Regarding the legitimacy of Firmbcpt forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is Firmbcpt safe?

Business

License

Is Firmbcpt markets regulated?

The regulatory license is the strongest proof.

ASIC Inst Deriv Trading License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Inst Deriv Trading License (STP)

Licensed Entity:

ALTUS INVESTIUM LTD

Effective Date: Change Record

2014-08-21Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

WALT COULSTON SE 5 L 5 66 HUNTER ST SYDNEY NSW 2000Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Firmbcpt Safe or a Scam?

Introduction

In the ever-evolving realm of forex trading, Firmbcpt has emerged as a player that promises a range of trading opportunities. Operating primarily in the Australian market, it claims to offer competitive trading conditions and a user-friendly platform. However, as with any financial service, traders must exercise caution and conduct thorough due diligence before engaging with a broker. The forex market is rife with potential scams, and the consequences of falling victim can be severe, leading to significant financial losses. This article aims to provide a comprehensive analysis of Firmbcpt, focusing on its regulatory status, company background, trading conditions, and customer experiences. Our evaluation will be based on a mix of narrative insights and structured data, ensuring a balanced approach to determining whether Firmbcpt is safe or poses risks to traders.

Regulation and Legitimacy

A broker's regulatory status is a critical factor in assessing its legitimacy. Firmbcpt claims to be regulated under the Australian Securities and Investments Commission (ASIC), which is known for its stringent regulatory framework aimed at protecting investors. However, there are concerns regarding the authenticity of this claim, as some sources categorize Firmbcpt as a suspicious clone, suggesting it may not be operating under legitimate oversight.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | Not listed | Australia | Suspicious clone |

The importance of robust regulation cannot be overstated; it provides a safety net for traders, ensuring that brokers adhere to strict operational standards. In the case of Firmbcpt, the lack of a valid license number raises red flags. Furthermore, discussions around its regulatory quality indicate that it may not have a history of compliance. Traders should be wary of engaging with a broker that lacks clear regulatory oversight, as it significantly increases the risk of potential fraud or malpractice.

Company Background Investigation

Understanding the history and ownership structure of Firmbcpt is essential in evaluating its credibility. The company appears to have been established within the last decade, positioning itself as a regional broker in Australia. However, detailed information about its ownership and management team is scarce. The absence of transparency raises concerns about the company's accountability and operational integrity.

Moreover, the management team's background is crucial in determining the firm's reliability. If the team lacks significant experience in the financial sector or has a history of involvement with dubious ventures, this could further compromise the broker's trustworthiness. Unfortunately, there is limited information available regarding the professional qualifications of the individuals behind Firmbcpt, which compounds the uncertainty surrounding its legitimacy.

Trading Conditions Analysis

When evaluating whether Firmbcpt is safe, it is vital to scrutinize its trading conditions. The broker advertises a competitive fee structure, which is often a significant factor for traders. However, several user reviews suggest that there may be hidden fees or unfavorable trading conditions that are not immediately apparent.

| Fee Type | Firmbcpt | Industry Average |

|---|---|---|

| Spread on Major Pairs | Variable | 1.0 - 2.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

While the spreads may seem attractive, the high overnight interest rates could deter long-term traders. Additionally, the lack of a commission model might suggest that the broker compensates through wider spreads, which could impact overall profitability. Traders should carefully assess these conditions against their trading strategies to ensure they align with their financial goals.

Client Funds Security

The security of client funds is paramount in determining whether Firmbcpt is safe. The broker claims to implement various safety measures, including segregated accounts for client funds and investor protection policies. However, the effectiveness of these measures is questionable given the lack of regulatory oversight.

Moreover, the absence of a clear history regarding any past security breaches or fund mismanagement raises further concerns. Traders should prioritize brokers that provide comprehensive details about their fund security measures, including third-party audits and insurance coverage. Without this transparency, it is challenging to ascertain the safety of funds held with Firmbcpt.

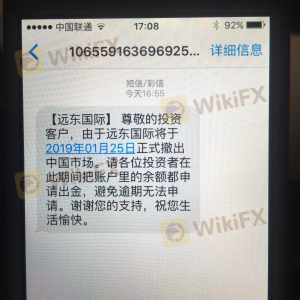

Customer Experience and Complaints

Customer feedback is an invaluable resource when assessing the reliability of a broker. In the case of Firmbcpt, user reviews paint a mixed picture. While some traders report satisfactory experiences, others have voiced significant complaints, particularly regarding withdrawal issues and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Service Issues | Medium | Average |

The most common complaint revolves around withdrawal delays, where clients have reported difficulties in accessing their funds. This is a critical issue, as it directly impacts a trader's ability to manage their investments. Furthermore, the company's lack of timely responses to customer inquiries exacerbates the situation, leaving clients feeling frustrated and unsupported.

Platform and Trade Execution

The trading platform offered by Firmbcpt is a crucial component of the overall trading experience. Users have noted that while the platform is generally stable, there are instances of slippage and order rejections. These issues can significantly affect trading outcomes, particularly for those employing high-frequency trading strategies.

Moreover, any signs of potential platform manipulation should be taken seriously. Traders should remain vigilant and monitor their trades closely to ensure that they are being executed fairly and transparently. If there are consistent issues with execution quality, it may indicate deeper operational problems within the brokerage.

Risk Assessment

When considering whether Firmbcpt is safe, it is essential to evaluate the overall risk profile associated with trading through this broker.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Lack of clear regulation raises concerns. |

| Fund Security | Medium | Uncertain security measures in place. |

| Customer Support | High | Poor response to client issues reported. |

Given these risk factors, traders should approach Firmbcpt with caution. It is advisable to conduct thorough research and consider starting with a small investment to gauge the broker's reliability before committing significant capital.

Conclusion and Recommendations

In conclusion, the evidence suggests that while Firmbcpt presents itself as a legitimate forex broker, there are numerous red flags that warrant caution. The lack of clear regulatory oversight, transparency in company operations, and consistent customer complaints raise serious concerns about its safety and trustworthiness.

For traders considering engaging with Firmbcpt, it is crucial to weigh these risks carefully. If you decide to proceed, consider starting with a minimal investment and closely monitor your trading experience. Alternatively, it may be prudent to explore more established brokers with robust regulatory frameworks and positive customer feedback.

In the forex market, ensuring that your broker is safe is paramount to protecting your investments and achieving your trading goals.

Is Firmbcpt a scam, or is it legit?

The latest exposure and evaluation content of Firmbcpt brokers.

Firmbcpt Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Firmbcpt latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.