Regarding the legitimacy of EGM Forex forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is EGM Forex safe?

Business

License

Is EGM Forex markets regulated?

The regulatory license is the strongest proof.

FCA Inst Market Making (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Inst Market Making (MM)

Licensed Entity:

Equiti Capital UK Limited

Effective Date:

2011-04-27Email Address of Licensed Institution:

compliance@equiti.comSharing Status:

No SharingWebsite of Licensed Institution:

www.equiticapital.co.ukExpiration Time:

--Address of Licensed Institution:

11 Ironmonger Lane London EC2V 8EY UNITED KINGDOMPhone Number of Licensed Institution:

+4402070970402Licensed Institution Certified Documents:

Is EGM Forex Safe or a Scam?

Introduction

EGM Forex, a trading name associated with EGM Securities, positions itself as a prominent player in the forex market, particularly targeting clients in Kenya and other regions. As the first non-dealing desk forex broker licensed by the Capital Markets Authority (CMA) in Kenya, EGM Forex aims to provide traders with direct access to interbank market rates, thereby enhancing transparency and efficiency. However, the forex market is rife with potential pitfalls, making it crucial for traders to conduct thorough evaluations of their brokers. This article will explore the legitimacy and reliability of EGM Forex by analyzing its regulatory status, company background, trading conditions, fund safety, customer experiences, platform performance, and associated risks.

Regulation and Legitimacy

The regulatory framework under which a broker operates is a critical factor in determining its safety and legitimacy. EGM Forex claims to be regulated by the Capital Markets Authority (CMA) of Kenya, which is an essential aspect of its operations. Regulation by a recognized authority provides a layer of protection for traders, ensuring that the broker adheres to specific operational standards.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| Capital Markets Authority (CMA) | 107 | Kenya | Verified |

The CMA is responsible for overseeing the activities of financial intermediaries in Kenya, ensuring compliance with local laws and regulations. While the CMA's regulatory framework is not as stringent as that of the UK's Financial Conduct Authority (FCA), it still imposes requirements for fund segregation and operational transparency. EGM Forex's compliance with these regulations suggests a level of legitimacy; however, the broker's history and track record in adhering to these regulations are equally important. Reports indicate that EGM Forex has maintained a clean regulatory record thus far, but potential clients should remain vigilant and inquire about any historical compliance issues.

Company Background Investigation

EGM Forex is part of the Equiti Group, which operates in various jurisdictions, including the United Kingdom, Jordan, and the UAE. Founded in 2016, EGM Forex has positioned itself as a key player in the Kenyan forex market. The company's ownership structure is rooted in the Equiti Group, which is known for its global reach and diverse financial services.

The management team at EGM Forex comprises experienced professionals with backgrounds in finance and trading. This expertise is essential for navigating the complexities of the forex market and ensuring that the broker operates smoothly. Transparency is also a strong point for EGM Forex; the company provides detailed information about its operations, contact details, and regulatory status on its website. This level of openness is crucial for building trust with potential clients.

Trading Conditions Analysis

When evaluating whether EGM Forex is safe, it's essential to consider its trading conditions, including fees, spreads, and commissions. EGM Forex offers two types of accounts: Executive and Premiere. The Executive account requires a minimum deposit of $15, while the Premiere account demands a higher initial deposit of $100.

The overall fee structure is competitive, with spreads starting as low as 1.6 pips for the Executive account and 0.2 pips for the Premiere account. However, the Premiere account incurs a commission of $7 per standard lot traded.

| Fee Type | EGM Forex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.6 pips (Executive) / 0.2 pips (Premiere) | 1.0-1.5 pips |

| Commission Structure | $7 per lot (Premiere) | Varies by broker |

| Overnight Interest Range | Standard rates apply | Varies by broker |

While the spreads are relatively low, the commission structure may deter some traders, particularly beginners. Additionally, EGM Forex does not charge deposit or withdrawal fees, which is a positive aspect of its trading conditions. However, traders should be cautious about any hidden fees that may arise during trading, as transparency is key in evaluating the broker's overall trustworthiness.

Customer Fund Safety

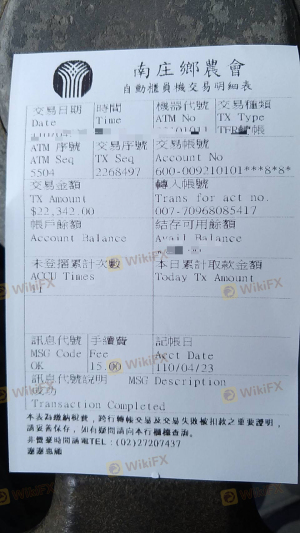

The safety of customer funds is paramount when assessing whether EGM Forex is safe. EGM Forex adheres to the CMA's requirement for client fund segregation, meaning that client funds are kept separate from the broker's operational funds. This practice is vital for protecting traders' investments in the event of financial difficulties faced by the broker.

Furthermore, EGM Forex offers negative balance protection, which ensures that traders cannot lose more than their initial investment. This feature is especially important in the volatile forex market, where rapid price fluctuations can lead to significant losses. While there have been no reported incidents of fund mismanagement or breaches of security, potential clients should always remain vigilant and conduct their own research regarding the broker's financial stability.

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding the overall experience with EGM Forex. Reviews from clients indicate a mixed bag of experiences. While many traders praise the broker for its user-friendly platform and competitive spreads, there are also complaints regarding slow customer support and withdrawal processing times.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Slow Customer Support | Moderate | Response time varies |

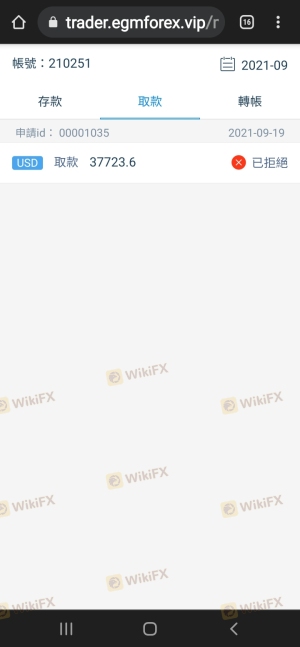

| Withdrawal Delays | High | Addressed on a case-by-case basis |

One common complaint revolves around withdrawal delays, where some users report waiting longer than expected for their funds to be processed. In contrast, others have had positive experiences, receiving their withdrawals promptly. This inconsistency in customer service may raise concerns for potential clients, as efficient support is critical in the trading environment.

Platform and Execution

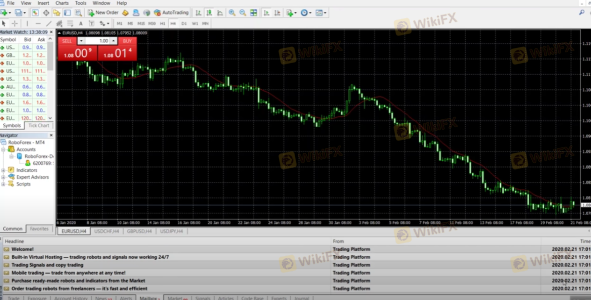

EGM Forex utilizes the popular MetaTrader 4 (MT4) platform, which is widely regarded for its stability and user-friendly interface. The platform offers various features, including advanced charting tools and automated trading capabilities, making it suitable for both novice and experienced traders.

However, the quality of order execution is a vital aspect of the trading experience. Reports suggest that EGM Forex has a reasonable execution speed, with minimal slippage during high volatility periods. Nevertheless, traders should remain cautious and monitor their execution quality, especially during significant market events.

Risk Assessment

When considering whether EGM Forex is safe, it is essential to evaluate the inherent risks associated with trading through this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | CMA regulation is less stringent than other jurisdictions. |

| Financial Risk | Medium | Potential for significant losses due to market volatility. |

| Operational Risk | Low | Established broker with a good track record. |

While EGM Forex appears to be a legitimate broker with robust safety measures in place, the regulatory environment in Kenya may present certain risks. Traders should be aware of the potential for market volatility and the impact it can have on their investments.

Conclusion and Recommendations

In conclusion, EGM Forex presents itself as a legitimate broker with a solid regulatory framework under the Capital Markets Authority of Kenya. While it offers competitive trading conditions and robust safety measures for client funds, there are areas for improvement, particularly in customer support and withdrawal processing times.

For traders considering whether EGM Forex is safe, it is essential to weigh the benefits against the potential risks. Beginners may find the broker's low minimum deposit appealing, but they should also be prepared for the possibility of slower support and occasional withdrawal delays.

If you are looking for alternatives, consider brokers regulated by tier-1 authorities, such as the FCA or ASIC, which may offer a higher level of security and support. Overall, EGM Forex is not a scam, but potential clients should proceed with caution and conduct thorough research before committing their funds.

Is EGM Forex a scam, or is it legit?

The latest exposure and evaluation content of EGM Forex brokers.

EGM Forex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EGM Forex latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.