Is Expertise Trader safe?

Business

License

Is Expertise Trader A Scam?

Introduction

Expertise Trader, also known as experti setrader 4.net, positions itself as an online broker offering various trading options including Forex, cryptocurrencies, stocks, and binary options. However, the rise of online trading has also led to an increase in fraudulent activities, making it crucial for traders to conduct thorough evaluations of brokers before investing their hard-earned money. This article aims to provide a comprehensive assessment of Expertise Trader, focusing on its regulatory status, company background, trading conditions, customer fund safety, user experiences, and overall risk profile. Our analysis is based on a review of multiple credible sources, including regulatory warnings and user feedback, to determine whether Expertise Trader is indeed a safe platform or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in assessing its legitimacy. Expertise Trader has been flagged by several financial authorities, including the CNMV (Comisión Nacional del Mercado de Valores) in Spain, which issued warnings about its fraudulent activities. Such warnings are significant red flags for potential investors.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CNMV | N/A | Spain | Blacklisted |

| FMA | N/A | Austria | Blacklisted |

The absence of a valid regulatory license raises concerns about the safety of funds and the broker's compliance with industry standards. Regulated brokers are required to adhere to strict guidelines, including the segregation of client funds and regular audits, which are designed to protect investors. In contrast, Expertise Trader's lack of regulation suggests a higher risk of malpractice and financial loss. Therefore, traders should exercise extreme caution when considering this broker.

Company Background Investigation

Expertise Trader claims to be operated by Expertise Trader Ltd., allegedly based in the United States. However, this information is dubious as the broker does not provide verifiable details about its ownership or operational history. The company lacks transparency, which is a significant concern for potential investors.

The management team behind Expertise Trader remains largely anonymous, with no credible information available regarding their qualifications or experience in the financial industry. This lack of transparency can be indicative of a scam, as reputable brokers typically provide detailed information about their team and company history. Additionally, the broker has not disclosed any legal documents, such as client agreements or terms and conditions, which further undermines its credibility.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential. Expertise Trader presents a high minimum deposit requirement of $600, which is considerably above the industry average. Most reputable brokers allow traders to start with deposits as low as $100 or $250, making this an unusual and potentially exploitative policy.

| Fee Type | Expertise Trader | Industry Average |

|---|---|---|

| Spread for Major Pairs | N/A | 1-2 pips |

| Commission Structure | N/A | Varies widely |

| Overnight Interest Range | N/A | Varies widely |

The lack of clarity regarding spreads and commissions raises further concerns about the broker's cost structure. Traders may find themselves facing hidden fees or unfavorable trading conditions that could erode their profits. Such practices are often employed by unregulated brokers to maximize their own gains at the expense of traders.

Customer Fund Safety

The safety of customer funds is paramount when selecting a broker. Expertise Trader does not provide adequate information regarding its fund security measures. There are no indications of segregated accounts, which are essential for protecting client funds from being used for operational expenses. Furthermore, the absence of investor protection schemes raises alarms about the potential loss of funds in the event of the broker's insolvency.

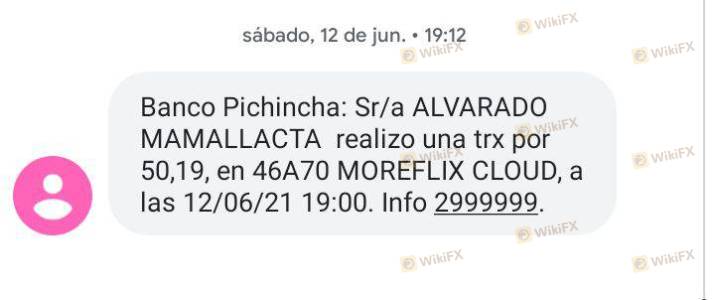

Historical complaints against Expertise Trader indicate that clients have faced significant difficulties in withdrawing their funds, a common issue with fraudulent brokers. Such practices not only jeopardize traders' investments but also highlight the broker's lack of accountability.

Customer Experience and Complaints

User experiences provide valuable insights into a broker's reliability. Expertise Trader has received numerous negative reviews, with many users reporting issues related to fund withdrawals and unresponsive customer service. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Poor |

| Customer Support Delays | High | Poor |

For instance, one user reported that their account was suddenly blocked, preventing them from accessing their funds. Another individual noted that attempts to withdraw money were met with vague excuses and delays, leading to frustration and financial loss. Such patterns of behavior are characteristic of scams and should be taken seriously by prospective traders.

Platform and Trade Execution

A broker's trading platform is a critical aspect of the trading experience. Expertise Trader claims to offer a proprietary trading platform; however, reviews indicate that it lacks essential features commonly found in reputable trading software. Users have reported issues with stability, order execution quality, and high slippage rates.

The absence of standard trading tools, such as MetaTrader 4 or MetaTrader 5, raises concerns about the broker's legitimacy. Legitimate brokers typically provide robust platforms that facilitate effective trading, while Expertise Trader's platform appears to be inadequate and unreliable.

Risk Assessment

Using Expertise Trader presents several risks that potential investors should consider. The lack of regulation, poor customer feedback, and questionable trading practices contribute to a high-risk environment.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Fund Safety Risk | High | No segregation of client funds |

| Withdrawal Risk | High | Historical issues with fund access |

To mitigate these risks, traders should seek brokers with established regulatory frameworks, transparent operations, and positive user feedback. It is essential to conduct thorough research and consider alternative, reputable brokers for safer trading experiences.

Conclusion and Recommendations

In conclusion, the evidence suggests that Expertise Trader is not a safe broker and exhibits several characteristics of a potential scam. The lack of regulation, poor customer experiences, and questionable trading conditions raise significant red flags. Therefore, traders are advised to exercise extreme caution when considering this broker.

For those looking to engage in Forex and other trading activities, it is recommended to explore alternative brokers that are regulated and have a proven track record of reliability and customer satisfaction. Some reputable options include brokers regulated by the FCA, ASIC, or other recognized financial authorities. Always prioritize safety and transparency in your trading endeavors to protect your investments effectively.

Is Expertise Trader a scam, or is it legit?

The latest exposure and evaluation content of Expertise Trader brokers.

Expertise Trader Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Expertise Trader latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.