Is Eiler FX safe?

Business

License

Is Eiler FX A Scam?

Introduction

Eiler FX is an online forex broker that claims to offer a wide range of trading instruments and services to its clients. Positioned as a gateway to diverse trading opportunities, Eiler FX has attracted the attention of both novice and experienced traders. However, with the rise of online trading scams, it is crucial for traders to exercise caution when selecting a broker. The potential for fraud in the forex market is significant, and traders must thoroughly evaluate the legitimacy and reliability of any broker before committing their funds. This article aims to provide an in-depth analysis of Eiler FX, examining its regulatory status, company background, trading conditions, and customer experiences to determine whether it is safe or a scam.

Regulation and Legitimacy

Regulation is a critical factor in assessing the safety of any forex broker. A regulated broker is subject to oversight by a financial authority, which helps to ensure compliance with industry standards and protects clients' funds. Unfortunately, Eiler FX operates without any regulatory oversight, which raises significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that Eiler FX does not adhere to the stringent requirements that regulated brokers must follow, such as maintaining segregated accounts for clients funds and providing negative balance protection. Additionally, Eiler FX claims to be associated with IG Group Ltd., a reputable company, but a search in the Financial Conduct Authority (FCA) register reveals no affiliation. This lack of transparency is a red flag, indicating that Eiler FX is operating in a potentially fraudulent manner. The lack of regulatory oversight not only puts traders' funds at risk but also limits their legal recourse in case of disputes or issues with withdrawals.

Company Background Investigation

Eiler FX is purportedly owned and operated by IG Group Ltd., with its offices located in the United Kingdom and St. Lucia. However, the company's claims about its history and ownership structure are questionable. The lack of verifiable information regarding the management team and their professional backgrounds further adds to the uncertainty surrounding Eiler FX.

The companys website does not provide sufficient details about its operational history or the individuals behind its management. This lack of transparency is concerning, as it makes it difficult for potential clients to assess the credibility of the broker. A reputable broker typically offers detailed information about its team, including qualifications and experience in the financial industry. In contrast, Eiler FX appears to operate with a significant degree of anonymity, making it difficult for traders to trust the platform.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is essential. Eiler FX offers various trading instruments, including forex, commodities, and cryptocurrencies, with a minimum deposit requirement of $250. However, the overall fee structure and trading conditions are not as favorable as they may initially appear.

| Fee Type | Eiler FX | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 2 pips | 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

Eiler FX's spreads are notably higher than the industry average, which can significantly impact profitability for traders. Additionally, the lack of transparency regarding commission structures and overnight interest rates raises further concerns. Traders should be wary of brokers that do not clearly disclose their fees, as hidden costs can erode potential profits.

Customer Funds Safety

The safety of customer funds is paramount when selecting a forex broker. Eiler FX lacks essential safety measures, such as segregated accounts and investor protection schemes. This means that traders' funds are not guaranteed, and in the event of the broker's insolvency, clients may lose their investments entirely.

Furthermore, the absence of negative balance protection means that traders could end up owing money to the broker if their account balance falls below zero. The lack of these critical safety features is a clear indication that Eiler FX does not prioritize the security of its clients' funds, making it a risky option for traders.

Customer Experience and Complaints

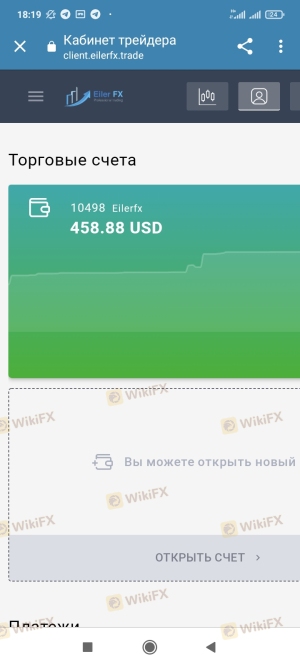

Customer feedback is a valuable resource for assessing the reliability of a broker. Reviews and testimonials about Eiler FX indicate a pattern of negative experiences among users. Common complaints include difficulties with withdrawals, lack of responsive customer support, and issues with account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Account Management | High | Poor |

Many users have reported being unable to withdraw their funds, which is a significant warning sign. In some cases, clients claim that their withdrawal requests were met with delays or outright denials, raising concerns about the broker's integrity. The company's poor response to complaints further exacerbates the situation, leaving traders feeling frustrated and unsupported.

Platform and Trade Execution

The trading platform offered by Eiler FX is another crucial aspect to consider. While the broker claims to provide a user-friendly interface, many users have reported issues with platform stability and execution quality. Problems such as slippage and order rejections can severely impact trading performance.

The absence of a well-known trading platform, such as MetaTrader 4 or 5, raises additional concerns about the broker's legitimacy. A reputable broker typically offers advanced trading software that includes essential features for effective trading. Eiler FX's platform appears to lack these capabilities, which may hinder traders' ability to execute their strategies effectively.

Risk Assessment

Using Eiler FX presents several risks that traders should be aware of. The lack of regulation, high fees, and poor customer feedback contribute to an overall risk profile that is concerning.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | No protection for customer funds |

| Operational Risk | Medium | Issues with platform stability |

To mitigate these risks, traders should consider using regulated brokers with a proven track record. It is essential to perform thorough due diligence and seek out platforms that prioritize customer security and transparency.

Conclusion and Recommendations

In conclusion, the analysis of Eiler FX raises significant concerns about its legitimacy and safety. The lack of regulation, poor customer feedback, and questionable trading conditions indicate that Eiler FX may not be a trustworthy broker. Traders should exercise extreme caution when considering this platform and be vigilant about the potential for fraud.

For those seeking to engage in forex trading, it is advisable to choose regulated brokers that offer transparent fee structures, robust customer support, and strong protections for client funds. Alternatives such as brokers regulated by the FCA, ASIC, or CySEC may provide a safer and more reliable trading environment.

In summary, is Eiler FX safe? The evidence suggests otherwise, and potential clients should be wary of engaging with this broker.

Is Eiler FX a scam, or is it legit?

The latest exposure and evaluation content of Eiler FX brokers.

Eiler FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Eiler FX latest industry rating score is 1.42, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.42 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.