Regarding the legitimacy of Fintech Maju Berjangka forex brokers, it provides BAPPEBTI and WikiBit, .

Is Fintech Maju Berjangka safe?

Risk Control

Software Index

Is Fintech Maju Berjangka markets regulated?

The regulatory license is the strongest proof.

BAPPEBTI Forex Trading License (EP)

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

FINTECH MAJU BERJANGKA

Effective Date:

--Email Address of Licensed Institution:

support@fintechberjangka.comSharing Status:

No SharingWebsite of Licensed Institution:

www.fintechberjangka.comExpiration Time:

--Address of Licensed Institution:

GEDUNG MENARA SUDIRMAN LANTAI 7 LOT D, JALAN JENDERAL SUDIRMAN KAV. 60 kelurahan SENAYAN kecamatan KEBAYORAN BARU kota JAKARTA SELATAN propinsi DKI JAKARTAPhone Number of Licensed Institution:

021-8060-4290Licensed Institution Certified Documents:

Is Fintech Maju Berjangka Safe or Scam?

Introduction

Fintech Maju Berjangka is a brokerage firm established in 2019, primarily targeting the Indonesian forex market. It offers a range of trading products including forex, commodities, and derivatives through the popular MetaTrader 4 platform. The rapid growth of online trading has made it essential for traders to carefully evaluate forex brokers to ensure their safety and legitimacy. With numerous reports of scams and fraudulent practices in the industry, understanding the regulatory framework and operational history of a broker is crucial. This article investigates the safety of Fintech Maju Berjangka by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, and potential risks.

Regulation and Legitimacy

Fintech Maju Berjangka operates under the regulation of the Badan Pengawas Perdagangan Berjangka Komoditi (Bappebti), which is Indonesia's regulatory body for commodity futures trading. Being regulated by a recognized authority is a significant indicator of a broker's legitimacy, as it ensures compliance with industry standards and provides a level of protection for traders.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Bappebti | 0001 / UP TP / SIP / 6 / 2021 | Indonesia | Verified |

Regulatory Quality and Compliance History: The presence of a regulatory license from Bappebti suggests that Fintech Maju Berjangka adheres to certain operational standards. However, as it is a relatively new player in the market, having been established only in 2019, its compliance history is limited. Traders should consider the implications of this limited history when assessing whether Fintech Maju Berjangka is safe. The regulatory environment in Indonesia is evolving, and while Bappebti provides oversight, it is essential to remain vigilant about the broker's adherence to regulations and any updates regarding their compliance status.

Company Background Investigation

Fintech Maju Berjangka was founded with the aim of providing a secure and efficient trading environment for Indonesian traders. The company has a relatively short operational history, which may raise concerns about its experience and stability in the competitive forex market.

Management Team and Experience: The management team at Fintech Maju Berjangka consists of professionals with backgrounds in finance and trading. However, detailed information about the team's experience and qualifications is not readily available, which can impact the perceived transparency of the company.

Transparency and Information Disclosure: Transparency is a critical factor in evaluating a broker's credibility. Fintech Maju Berjangka's website provides essential information about its services, trading conditions, and contact details. Nonetheless, the lack of comprehensive disclosures regarding the management team and operational strategies may leave potential clients questioning the company's reliability.

Trading Conditions Analysis

When assessing whether Fintech Maju Berjangka is safe, it is vital to analyze its trading conditions, including fees and spreads. The broker offers competitive trading conditions, but traders should be aware of any unusual or excessive fees that could affect their profitability.

| Fee Type | Fintech Maju Berjangka | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips | 1.5 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | 0.5% - 1.5% | 0.5% - 2.0% |

Overall Fee Structure: The spread on major currency pairs at Fintech Maju Berjangka is slightly lower than the industry average, making it an attractive option for traders. However, the variable commission model may lead to increased costs for frequent traders, which should be considered when determining the overall cost of trading with this broker.

Client Fund Security

Protecting client funds is a paramount concern for any brokerage firm. Fintech Maju Berjangka claims to implement several security measures to safeguard client assets.

Fund Security Measures: The broker utilizes segregated accounts to keep client funds separate from its operational funds. This practice is crucial for ensuring that client funds are protected in the event of financial difficulties faced by the broker. Additionally, Fintech Maju Berjangka offers negative balance protection, which prevents clients from losing more than their initial investment.

Historical Security Issues: As of now, there have been no significant reports of fund security issues or disputes involving Fintech Maju Berjangka. However, traders should remain cautious and conduct due diligence to ensure their funds are secure, especially given the broker's relatively short history in the market.

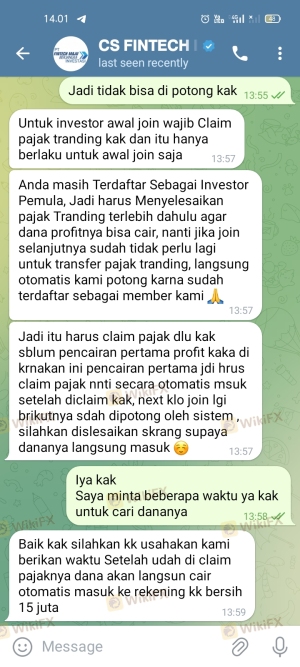

Customer Experience and Complaints

Analyzing customer feedback is essential to understanding the overall reliability of a broker. Fintech Maju Berjangka has received mixed reviews from clients, with some praising its trading platform and others expressing concerns about customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Platform Stability | Medium | Adequate |

| Customer Support Availability | High | Poor |

Common Complaint Patterns: The most frequent complaints revolve around withdrawal issues and the responsiveness of customer support. Some users have reported delays in processing withdrawals, which raises questions about the broker's operational efficiency.

Case Studies: One user reported a delay in withdrawing funds, claiming that customer service was unresponsive for several days. This experience highlights the potential risks associated with trading through Fintech Maju Berjangka and suggests that traders should be prepared for possible delays in accessing their funds.

Platform and Trade Execution

The trading platform offered by Fintech Maju Berjangka is MetaTrader 4, known for its user-friendly interface and advanced trading features.

Platform Performance and Stability: Users have generally reported a stable trading experience, but there have been occasional complaints regarding slippage and order rejections. Such issues can significantly impact trading outcomes, making it essential for traders to monitor their execution quality.

Signs of Platform Manipulation: While there are no substantial reports of manipulation, the presence of slippage and order rejections could indicate underlying issues with the broker's execution process. Traders should remain vigilant and consider these factors when deciding whether Fintech Maju Berjangka is safe.

Risk Assessment

Using Fintech Maju Berjangka involves several risks that traders should consider before opening an account.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Limited compliance history |

| Fund Security Risk | Medium | Segregated accounts in place |

| Customer Service Risk | High | Reports of slow responses and withdrawal issues |

Risk Mitigation Suggestions: Traders are advised to start with a demo account to familiarize themselves with the platform and assess its reliability. Additionally, maintaining a diversified trading portfolio can help mitigate risks associated with any single broker.

Conclusion and Recommendations

In conclusion, while Fintech Maju Berjangka operates under the regulation of Bappebti, its relatively short history and mixed customer feedback warrant caution. The broker does offer competitive trading conditions and robust security measures, but potential clients should be aware of possible withdrawal issues and customer support challenges.

For traders seeking a reliable forex broker, it may be prudent to consider alternatives with a longer operational history and a proven track record of customer satisfaction. Overall, while there are no clear indications that Fintech Maju Berjangka is a scam, prospective clients should conduct thorough research and remain vigilant in their trading activities.

Is Fintech Maju Berjangka a scam, or is it legit?

The latest exposure and evaluation content of Fintech Maju Berjangka brokers.

Fintech Maju Berjangka Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Fintech Maju Berjangka latest industry rating score is 5.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.