier regulator, such as the Financial Conduct Authority (FCA) in the UK, is concerning. The FCA is known for its stringent requirements and oversight, and brokers operating without its regulation may not adhere to the same standards. Furthermore, reports indicate that HHIFX may be a clone of an existing regulated entity, further complicating its legitimacy. This lack of regulatory oversight raises questions about the safety of funds deposited with HHIFX, making it essential for potential clients to consider these factors carefully.

Company Background Investigation

HHIFX's history and ownership structure are crucial in evaluating its credibility. The company claims to have been established to provide a user-friendly trading experience. However, there is limited information available regarding its founding, management team, and operational history. Transparency is key in the financial industry, and the absence of detailed information about the company's background can be a significant warning sign.

The management team plays a vital role in the success and reliability of a trading platform. While HHIFX presents itself as a professional organization, the lack of publicly available information about its executives and their qualifications raises concerns. A competent management team with a proven track record is essential for fostering trust and ensuring the platform operates in the best interest of its clients. Unfortunately, HHIFX does not provide sufficient information to instill confidence in potential investors.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for assessing its reliability. HHIFX claims to provide competitive spreads, various account types, and a range of trading instruments. However, a closer examination reveals several inconsistencies in its fee structure and trading conditions.

Trading Costs Comparison Table

| Fee Type | HHIFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.2 pips |

| Commission Model | None | $5 per lot |

| Overnight Interest Range | 0.5% | 0.3% |

While HHIFX claims to offer no commission on trades, the spreads are higher than the industry average. This discrepancy may suggest that the broker compensates for the lack of commissions through wider spreads, which can eat into traders' profits. Additionally, the overnight interest rates appear to be higher than average, which could impact long-term traders adversely.

Customer Funds Safety

The safety of customer funds is a paramount concern for any trader. HHIFX claims to implement various measures to protect client funds, including segregated accounts and encryption protocols. However, the absence of regulatory oversight undermines these claims.

Segregated accounts are designed to keep client funds separate from the broker's operational funds, providing an extra layer of security. Nevertheless, without a credible regulatory body overseeing these practices, traders have little recourse if issues arise. Moreover, the lack of a compensation scheme for clients in case of broker insolvency is a significant drawback.

Customer Experience and Complaints

User feedback plays a crucial role in assessing the reliability of a trading platform. Analyzing reviews and complaints about HHIFX reveals a mixed bag of experiences. While some users report satisfactory trading experiences, others express concerns regarding withdrawal issues and unresponsive customer support.

Common Complaint Types Table

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

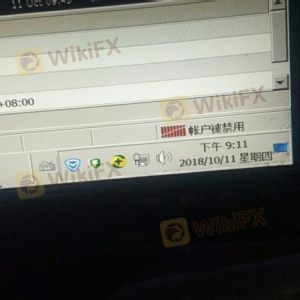

| Account Blocking | Medium | No Clear Reason |

| Poor Customer Support | High | Unresponsive |

The most significant complaint revolves around withdrawal delays, with many users reporting difficulties in accessing their funds. This is a common red flag in the industry, often indicating underlying issues with the broker's financial stability. Furthermore, the company's slow response to inquiries exacerbates these concerns, as effective communication is vital for resolving issues promptly.

Platform and Execution Quality

The performance and reliability of the trading platform are essential for a seamless trading experience. HHIFX claims to utilize advanced trading technology, but user experiences suggest otherwise. Many traders report issues with order execution, including slippage and rejections during high volatility periods. These problems can significantly impact trading outcomes, particularly for those employing scalping or day trading strategies.

Risk Assessment

Engaging with HHIFX presents several risks that potential clients should consider. The lack of regulation, combined with user complaints about withdrawals and execution issues, creates an environment of uncertainty.

Risk Assessment Summary Table

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No credible regulation |

| Financial Stability Risk | High | User complaints about withdrawals |

| Execution Risk | Medium | Reports of slippage and rejections |

To mitigate these risks, traders should conduct thorough research, be cautious with their investments, and consider using demo accounts to test the platform before committing significant funds.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that HHIFX may not be a safe trading option. The lack of credible regulation, coupled with user complaints regarding withdrawals and execution issues, raises significant concerns about the platform's legitimacy. While some traders may have positive experiences, the overall risk profile of HHIFX makes it a questionable choice for most investors.

For traders seeking reliable alternatives, it is advisable to consider well-regulated brokers with transparent practices, such as those regulated by the FCA or ASIC. Such brokers typically offer robust investor protection and a proven track record of compliance, which can provide peace of mind when trading in the forex market.

Is HHIFX a scam, or is it legit?

The latest exposure and evaluation content of HHIFX brokers.

HHIFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HHIFX latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.