Regarding the legitimacy of GAAFX forex brokers, it provides VFSC and WikiBit, .

Is GAAFX safe?

Business

License

Is GAAFX markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

GLOBAL ASSET ADVISORS Limited

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is GAAFX Safe or Scam?

Introduction

GAAFX, a forex broker, positions itself within the competitive landscape of the foreign exchange market, catering to a diverse clientele with varying trading needs. As the forex market continues to expand globally, the importance of selecting a trustworthy broker cannot be overstated. Traders are often lured by attractive offers, but the potential for scams looms large in an industry that is still grappling with regulation and oversight. This article aims to provide a thorough evaluation of GAAFX, assessing its safety and legitimacy through a structured analysis of its regulatory status, company background, trading conditions, and customer experiences.

To arrive at a well-rounded conclusion, we will utilize a combination of qualitative insights and quantitative data derived from various reputable sources, including regulatory bodies and user reviews. By examining GAAFX through these lenses, we will answer the crucial question: Is GAAFX safe?

Regulation and Legitimacy

The regulatory environment in which a broker operates plays a crucial role in ensuring the safety of traders' funds and the legitimacy of trading practices. GAAFX claims to operate under a regulatory framework, but scrutiny reveals potential shortcomings that warrant attention.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission (VFSC) | Not specified | Vanuatu | Revoked |

GAAFX's regulatory history raises red flags, particularly with the VFSC revoking its license. This raises concerns about the broker's compliance with industry standards and regulatory requirements. The lack of a robust regulatory framework can expose traders to higher risks, including potential fraud and mismanagement of funds. The implications of operating without strong regulatory oversight are significant, as traders may find themselves without recourse in the event of disputes or financial losses. Thus, it is imperative for potential clients to consider these factors when evaluating whether GAAFX is safe.

Company Background Investigation

GAAFX is operated by Global Asset Advisors LLC, a company that has been in the forex brokerage business for several years. However, the transparency regarding its ownership structure and operational history is limited. The management teams qualifications and experience in the financial sector also remain ambiguous, which can be a cause for concern among potential traders.

The company's history does not reflect any significant milestones or achievements that would enhance its credibility. Furthermore, the lack of comprehensive information regarding its founders and management team can lead to doubts about the brokers reliability. A transparent organization typically provides detailed information about its leadership and operational practices; hence, the opacity surrounding GAAFX's management could indicate a lack of accountability. In light of these factors, traders must exercise caution and conduct thorough research before engaging with GAAFX, as the question of "Is GAAFX safe?" remains uncertain.

Trading Conditions Analysis

When assessing a forex broker, understanding the trading conditions is vital, as they directly impact profitability and trading experience. GAAFX presents a range of trading costs and conditions that require careful examination.

| Cost Type | GAAFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable, starting from 0.6 pips | 1.2 pips |

| Commission Model | No commissions | Varies widely |

| Overnight Interest Range | Not specified | Varies widely |

GAAFX advertises competitive spreads, which can be appealing to traders. However, the absence of clear information regarding overnight interest rates and potential hidden fees raises concerns. Such ambiguities can lead to unexpected costs that may erode trading profits. Furthermore, the lack of a commission structure might seem advantageous at first glance, but it often indicates that other fees may be embedded in the trading conditions. This necessitates a thorough review of the fine print before committing to any financial engagement with GAAFX.

Client Funds Security

The security of client funds is a critical aspect of evaluating a forex broker. GAAFX claims to implement various measures to ensure the safety of traders' deposits, but the effectiveness of these measures remains questionable.

GAAFX reportedly utilizes segregated accounts to separate client funds from its operational capital. This is a standard practice in the industry that protects traders' investments in the event of the broker's insolvency. However, without robust regulatory oversight, the efficacy of such measures can be compromised. Additionally, there is no mention of investor protection schemes or negative balance protection, which are essential safeguards for traders.

Historical data regarding any past security breaches or disputes involving GAAFX is scarce, which raises further concerns. The lack of transparency surrounding these issues can lead to uncertainty about the broker's commitment to safeguarding client funds. Consequently, traders must be vigilant and consider these factors when determining whether GAAFX is safe for their trading activities.

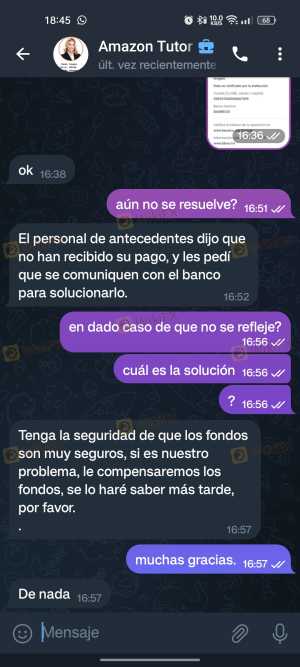

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding the real-world experience of traders using GAAFX. Reviews and testimonials often highlight the strengths and weaknesses of a broker, providing insights into potential issues.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Account Lockouts | High | Unresolved issues |

| Customer Support Issues | Medium | Inconsistent support |

Common complaints about GAAFX include delays in withdrawals and issues related to account access. Several users have reported difficulties in retrieving their funds, which is a significant red flag in the forex trading industry. The responsiveness of customer support has also been criticized, with many users experiencing long wait times for assistance.

For example, one user reported being unable to withdraw funds after multiple attempts, resulting in frustration and loss of trust in the broker. Such experiences highlight the importance of reliable customer support and efficient withdrawal processes, both of which are essential for a positive trading experience. This leads to the question: Is GAAFX safe for traders who prioritize timely access to their funds?

Platform and Trade Execution

The performance of the trading platform is another critical factor in assessing a broker's reliability. GAAFX offers the popular MetaTrader 4 and 5 platforms, which are known for their user-friendly interfaces and robust features. However, the platform's stability and execution quality are crucial for successful trading.

Traders have reported mixed experiences with GAAFX's order execution, with some noting instances of slippage and rejected orders. Such occurrences can significantly impact trading outcomes, especially for those employing high-frequency trading strategies. Additionally, any signs of platform manipulation, such as artificially widening spreads during volatile market conditions, can further erode trust in the broker.

Overall, while the platform may offer essential tools for trading, the execution quality and potential issues with slippage warrant careful consideration when evaluating whether GAAFX is safe.

Risk Assessment

Using GAAFX involves several risks that potential traders should be aware of. A comprehensive risk assessment can help individuals make informed decisions about their trading activities.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of robust regulation |

| Financial Risk | Medium | Potential hidden fees |

| Operational Risk | Medium | Platform stability issues |

The regulatory risks associated with GAAFX are particularly concerning, given the revoked license from the VFSC. This lack of oversight increases the likelihood of encountering financial mismanagement or fraudulent practices. Additionally, the potential for hidden fees and unclear trading conditions poses financial risks that traders must consider.

To mitigate these risks, potential clients should conduct thorough due diligence, including researching user reviews, examining the broker's regulatory status, and testing the platform with a demo account before committing significant capital.

Conclusion and Recommendations

In conclusion, while GAAFX presents itself as a viable option for forex trading, significant concerns regarding its regulatory status, transparency, and customer experiences raise alarms about its safety and legitimacy. The revoked license from the VFSC is a major red flag, indicating that GAAFX is not safe for traders who prioritize regulatory protection and fund security.

For traders seeking reliable alternatives, it is advisable to consider brokers with strong regulatory oversight, transparent fee structures, and positive customer feedback. Options such as brokers regulated by the FCA or ASIC may provide a safer trading environment. Ultimately, conducting thorough research and due diligence is essential for any trader considering GAAFX or similar brokers.

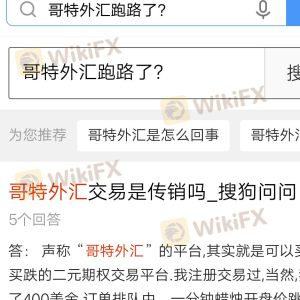

Is GAAFX a scam, or is it legit?

The latest exposure and evaluation content of GAAFX brokers.

GAAFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GAAFX latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.