Is GOLD TINKLE safe?

Business

License

Is Gold Tinkle A Scam?

Introduction

Gold Tinkle, operated by Genesis Business Group Limited, positions itself as a player in the forex trading market, primarily targeting new investors with promises of high returns. However, the rise of online trading has also seen an increase in fraudulent schemes, making it crucial for traders to carefully evaluate the legitimacy of brokers before committing their funds. With numerous reports and reviews circulating online, this article seeks to provide a comprehensive analysis of Gold Tinkle, assessing its safety and credibility. Our investigation draws from multiple sources, including user reviews, regulatory data, and expert analyses, to present a balanced view of whether Gold Tinkle is indeed a safe platform or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is paramount in determining its legitimacy. Gold Tinkle operates without valid supervision from recognized financial authorities, raising significant concerns regarding its credibility. Regulated brokers are typically held to strict standards that safeguard customer funds and ensure fair trading practices. Below is a summary of Gold Tinkle's regulatory information:

| Regulatory Authority | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The absence of any valid regulatory oversight is a major red flag. According to various sources, Gold Tinkle has been flagged as a potential Ponzi scheme, operating without any formal registration with the Bank of Malaysia or other reputable financial institutions. This lack of regulatory compliance not only questions the broker's legitimacy but also exposes traders to high risks, as there are no regulatory bodies to provide recourse in the event of disputes or fund mismanagement.

Company Background Investigation

Examining the background of Gold Tinkle reveals several alarming aspects. Founded in December 2018, the company claims to be part of a multi-level marketing scheme with no verifiable retail products or services. Instead, it relies heavily on affiliate marketing, where existing members recruit new investors to generate returns. The management team, led by David Cheng, presents a professional façade, but there is little to no verifiable information about his credentials or history outside of the companys promotional materials. This lack of transparency raises questions about the company's operational integrity and the qualifications of its leadership.

Additionally, the company's website and social media presence lack meaningful engagement or testimonials from verified users, further indicating a potential attempt to mislead prospective investors. Overall, the opacity surrounding Gold Tinkle's business model and ownership structure casts a shadow over its legitimacy.

Trading Conditions Analysis

When evaluating the trading conditions offered by Gold Tinkle, it is essential to scrutinize its fee structure. Reports suggest that the broker employs a convoluted fee model, which may include hidden charges that are not immediately apparent to users. Below is a comparison of Gold Tinkle's core trading costs against industry averages:

| Fee Type | Gold Tinkle | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 1.5% |

The lack of transparency regarding spreads and commissions could lead to unexpected costs, making it difficult for traders to gauge the profitability of their trades. Moreover, the absence of clear information on overnight interest rates and other charges could result in higher-than-expected expenses, further diminishing the appeal of trading with Gold Tinkle.

Client Funds Safety

The safety of client funds is a crucial aspect of any trading platform. Gold Tinkle's approach to fund security appears to be inadequate. Reports indicate that the broker does not implement proper measures for fund segregation, which is essential for protecting clients' investments. Without regulatory oversight, there are no investor protection mechanisms in place, leaving clients vulnerable to potential fraud or misappropriation of funds.

Furthermore, historical complaints about Gold Tinkle highlight issues related to fund withdrawal, with users reporting difficulties in accessing their money. Such incidents raise significant concerns about the broker‘s financial practices and commitment to safeguarding clients’ assets.

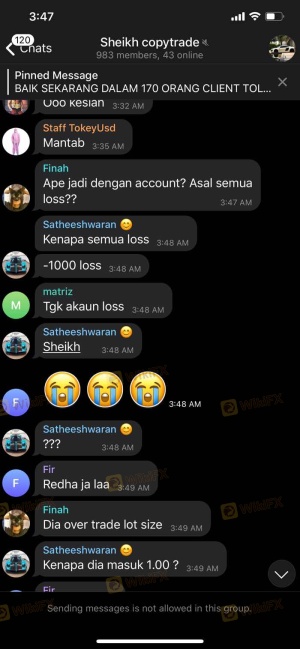

Customer Experience and Complaints

Analyzing customer feedback reveals a troubling pattern of dissatisfaction among users of Gold Tinkle. Many reviews highlight issues such as unresponsive customer service, difficulty withdrawing funds, and pressure tactics urging clients to deposit more money. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow to respond |

| Unresponsive Support | Medium | Lacks effective communication |

| Pressure to Deposit More | High | Aggressive tactics |

A couple of notable case studies illustrate these concerns. One user reported being unable to withdraw their funds despite multiple requests, while another mentioned being pressured to invest additional money under the guise of securing their initial investment. These experiences suggest a concerning trend that potential investors should consider before engaging with Gold Tinkle.

Platform and Execution

The performance of a trading platform is critical for a positive trading experience. Gold Tinkle's platform has been criticized for its instability and poor user experience. Traders have reported issues with order execution, including slippage and rejected orders, which can significantly impact trading outcomes. The lack of robust trading tools and features further hampers the overall user experience, making it difficult for traders to implement effective strategies.

Risk Assessment

Using Gold Tinkle presents several risks that potential investors should be aware of. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Fund Safety | High | Lack of fund segregation and investor protection |

| Customer Support | Medium | Unresponsive service and complaints reported |

| Platform Integrity | High | Issues with execution and potential manipulation |

To mitigate these risks, prospective traders should consider conducting thorough research and possibly seeking alternatives with better regulatory standing and customer reviews.

Conclusion and Recommendations

In conclusion, the evidence suggests that Gold Tinkle exhibits several characteristics typical of a scam. The lack of regulatory oversight, coupled with numerous complaints regarding fund safety and customer service, indicates a high level of risk for potential investors. Therefore, it is advisable for traders to exercise extreme caution when considering Gold Tinkle as a trading platform.

For those seeking safer alternatives, consider brokers that are regulated by reputable authorities and have a proven track record of client satisfaction. Some recommended options include well-established platforms that offer transparent fee structures, robust customer support, and secure trading environments. Remember, the key to successful trading is not just about potential profits but also about ensuring the safety and security of your investments.

Is GOLD TINKLE a scam, or is it legit?

The latest exposure and evaluation content of GOLD TINKLE brokers.

GOLD TINKLE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GOLD TINKLE latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.