Executive Summary

This fintech maju berjangka review looks at a new forex broker in the trading world. Fintech Maju Berjangka started in 2019 and works under Indonesia's Badan Pengawas Perdagangan Berjangka Komoditi, which watches over commodity futures trading. The broker gives traders access to financial derivatives trading. Users really like this broker, giving it a perfect 5-star rating that shows strong client approval.

The platform uses MetaTrader 4, which many traders know well. It offers many different things to trade like forex, futures, stocks, indices, and cryptocurrencies. This wide selection makes Fintech Maju Berjangka a good choice for investors who want to trade different financial markets through one platform.

The broker focuses on small to medium-sized investors who want to trade financial derivatives. Since the company is new, there isn't much historical data, but the high user ratings show that people like the service so far.

Important Disclaimers

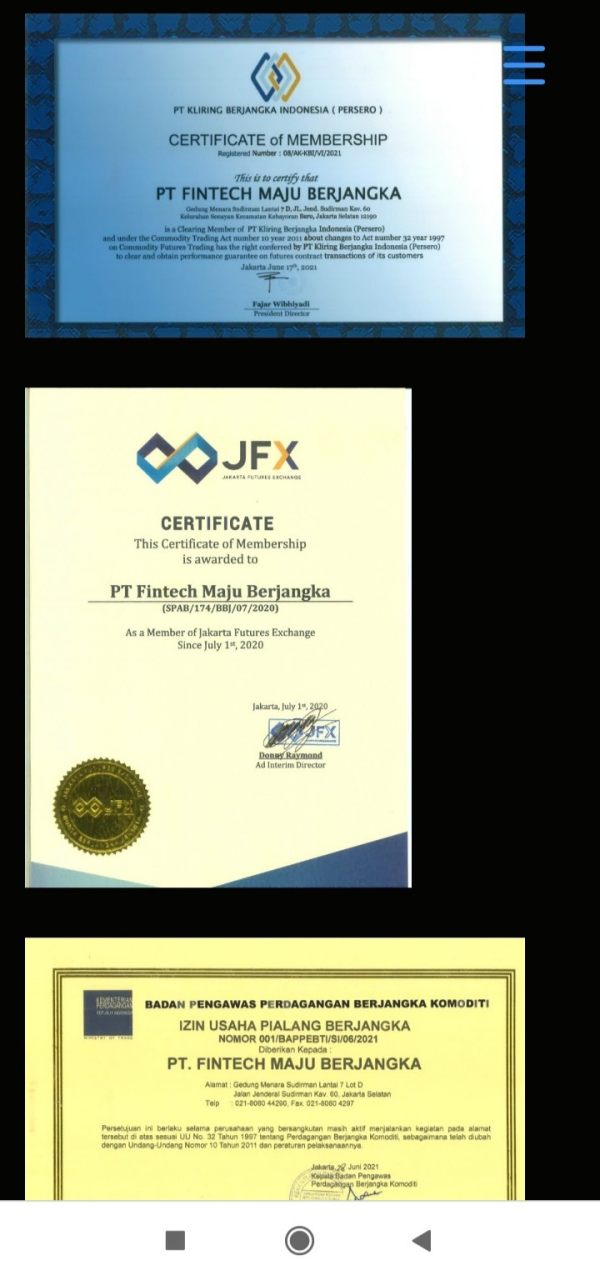

Fintech Maju Berjangka works under Indonesian rules through Badan Pengawas Perdagangan Berjangka Komoditi. Potential clients must think carefully about regional legal and regulatory differences that may affect their trading. Rules are different in different countries, so traders should check if they can use the platform legally before they start.

This review uses available user feedback and public platform information. Like any financial service review, personal opinions may influence the assessment, and individual trading experiences may be very different from what this analysis shows.

Broker Rating Framework

Broker Overview

Fintech Maju Berjangka started in 2019 in the fast-changing fintech world. The company connects traditional financial derivatives trading with modern technology solutions, though specific headquarters location information is not available. The broker's recent start shows the growing trend of technology-driven financial service providers trying to make complex trading instruments easier to access.

The company focuses on providing complete online trading solutions across multiple financial derivatives categories. This lets clients diversify their trading through one platform, which may reduce complexity while keeping broad market exposure opportunities.

Fintech Maju Berjangka only uses the MetaTrader 4 platform. This choice uses one of the industry's most established and trusted trading environments, and the broker gives access to five major asset categories: foreign exchange, futures contracts, stock derivatives, market indices, and cryptocurrency instruments. This diverse offering lets traders use various strategies across different market conditions and risk profiles, while regulatory compliance is maintained through Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan.

Regulatory Jurisdiction: Fintech Maju Berjangka works under Indonesia's Badan Pengawas Perdagangan Berjangka Komoditi supervision. This ensures compliance with local financial regulations and gives traders regulatory protection within Indonesian jurisdiction.

Deposit and Withdrawal Methods: Specific information about payment processing methods, supported currencies, and transaction procedures is not detailed in available documentation.

Minimum Deposit Requirements: Current documentation does not specify minimum deposit amounts or account funding requirements for different account types.

Promotional Offerings: Information about bonus structures, promotional campaigns, or incentive programs is not available in current documentation.

Tradeable Assets: The platform provides complete access to financial derivatives across five major categories: foreign exchange pairs, futures contracts, stock derivatives, market indices, and cryptocurrency instruments. This offers traders diverse portfolio construction opportunities.

Cost Structure: Detailed information about spread configurations, commission structures, overnight fees, and other trading costs is not specified in available documentation. Direct platform inquiry is required for precise pricing details.

Leverage Ratios: Specific leverage offerings and margin requirements across different instrument categories are not detailed in current documentation.

Platform Selection: The broker only uses MetaTrader 4 as its primary trading platform. This gives traders access to advanced charting tools, automated trading capabilities, and comprehensive market analysis features suitable for various trading strategies and experience levels.

Geographic Restrictions: Information about territorial limitations, restricted jurisdictions, or regional access constraints is not specified in available documentation.

Customer Support Languages: Customer service is available through email communication at the provided support address. However, specific language support options and multilingual capabilities are not detailed in current documentation.

This comprehensive fintech maju berjangka review continues with detailed analysis across all evaluation dimensions to give traders thorough insights into the broker's capabilities and limitations.

Detailed Rating Analysis

Account Conditions Analysis

Evaluating Fintech Maju Berjangka's account conditions is challenging because there's limited public information about specific account structures and requirements. Current documentation doesn't provide details about various account types that may be offered, making it hard to assess the diversity and appropriateness of account options for different trader profiles and investment levels.

Minimum deposit requirements, which serve as crucial entry barriers for potential clients, are not specified in available materials. This lack of transparency about initial funding requirements prevents prospective traders from making informed decisions about platform accessibility relative to their financial capabilities and investment intentions.

The account opening process, including verification procedures, documentation requirements, and approval timeframes, is not detailed in current documentation. Additionally, specialized account features such as Islamic accounts for Sharia-compliant trading, professional trader accounts, or institutional arrangements are not mentioned in available information.

Without comprehensive account condition details, this fintech maju berjangka review cannot provide definitive scoring for this dimension. This highlights the need for potential clients to directly contact the broker for specific account-related information before making platform selection decisions.

Fintech Maju Berjangka shows solid capabilities in tools and resources through its strategic platform selection and instrument diversity. The broker's exclusive use of MetaTrader 4 gives traders access to one of the industry's most established and feature-rich trading environments, supporting advanced charting capabilities, technical analysis tools, and automated trading functionality through Expert Advisors.

The platform's comprehensive instrument selection across forex, futures, stocks, indices, and cryptocurrencies offers traders significant diversification opportunities. This also gives them the ability to implement complex trading strategies across multiple asset classes, and this multi-asset approach enables portfolio diversification and risk management through a single trading interface.

However, current documentation doesn't provide specific information about additional research and analysis resources, educational materials, or proprietary trading tools that might enhance the trading experience. The absence of details about market research, economic calendars, trading signals, or educational content represents potential areas where the broker's offering may be limited compared to more comprehensive service providers.

Automated trading support through MetaTrader 4's Expert Advisor functionality provides sophisticated traders with algorithmic trading capabilities. However, specific platform customizations or proprietary automation tools are not mentioned in available documentation.

Customer Service and Support Analysis

The customer service infrastructure at Fintech Maju Berjangka appears limited based on available information. Email support is the primary documented communication channel through their designated support address, and while email support can be effective for non-urgent inquiries and detailed problem resolution, the absence of additional contact methods such as live chat, telephone support, or social media channels may limit immediate assistance availability.

Response time expectations, service level agreements, and support availability hours are not specified in current documentation. This makes it difficult for potential clients to set appropriate expectations for support interactions, and the quality of service delivery, staff expertise levels, and problem resolution effectiveness cannot be adequately assessed without specific user feedback regarding support experiences.

Multilingual support capabilities remain unclear, which could be particularly relevant given the broker's Indonesian regulatory jurisdiction and potential international client base. Language barriers could significantly impact support effectiveness for non-Indonesian speaking clients.

The lack of comprehensive support channel information suggests that clients may need to rely primarily on platform self-service capabilities and community resources. This potentially limits assistance availability during critical trading situations or technical difficulties.

Trading Experience Analysis

The trading experience evaluation for Fintech Maju Berjangka faces limitations due to insufficient specific user feedback regarding platform performance, execution quality, and overall trading environment characteristics. While the broker uses MetaTrader 4, which generally provides reliable platform stability and comprehensive functionality, specific performance metrics for this particular implementation are not available in current documentation.

Order execution quality, including fill rates, slippage characteristics, and execution speed during various market conditions, cannot be adequately assessed without detailed user experience reports or platform performance data. These factors significantly impact trading profitability and overall client satisfaction.

Platform functionality completeness through MetaTrader 4 suggests standard features including advanced charting, technical indicators, automated trading capabilities, and market analysis tools should be available. However, any broker-specific customizations or limitations are not documented.

Mobile trading experience, which has become increasingly important for modern traders, is not specifically addressed in available information. The availability and functionality of mobile applications or mobile-optimized web platforms remain unclear.

The overall trading environment, including market access during news events, weekend trading availability, and platform reliability during high volatility periods, requires direct user feedback for accurate assessment. This information is not comprehensively available in current documentation, so this fintech maju berjangka review cannot provide definitive scoring for trading experience without more detailed performance data and user feedback.

Trustworthiness Analysis

Fintech Maju Berjangka demonstrates solid trustworthiness foundations through its regulatory compliance with Indonesian authorities and exceptional user rating performance. The broker's supervision by Badan Pengawas Perdagangan Berjangka Komoditi provides regulatory oversight and compliance framework, ensuring adherence to local financial market standards and offering clients protection within Indonesian jurisdiction.

The remarkable 5-star user rating suggests strong client satisfaction and positive service delivery experiences. This indicates that existing users have generally favorable perceptions of the broker's reliability and service quality, and this high rating level, while based on potentially limited sample size given the company's recent establishment, represents positive market reception.

However, specific fund safety measures, client money segregation practices, and additional security protocols are not detailed in available documentation. These factors are crucial for comprehensive trustworthiness assessment, particularly regarding client asset protection and operational security standards.

Company transparency regarding ownership structure, financial statements, and operational details appears limited in publicly available information. This may concern some potential clients seeking comprehensive due diligence information.

The presence of isolated negative exposure incidents, while minimal, suggests the importance of continued monitoring of client feedback and complaint resolution effectiveness to maintain current positive reputation levels.

User Experience Analysis

User experience evaluation reveals a generally positive but limited feedback profile for Fintech Maju Berjangka. The perfect 5-star overall rating indicates high satisfaction levels among current users, suggesting effective service delivery and platform functionality that meets client expectations within the broker's operational scope.

However, the presence of isolated negative exposure incidents indicates that not all client experiences have been uniformly positive. This highlights the importance of understanding potential service limitations or areas requiring improvement, and the specific nature and resolution of these negative experiences are not detailed in available documentation.

Interface design quality, navigation efficiency, and overall platform usability cannot be comprehensively assessed without detailed user interface reviews and usability testing feedback. These factors significantly impact daily trading efficiency and client satisfaction levels.

Registration and account verification processes, including required documentation, approval timeframes, and potential complications, are not specifically addressed in available user feedback. This makes it difficult to assess onboarding experience quality.

Fund management operations, including deposit processing times, withdrawal efficiency, and payment method reliability, require specific user experience data for accurate evaluation. This information is not comprehensively available in current documentation.

The broker appears well-suited for small to medium-sized investors seeking diversified financial derivatives trading opportunities. However, specific user demographic analysis and satisfaction segmentation data would enhance understanding of optimal client fit.

Conclusion

This comprehensive fintech maju berjangka review reveals a broker with promising foundations but limited transparency in several crucial operational areas. While Fintech Maju Berjangka demonstrates strong user satisfaction with its perfect 5-star rating and provides solid regulatory compliance through Indonesian oversight, significant information gaps regarding account conditions, cost structures, and detailed service specifications limit comprehensive evaluation capabilities.

The broker appears most suitable for investors seeking access to diversified financial derivatives trading through the established MetaTrader 4 platform. This is particularly true for those comfortable operating within Indonesian regulatory jurisdiction, and the multi-asset offering spanning forex, futures, stocks, indices, and cryptocurrencies provides valuable diversification opportunities for portfolio construction.

Primary advantages include exceptional user ratings, regulatory compliance, diverse trading instruments, and utilization of industry-standard trading platform technology. However, limitations include insufficient transparency regarding account conditions, cost structures, comprehensive customer support infrastructure, and detailed service specifications that potential clients require for informed decision-making.

Prospective traders should conduct direct platform inquiries to obtain specific information regarding account requirements, trading costs, and service details before making final platform selection decisions.