Is EIGENFX safe?

Business

License

Is EigenFX A Scam?

Introduction

EigenFX is a forex broker that positions itself within the competitive landscape of online trading, offering a variety of trading instruments, including forex pairs, CFDs, and options. Established with the intent to cater to both novice and experienced traders, the platform promises an array of features and trading opportunities. However, with the rise of numerous fraudulent schemes in the forex market, investors must exercise caution when selecting brokers. This article aims to provide an objective analysis of EigenFX, exploring its regulatory status, company background, trading conditions, customer experiences, and overall risks associated with trading on this platform. Our investigative approach combines qualitative assessments and quantitative data drawn from various reputable sources, ensuring a comprehensive evaluation of whether EigenFX is safe or a scam.

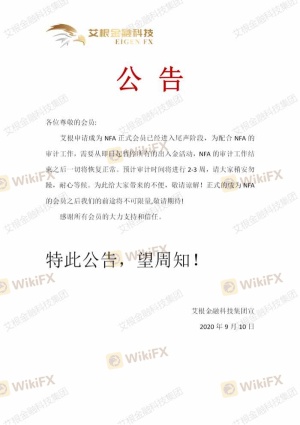

Regulation and Legitimacy

The regulatory environment is a critical factor when assessing the legitimacy of any forex broker. Regulatory bodies are tasked with overseeing trading practices and protecting investors from fraud. EigenFX's regulatory status raises significant concerns, as it currently operates without proper oversight from recognized financial authorities. Below is a summary of the core regulatory information regarding EigenFX:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

The absence of regulation is alarming, especially in an industry where oversight is crucial for safeguarding traders' interests. Without a regulatory framework, EigenFX lacks accountability, and traders may face challenges in recovering funds in case of disputes. Historically, brokers without regulation have been associated with higher risks, including fraudulent activities and mismanagement of client funds. Thus, it is imperative for potential traders to consider the lack of regulatory oversight when evaluating if EigenFX is safe.

Company Background Investigation

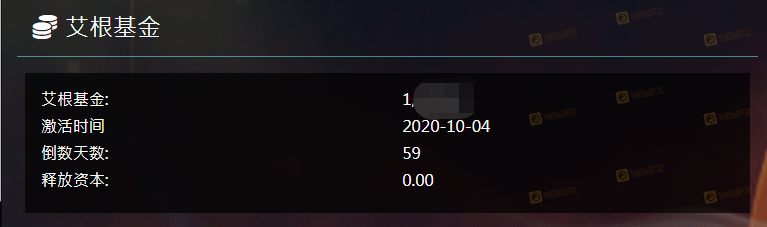

EigenFX's history and ownership structure are essential components in determining its trustworthiness. Unfortunately, detailed information about the company's founding, ownership, and operational history is sparse. The lack of transparency regarding its management team further complicates the assessment. A reputable broker typically provides comprehensive details about its leadership and operational practices, which fosters trust among potential clients.

The management team‘s professional backgrounds are also crucial; experienced leaders with a solid track record in the financial industry can significantly enhance a broker's credibility. However, EigenFX does not provide sufficient information about its team, which is a red flag for potential investors. Transparency in operations and clear communication about the company’s history are vital for building trust, and the absence of such information raises questions about whether EigenFX is a scam.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions, including fees and costs, is paramount. EigenFX offers various account types, each with different deposit requirements and leverage options. However, the overall fee structure and potential hidden costs remain unclear. Below is a comparison of EigenFX's core trading costs against industry averages:

| Fee Type | EigenFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.2 pips | 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

While EigenFX advertises competitive spreads, the lack of clarity regarding commissions and overnight interest raises concerns. Unusual or hidden fees can significantly impact profitability, and traders should be wary of any broker that does not provide transparent pricing structures. Therefore, potential clients must consider these factors carefully when assessing whether EigenFX is safe for investment.

Client Funds Security

The safety of client funds is a primary concern for traders. EigenFX claims to implement various security measures; however, the specifics regarding fund segregation and investor protection remain vague. A reputable broker typically holds client funds in segregated accounts, ensuring that they are kept separate from the broker's operational funds. This practice protects traders in the event of the broker's insolvency.

Moreover, investor protection schemes, often provided by regulatory bodies, offer additional layers of security. Unfortunately, EigenFX lacks affiliation with any regulatory authority, which means that traders may not have access to such protections. The absence of a clear policy on negative balance protection is another concern, as it could lead to traders losing more than their initial investment. Given these factors, it is crucial for potential clients to weigh the risks associated with trading on EigenFX when considering if EigenFX is a scam.

Customer Experience and Complaints

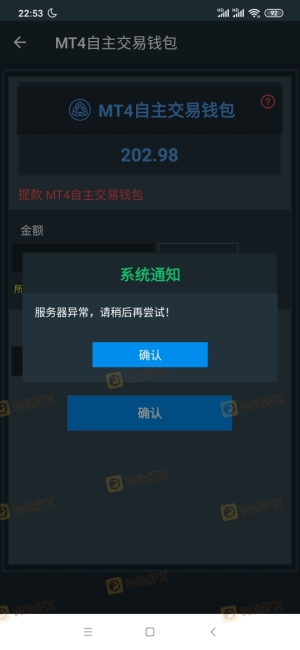

Understanding the customer experience is vital when evaluating a broker's reliability. Reviews and feedback from existing users can provide insights into the broker's operational integrity and responsiveness. Common complaints against EigenFX include issues related to withdrawal difficulties, lack of transparency, and inadequate customer support. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Transparency | Medium | Average |

| Customer Support Issues | High | Poor |

For instance, several users have reported challenges in withdrawing funds, which is a significant red flag. A broker's ability to facilitate withdrawals promptly is fundamental to its credibility. Additionally, the quality of customer support plays a crucial role in resolving issues; however, EigenFX has received mixed reviews in this area. The consistent pattern of complaints raises serious concerns about whether EigenFX is safe for traders.

Platform and Execution

The trading platform's performance, including stability and execution quality, is critical for a positive trading experience. EigenFX utilizes popular platforms like MetaTrader 4 and 5, which are known for their robust features. However, users have reported issues with order execution, including slippage and rejections. These problems can affect trading outcomes and lead to frustration among traders.

Moreover, any signs of platform manipulation, such as frequent slippage or unauthorized trade rejections, should be taken seriously. If traders observe patterns that suggest manipulation, it could indicate deeper issues within the broker's operational practices. Therefore, assessing the execution quality and overall platform performance is essential when determining if EigenFX is a scam.

Risk Assessment

Trading with EigenFX involves several risks that potential clients should be aware of. The lack of regulatory oversight, unclear fee structures, and customer complaints contribute to an overall risk profile that is concerning. Below is a risk assessment summary:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | Medium | Lack of transparency regarding fees |

| Operational Risk | High | History of withdrawal issues and complaints |

To mitigate these risks, potential traders should conduct thorough due diligence before engaging with EigenFX. This includes starting with a small investment, utilizing demo accounts, and being cautious with larger deposits. Understanding the risks involved is crucial for making informed trading decisions, particularly when evaluating if EigenFX is safe.

Conclusion and Recommendations

In conclusion, the evidence suggests that potential traders should exercise extreme caution when considering EigenFX as a trading partner. The lack of regulatory oversight, coupled with a history of customer complaints and unclear trading conditions, raises significant red flags. While the broker offers a range of trading instruments and competitive spreads, the associated risks may outweigh the benefits.

For traders seeking a reliable and safe trading environment, it may be prudent to consider alternative brokers that are well-regulated and have a proven track record of customer satisfaction. Brokers such as [insert alternative broker names] provide robust regulatory frameworks, transparent fee structures, and improved customer support, making them safer choices for traders. Ultimately, ensuring the safety of investments should be a top priority, and the lack of transparency and regulatory compliance at EigenFX makes it a questionable option for trading in the forex market.

Is EIGENFX a scam, or is it legit?

The latest exposure and evaluation content of EIGENFX brokers.

EIGENFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EIGENFX latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.