Is ExpertFX safe?

Business

License

Is ExpertFX A Scam?

Introduction

ExpertFX positions itself as a player in the forex market, offering trading services that promise competitive conditions and advanced trading tools. However, the rise of online trading has brought about a proliferation of brokers, making it crucial for traders to exercise caution when selecting a platform. The potential for scams in the forex industry is significant, and due diligence is essential to safeguard ones investments. This article aims to provide an objective analysis of ExpertFX, examining its regulatory status, company background, trading conditions, customer experiences, and overall safety. The investigation is based on a review of various sources, including regulatory bodies, user reviews, and financial analysis.

Regulation and Legitimacy

The regulatory framework within which a broker operates is fundamental to ensuring the safety of traders' funds. ExpertFX claims to be regulated by the Financial Services Authority (FSA) of St. Vincent and the Grenadines. However, it is crucial to note that this regulatory body is not considered reputable compared to other major regulators like the FCA in the UK or ASIC in Australia.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSA | Not disclosed | St. Vincent | Unverified |

The lack of stringent regulatory oversight raises significant concerns about the safety of funds and the legitimacy of the trading practices employed by ExpertFX. Furthermore, the FSA does not offer substantial protection or compensation for traders in the event of broker insolvency or fraud. This regulatory environment places ExpertFX in a precarious position, making it imperative for potential investors to ask, is ExpertFX safe? Given the absence of strong regulatory backing and the associated risks, trading with ExpertFX could be considered hazardous.

Company Background Investigation

ExpertFX was established in 2018 and claims to operate out of St. Vincent and the Grenadines. However, the company lacks transparency regarding its ownership structure and management team. This opacity raises red flags about the broker's credibility. A thorough examination of the company's history reveals no significant milestones or achievements that would instill confidence in its operations.

The management team's background is also unclear, with minimal information available regarding their qualifications or experience in the financial sector. This lack of transparency is concerning, as it suggests that traders may be dealing with an anonymous entity, further complicating the question of is ExpertFX safe? The absence of clear information about the company's structure and management can lead to mistrust among potential clients, making it crucial for traders to consider these factors before engaging with ExpertFX.

Trading Conditions Analysis

The trading conditions offered by ExpertFX are another critical aspect to evaluate. The broker claims to provide competitive spreads and various account types. However, user reviews indicate that the actual trading costs may be higher than advertised, with some traders reporting spreads starting from 2.8 pips, which is significantly above the industry average.

| Fee Type | ExpertFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.8 pips | 1.0-1.5 pips |

| Commission Model | Not disclosed | Varies widely |

| Overnight Interest Range | Not disclosed | Varies widely |

Additionally, there are reports of hidden fees, such as withdrawal fees and inactivity charges, which can significantly impact traders' profitability. The lack of clarity surrounding these fees raises further questions about the broker's integrity. Thus, potential clients should critically assess whether is ExpertFX safe for their trading needs, especially in light of the potential for unexpected costs.

Client Fund Security

The security of client funds is paramount when assessing any forex broker. ExpertFX claims to implement measures for fund safety, including segregated accounts. However, the effectiveness of these measures is questionable given the regulatory environment in which the broker operates.

There is no evidence to suggest that ExpertFX offers any investor protection or negative balance protection policies, which are standard among reputable brokers. Past incidents involving unregulated brokers have highlighted the risks associated with inadequate fund protection, making it essential for traders to consider whether is ExpertFX safe for their investments. Historical disputes or issues related to fund security have not been documented, but the lack of robust regulatory oversight raises concerns about the potential for future problems.

Customer Experience and Complaints

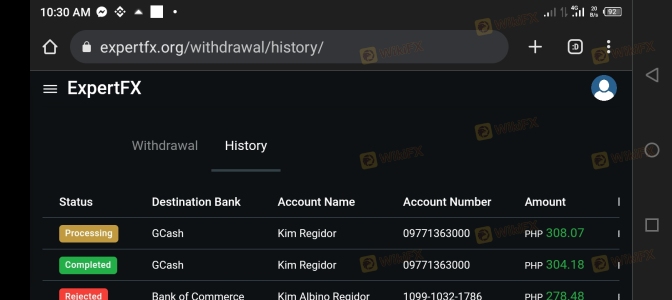

Customer feedback is a valuable indicator of a broker's reliability. Analysis of user reviews reveals a pattern of complaints regarding withdrawal difficulties and unresponsive customer service. Many users have reported challenges in accessing their funds, with some alleging that their accounts were blocked without explanation.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Customer Service | Medium | Poor |

These complaints suggest a troubling trend that could indicate deeper issues within the company's operational framework. For instance, one user reported being unable to withdraw their funds after a profitable trading session, raising serious concerns about the broker's practices. Such experiences lead to the question of whether is ExpertFX safe, especially for those who may rely on timely access to their funds.

Platform and Trade Execution

The trading platform offered by ExpertFX is critical to the user experience. While the broker claims to use popular trading platforms like MetaTrader 4 and MetaTrader 5, user reviews indicate that the platforms may suffer from instability and technical glitches.

The quality of trade execution is equally important, with reports of slippage and order rejections. These issues can significantly impact trading performance and profitability. Traders must assess whether the platform's performance aligns with their expectations and if they can trust ExpertFX to provide a reliable trading environment. The question of is ExpertFX safe extends beyond regulatory compliance to encompass the quality of the trading experience provided.

Risk Assessment

Engaging with ExpertFX carries inherent risks, primarily due to its unregulated status and questionable operational practices.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of reputable regulation raises concerns. |

| Fund Safety Risk | High | Insufficient protection measures for client funds. |

| Customer Service Risk | Medium | Reports of poor customer service and withdrawal issues. |

To mitigate these risks, potential traders are advised to conduct thorough research, seek alternative regulated brokers, and remain vigilant about their trading practices. The question of is ExpertFX safe should weigh heavily in the decision-making process.

Conclusion and Recommendations

In conclusion, the analysis of ExpertFX raises significant concerns regarding its legitimacy and safety. The absence of reputable regulation, coupled with a lack of transparency and numerous customer complaints, suggests that potential traders should approach this broker with caution.

For those considering forex trading, it is advisable to seek out regulated brokers with proven track records and robust customer support. Alternatives such as brokers regulated by the FCA or ASIC may provide a safer trading environment. Ultimately, the question remains: is ExpertFX safe? The evidence points towards a conclusion that suggests significant risks, making it prudent for traders to explore more reliable options.

Is ExpertFX a scam, or is it legit?

The latest exposure and evaluation content of ExpertFX brokers.

ExpertFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ExpertFX latest industry rating score is 1.39, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.39 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.