Is GLOBALFOREX safe?

Business

License

Is GlobalForex Safe or Scam?

Introduction

GlobalForex is a broker that positions itself within the competitive landscape of the forex market, offering a range of trading services that appeal to both novice and experienced traders. As the forex trading environment is rife with opportunities, it is also fraught with risks, making it imperative for traders to conduct thorough due diligence before engaging with any broker. This article aims to critically evaluate the legitimacy and safety of GlobalForex by examining its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and overall risk assessment. Our investigation is based on a comprehensive review of multiple online sources, including regulatory databases, user feedback, and expert analyses, ensuring a well-rounded understanding of whether GlobalForex is a safe option for traders or a potential scam.

Regulation and Legitimacy

A broker's regulatory status is a key indicator of its trustworthiness. Regulatory bodies enforce rules and standards that protect traders and ensure fair practices. Unfortunately, GlobalForex does not appear to be regulated by any recognized financial authority, which raises significant concerns about its legitimacy and the safety of client funds. Below is a summary of the regulatory information available:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that GlobalForex does not adhere to the strict oversight that is essential for safeguarding traders' interests. Regulatory bodies like the FCA (UK), ASIC (Australia), and SEC (USA) impose stringent requirements on brokers, including capital adequacy, regular audits, and transparency in operations. Without such oversight, traders are left vulnerable to potential fraud and malpractice.

The quality of regulation is paramount; brokers regulated by top-tier authorities are generally deemed more reliable. In contrast, brokers like GlobalForex, lacking any regulatory framework, pose a higher risk to traders. The lack of a regulatory license is a significant red flag, suggesting that traders should be extremely cautious when considering GlobalForex for trading activities.

Company Background Investigation

Understanding a broker's background is critical in assessing its reliability. GlobalForex claims to operate in the forex market, but limited information is available regarding its history, ownership structure, and management team. The lack of transparency surrounding these aspects raises concerns about the broker's credibility.

There is little to no publicly available information about the founders or the management team, which is unusual for a broker aiming to attract clients. A reputable brokerage typically provides details about its leadership, including their qualifications and experience in the financial sector. The absence of such information suggests a lack of accountability and raises questions about the broker's operations.

Moreover, the company's website does not provide clear contact information or a physical address, further obscuring its legitimacy. In the financial services industry, transparency is crucial, and the inability to verify a broker's operational history and ownership can be a strong indicator of potential risks. Therefore, as we evaluate whether GlobalForex is safe, it is essential to consider these transparency issues seriously.

Trading Conditions Analysis

When assessing a broker, the trading conditions they offer can significantly influence a trader's experience. GlobalForex presents a variety of trading options, but the lack of clarity in their fee structure and trading conditions is concerning. A detailed examination of their fees reveals a potential lack of transparency, which could lead to unexpected costs for traders.

Below is a comparison of core trading costs:

| Fee Type | GlobalForex | Industry Average |

|---|---|---|

| Spread for Major Pairs | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | $0 - $10 |

| Overnight Interest Range | N/A | 0.5% - 2.0% |

The absence of clearly defined spreads and commission structures raises questions about how GlobalForex generates revenue. In the forex industry, brokers typically charge commissions or spreads, and any ambiguity in these areas can lead to distrust.

Moreover, if traders encounter unexpected fees or unfavorable trading conditions, it could lead to significant financial losses. Therefore, potential clients should be wary of engaging with GlobalForex until more transparent information regarding its fees and trading conditions is made available.

Customer Fund Security

The safety of customer funds is paramount in the forex trading industry. Reputable brokers implement strict measures to protect client funds, such as segregating client accounts and providing investor compensation schemes. Unfortunately, GlobalForex does not provide sufficient information regarding its fund security measures.

A detailed analysis of the broker's policies on fund segregation, investor protection, and negative balance protection reveals a concerning lack of clarity. Without robust measures in place, traders risk losing their investments in the event of a broker's insolvency or fraudulent activities.

Furthermore, historical data on any past security breaches or fund mismanagement issues related to GlobalForex is notably absent, which adds to the uncertainty surrounding the broker's commitment to safeguarding client assets. As such, the question of whether GlobalForex is safe remains open, with significant concerns regarding its fund security protocols.

Customer Experience and Complaints

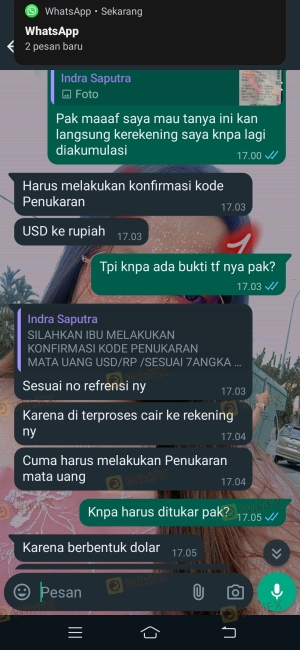

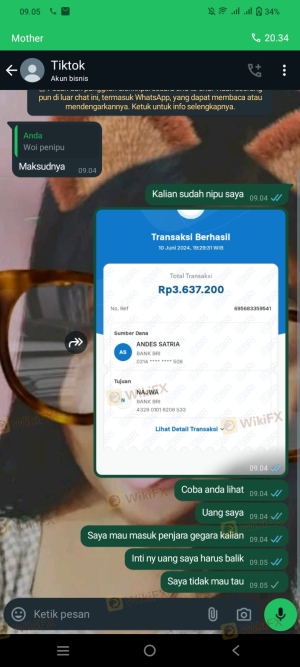

Customer feedback is a vital component in assessing a broker's reliability. Reviews and testimonials can provide insight into the experiences of other traders. Unfortunately, there is a mixed bag of feedback regarding GlobalForex, with several users reporting issues related to withdrawals and customer service.

Below is a summary of common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Poor Customer Service | Medium | Unresolved Queries |

| Lack of Transparency | High | No Response |

Typical complaints include difficulties in withdrawing funds, which is a significant red flag for any trading platform. If traders face challenges in accessing their own money, it casts doubt on the broker's legitimacy.

Additionally, the overall customer service experience has been criticized, with many users reporting slow response times and unresolved inquiries. This lack of support can be detrimental, especially for traders who may require immediate assistance. Therefore, potential clients should carefully consider these complaints when evaluating whether GlobalForex is safe for their trading activities.

Platform and Trade Execution

The trading platform's performance is crucial for a trader's success. GlobalForex claims to offer a user-friendly trading experience, but there are concerns regarding the platform's stability and execution quality. Essential aspects such as order execution speed, slippage, and rejection rates are critical in determining a broker's reliability.

Feedback from users indicates that there have been instances of slow execution and slippage, which can significantly impact trading outcomes. Additionally, any signs of platform manipulation, such as sudden spikes in spreads or rejections of orders, could indicate underlying issues with the broker's operations.

As traders rely heavily on the performance of the trading platform, any deficiencies in this area can lead to substantial losses. Therefore, it is essential to scrutinize the platform's performance and user experiences before deciding whether to engage with GlobalForex.

Risk Assessment

Engaging with a broker like GlobalForex involves inherent risks, especially given the lack of regulatory oversight and transparency. Below is a risk scoring card summarizing key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | Lack of clear fund protection measures |

| Customer Service Risk | Medium | Reports of slow response and unresolved issues |

| Trading Conditions Risk | High | Ambiguous fee structure and potential hidden costs |

Given these identified risks, traders should exercise caution when considering GlobalForex as their trading partner. It is advisable to conduct thorough research and possibly seek alternatives that offer better regulatory protections and transparency.

Conclusion and Recommendations

In conclusion, the evidence gathered raises significant concerns regarding the safety and legitimacy of GlobalForex. The absence of regulatory oversight, coupled with a lack of transparency in its operations and customer feedback indicating potential issues with fund withdrawals and customer service, suggests that traders should approach this broker with caution.

For traders seeking a reliable and secure trading environment, it is recommended to consider alternatives that are regulated by reputable authorities and offer transparent trading conditions. Brokers such as IG, OANDA, or Forex.com provide robust regulatory frameworks and proven track records, making them safer choices for forex trading.

Ultimately, the question of whether GlobalForex is safe remains unresolved, and potential clients should weigh the risks carefully before making any investment decisions.

Is GLOBALFOREX a scam, or is it legit?

The latest exposure and evaluation content of GLOBALFOREX brokers.

GLOBALFOREX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GLOBALFOREX latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.