Is Fortune-ever safe?

Business

License

Is Fortune Ever Safe or Scam?

Introduction

Fortune Ever is a forex broker that has gained attention in the trading community for its various offerings in the foreign exchange market. As with any financial service provider, it is crucial for traders to conduct thorough evaluations before entrusting their funds. The forex market is known for its volatility and risks, making it imperative to assess the legitimacy and safety of brokers. This article aims to provide a comprehensive analysis of Fortune Ever, focusing on its regulatory status, company background, trading conditions, customer fund safety, client experiences, platform performance, risk assessment, and ultimately, whether it is safe or a potential scam.

Regulation and Legitimacy

Fortune Ever operates without any valid regulatory oversight, a significant red flag for potential investors. Regulatory bodies are essential for ensuring that brokers adhere to specific standards designed to protect investors. The absence of regulation raises serious concerns about the safety and legitimacy of the broker's operations. Below is a summary of the regulatory status of Fortune Ever:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of regulation means that Fortune Ever does not have to comply with any regulatory requirements, which may lead to increased risks for traders. Without oversight, there is a higher likelihood of fraudulent activities, and clients might find it challenging to seek recourse in case of disputes. The historical compliance of a broker is also a critical factor, and in this case, Fortune Ever has no documented history of compliance with any regulatory standards.

Company Background Investigation

Fortune Ever was founded with the goal of providing a platform for forex trading, but its operational history remains vague. There is limited information regarding the company's ownership structure and the backgrounds of its management team. A transparent company typically discloses its management team's expertise and experience, which can foster trust among potential clients. Unfortunately, Fortune Ever lacks this transparency, making it difficult for traders to evaluate the credibility of its leadership.

The absence of detailed information about the company's history and ownership raises questions about its reliability. Traders should be cautious when dealing with brokers that do not provide clear insights into their management and operational practices. The lack of transparency can often be indicative of a broader issue, including potential scams or unethical practices.

Trading Conditions Analysis

Fortune Ever offers a range of trading services, but the specifics of its fee structure and trading conditions are essential for potential clients to understand. The overall cost of trading can significantly impact profitability, and it is critical to assess whether the broker's fees align with industry standards. Below is a comparison of core trading costs associated with Fortune Ever:

| Fee Type | Fortune Ever | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Variable | 1.0 pips |

| Commission Structure | N/A | $5 per lot |

| Overnight Interest Range | High | Low |

The absence of a clear commission structure and the potential for high overnight interest rates can be concerning for traders. Unusual fee policies may indicate that the broker is attempting to profit at the expense of its clients, making it crucial for traders to fully understand the cost implications before engaging with Fortune Ever.

Client Fund Safety

The safety of client funds is paramount when evaluating a broker. Fortune Ever does not provide clear information regarding its fund safety measures, such as fund segregation, investor protection, and negative balance protection policies. These elements are vital for ensuring that clients' investments are secure. A broker that fails to implement stringent fund safety measures may expose clients to significant risks, especially in the event of financial instability or mismanagement.

Historically, brokers without robust safety measures have faced issues related to fund mismanagement and client losses. Therefore, traders considering Fortune Ever should be wary of the potential risks involved in entrusting their funds to an unregulated and opaque broker.

Customer Experience and Complaints

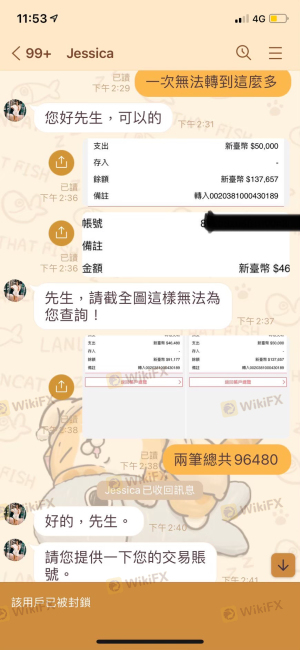

Customer feedback is a valuable source of information when assessing a broker's reliability. Reviews and testimonials from existing clients can provide insights into the quality of service and any recurring issues. In the case of Fortune Ever, several complaints have been noted regarding withdrawal difficulties and unresponsive customer support. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Service Issues | Medium | Unresolved |

| Platform Performance | Medium | Inconsistent |

Two notable cases highlight the concerns surrounding Fortune Ever. One trader reported difficulties in withdrawing funds, which took weeks to resolve, raising concerns about the broker's reliability. Another client experienced poor customer service, with responses taking longer than expected, leading to frustration and dissatisfaction. Such issues can significantly impact a trader's experience and raise questions about the broker's overall trustworthiness.

Platform and Execution Performance

The performance of the trading platform is critical for any broker. Traders expect a reliable, stable, and user-friendly platform that allows them to execute trades efficiently. However, reports indicate that Fortune Ever's platform may suffer from performance issues, including slippage and order rejections. These factors can lead to negative trading experiences and impact profitability. Traders should be cautious when considering a broker that does not provide a seamless trading experience.

Risk Assessment

Engaging with unregulated brokers like Fortune Ever carries inherent risks. Traders must be aware of the potential for loss of funds, lack of recourse in disputes, and the possibility of fraudulent activities. Below is a summary of the key risk areas associated with trading with Fortune Ever:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Potential for fund mismanagement |

| Operational Risk | Medium | Reports of platform performance issues |

To mitigate these risks, traders should consider diversifying their investments and only trading with well-regulated brokers that have a proven track record of reliability and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that Fortune Ever is not a safe broker. The lack of regulation, transparency, and numerous complaints raise significant concerns about its legitimacy. Traders should exercise extreme caution when considering this broker, as there are several red flags indicating that it may not be trustworthy.

For those looking to engage in forex trading, it is advisable to explore alternative brokers that are well-regulated and offer transparent operations. Some recommended options include brokers that are overseen by top-tier regulatory bodies, ensuring a safer trading environment. Always prioritize safety and conduct thorough research before investing your hard-earned money.

Is Fortune-ever a scam, or is it legit?

The latest exposure and evaluation content of Fortune-ever brokers.

Fortune-ever Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Fortune-ever latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.