Regarding the legitimacy of G-IMFCH forex brokers, it provides FCA, FMA and WikiBit, .

Is G-IMFCH safe?

Business

License

Is G-IMFCH markets regulated?

The regulatory license is the strongest proof.

FCA Inst Market Making (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Inst Market Making (MM)

Licensed Entity:

Curro Markets Limited

Effective Date:

2005-09-27Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2019-12-19Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FMA Inst Market Making (MM)

Financial Markets Authority

Financial Markets Authority

Current Status:

UnverifiedLicense Type:

Inst Market Making (MM)

Licensed Entity:

ROCKFORT MARKETS LIMITED

Effective Date:

2016-07-16Email Address of Licensed Institution:

accounts@rockfortmarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Level 17, 55 Shortland Street, Auckland Central, Auckland, 1010, New ZealandPhone Number of Licensed Institution:

022 569 6789Licensed Institution Certified Documents:

Is G-IMFCH Safe or Scam?

Introduction

G-IMFCH is a forex broker that has garnered attention in the trading community, positioning itself as a platform for trading various financial instruments. As the forex market continues to expand, traders are increasingly cautious about selecting brokers due to the prevalence of scams and unregulated entities. It is essential for traders to conduct thorough due diligence when evaluating brokers to safeguard their investments. This article aims to investigate whether G-IMFCH is a trustworthy broker or a potential scam by analyzing its regulatory status, company background, trading conditions, customer experiences, and more. Our assessment is based on data gathered from reputable financial sources, user reviews, and regulatory databases.

Regulatory Status and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy. G-IMFCH claims to be regulated by two financial authorities: the Financial Markets Authority (FMA) in New Zealand and the Financial Conduct Authority (FCA) in the UK. However, both regulatory bodies have classified G-IMFCH as a "suspicious clone," raising serious doubts about the validity of its licenses.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FMA | N/A | New Zealand | Suspicious Clone |

| FCA | N/A | United Kingdom | Suspicious Clone |

This classification indicates that G-IMFCH may not be operating under the stringent regulations typically associated with legitimate brokers. The lack of a valid regulatory framework can expose traders to significant risks, including the potential for fraud and mismanagement of funds. Furthermore, the broker has been associated with numerous complaints—36 in total—indicating a troubling track record. The high number of complaints, combined with its dubious regulatory status, suggests that G-IMFCH may not be a safe choice for forex trading.

Company Background Investigation

G-IMFCH, also known as Global Integrable Multilateral Financial Clearing House, has been operating for approximately 5 to 10 years. However, the details surrounding its ownership structure and management team remain opaque, raising concerns about transparency. A reputable broker typically provides clear information about its founders and management, along with their qualifications and experience in the financial industry. Unfortunately, G-IMFCH does not offer such insights, which can be a red flag for potential investors.

The company's official website has also faced functionality issues, further complicating efforts to gather reliable information. Transparency is crucial in the financial sector, as it fosters trust between brokers and their clients. G-IMFCH's lack of transparency and the absence of verifiable information about its management team may indicate that it is not committed to providing a secure trading environment.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for assessing its reliability. G-IMFCH presents a competitive fee structure, but it is essential to scrutinize any unusual or hidden fees that may affect traders' profitability. The broker offers a range of trading accounts, but the specifics regarding spreads, commissions, and overnight interest rates are not thoroughly disclosed.

| Fee Type | G-IMFCH | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of clarity regarding these fees can make it challenging for traders to accurately assess their potential costs and profits. Moreover, the absence of industry-standard trading conditions may indicate that G-IMFCH is not aligned with best practices in the forex trading landscape. Traders should be cautious and consider the potential impact of unclear fee structures on their trading experience.

Client Funds Security

Client funds' security is paramount when selecting a forex broker. G-IMFCH has not provided sufficient information regarding its security measures, including whether it segregates client funds and offers investor protection. The lack of clear policies on fund segregation and negative balance protection raises concerns about the safety of traders' investments.

Historically, many unregulated brokers have faced issues related to fund mismanagement and loss of client assets. G-IMFCH's classification as a "suspicious clone" adds to the anxiety surrounding its financial practices. Without robust security measures in place, traders may find themselves vulnerable to losing their investments in the event of the broker's insolvency or fraudulent activities.

Customer Experience and Complaints

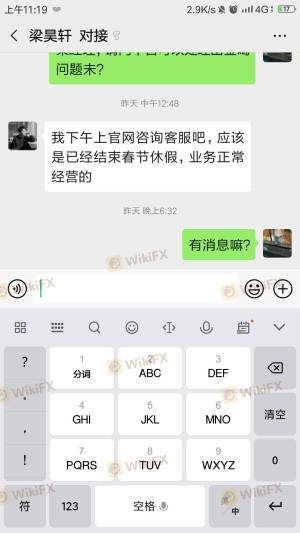

Customer feedback plays a crucial role in evaluating a broker's reliability. G-IMFCH has received numerous complaints, primarily concerning withdrawal issues and poor customer service. Many users have reported difficulties in accessing their funds, which is a significant red flag when considering whether G-IMFCH is safe.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Complaints | Medium | Poor |

One notable case involves a trader who reported being unable to withdraw funds after multiple requests, leading to frustration and financial loss. Such complaints highlight the potential risks associated with trading with G-IMFCH. The company's inadequate response to customer grievances further exacerbates concerns about its reliability and commitment to client satisfaction.

Platform and Trade Execution

The performance of a trading platform is critical for a positive trading experience. G-IMFCH offers a trading platform, but details regarding its stability, execution quality, and user experience are lacking. Reports of slippage and order rejections have surfaced, indicating potential issues with trade execution.

Traders rely on efficient and reliable platforms to execute their trades effectively. If G-IMFCH's platform demonstrates signs of manipulation or inefficiency, it could significantly impact traders' performance and profitability. Users should be cautious and consider these factors when evaluating whether G-IMFCH is a safe broker.

Risk Assessment

The overall risk associated with trading with G-IMFCH is concerning. Given its dubious regulatory status, lack of transparency, and numerous customer complaints, traders should approach this broker with caution.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Classified as a suspicious clone |

| Customer Service | High | Numerous complaints regarding withdrawals |

| Fund Security | High | Lack of clear security measures |

To mitigate these risks, traders should thoroughly research alternative brokers with strong regulatory oversight, transparent fee structures, and positive customer feedback. Engaging with a reputable broker can significantly enhance the safety of traders' investments.

Conclusion and Recommendations

In conclusion, the evidence suggests that G-IMFCH is not a safe broker for forex trading. Its classification as a "suspicious clone," coupled with a high number of complaints and insufficient transparency, raises serious concerns about its legitimacy. Traders should exercise caution and consider the potential risks involved in trading with G-IMFCH.

For traders seeking reliable alternatives, it is advisable to explore brokers that are regulated by top-tier authorities, offer transparent trading conditions, and maintain a positive reputation in the trading community. By prioritizing safety and due diligence, traders can make informed decisions that protect their investments in the forex market.

Is G-IMFCH a scam, or is it legit?

The latest exposure and evaluation content of G-IMFCH brokers.

G-IMFCH Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

G-IMFCH latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.