Is Greenstan Wealth safe?

Business

License

Is Greenstan Wealth Safe or a Scam?

Introduction

Greenstan Wealth has emerged as a player in the forex trading market, offering various trading services to traders worldwide. However, as the forex market continues to grow, so does the number of scams targeting unsuspecting traders. It is crucial for traders to carefully evaluate the reliability and safety of forex brokers before committing their funds. This article aims to provide a comprehensive analysis of Greenstan Wealth by examining its regulatory status, company background, trading conditions, customer feedback, and overall risk assessment. The investigation draws from various online sources and user reviews to present a balanced view of whether Greenstan Wealth is safe for trading or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its legitimacy. Greenstan Wealth claims to operate under the jurisdiction of the National Futures Association (NFA). However, it has been flagged as an unauthorized entity by the NFA, raising significant concerns about its compliance with regulatory standards. Below is a summary of the broker's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| National Futures Association (NFA) | 0538567 | United States | Unauthorized |

The lack of proper regulation is a significant red flag for potential investors. Regulatory bodies like the NFA impose strict guidelines to protect traders and ensure that brokers operate fairly and transparently. The absence of oversight means that traders have limited recourse if issues arise, such as withdrawal problems or fraudulent activities. Furthermore, the broker's claims of being regulated appear dubious, suggesting that it may not have undergone the rigorous checks necessary to operate legally. Therefore, the question remains: Is Greenstan Wealth safe? The evidence points to a concerning lack of regulatory oversight.

Company Background Investigation

Greenstan Wealth was reportedly established in 2021, positioning itself as a new entrant in the forex trading space. However, the company's history is shrouded in ambiguity, with limited information available about its ownership structure and management team. This lack of transparency raises concerns about the broker's credibility.

The management teams background is critical in assessing the company's reliability. A strong team with a proven track record in the financial industry can instill confidence among traders. Unfortunately, Greenstan Wealth does not provide sufficient details about its management, which could indicate a lack of professionalism and accountability.

Moreover, the company's transparency regarding its operations and business practices is questionable. Reliable brokers often disclose their physical address, contact information, and legal documents, which help establish trust. However, Greenstan Wealth has been criticized for its vague communication and lack of accessible information. This lack of transparency further complicates the question: Is Greenstan Wealth safe? Based on the available information, potential traders should approach this broker with caution.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for assessing its overall value. Greenstan Wealth claims to provide competitive trading fees and conditions, but a closer examination reveals potential issues. The broker's fee structure appears to be opaque, with many users reporting unexpected charges. Below is a comparative analysis of the core trading costs associated with Greenstan Wealth:

| Fee Type | Greenstan Wealth | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.0 pips | 1.5 pips |

| Commission Structure | Varies | Fixed or Variable |

| Overnight Interest Range | 1.5% | 1.0% |

The spreads offered by Greenstan Wealth seem to be higher than the industry average, which could significantly impact trading profitability. Additionally, the commission structure lacks clarity, making it difficult for traders to understand their total trading costs. There have also been reports of hidden fees that could catch traders off guard, raising further concerns about the broker's integrity. Given these factors, it is essential to ask: Is Greenstan Wealth safe? The ambiguous fee structure and higher-than-average costs suggest that traders should be wary of engaging with this broker.

Client Fund Safety

The safety of client funds is paramount for any broker. Greenstan Wealth claims to implement various measures to protect client funds, but the effectiveness of these measures is unclear. A thorough analysis reveals that the broker does not provide sufficient information about its fund segregation practices, investor protection policies, or negative balance protection.

In reputable brokerage firms, client funds are typically kept in segregated accounts, ensuring that they are not used for operational expenses. This practice protects traders in the event of the broker's insolvency. However, without clear disclosures from Greenstan Wealth, traders may find themselves at risk. Additionally, the absence of a robust investor protection scheme raises further concerns about the safety of funds deposited with the broker.

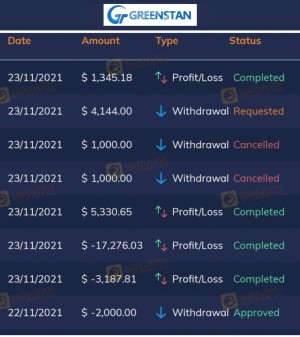

Historically, there have been reports of clients facing difficulties when attempting to withdraw their funds, which is a significant warning sign. If a broker cannot facilitate withdrawals, it raises the question of whether it is acting in good faith. Therefore, the critical question remains: Is Greenstan Wealth safe? Based on the lack of transparency and historical withdrawal issues, potential traders should exercise extreme caution when considering this broker.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability. Greenstan Wealth has garnered numerous complaints from users, particularly regarding withdrawal issues and poor customer service. Common complaint patterns include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow or No Response |

| Poor Customer Support | Medium | Inconsistent |

| Misleading Information | High | No Acknowledgment |

Many users have reported being unable to withdraw their funds, often citing a lack of communication from the broker. In some cases, clients have claimed that their accounts were frozen, and they were asked to deposit additional funds to unlock their accounts. Such practices are alarming and raise significant concerns about the broker's integrity.

For example, one user reported being defrauded of a substantial amount, claiming that the broker's representatives induced them to deposit more funds under false pretenses. This type of behavior is indicative of a potentially fraudulent operation. Therefore, it is essential to consider: Is Greenstan Wealth safe? The overwhelming negative feedback and serious complaints suggest that traders should be cautious and consider alternate options.

Platform and Execution

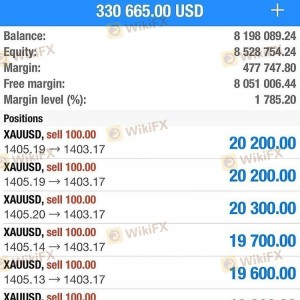

The trading platform provided by a broker plays a crucial role in the overall trading experience. Greenstan Wealth uses the widely recognized MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and robust features. However, user reviews indicate that the platform may suffer from performance issues, including slippage and order rejections.

Traders have reported instances where their orders were not executed as expected, leading to potential financial losses. Such execution problems can be detrimental, especially in a volatile market like forex. Moreover, there are concerns about the broker's potential manipulation of trades, which could further erode traders' confidence.

Given these factors, the pressing question remains: Is Greenstan Wealth safe? While the use of a reputable platform like MT4 is a positive aspect, the reported execution issues and potential manipulation raise serious concerns for prospective traders.

Risk Assessment

Engaging with Greenstan Wealth entails various risks that potential traders should carefully evaluate. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of valid regulation raises concerns. |

| Financial Risk | High | Reports of withdrawal issues indicate potential fraud. |

| Execution Risk | Medium | Complaints regarding order execution could impact trading. |

The cumulative risks associated with trading through Greenstan Wealth are significant. The absence of regulatory oversight, combined with numerous complaints about fund withdrawals and execution issues, presents a precarious situation for traders. To mitigate these risks, it is advisable to conduct thorough due diligence and consider alternative, regulated brokers.

Conclusion and Recommendations

In conclusion, the evidence presented raises serious concerns about the legitimacy and safety of Greenstan Wealth. The broker's lack of regulation, opaque fee structure, and numerous customer complaints suggest that it may not be a safe option for traders. Therefore, it is imperative to ask: Is Greenstan Wealth safe? The overwhelming consensus from available data indicates that traders should approach this broker with extreme caution.

For those considering trading in forex, it may be wise to explore alternative options that offer robust regulatory oversight and transparent practices. Reputable brokers such as IG, OANDA, or Forex.com are examples of firms that have established a solid reputation within the industry. Ultimately, ensuring the safety of your investments should be the top priority.

Is Greenstan Wealth a scam, or is it legit?

The latest exposure and evaluation content of Greenstan Wealth brokers.

Greenstan Wealth Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Greenstan Wealth latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.